The Federal Open Market Committee begins their two-day meeting this morning, an effort that will almost certainly culminate with steady rates and fairly limited alterations to the accompanying FOMC statement. The underlying message is “steady as she goes.” We have yet to see data break meaningfully to either side of the Fed’s forecast such to expect a change in the pace of rate hikes. With the economic data continuing to support the broad contours of the Federal Reserve’s forecast, we should expect the Fed to remain on track to hike policy rates by 25bp each quarter for the remainder of this year.

Continued here as a newsletter…

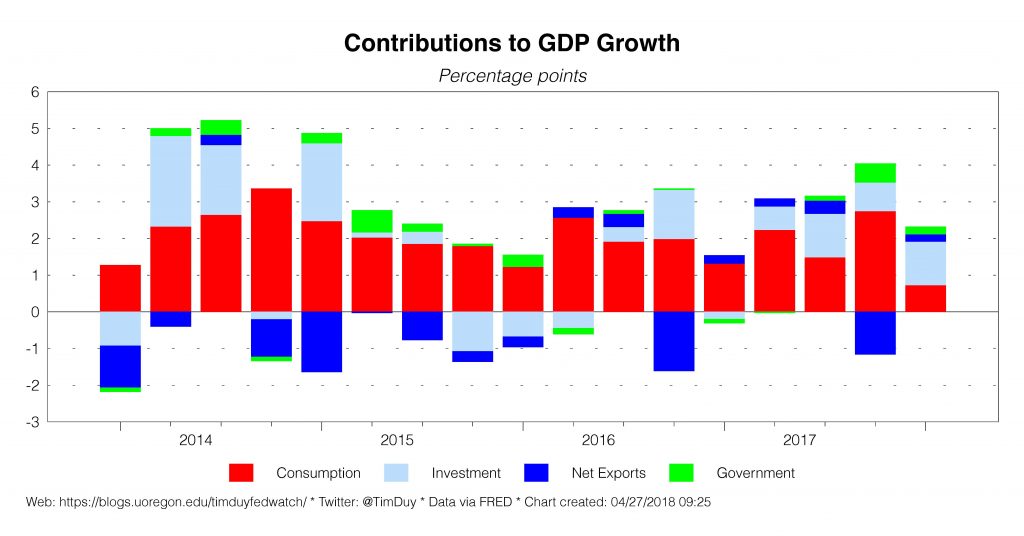

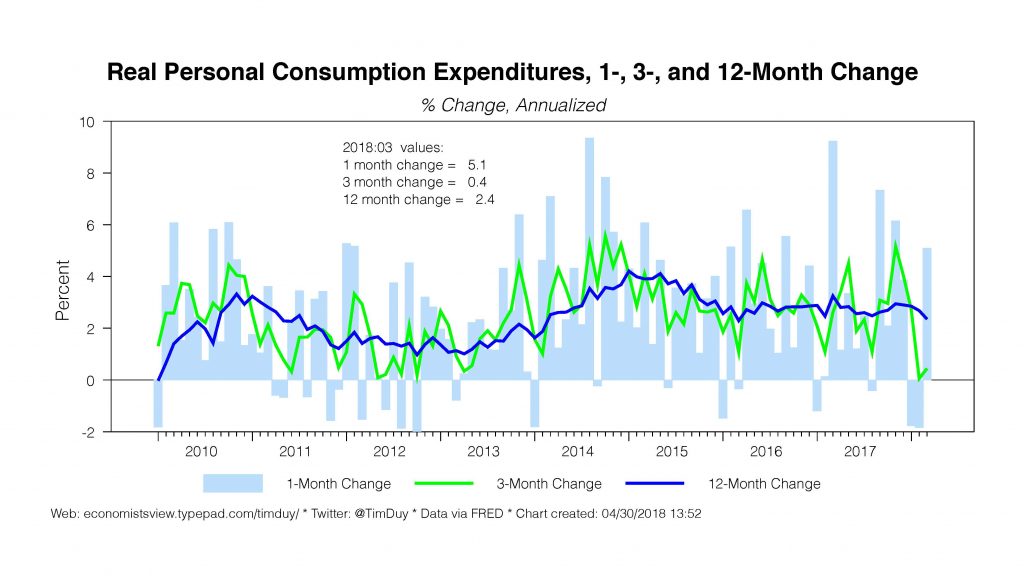

Last week the Bureau of Economic Analysis reported that economic growth edged down to 2.3 percent in the first quarter, compared to 2.9 percent in the final quarter of last year. This slowdown, however, is likely less than meets the eye. It has been long suspected that residual seasonality weighs down the first quarter data. Consequently, the year-over-year trend – which continues to rise, supported by solid investment numbers – is arguably a better measure of activity. Moreover, while consumption growth slowed compared to the previous quarter, the underlying pace of 2.5 percent growth has been remarkably steady for more than two years.

