If You Don’t Have Time This Morning

Generally upbeat manufacturing and services survey data will reveal the underlying strength of the economy even under the weight of the pandemic. Still, the sizable employment gap will leave little doubt that the Fed will not be removing accommodation anytime soon.

Vaccine Update

As of Sunday, Bloomberg estimates that the U.S. has delivered 30.5 million doses of vaccine and the rate of vaccination now exceeds 1.3 million per day. Meanwhile, the number of new cases is falling quickly, down 40% from the peak, although concerns remain about the spread of new variants.

Recent Data and Events

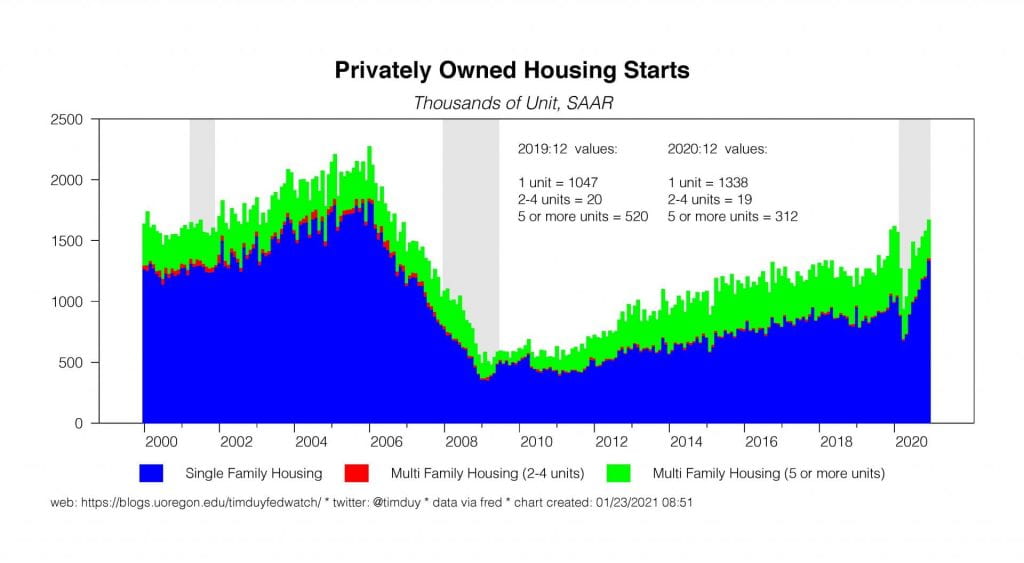

The U.S. economy grew at a 4% pace in the final quarter of 2021, a notch below expectations for a 4.2% gain. Consumption contributed a meager 1.7 percentage points of the gain as the pandemic weighed on household spending. Fixed investment contributed 3.02 percentage points, down from the 5.39 percentage point contribution of the third quarter but still solid. Government spending, particularly at the state and local level, dragged down growth by 0.22 percentage points. Net exports subtracted 1.52 percentage points; this recession is unusual in that the trade deficit rose as the shift into goods spending supported imports.

