If You Don’t Have Time This Morning

The Fed will likely take a backseat to fiscal support and pandemic response in the coming months.

Vaccine Update

As of Monday, Bloomberg estimates that the U.S. has given 14.3 million doses of vaccine.

Recent Data

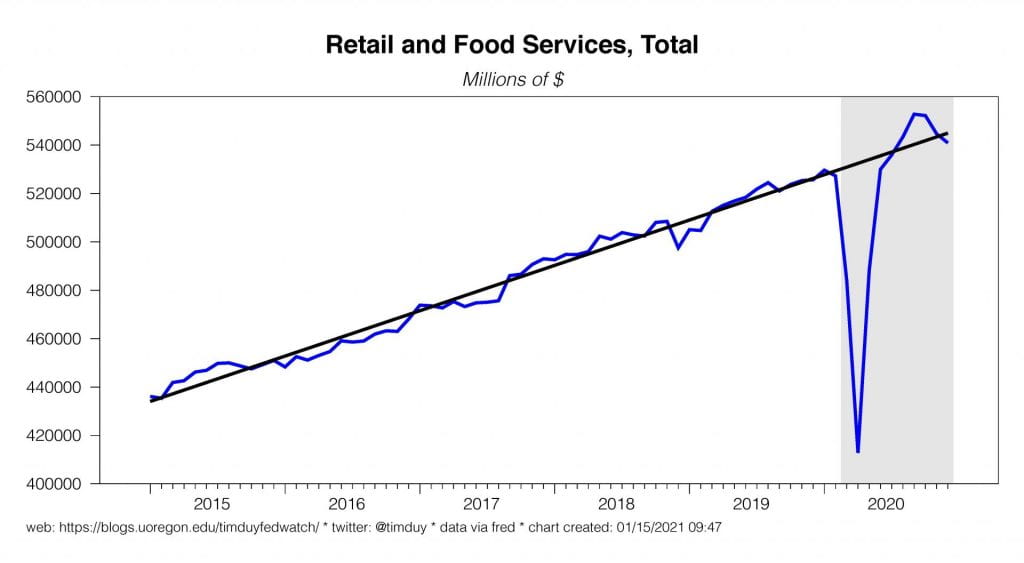

December retail sales disappointed with softness in both the headline and control groups. Headline sales have reverted to pre-pandemic trend:

While the control group remains above trend:

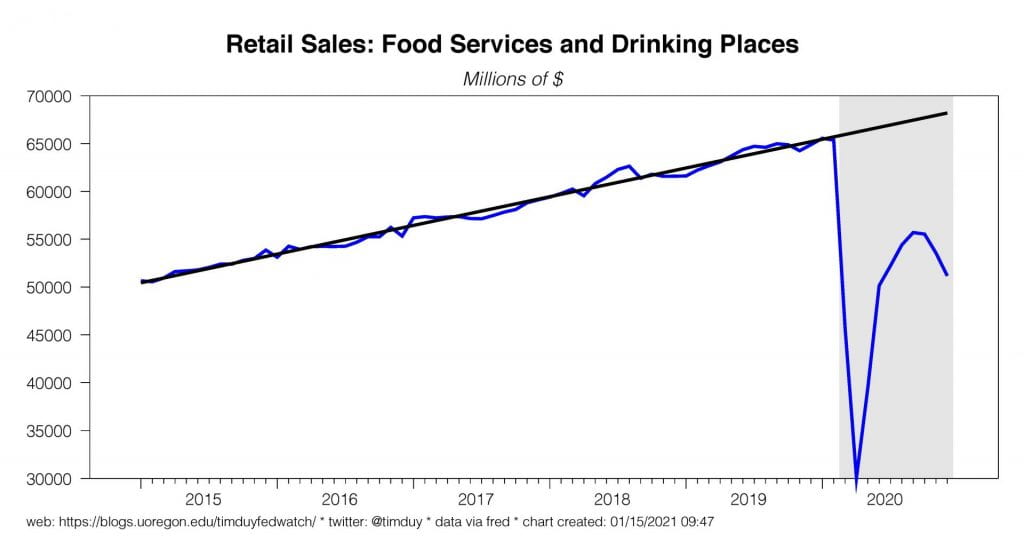

And, expectedly, food and drinking services continued to retreat from the September high:

Realistically, we know what will happen in this sector. Food and drinking services will be on an upswing again as we move through the winter wave of Covid-19 cases and as the pace of vaccinations accelerates in the weeks ahead. What we still don’t know is to what extent the control group fully reverts to the pre-pandemic trend or experiences a level shift upward. Given the magnitude of fiscal stimulus about to flow into the economy, the greater control over the pandemic likely this year, and the current level of overall retail sales near trend, I suspect that we will ultimately see a level shift upward in retail sales.

The retail sales numbers overshadowed the solid 1.6% gain in industrial production in December:

Auto production hovering near pre-pandemic levels:

I am keeping an eye out for any temporary weakness related to the ongoing computer chip shortage.

