The minutes of the November FOMC meeting followed the path of recent Fed speakers. The Fed is still likely to raise rates in December:

Consistent with their judgment that a gradual approach to policy normalization remained appropriate, almost all participants expressed the view that another increase in the target range for the federal funds rate was likely to be warranted fairly soon if incoming information on the labor market and inflation was in line with or stronger than their current expectations.

There will be some holdouts with in December:

However, a few participants, while viewing further gradual increases in the target range of the federal funds rate as likely to be appropriate, expressed uncertainty about the timing of such increases.

And some that believe the Fed has already done enough:

A couple of participants noted that the federal funds rate might currently be near its neutral level and that further increases in the federal funds rate could unduly slow the expansion of economic activity and put downward pressure on inflation and inflation expectations.

Overall, they set the stage for a change of language in the December statement:

Participants also commented on how the Committee’s communications in its postmeeting statement might need to be revised at coming meetings, particularly the language referring to the Committee’s expectations for “further gradual increases” in the target range for the federal funds rate. Many participants indicated that it might be appropriate at some upcoming meetings to begin to transition to statement language that placed greater emphasis on the evaluation of incoming data in assessing the economic and policy outlook; such a change would help to convey the Committee’s flexible approach in responding to changing economic circumstances.

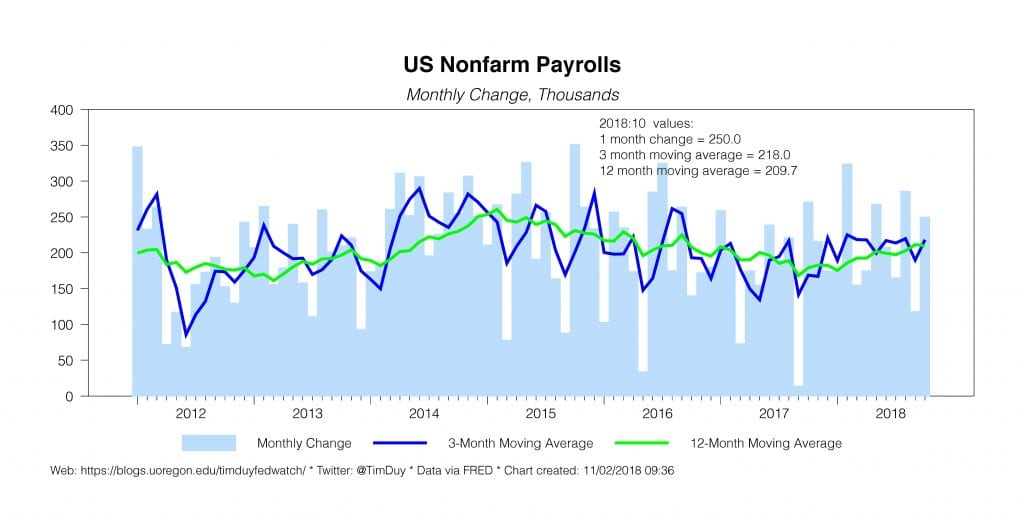

The upshot is that with rates near their neutral level, future policy changes are increasingly data dependent. The economy is at an inflection point as this year’ fiscal-induced euphoria wanes. The magnitude of the slowdown will determine how many, if any, rate hikes we see next year.