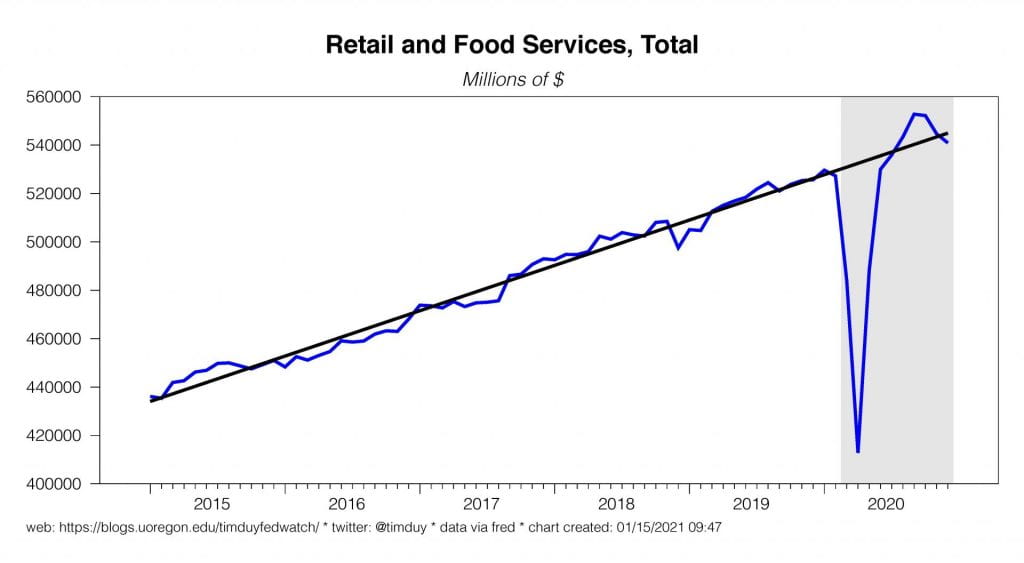

The hit to consumer spending occurred in the latter part of the quarter. Expenditures were down again in December, falling 0.6% (real, 0.2% nominal):

The weakness is primarily attributable to goods spending which had surged above trend early in the pandemic and has now softened:

We don’t know yet if goods spending will mean revert as the economy normalizes. We do know that services spending will accelerate once the pandemic comes under control. Personal income rose 0.6% (nominal, 0.2% real), bolstered by rising wages and salaries and transfer payments. Wages and salaries now exceed the pre-pandemic peak:

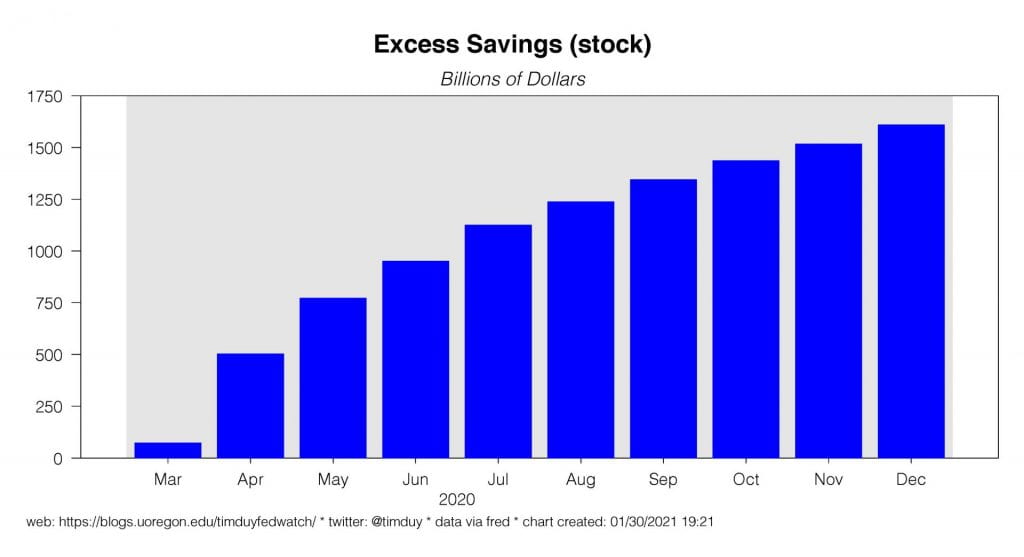

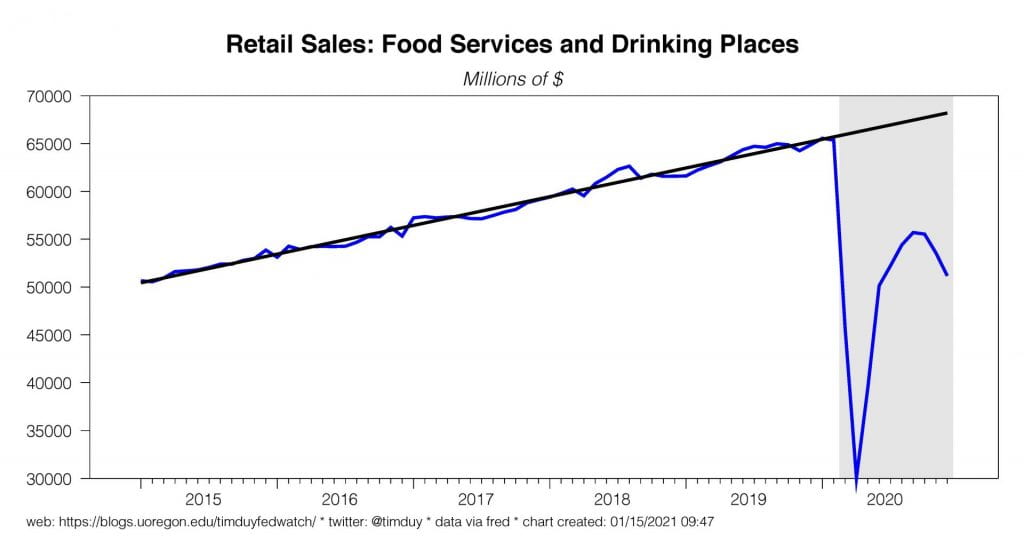

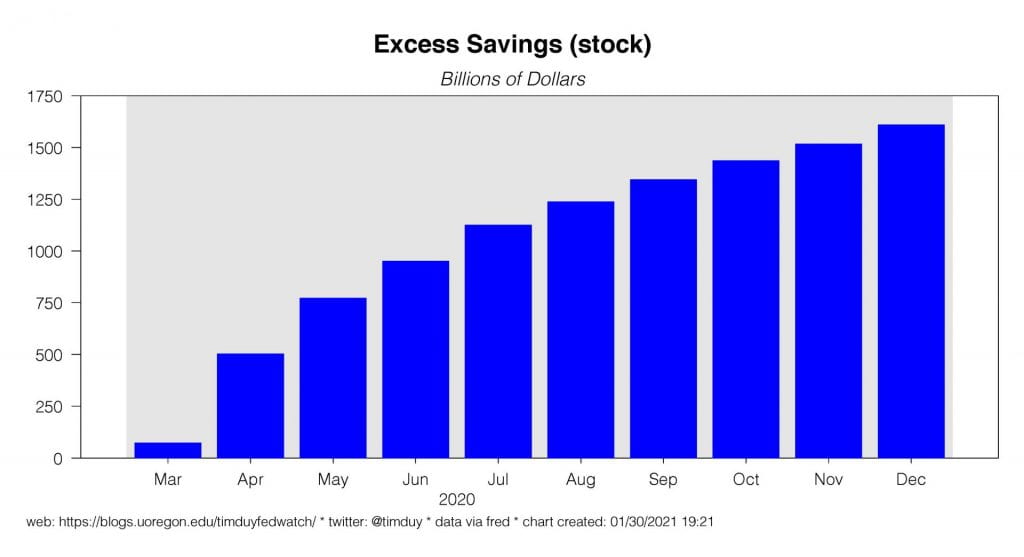

Top-line income will see further support in January from December’s fiscal support package. The economy still faces a supply constraint due to the pandemic with households locked out of certain components of services spending. As a consequence, income growth is transferred in part to savings. The saving rate rose from 12.9% to 13.7% and my estimate of the stock of excess savings accumulated during the pandemic rose to $1.6 trillion:

This is money floating around to support spending later this year or asset prices.