Preliminary consumer sentiment edged down in January to 79.2 from 80.7. I would describe this as effectively unchanged given the normal variance in the series, but you can’t make a news story on that kind of analysis. Bloomberg has this to add:

The slightly more downbeat sentiment reading signals consumers may be starting the year with less faith in the economic recovery as soaring virus cases lead to new restrictions just as inoculations become more available. Nearly 1 million Americans filed for unemployment benefits last week after the biggest jump in claims since March, a report showed Thursday.

An interesting detail is that inflation expectations have firmed since the pandemic began:

Better than weakening further as might be expected but I doubt the Fed is impressed. I think the Fed would prefer this metric trending in a range at least 25bp higher than the current level.

The Atlanta Fed GDPNow estimate for the fourth quarter is currently at 7.4%

Fed Speak

I covered Fed Speak extensively in posts last week here, here, and here. The basic story is that while some Fed presidents are entertaining the possibility of tapering later this year if the economy outperforms expectations, the consensus opinion at the Fed is that it is too early to think about tapering. The Fed won’t think about tapering seriously until the data turns decisively in a positive direction. We have to wait until the second half of the year for that to happen.

Upcoming Data and Events

As far as data is concerned, we have a slow week ahead of us with more important data not arriving until Thursday. On that day we get insights into what has been a red-hot housing market in the U.S. with December new starts and permits data. This series can be volatile but I don’t expect anything that would lead us to question the underlying direction of the data. Fundamentally, the aging of the Millennials is a demographic force underpinning housing demand. Thursday we also get the usual initial claims report; claims were higher last week at 965k as the pandemic became a renewed weight on certain sectors of the economy, in particular leisure and hospitality. The enhanced unemployment benefits included in December’s fiscal package will be helpful in compensating for this weakness; President-elect Joseph Biden’s plan is even more generous. Friday brings existing home sales; the expectation is for a slightly lower number than in November which would not be a surprise given tight inventories. Friday also brings Markit PMIs for January.

It’s blackout week for the Fed so (mercifully?) there will be no speeches to dissect.

On Tuesday, Janet Yellen will start the confirmation process with a hearing at the Senate Finance Committee. Yellen is expected to press for administration priorities and help sell Biden’s proposed $1.9 trillion support package. She is expected to say:

“Economists don’t always agree, but I think there is a consensus now: Without further action, we risk a longer, more painful recession now – and long-term scarring of the economy later.”

On the dollar, Yellen the Wall Street Journal reports she will deliver this talking point:

“The value of the U.S. dollar and other currencies should be determined by markets. Markets adjust to reflect variations in economic performance and generally facilitate adjustments in the global economy.”

Yellen is also expected to say that the U.S. doesn’t intend to weaken the dollar to achieve a competitive trade advantage but it sounds like she will fall short of advocating for a “strong dollar” policy. Possibly more important will be her degree of opposition to currency manipulation by other nations and her willingness to attempt to counter that manipulation. Finally, she will be questioned about any potential Fed-Treasury cooperation. I think she will say that she expects the Treasury and Fed will cooperate when appropriate on issues like emergency lending programs but will emphasize the Fed’s independence in monetary policy issues like interest rates and bond buying.

On Wednesday, January 20, Joseph Biden will be sworn in as the 46th president of the United States of America.

| Day | Release | Wall Street | Previous |

| Thursday | Building Permits, Dec. | 1.602m | 1.635m |

| Thursday | Housing Starts, Dec. | 1.560m | 1.547m |

| Thursday | Initial Unemployment Claims | 900k | 965k |

| Friday | Existing Home Sales, Dec. | 6.55m | 6.69m |

| Friday | Markit Manufacturing PMI, Jan. | 56.5 | 57.2 |

| Friday | Markit Services PMI, Jan. | 53.6 | 54.8 |

Discussion

It’s going to be a busy couple of months as the Biden administration scrambles to undo the last four years. Aside from another fiscal support package, the most immediate mark Biden can make on the economy is to provide a coordinated, national approach to pandemic response and vaccine delivery. There are probably some easy wins here relative to the Trump administration. For instance, Biden’s goal of 100 million vaccinations in 100 days seems like under-promising with the daily average already at 850,000; I am watching for upside surprises on pandemic control in the months ahead.

Between additional fiscal stimulus and a more organized pandemic response, watch for rising estimates for 2021 growth. For instance, Goldman Sachs raised its 2021 GDP forecast to 6.6% and now expects the unemployment rate to fall to 4.5% at the end of the year. I think we will gain greater visibility on the likelihood of such outcomes as we see the competing influences of the fading winter wave, the return to warmer weather, the rise of new, more infectious variants, and expanded vaccinations. If on net cases are turning sustainably down by the end of February, the more optimistic outcomes will be increasingly plausible.

The Fed may drift into the shadows for the next few months as fiscal policy and pandemic response have their time in the spotlight. The Fed’s messaging has been fairly clear. For the time being, it is not entertaining discussion of tapering or moving forward rate hikes. There will be the occasional speaker who opines on a forecast that if realized could change the path of policy, but this is just speculation. Actual discussion of changes to the expected policy path will not happen ahead of supportive data; the Fed will be more reactive than proactive relative to past cycles.

Bottom Line: Steady monetary policy until the economy shifts gears.

Good luck and stay safe this week!