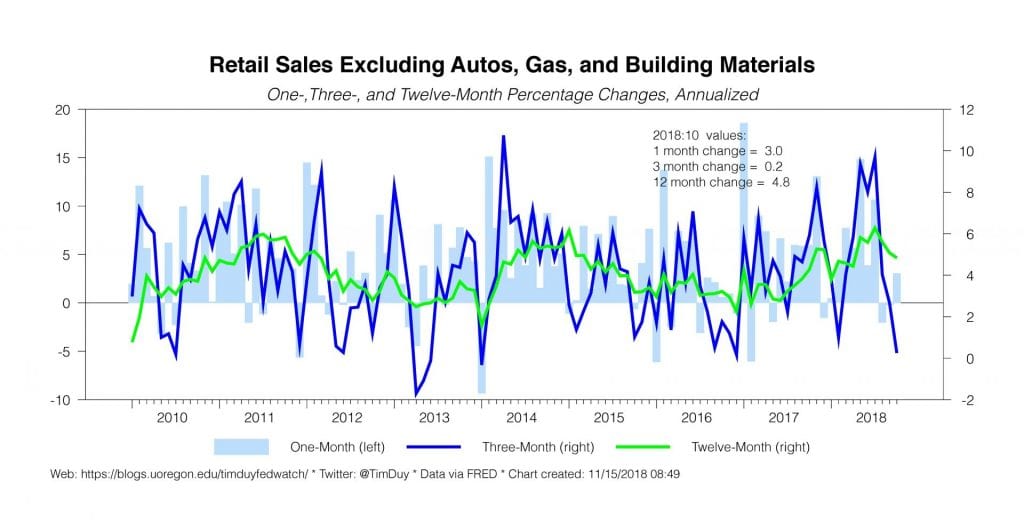

Separately, on the data front, consumer spending remains alive and well:

By all accounts, the momentum seems to be holding as we enter the final weeks of the year. Which shouldn’t be a surprise. Confidence is high, unemployment low, gas prices down, and wages up. That dynamic keeps household spending powering forward for now.

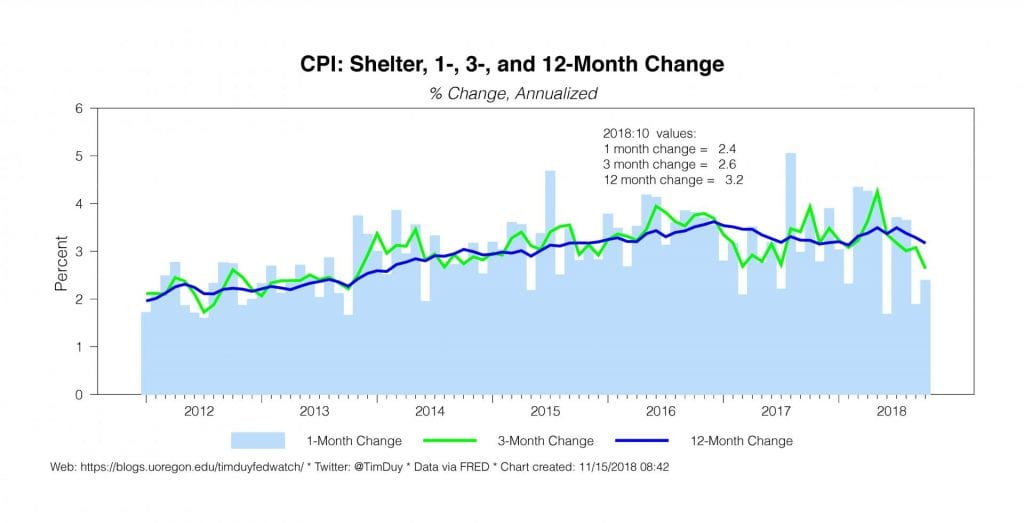

From the same report, inflation remains quiet despite concerns the economy has surpassed full employment:

These low inflation numbers give the Fed room to pause when they are confident economic momentum has downshifted enough to end the downward pressure on unemployment. Be wary though of possible upside surprise to inflation numbers in the next few months year if we see a concentration of price hikes around the turn of the year (in a low inflation environment firms hike less frequently).