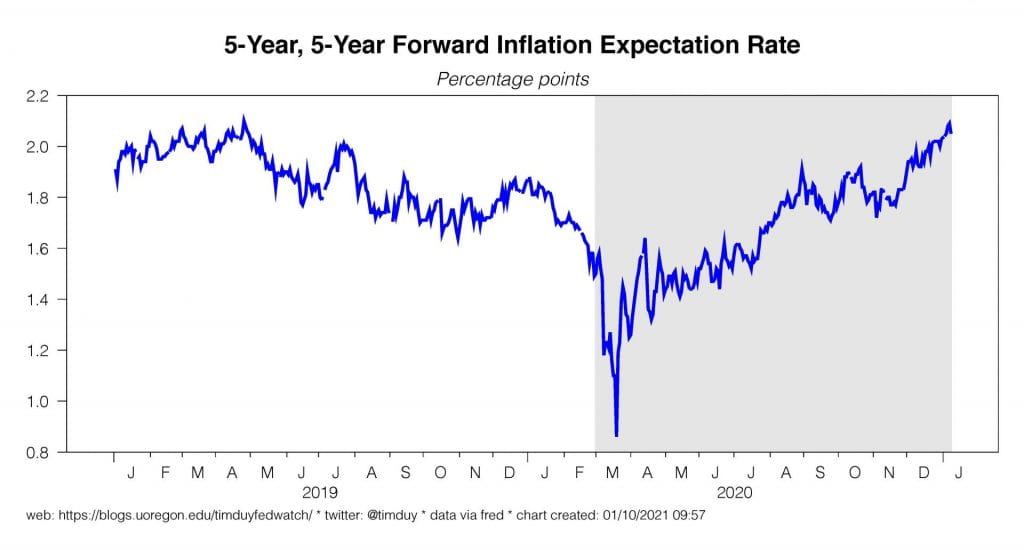

Inflation was stronger for the month but the Fed will view this as transitory. Year-over-year core inflation remains an anemic 1.5%:

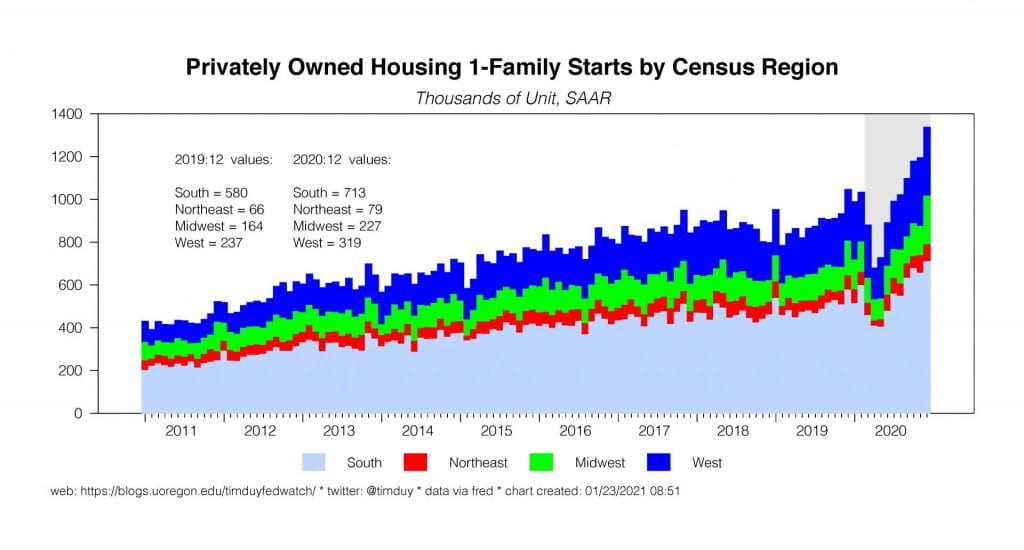

New single-family home sales were a notch higher and look to be reverting to the pre-recession trend:

Note that in contrast to the last recession, new home prices are rising:

If you are a forced to sell into this market, you are selling into strength rather than weakness. New orders for core capital goods remain on an uptrend:

If you are a forced to sell into this market, you are selling into strength rather than weakness. New orders for core capital goods remain on an uptrend:

The sector continues to show surprising strength very inconsistent with recessions of the past; we should see that strength continue more broadly in manufacturing surveys this week. For a teaser, note that the Chicago PMI for January came in at 63.8, up from 58.7.

