I am taking some downtime, so postings will light to (more likely) nonexistent this week.

Month: June 2019

Rate Cut On The Way

The Fed turned more dovish than I anticipated, basically announcing a July rate cut as clearly as they could without taking out an ad in the Wall Street Journal.

The story begins with the Fed’s statement. The Fed dropped its “patient” stance in favor of a pledge to “act as appropriate.” Given the increased “uncertainties” to the outlook and the “muted inflation pressures” the only logical direction for policy is to cut rates. This shouldn’t be a surprise – the proximity to the lower bound coupled with low inflation was always going to lead the Fed to err on the side of a rate cut. It just took them some time to find their way there.

But the story was just beginning. The dot plot was far more dovish than I anticipated. I expected one policy maker anticipating lower rates, thinking of St. Louis Federal Reserve President James Bullard (who dissented). Instead, there were eight participants expecting lower rates, seven of them 50 basis points. While not enough to change the median of the forecasts, it clearly indicated the leaning of the participants.

The forecasts were dovish as well. The inflation forecast, the longer-run unemployment rate, and the longer run interest rate were all marked down. The reduction of the longer run interest rate from a median forecast of 2.8% to 2.5% was particularly relevant. That tells me that the shift in the outlook is more about a fundamental reassessment of the level of financial accommodation in the economy than a reaction to just the trade disputes. The Fed is acknowledging that policy has been less accommodative than they believed. The persistence of low inflation likely helped them reached that conclusion.

Federal Reserve Chair Powell did nothing to push back on a dovish interpretation of this meeting. Notably, he downplayed any divisions that might be implied be the dot plot, saying that even those who held rate forecast steady were leaning toward additional accommodation. He expressed greater concern about inflation and did not try to emphasize low inflation as transitory. He didn’t appear fazed about the prospect of a 50bp cut. He acknowledged research supporting more aggressive policy moves when near the zero bound. He talked about the importance of sustaining low unemployment. It all points to an imminent rate cut.

Equity and bond markets rallied as might be expected. Interest rates dropped more sharply at the short end of the yield curve; the 10s2s spread steepened as I would anticipate to happen if the Fed enters an easing cycle. Market participants have priced in a 100% change of a rate hike in July. The 2 year treasury yield is also begging the Fed to cut rates.

Yes, there is some commentary that this July cut is conditional on trade talks or data. I don’t think so; it would take some spectacular data to call the July cut into question. Powell and his colleagues knew exactly how the market would react to this meeting and did nothing to push back against that reaction. It would be exceedingly difficult to pull back on a rate cut now.

Nor is there any reason to. Yes, financial stability concerns linger in the background. I think though the Fed will weigh more heavily meeting its employment and inflation mandates. The persistently low inflation leaves them room to ease and protect against downside risks to employment. It important to lean against those risks given the proximity to the zero lower bound. It is also important to lean against those risks because you don’t want to go into a recession with low inflation.

Bottom Line: The Fed greenlit a July rate cut. The dots suggest more will follow, with a minimum of 50bp on the way. While I think July is pretty much locked in, future cuts are of course data dependent.

Stage Set For a Dovish Shift

If You Don’t Have Any Time This Morning

Expect a more dovish Fed this week, but no rate cut.

