If You Don’t Have Any Time This Morning

The Federal Reserve will hold rates steady at the upcoming December FOMC meeting. At this juncture, they like us remain focused on the data flow. Until the outlook shifts meaningfully one way or the other, the Fed is content to sit on the sidelines.

Key Data

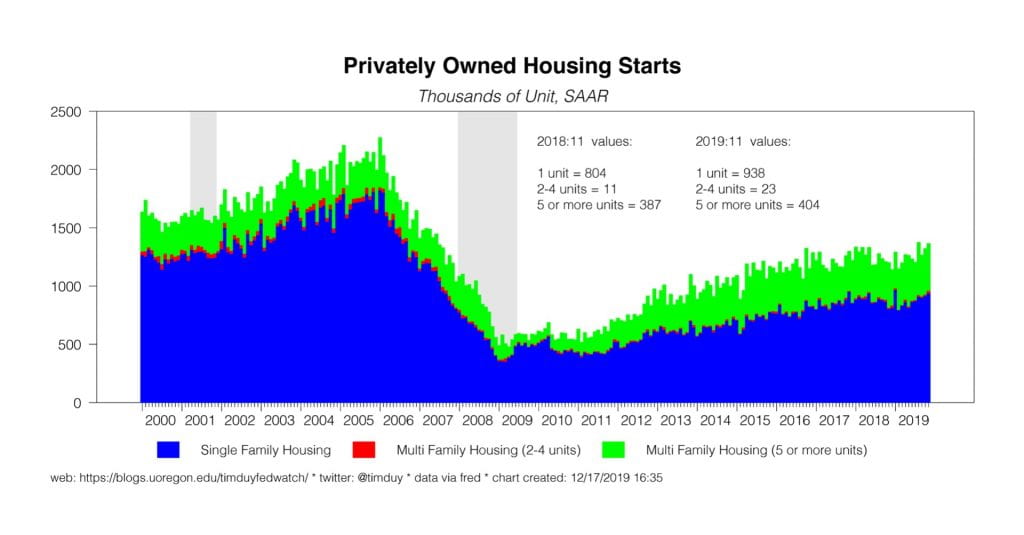

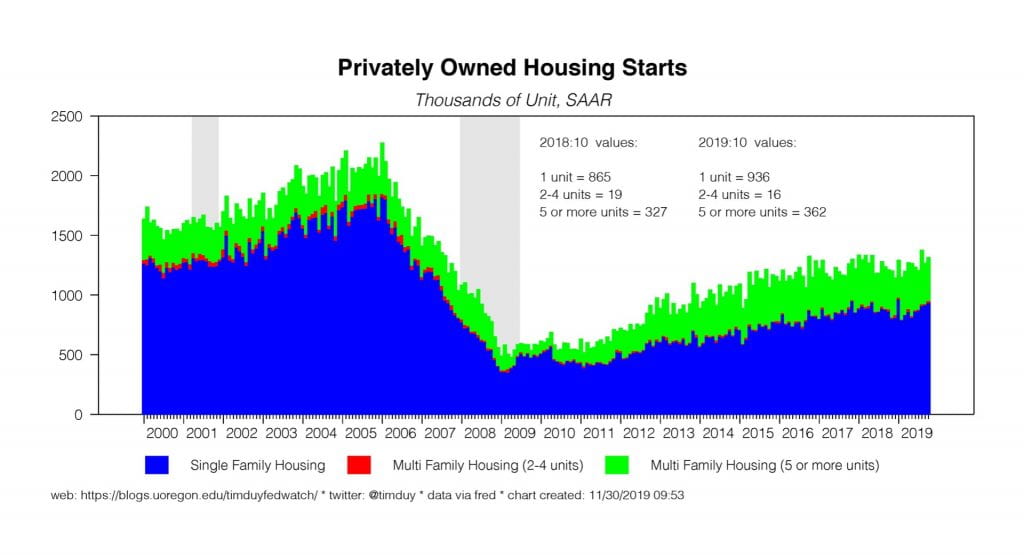

Data remains generally lackluster, disappointing both those still looking for a recession and those hoping for a rapid rebound. Housing remains perhaps the brightest sector as last year’s soft patch is now well in the rearview mirror:

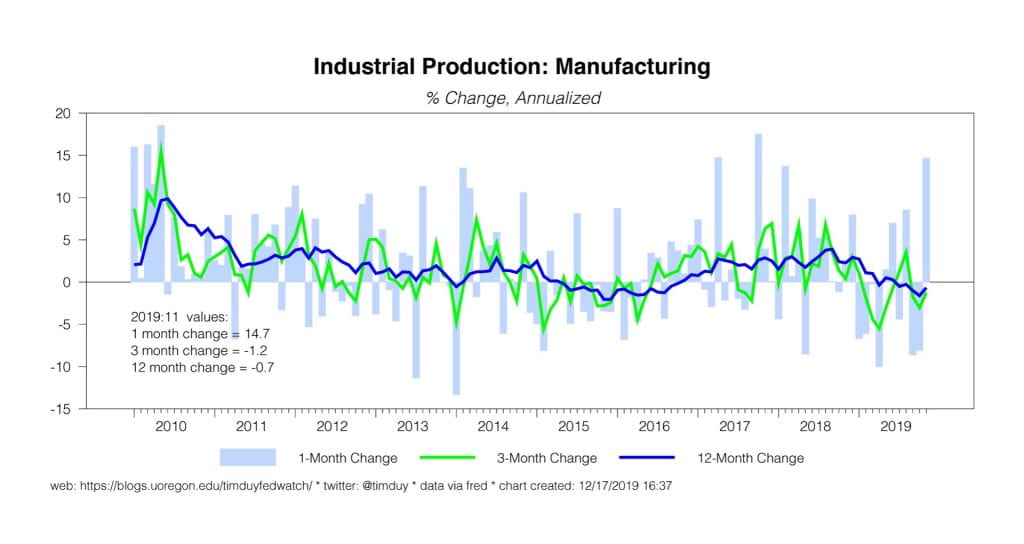

New manufacturing orders continue to move sideways:

While not the most exciting data, the relative strength of new orders stands in stark contrast to the widespread concerns that investment spending by firms would fall off a cliff this year. To be sure, the hangover from the 2018 fiscal stimulus coupled with slower foreign growth and trade policy uncertainty have weighed on investment spending this year. These negative shocks, however, were insufficient to trip the economy into recession or even match the weakness in new orders seen in 2015-16.

Consumer spending growth has moderated back to a pace like that of 2015-16:

That seems like it should not be a surprise. The drop last year and the rebound earlier this year were both obviously noise in the data that had little to do underlying trends.

Inflation continues to track below the Fed’s target: With neither the economy on fire nor inflation rising, the Fed has little reason to turn their attention to reversing this year’s rate cuts anytime soon.

With neither the economy on fire nor inflation rising, the Fed has little reason to turn their attention to reversing this year’s rate cuts anytime soon.

Fedspeak

Last week Federal Reserve Chair Jerome Powell provided this year-end assessment of the economy:

We started 2019 with a favorable outlook, and over the year the outlook has changed only modestly in the eyes of many forecasters. For example, in the Survey of Professional Forecasters, the forecast for inflation is a bit lower, but the unemployment forecast is unchanged and the forecast for gross domestic product (GDP) is nearly unchanged.The key to the ongoing favorable outlook is household spending, which represents about 70 percent of the economy and continues to be strong, supported by the healthy job market, rising incomes, and solid consumer confidence.

I am not sure that the “key to the ongoing favorable outlook” is really consumer spending. After a discussion of evolving trends this year, Powell gets to what I think is the more central reason that the economy has held up this year:

To help keep the U.S. economy strong in the face of global developments and to provide some insurance against ongoing risks, we progressively eased the stance of monetary policy over the course of the year.

Going into 2019, the Fed thought that they needed additional rate hikes to slow the economy back to a moderate pace. Had they remained true to that outlook, the results this year would have been very different.