Upcoming Data and Events

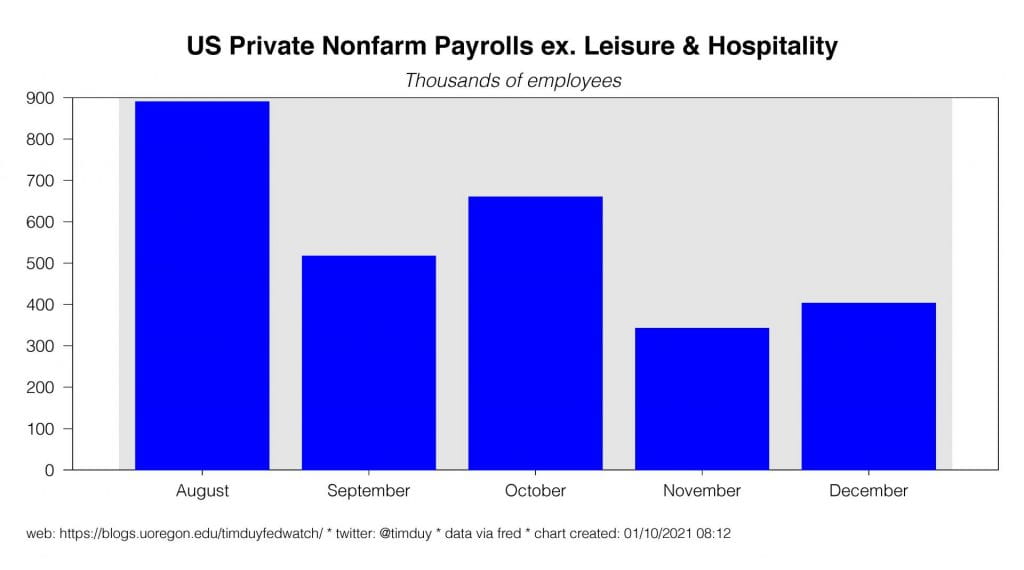

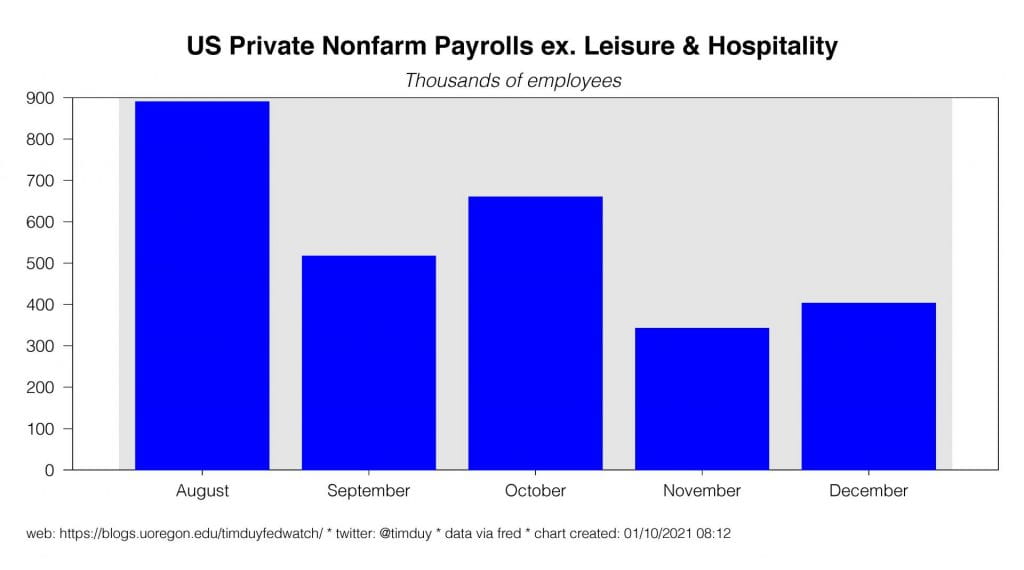

This is the typically busy first week of the month. We begin Monday with the Markit and ISM manufacturing surveys; both are expected to show that this sector of the economy entered 2021 with substantial momentum. This should also be evident in the service sector reports released later in the week. Altogether, these surveys should reveal that the economy is well-positioned for solid growth once the pandemic comes under control. That said, employment data – the ADP report on Wednesday, initial unemployment claims on Thursday, and the employment report on Friday – are expected to show only modest improvement over previous releases. The weakness should still be largely concentrated in the sectors most impacted by the winter wave of the pandemic and the associated restrictions on activity. I will be focused on hiring in the private sector excluding leisure and hospitality:

Regional Fed presidents will be visible throughout the week with comments from Cleveland Federal Reserve Bank President Loretta Mester, St. Louis Fed President James Bullard, Philadelphia Fed President Patrick Harker, Chicago Fed President Charles Evans, and San Francisco Fed President Mary Daly.