Data

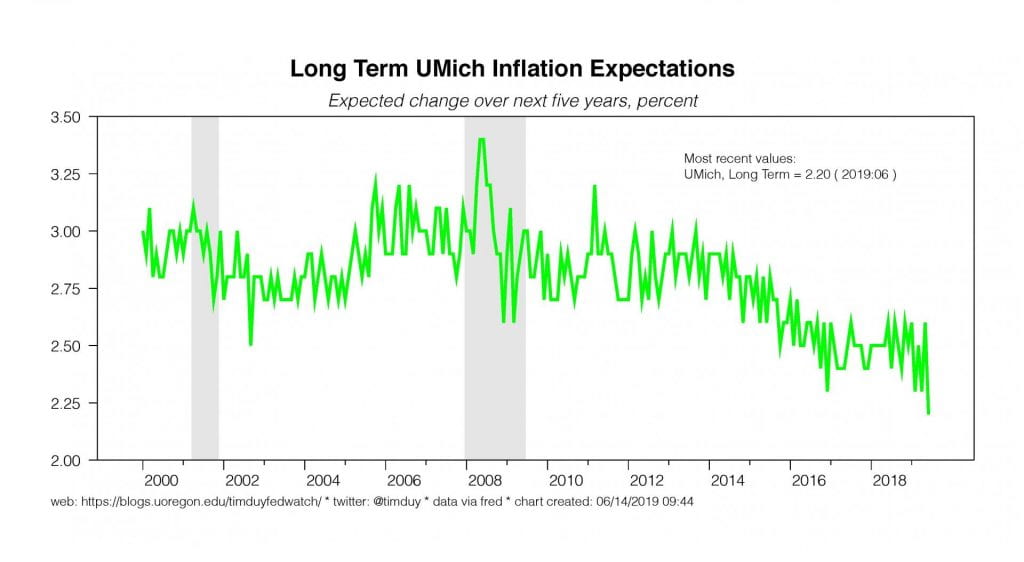

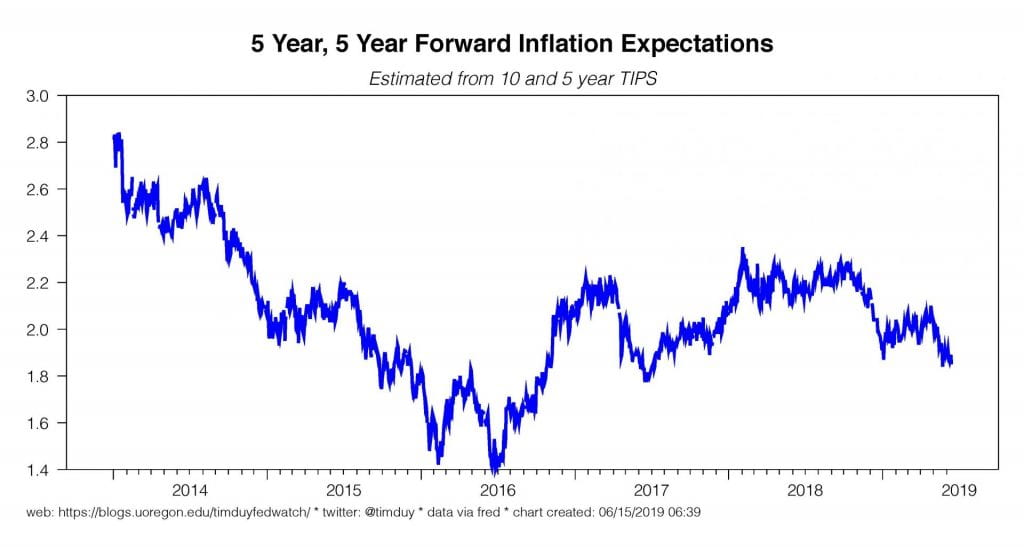

Incoming inflation data raises questions about the persistence of the supposedly transitory weakness inflation.The April PCE report gave support to the Fed’s hypothesis, but the May CPI report took away some support. See my note on the May CPI numbers here. Perhaps most worrisome for the Fed were declining survey-based and market-based measures of inflation expectations. The University of Michigan measure of long-run inflation expectations fell to a record low in June while the 5-year, 5-year forward expected rate of inflation remains mired below 2%.

On a positive note, industrial production bounced higher.The weakness spreading through the nation’s factories continues to fall short of the degree experienced in 2015-16. Of course, even that weakness occurred outside a recession; realistically, the declining share of manufacturing in the economy relative to the service sector means we need to carefully parse this data to differentiate between sector-specific and economy-wide shocks.

Contrary to expectations, consumer spending remains alive and well.Retail sales rose in May and previous months were revised higher. The underlying pace of sales remains consistent with something close to early 2017, solid but not exciting. No wonder then that consumer confidence continues to hold near cycle highs. Absent sizable job losses, it is simply unreasonable to expect that consumer spending will tumble off a cliff. If people have jobs, they have money, and if they have money, they spend money.

Fedspeak

Blackout period ahead of this week’s FOMC meeting, so no Fedspeak to report. It’s notable that at least there appears to have been no effort to push back on market expectations via deep background.

Upcoming Data

Light data schedule this week. Tuesday we get new residential construction data for May. On Friday we get more housing data with existing home sales, also for May. If you are expecting bad housing news, I would note that homebuilder stocks have been on a tear lately and are at 52-week highs. On a local note, it looks like housing markets around me bounced back in May. I am thinking that we are likely past any lingering housing concerns from late last year.