Hence, I don’t see much value in agonizing over the quarterly movements in GDP at the moment as the underlying story has yet to change: The economy is operating at a pace that exceeds the Fed’s estimate of longer run growth. Over time, this pace of activity will reduce remaining labor market slack until employment exceeds full employment. In this light, some of the important issues are:

Hence, I don’t see much value in agonizing over the quarterly movements in GDP at the moment as the underlying story has yet to change: The economy is operating at a pace that exceeds the Fed’s estimate of longer run growth. Over time, this pace of activity will reduce remaining labor market slack until employment exceeds full employment. In this light, some of the important issues are:

- When is the economy at or beyond full employment? The unemployment rate of 4.1 percent is already below the Fed’s 4.5 percent estimate of the natural rate of unemployment. But is the Fed overly pessimistic on this point? So far, tepid wage growth suggests there remains room for further downward revisions to the Fed’s natural rate estimate. But the latest improvement in the employment cost index opens the door to the possibility that wage growth may finally be set to expand. If wage growth accelerates this year, the Fed will become increasingly certain that they have a fairly good estimate of full employment.

- But will inflation accelerate? An acceleration of wage growth does not automatically translate into a faster pace of inflation. Productivity might rise in response to higher wages, or profit margins might be squeezed. Faster wage growth thus by itself only gives policy makers confidence in their estimates of full employment and, by extension, provides the justification for further rates hikes to limit the extend the economy overshoots full employment.