Powell details the slower global growth and rising trade risks that help to prompt the Fed dovish pivot. Additionally, he notes:

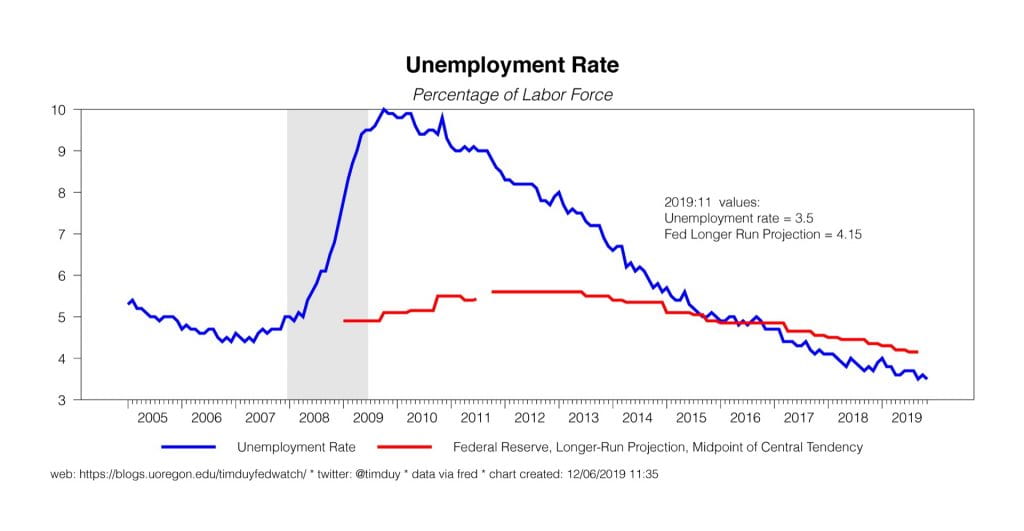

Since the end of last year, incoming data—especially muted inflation data—prompted analysts inside and outside the Fed to again revise down their estimates of r* and u*.4 Taken at face value, a lower r* would suggest that monetary policy is providing somewhat less support for employment and inflation than previously believed, and the fall in u* would suggest that the labor market was less tight than believed.

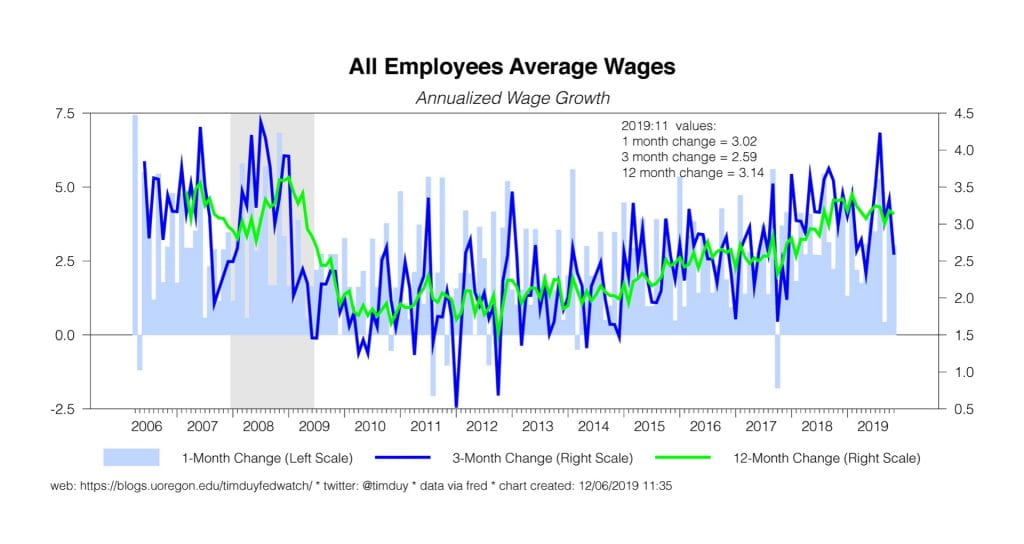

We should continue to watch for estimates of u* in particular to be revised lower in light of continued sub-par inflation outcomes.Powell also highlights the benefits of low unemployment for the labor market in general:

Many people at our Fed Listens events have told us that this long expansion is now benefiting low- and middle-income communities to a degree that has not been felt for many years. We have heard about companies, communities, and schools working together to help employees build skills—and of employers working creatively to structure jobs so that employees can do their jobs while coping with the demands of family and life beyond the workplace. We have heard that many people who in the past struggled to stay in the workforce are now working and adding new and better chapters to their lives.