Initial unemployment claims as usual on Thursday. And, of course, the big event for the week is Wednesday’s conclusion of the FOMC meeting, the release of the Summary of Economic projections, and Federal Reserve Chairman Jerome Powell’s press conference.

Discussion

I think it is very unlikely the Fed will cut interest rates this week.I don’t think the internal consensus yet exists to support such a move. The data flow is not deteriorating quickly enough to justify an immediate rate cut. Arguably, this past week’s readings on consumer spending and manufacturing suggest the economy is nowhere near teetering into a recession and will give ammunition to the wait-and-see crowd on the FOMC.

That said, I still expect the Fed to open the door for a July rate cut on the basis on the deceleration in job growth and weak inflation readings.The Fed is clearly focused on “sustaining” the expansion, not controlling inflation. Sustaining the expansion at this point means protecting against excessive deceleration in the pace of activity. Moreover, weak inflation makes it even more important to protect against the downside risks. The Fed should be very wary about going into a recession with inflation already on a soft trend. Eventually, the Fed is going to need to put up or shut up about inflation concerns.Seriously, aren’t we all getting a bit tired with Fed officials bemoaning the possibility that inflation expectations are slipping yet ignoring any evidence that those expectations are indeed slipping?

In the FOMC statement, I expect the Fed will signal that a more dovish stance by replacing “the Committee will be patient” with “the Committee will act as appropriate” to sustain the expansion.I would expect Powell in his press conference to note that “appropriate” policy could be a rate hike, but we all kind of know which way the wind is blowing. It would be a signal that the odds of a rate cut clearly outweigh the odds of a rate hike.

What about the dots? Powell, in his recent Chicago speech, told us ignore the dots in favor of understanding the dynamics behind the dots:

A focus on the median forecast amounts to emphasizing what the typical FOMC participant would do if things go as expected. But we have been living in times characterized by large, frequent, unexpected changes in the underlying structure of the economy. In this environment, the most important policy message may be about how the central bank will respond to the unexpected rather than what it will do if there are no surprises. Unfortunately, at times the dot plot has distracted attention from the more important topic of how the FOMC will react to unexpected economic developments. In times of high uncertainty, the median dot might best be thought of as the least unlikely outcome.

With respect to the dots, I have quite a bit of sympathy for the Fed’s communication challenges. The dot plot arose from a good faith effort on the part of the Fed to more fully communicate the analysis behind monetary policy decisions. What is being communicated, however, is not a consensus view whereas the actual policy decision is a consensus view. The Chair is stuck trying to bridge that gap in the press conference, sometimes less successfully than other times.

Still, what has been given is difficult to take back. Powell can downplay the dots, but they will nonetheless be published. And if they are published, we have to talk about them. That’s the way this works. I expect the 2020 rate median projected rate hike will revised away. I think the 2019 median will hold steady. My expectation is that there will be at least one dot that anticipates a rate cut later this year. Regarding the remainder of the forecasts, I expect that the inflation forecast for this year and the longer-run employment forecasts will both be revised lower. Due to the solid first quarter GDP number, the growth estimate is likely to be revised higher.

Bottom Line: The Fed is likely to turn more dovish this week and open up the possibility of a rate cut. I think they still need more data to justify a rate cut. Another jobs report alone the lines of the May report would go a long way toward supporting that cut in July.

Still Less Transitory Than Persistent

The soft CPI numbers for April throw some cold water on the Fed’s expectation that recent weak inflation data will prove to be transitory. Core CPI clocked in at an anemic 1.4% annualized monthly rate and 2% yearly rate in May:

Recall that CPI inflation generally runs hot compared to PCE inflation, hence these numbers remains consistent with below-target inflation. Shelter inflation has pulled back from recent strength:

The stronger numbers earlier in the year had come as a surprise to me given softer housing markets and the rapid pace of apartment construction in recent years. If the data is reverting to my expectations, one source of strength in recent numbers may be persistently weaker going forward. Goods inflation is softer:

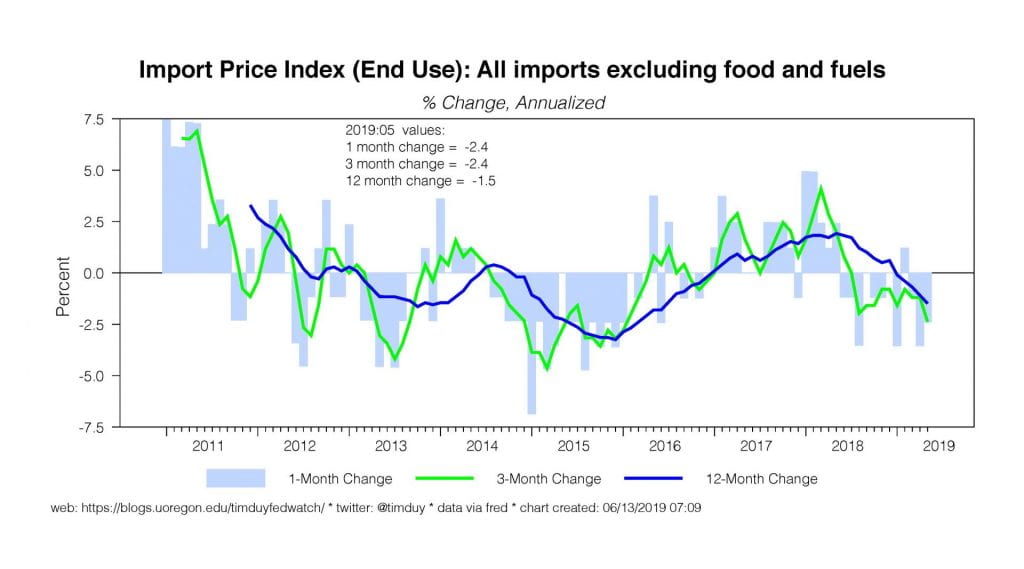

Relatedly, import prices are falling again:

This points toward weaker global demand which is in turn places some downward pressure on US inflation. Service sector inflation is also on the softer side:

It’s instructive to look at the acceleration in of services inflation in the periods 1999-2001, 2003-2006, and in 2007-2008, each of which contributed to a potentially more persistent inflationary environment that caught the Fed’s attention. There is no evidence in recent broad trends to suggest that such concerns are relevant at this time.

Separately, initial unemployment claims continue to move sideways:

The relative stagnation of the claims data remains consistent with a labor market that has shifted gears to a slower pace but does not show signs of recession.

Bottom Line: My read is that at a minimum inflation remains a nonissue with the risks weighted toward the possibility that recent weakness is more persistent than transitory. In addition, the slowing pace of job growth should take more pressure off inflation in the months ahead. The combination gives the Fed room to cut rates. Assuming this data flow continues to hold, I anticipate the Fed to signal a rate cut at next week’s FOMC meeting and follow through with that cut in July.

Data Beginning to Clear the Way for a Rate Cut

Central Takeaway If You Don’t Have Any Time This Morning

The Fed hastily delivered a soothing message last week by promising to act appropriately to maintain the expansion. It was hard not to read that as dovish. That combined with the employment data puts a rate cut in play this summer.

Things That You Should Already Know About

The Trump administration announced that Mexico had agreed to help stem the flow of immigrants into the U.S. In return, the threat of tariffs has been lifted indefinitely. That said, I doubt the coast is clear entirely. I suspect that if Trump perceives this as a win, he will use this tool again.

Data

Last Friday the BLS delivered a disappointing Employment Report for May.The earlier-released ADP report guided in the right direction as the BLS estimated nonfarm payroll growth at 75k compared to expectations for 180k. As if not more importantly, previous months were revised downward, dragging down the three-month average to 151k.

With these revisions it becomes more apparent that job growth has slowed markedly in the last four months. It would seem that the economy’s fiscal stimulus sugar high has worn off. But what is left behind? Sustained growth at this pace remains above the Fed’s estimates of that necessary to keep the unemployment rate steady once demographic effects take hold.The magic number is roughly 100k, so 150k might still be sufficient to put downward pressure in unemployment. That will be something the Fed will puzzle over.

In a disappointing development, wage growth has decelerated.That said, this may not be something that should come as a complete surprise given that inflation has decelerated as well. Real wages continue to grow at a clip comparable with the immediate pre-recession period. Temporary help employment continues to grind a bit higher, but the pace is anemic. Still, temp workers are not being let go at a pace normally associated with recessions.