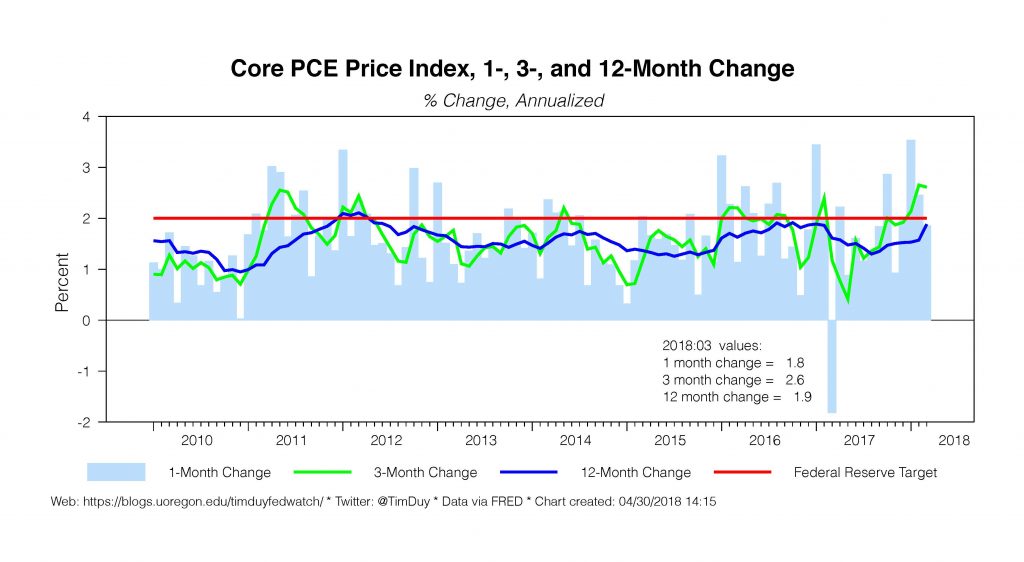

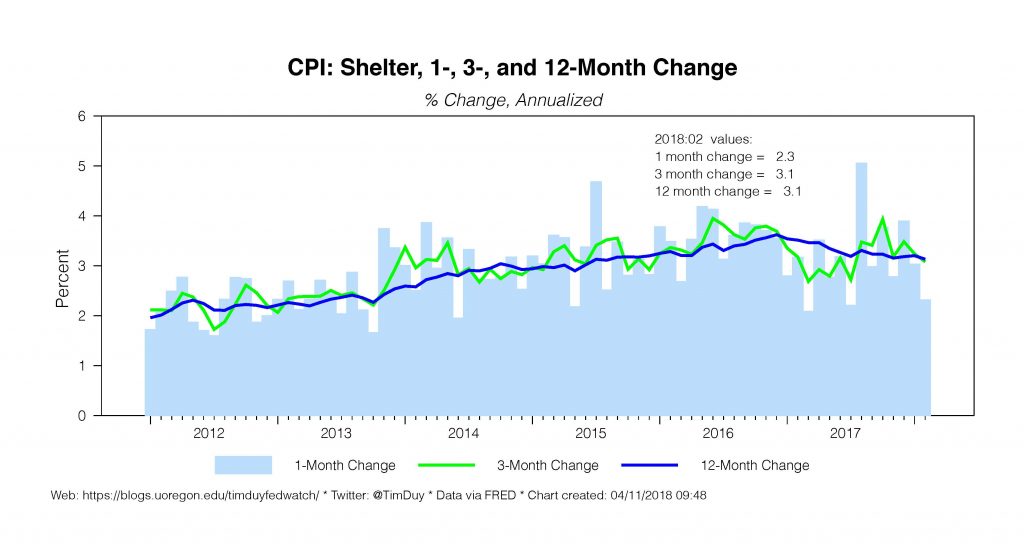

- How much inflation overshooting will the Fed tolerate? Core inflation has rebounded to 1.9 percent year-over-year, pretty much in line with the Fed’s 2 percent target. The Fed’s hence accurately predicted that last year’s inflation shortfall would prove transitory. The inflation rebound again justifies the Fed’s outlook but does not by itself argue for a faster pace of rate hikes. Nor would modest overshooting of the target increase the pace of rate hikes. The Fed would likely tolerate inflation as high as 2.5 percent as long as they could reasonable forecast a return to target over the medium term given the expected current path of policy rates. Note too that any expectation of inflation overshooting remains premature. Monthly inflation decelerated below 2 percent in March; there may be some new seasonal effects in the data as firms increasingly concentrate price changes near the start of the year. Moreover, there remains downward pressures on shelter costs which will weigh on overall inflation.

- Growing downside risks? Although activity remains consistent with the Fed’s forecast, there is always a risk that the current tailwinds revert again to headwinds. Supply chain disruptions stemming from international trade disputes, for example. More concretely, there is growing evidence of decelerating global activity. In short, it is worth remembering that many things fell into place for the US economy after the 2015-16 soft patch. Streaks of good luck eventually come to an end.

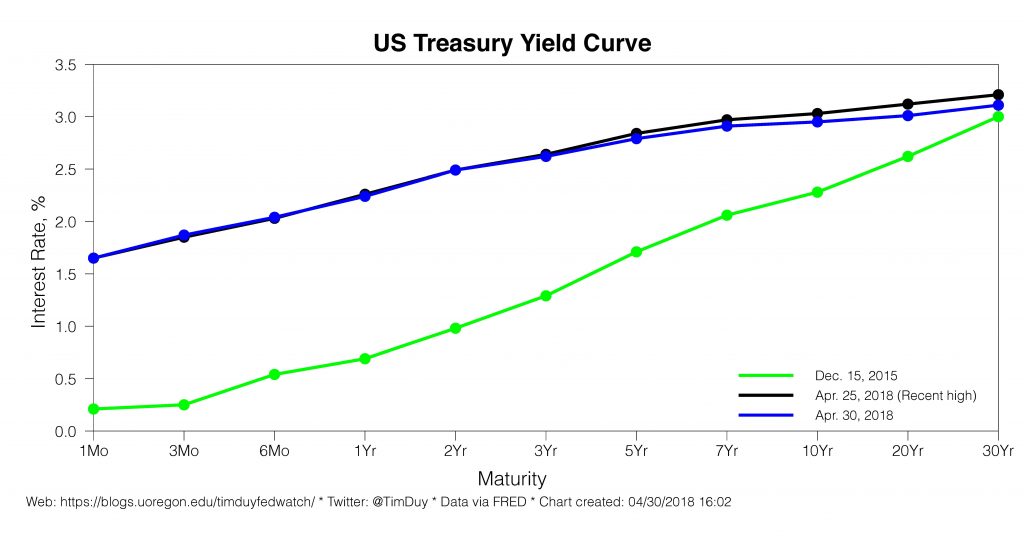

Bottom Line: I anticipate the Fed will continue to hike interest rates; best bet is that policy rates edge up 25bp a quarter for the rest of the year and into next. I am watching for risks to both sides of this forecast, but at this point those risks have yet to materialize into reality. Considering the resilience of very long rates to policy tightening, I anticipate that further upward pressure on rates remains concentrated on the short-end of the yield curve. I suspect the Fed continues to hike rates until they flatten out the yield curve – at that point policy makers will face some more significant challenges.

Note: Sorry for the brief hiatus from Fed watching. Other job/family duties needed my attention for a bit.