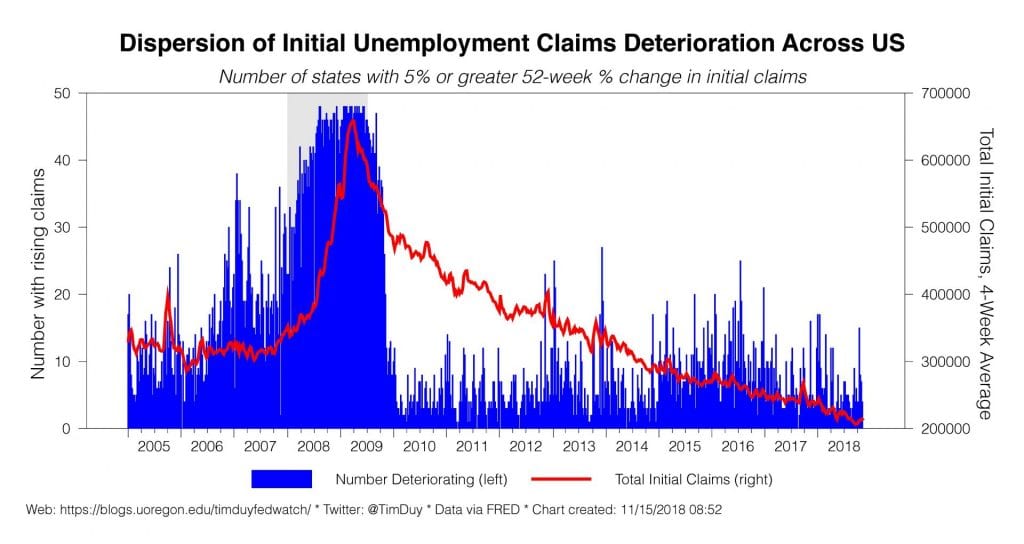

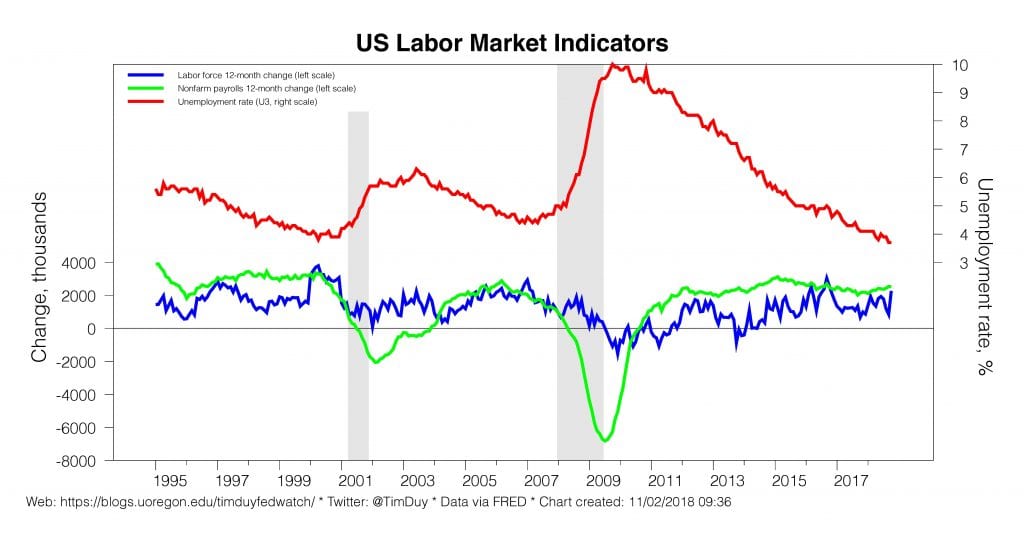

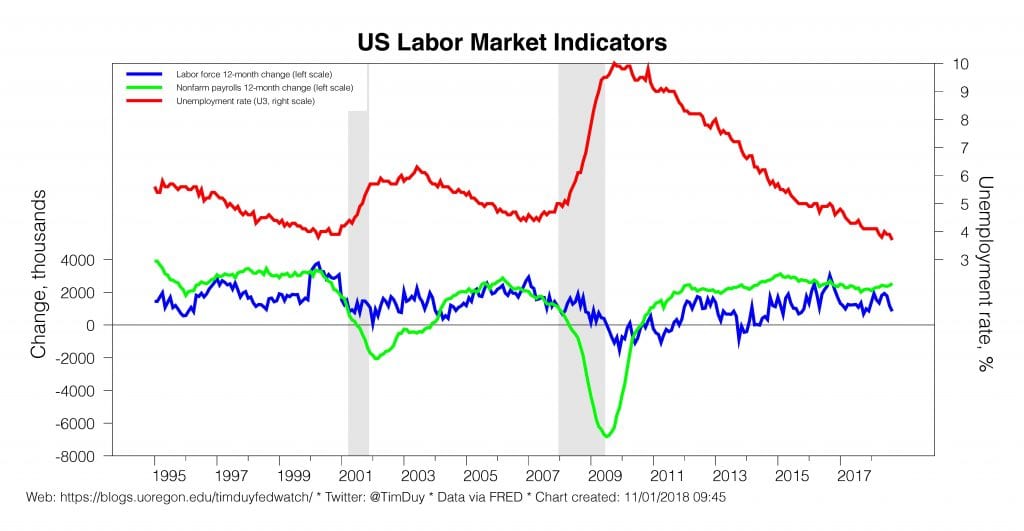

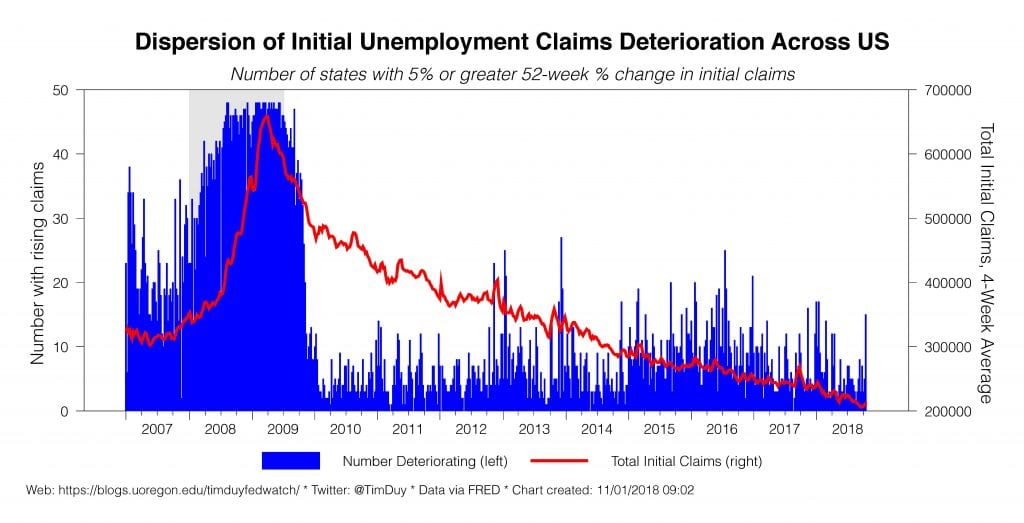

Speaking of unemployment, some economists are raising alarm bells over the recent rise in initial unemployment claims. This isn’t crazy; claims typically rise ahead of recessions. That said, the increase so far is fairly minimal, might be influenced by seasonal adjustment issues, and, as importantly to me but often overlooked, the breadth of rising claims also remains minimal:

We would see a bigger rise in the dispersion of claims across states if there was a significant worsening of the labor market. There was even a subtle rise in the dispersion of claims in 2015-16 in the aftermath of the oil price decline while claims moved sideways. See also the rising dispersion of claims ahead of the 2007 recession.

Speaking of the 2015-2016 oil induced trauma, I sense a fear that we are about to see a repeat of that episode now that oil prices have fallen. Such fears are perfectly understandable given that the US is now both a major producer and a consumer of oil products. For what it’s worth, however, the sector never recovered the jobs lost during that period:

Ditto for capital investment:

Given the lack of recovery, it seems unlikely that the magnitude of the previous downturn will be repeated.

Bottom Line: Fed remains likely to hike in December, but policy beyond that meeting is pretty much a blank slate. There is a lot of data to come between now and March, the most likely next opportunity for a rate hike. It could be soft enough to justify a pause as early as that meeting.