Fedspeak

New York Federal Reserve President John Williams, speaking before the jobs report, did not appear eager to cut rates. Via the Wall Street Journal:

“There are more uncertainties today,” he said while answering questions following remarks Thursday at the Council on Foreign Relations in New York, but “my base case is an economy that continues to grow above trend, an economy that still has a very low unemployment rate and inflation moving back to 2%.”

We don’t know if the jobs report changed his view, but my guess is that Williams would see 150k job growth as generally consistent with this outlook.

Meanwhile Dallas Federal Reserve President Robert Kaplan was equally circumspect about the outlook. Regarding the risk posed by trade wars:

“Some of these decisions can change. We may see a new announcement and new decisions in the next four or five weeks. I am concerned…But it is too soon to make a judgment about whether there is any action that would be appropriate.”

This is important; the Fed would not want to base a rate cut decision on the trade wars if peace comes in just a few weeks if those trade wars never happen.

Upcoming Data

A fairly busy week ahead of us.A wide swath of price data arrives this week, with the Producer Price Index on Tuesday, the Consumer Price Index on Wednesday, and import prices on Thursday. Obviously, we will be looking for more signs to confirm or deny the Fed’s contention that the weak inflation in recent months was just transitory. Thursday we also get the usual weekly initial unemployment claims report. Friday is a big day. First, we get some insight into the consumer with the Retail Sales report; expectations are high, with Wall Street looking for headline sales to rebound 0.7% while ex-autos are up 0.4%. Following up the sales data is the Industrial Production report which is expected to be up 0.2% after a decline in April. Both reports will be watched for auto industry insight, but the basic soft trend in that sector probably won’t improve anytime soon as autos are on the downhill side of the post-recession recovery. Still, the day isn’t over then. It ends only after we see May University of Michigan Consumer Sentiment and April Business Inventories.

Blackout period for the Fed, so no Fedspeak expected. If the Fed wants to say something, it will be on deep background.

Discussion

My basic view since the beginning of the year has been that a rate cut is more likely than a rate hike. The exact timing of that move became clearer last week when Powell inserted into a non-related speech that the Fed was ready to act as appropriate to sustain the recovery. The proximate cause for those remarks were the threat of potential economic disruption from Trump’s tariff threat to Mexico. For me, that brought September into play on the basis that the Fed would require a few more months of softer data to justify a rate cut. If data worsened more quickly than expected, pull the hike forward, if not push it backward.

Events since Powell’s comments have evolved quickly.On the positive side, negotiations between the U.S. and Mexico over immigration issues yielded enough fruit that the threat of tariffs are off the table (as noted above, however, this probably won’t be the last we see of Trump and tariffs). On the negative side, the jobs report revealed a marked slowdown in job growth since the beginning of the year.

Do the two events cancel each other out? No. It is tempting to conclude that with downside risks reduced, the Powell will regret sending a dovish signal this week. I think, however, that even if this most recent tariff dispute has not occurred, the shift in the employment data would have been sufficient to put a rate cut into play. A clear slowing in economic activity by itself raises the downside risks because you don’t know when that slowing will end. Given the economy’s proximity to the lower bound, the Fed’s most likely move is to prepare for a rate cut.

The jobs report provides cover for the Fed to use the June FOMC meeting to signal a rate cut at the end of July. Why not cut in June? A number of reasons:

- This dovish shift probably as if yet doesn’t have wide internal support. See Williams’ comments above. It will take a meeting to build that support.

- I suspect the median FOMC participant would like to see a little more data that confirms the slowing trend in the labor market.Perhaps the June employment report reveals strong upward revisions that make them rethink the degree of slowing.

- Worries about financial stability persist.The Fed remains wary that persistent low interest rates will set in motion the next financial crisis. Some will see the past week’s equity rally as validation of those concerns.

- Recent inflation readings support the Fed’s contention that recent inflation weakness was in fact transitory.In the Fed’s world, unemployment remains below the natural rate, which in turn places upward pressure on inflation when inflation is already near trend. They do not have a policy of deliberately overshooting their 2 percent target. They do not know yet that the slowdown is yet sufficient to reduce the upward pressure on inflation let alone put downward pressure on inflation.

The current setup feels a lot like 1995.Then, like now, the Fed spent the first part of the year struggling with the magnitude of the economic slowdown underway. By the time of the July 1995 meeting, however, the Fed had enough evidence in hand to justify a rate cut, the first of three 25 basis point cuts. Interestingly, the employment picture shifted in the first half of 1995 as it has so far in the first half of 2019. If the Fed can engineer a repeat, 1995 would be a good model to follow as it is arguably the only instance of a soft landing for monetary policy.