| Day |

Release |

Wall Street |

Previous |

| Monday |

Markit US Manufacturing PMI, Jan. |

59.1 |

59.1 |

| Monday |

ISM Manufacturing, Jan. |

60.0 |

60.7 |

| Wednesday |

ADP Employment, Jan. |

60k |

-123k |

| Wednesday |

Markit US Composite PMI, Jan. |

57.5 |

57.5 |

| Wednesday |

Markit US Services PMI, Jan. |

57.5 |

57.5 |

| Wednesday |

ISM Services, Jan. |

56.7 |

57.2 |

| Thursday |

Nonfarm Productivity, 4Q20 |

-3.1% |

4.6% |

| Thursday |

Initial Jobless Claims |

835k |

847k |

| Friday |

Unemployment Rate, Jan. |

6.7% |

6.7% |

| Friday |

Nonfarm Payrolls, Jan. |

50k |

-140k |

Fed Speak and Discussion

The discussion at last week’s FOMC must have shut the door hard on any premature tapering talk. Note these comments by Federal Reserve Bank of Dallas President Robert Kaplan via Bloomberg:

“I don’t want to associate or even think about associating a time frame with that,” he said Friday during a virtual forum hosted by the North Dallas Chamber of Commerce. “I’m going to be very careful as I monitor the economy this year to see how the economy unfolds, to be patient, and more importantly, not to be rigid or pre-determined in judging when we actually meet that.”

Recall that just a few weeks ago, Kaplan was eagerly anticipating the tapering discussion. Via Reuters:

“We should be as aggressive as we can be while we are in the teeth of this pandemic, until we are convinced that we have weathered this pandemic,” Kaplan said in a virtual town hall event. But “later this year, my own view is, we should at least be having an earnest discussion about when it’s appropriate to taper” the Fed’s asset purchase program.

The Fed’s goal is to avoid another repeat of the 2013 “taper tantrum” and I sense internal pressure on presidents to get with the program. No more loose talk about the timing of the tapering discussion or the actual tapering.

Federal Reserve Chair Jerome Powell appears convinced that the Fed can accomplish the lessening of policy accommodation when the time comes without spooking financial markets. From last week’s press conference:

And when we see ourselves getting to that point, we’ll communicate clearly about it to the public. So nobody will be surprised when the time comes. And we’ll do that well in advance of actually considering what will be a pretty gradual taper… Yeah, so you know, I was here — we had all the same questions back after the global financial crisis. We raised interest rates, we froze the balance sheet size, and then we shrank the balance sheet size. So there’s no reason why we won’t be able to do that again. In fact, we learned a lot from that experience. And, you know, we understand as we understood then, but even more so we understand that the that the way to do it is to communicate well in advance, to do predictable things, and to move gradually. And that’s what we’re going to do. We’re going to be very transparent.

Shorter Powell: We learned during the last cycle how to remove accommodation. We aren’t at that point yet, but when we get there, it will be communicated well in advance, transparently, and, importantly, the actual change will be “pretty” gradual.

In practice, the Fed most likely won’t have data sufficient to justify a tapering discussion until deep into the third quarter. If so, Kaplan’s earlier prediction will be accurate in that the Fed will have that discussion before the end of the year. Until that data arrives, however, the Fed will continue to avoid public speculation on any particular timing of that discussion or the actual tapering.

Separately, the Fed remains under pressure from critics who believe the easy money policy is spawning asset bubbles with the GameStop drama being the latest example of speculative excess. The Fed will strongly resist reducing financial accommodation to limit speculative behavior on Wall Street. Consider this from San Francisco Federal Reserve Bank President Mary Daly via Bloomberg:

“I am not willing to pull that bridge away and injure, in my judgment, the livelihoods of people — because they don’t have jobs, they don’t have income, they don’t have wage growth — simply to ensure that some people who already have stock market wealth don’t get more.”

Daly’s point is that even if the Fed’s policy is boosting asset prices and thus wealth inequality, using that as an excuse to tighten policy risks slowing the recovery and job growth and, in the process, aggravating income inequality. In other words, reducing wealth inequality by crushing the top with tighter monetary policy does nothing to actually improve (and may worsen) the prospects of those at the bottom. The Fed does of course recognize the financial instability and asset bubbles could harm economic growth similar to that experienced in the wake of the dot.com or housing bubbles. At the moment, however, the Fed don’t see such concerns as relevant and instead remain focused on employment and inflation, both of which are far from the Fed’s goals.

Bottom Line: Although there are many reasons for optimism, the Fed will not think about tightening until the data reveals considerably more progress. My baseline expectation is that we are still many months away from that point.

Good luck and stay safe this week!