The Fed in general, and it seems Powell in particular, has clearly had an epiphany regarding the benefits of persistently low unemployment.In prior cycles central bankers would be looking upon sub-4% unemployment rates with much more suspicion as a warning sign that inflation will soon be on the rise. The shift has substantial implications for policy; the Fed views the costs of high unemployment as sufficiently high relative to those of the risk of inflation at these levels that they very much err against the possibility of recession. This in turn lessens the possibility that Fed action or inaction helps trip the economy into recession and brightens the near- to medium-term outlooks.

Upcoming Data

We have an important week of data ahead of us.It begins with the ISM and Market PMIs on Monday. Market participants are looking for signals from the ISM data that the manufacturing downturn is bottoming out, essentially confirming the story from the flash Markit PMI. Stabilization of the ISM data would be the final blow to the past year’s fears fanned by the recessionistas.On Wednesday we get the service sector versions of these reports; the expectation is that the service sector data also firms, recognizing of course that the sector overall has largely shrugged off the manufacturing weakness. Also Wednesday comes the ADP employment report to heighten our anticipation of the Friday release of the November employment report. There we will look for any signs that the labor market is cooling; the initial claims data suggests that the labor market momentum remains fairly steady. On Thursday we get the usual initial unemployment claims release as well as the international trade data for October.

Discussion

The minutes of the October Federal Open Market Committee meeting made clear that the Fed is done reacting to the risk of economic weakness. With three rates now the rearview mirror, Federal Reserve Chair Jerome Powell and his colleagues shifted into a new phase in this cycle, now carefully watching the data for signs that the risks to the outlook are becoming a reality beyond what we have seen this year.

For now, this means that the Fed will remain on hold until they see a substantial change in the forecast. Still, considering the central bankers remain wary of potential downsides to their generally optimistic forecast, the balance of risks remains weighed toward another rate cut in the months ahead.

Last month’s rate cut was anything but a unanimous decision. Although “many” participants favored a more accommodative policy stance, “some” preferred to hold steady at this meeting. And even among the more dovish group there was little appetite to consider further rate cuts. Consequently, committee members choose to strike the “act as appropriate” language from FOMC statement with the intention of signaling that they expected to hold rates at the current level barring a “material reassessment of the economic outlook.”

This policy position basically takes December and likely January rate cuts off the table. To be sure, policy remains data dependent and hence is not on a preset path. Realistically though, it seems unlikely that enough data will emerge in the next several to justify a substantial change in the Fed’s forecast for the worse. And if manufacturing looks to be stabilizing in this week’s data, the most likely direction is for upward adjustments to the outlook.

At this point, fourth quarter GDP growth looks to be coming in just below trend growth; the current Atlanta Fed estimate is 1.7%. That kind of number is not going to lead to material reassessment of the outlook.Indeed, even if the number comes in on the weaker side, there is simply too much quarterly variability in GDP numbers to justify such a shift. Instead, the Fed will be looking for signs that such weakness would persist beyond one quarter and push unemployment rates higher before making an assessment in favor of easier policy (and hence why the employment reports are so important). It will take some time for such data to emerge. That makes a policy change in the near term unlikely.

That said, even if the bar to a policy change is high, balance of risks to that forecast remains on the side of additional easing.First, for all intents and purposes, Powell made clear in his post-FOMC press conference that only evident inflationary pressure would justify a rate hike and we are a long way from that point so we know the risks are not balanced in that direction. Second, the Fed retains enough concerns about the forecast that even though they don’t expect to cut rates again, the doves that drove this last rate cut must still be wary that another is needed.

The minutes identify a number of potential issues such as further downside risk for global growth and trade developments and the persistence of low inflation. Moreover, a few participants reminded the committee that policy rates remain near the effective lower bound. At the currently, policy makers will tend toward moving aggressively should the data soften because the costs of delay and falling back to zero are so high. In fact, it may be that this concern will ultimately lead the Fed to require a lower bar for another rate cut than suggested by the minutes.

Bottom Line: Fed is hoping that they have done enough to ensure a soft-landing for the economy. Given how much easing is already in place and the current condition of the economy, they anticipate that rates will hold steady deep into 2020. I suspect it would take at least that long before conditions changed sufficiently in a positive direction to lead them to consider unwinding rate cuts. But in the near term, the Fed still retains a dovish bias and hence the risks remain slightly tilted toward additional cuts.