To be sure, I can’t rule out a June rate cut.As I often say, when the Fed shifts gears, it shifts quickly. Still, the reasons outlined above suggest to me the path forward is to use June to signal a high probability that the next move is a cut and to deliver that cut in July (assuming of course the data continues to support that move).

Bottom Line: The Fed set a low bar for a rate cut. The data is beginning to clear the way for that cut.

Fed Prepared to Adjust Policy As Needed

Recent Data

Incoming data has been…well, not terrible really despite the pessimism bubbling over on Wall Street. The ISM manufacturing report was on the soft side, to be sure, but still nothing like the kind of weakness typically associated with recession:

The ISM nonmanufacturing report, however, held strong in May:

At least for now, it looks like the two indexes are diverging much as they did in 2015-16:

This potential divergence is of course important, very important. The services sector is a much bigger portion of the economy. We need to be careful about not extrapolating a manufacturing sector specific shock to the rest of the economy.Are tariffs an economy-wide shock or primarily a manufacturing shock? How much would they bleed into the broader economy? It’s something we need to keep in mind after the false recession signal sent by manufacturing data in the 2015-16 period.

Note also the ISM manufacturing employment component remains in positive territory whereas in 2015-16 it dipped below 50. Moreover, the service sector employment component jumped higher in May. Both are inconsistent with the disappointingly small 27k gain in the ADP employment numbers. Also inconsistent are the initial unemployment claims numbers, which are pretty much flat this year and not jumping higher as might be expected in the event of a material change in the labor market:

More on the labor market below.

The Federal Reserve released a fresh Beige Bookahead of the upcoming FOMC meeting. Interestingly, as of mid-May the anecdotal evidence indicated economic activity “expanded at a modest pace…a slight improvement over the previous period.” Also, growth was universal: Almost all Districts reported some growth, and a few saw moderate gains in activity. Manufacturing, however, showed some cracks in the foundation:

Manufacturing reports were generally positive, but some Districts noted signs of slowing activity and a more uncertain outlook among contacts.

That uncertainty has certainly risen given that the trade dispute with China remains unsettled while President Trump escalated trade uncertainty with his threat of tariffs on Mexico.

Fed Speak

The highlight of the week were the comments by Federal Reserve Chair Jerome Powell. He added a paragraph to his speech Tuesday to signal that the Fed will “act as appropriate to sustain the expansion.”For more on Powell, see what I wrote earlier this week.

Powell’s colleague Lael Brainard backed him upin an interview with Yahoo! Finance, reassuring market participants that the Fed would adjust policy accordingly. In regards to what she is looking at:

LAEL BRAINARD: So I think I look very carefully at the payrolls number that comes out at the end of this month (sic). I don’t tend to take too much signal from one particular data point. I like to put it in context and look over several months and look at that trend line.

But I will be paying very close attention to the payrolls number on Friday. And the labor market does give us a lot of signals about what’s going on in the economy. Initial claims is another important one that I pay a lot of attention to.

The key here is that the Fed continues to look at the totality of the data, not just any one data point, and then adds in the risks to the outlook, such as trade wars, so assess the appropriate policy path. Not one thing alone will prompt the Fed to alter interest rates.

At least one Fed official is ready for a rate cut. Earlier this week St. Louis Federal Reserve President James Bullard made his thoughts clear. Via Bloomberg:

“A downward policy rate adjustment may be warranted soon to help re-center inflation and inflation expectations at target and also to provide some insurance in case of a sharper-than-expected slowdown,” Bullard said Monday in remarks prepared for a talk in Chicago. “The direct effects of trade restrictions on the U.S. economy are relatively small, but the effects through global financial markets may be larger.”

Note that Bullard centers his case on the inflation outlook; his colleagues generally favor the view that the recent weakness is only transitory.

