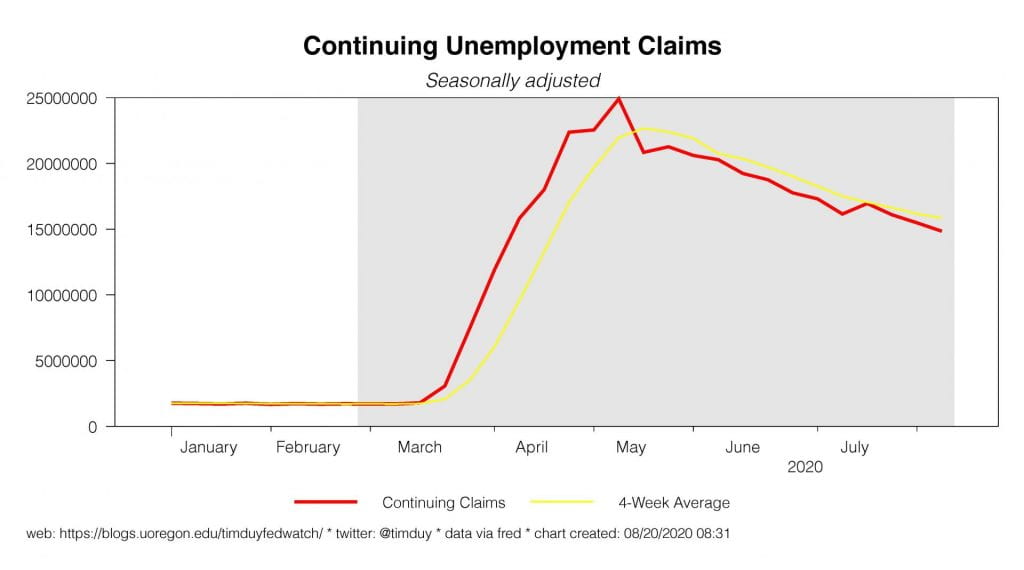

Initial claims disappointed by edging up above one million:

The decline unfortunately remains slow. Same too for continuing claims:

There are no miracles happening here; the most pandemic-impacted sectors will recover only slowly until we gain a better hold of the virus. Obviously, the end of the additional $600/week of unemployment benefits is worrisome in this environment. It is an unfortunate fact though that it is important to separate the micro stories from your macro narrative:

Lowest 40% of households by income account for 22% of consumption, so drop in spending from this cohort isn’t immediate blow to economy; but potential wave of evictions, less fiscal relief & slower labor recovery could dent spending & growth longer-term @MoodysInvSvc @BLS_gov pic.twitter.com/od114oN5kq

— Liz Ann Sonders (@LizAnnSonders) August 20, 2020

Keep an eye on these high frequency spending measures. They haven’t rolled over yet.

Coner Sen notes that household wealth may have reached a record high in Q2:

A paradox of this economic crisis is that while U.S. employment remains 13 million below its pre-pandemic peak, the net worth of American households may be at a record high, thanks to the soaring prices of stocks and homes.

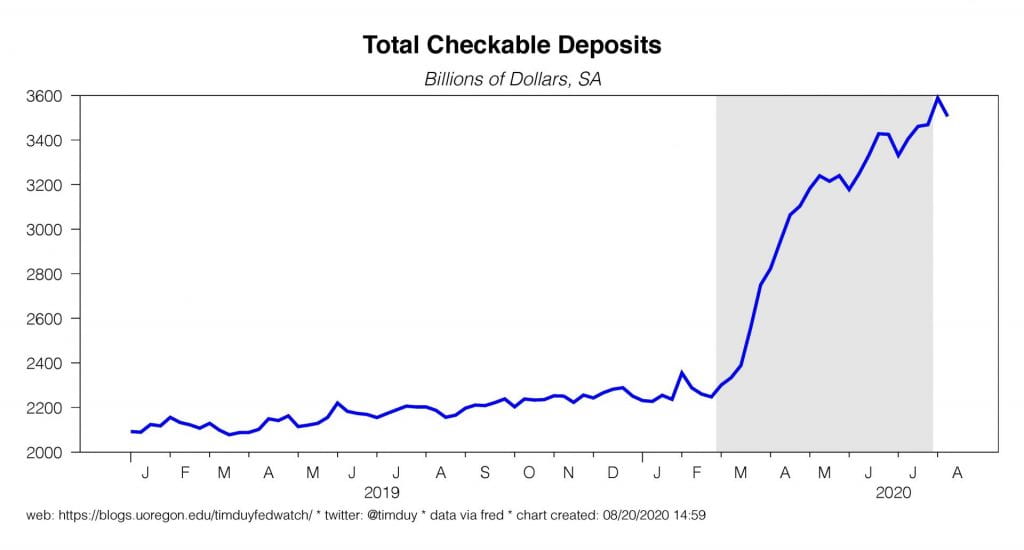

I don’t think the conventional wisdom has completely processed the potential implications of the massive improvement in household balance sheets this year. Watch for my piece on this topic in Bloomberg tomorrow morning. For a bit of a preview, checkable deposits grew by roughly $1.3 trillion during the crisis:

That is a lot of unplanned saving, a lot of hot money. It could flow out slowly or it can rush out and slam into the economy once confidence turns higher. It’s the forgotten trillion dollars that won’t stay forgotten forever.

Finally, the Federal Reserve confirmed that Chair Jerome Powell will speak at this year’s Jackson Hole conference. His topic will be the “Monetary Policy Framework Review.” I suspect the text will focus on the reasoning behind the review and the process itself and give a preview of the outcomes without doing the full reveal that is anticipated to come in September. Market participants generally anticipate the framework will conclude with a shift toward an average inflation targeting framework that requires some modest overshooting of the 2% target; I don’t know that Powell will confirm, but I doubt he will deny.

Happy end of week!