Upcoming Data

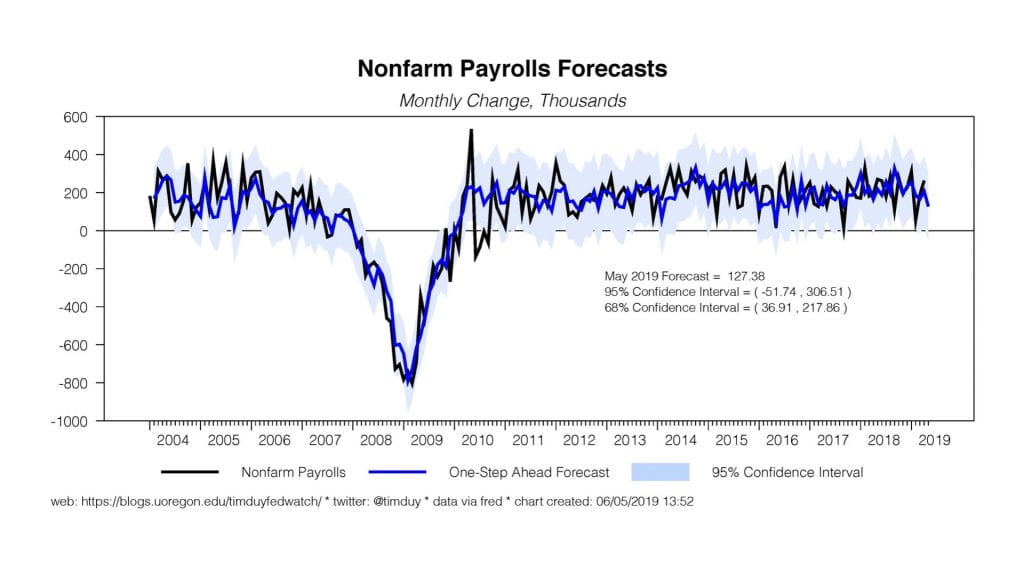

The highlight of the week is Friday Employment Situation report for May.The ADP report threw some cold water on expectations for the report. Still, Wall Street currently anticipates a gain of 180k compared to 263k in April. Incorporating the ADP numbers into my forecast yields a gain of 127k:

I fear that the ADP report may be a head fake given its inconsistency with other data as noted above; my experience is that when ADP misleads market participants, it misleads in a big way.That said, even if ADP does prove accurate and the employment report is on the soft side, the Fed will probably not take an excessively weak number seriously and instead see it as an outlier.Ithink a modestly solid number like 125k would make more of an impact as it would be consistent with an expected slowdown in hiring that would help stabilize the unemployment rate. Still, as Brainard noted above, it is just one number.

Discussion

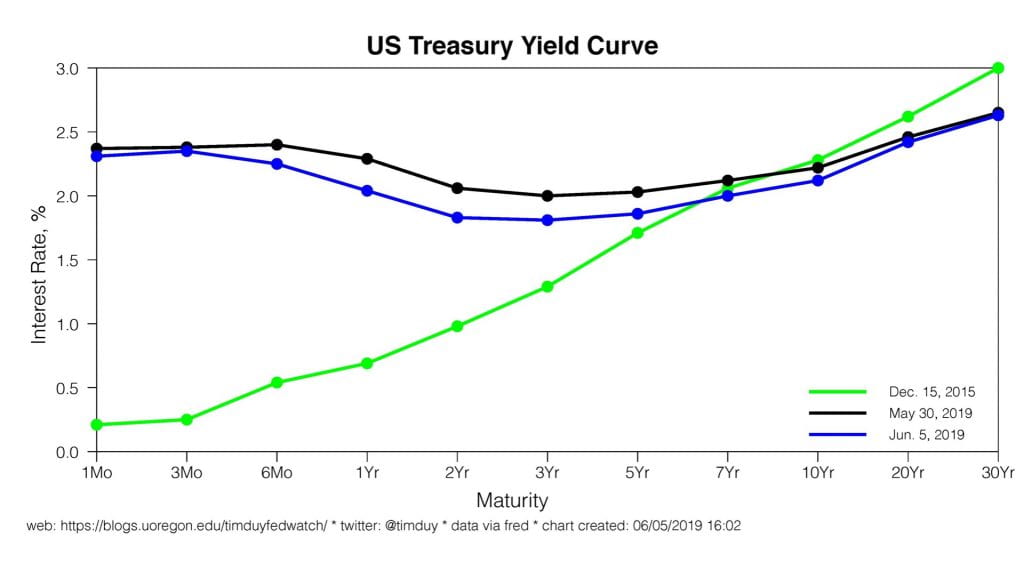

Market participants continue to look for a rate cut.That’s the story from the yield curve, and that story has only gotten stronger in recent weeks:

The 10s2s portion of the curve has yet to invert; I interpret this to mean that market participants believe policy is a bit too tight and if the Fed cut interest rates in the near future they can avoid a recession. I would be more worried about recession if the 10s2s inverted and the Fed was still hiking rates. I will become more worried if the Fed ignores the signal to cut from shorter end of the curve. Truth be told, my own ongoing expansion forecast is very much dependent on the Fed cutting rates before recessionary dynamics set in.

Luckily, as noted above, the Fed is increasingly open to the proposition that a rate cut might be necessary, even an insurance cut if the data continues to slow as expected and trade tensions boost the downside risks. I am challenged to see this cut come before September.My read of the Fed is that the consensus FOMC view feels the expected slowing of activity remains inconsistent with a rate cut given the expectation that inflation rebounds while unemployment remains low. They don’t want to get caught scurrying to hike rates again in a few months if risks suddenly dissipate. Hence, I think they need some additional confirmation from the data that a rate cut is necessary before cutting rates. The exact timing is thus subject to evolving economic conditions, but if the economy slows as expected, I expect the Fed to have enough data in hand by September to make their move.

Bottom Line: The missing piece in the rate cut story is seemingly the most important – a consistent pattern of data soft enough to make the Fed fear there is a threat to the employment and inflation outlooks. I anticipate the data will soften enough in the next few months to prompt the Fed to act in September. How much softer? Given the rising risks to the outlook, the Fed seems to have set a fairly low bar for a rate cut. That means the data flow doesn’t have to be too much softer.

Powell Tells Us What We Should Already Know

Federal Reserve Chair Jerome Powell delivered opening remarks for the Fed’s “Conference on Monetary Policy Strategy, Tools, and Communications Practices.” Market participants buzzed over the inclusion of this paragraph:

I’d like first to say a word about recent developments involving trade negotiations and other matters. We do not know how or when these issues will be resolved. We are closely monitoring the implications of these developments for the U.S. economic outlook and, as always, we will act as appropriate to sustain the expansion, with a strong labor market and inflation near our symmetric 2 percent objective. My comments today, like this conference, will focus on longer-run issues that will remain even as the issues of the moment evolve.

The inclusion of this paragraph is notable. It looks like a last minute addition. It was clearly intended to send a signal. But what sort of signal?

One take is that Powell intended to signal an imminent rate cut. I do not think this is the case. The consensus view within the FOMC is still that a rate cut would be premature. Instead, the more likely message is that the Fed recognizes the issues currently of concern for market participants and they stand ready to adjust policy as necessary. Vice Chair Richard Clarida added some clarity in a CNBC interview:

“We will put in policies that need to be in place to keep the economy, which is in a very good place right now, and it’s our job to keep it there.”

Both Powell and Clarida are reminding us that the Fed sets policy systematically. If tariffs threaten the economic forecast to an extent that the Fed believes they will not be able to be their mandate, policy makers will act accordingly. This is the case whenever the economy faces a shock, even shocks that are triggered by rash trade policy actions. We should already know this, of course.

In other words, the Fed has little choice but to “bail out” President Trump should his trade policies threaten the economy. That’s how it works. The Fed is not going to let the economy tumble into recession to punish Trump. That would simply be an instance of cutting off your nose to spite your face.

Importantly, Clarida opened up the possibility of an insurance cut:

“I’m not going to look into a crystal ball. I will look into the past,” Clarida said. “That has been in the monetary policy toolkit in the past.”

The implication is that the data does not need to turn recessionary in order for the Fed to cut rates. The data and risks to the forecast only need to suggest a substantial likelihood that the pace of activity will fall below the Fed’s estimate of potential growth (roughly 2%), which in turn would be expected to place upward pressure on unemployment and downward pressure on inflation.

Altogether, the message is that the bar for a rate cut is fairly low. What size of rate cut? If the cut is in fact more insurance than panic, I suspect it will be 25 basis points. If the data gets away from the Fed more quickly than anticipated, it will be 50 basis points. Assuming the economy slows as anticipated in the next few months, inflation remains low, and weaponized uncertainty remains the Trump administration’s primary policy choice, I think a 25 basis point rate cut in September is a reasonable baseline scenario. If the slowdown turns elusive, the odds of a rate cut obviously decline accordingly.

Bottom Line: The Fed stands ready to adjust policy as needed to respond to unexpected shocks; this is true even if the shocks emanate from the White House.