If You Don’t Have Any Time This Morning

Expect a more dovish Fed this week, but no rate cut.

Data

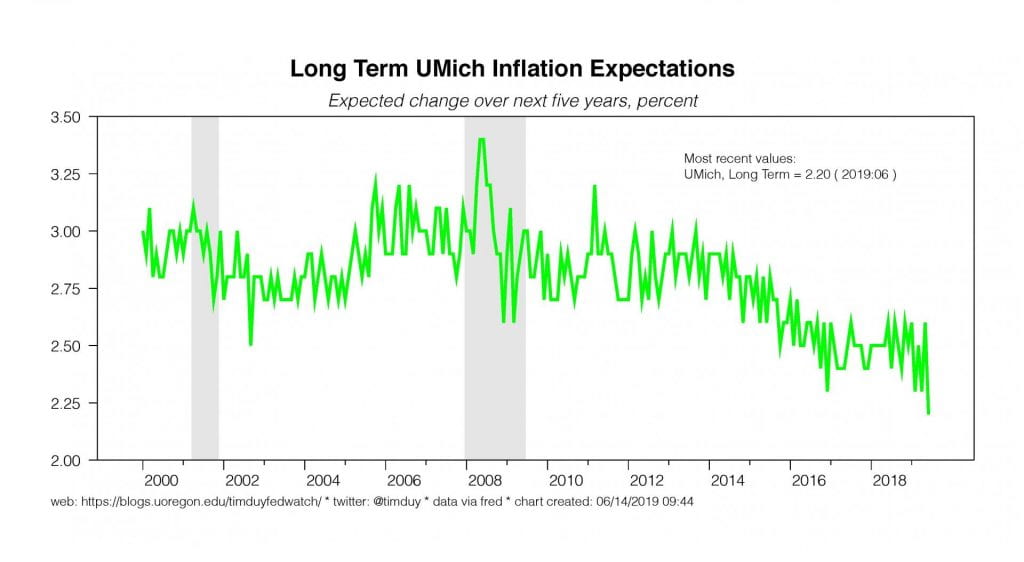

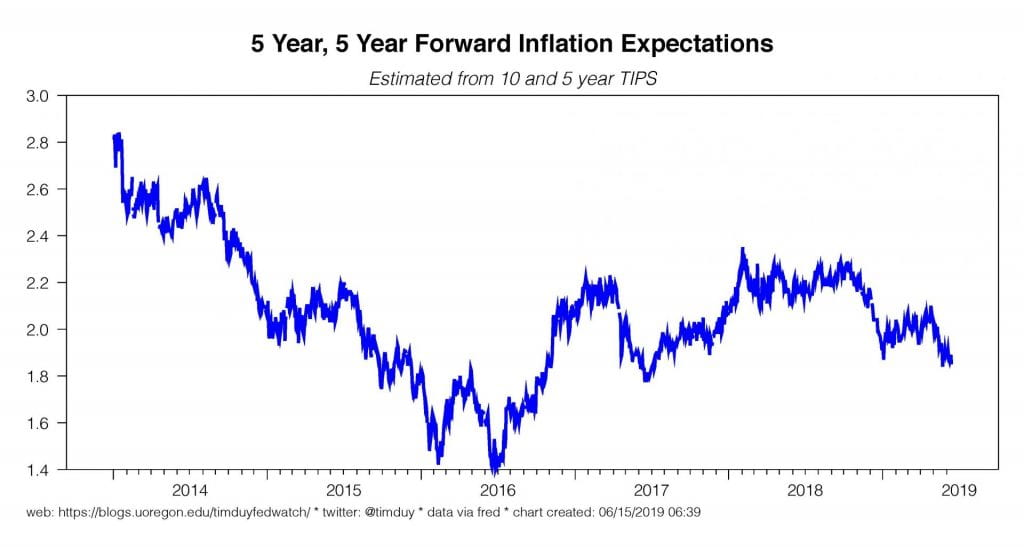

Incoming inflation data raises questions about the persistence of the supposedly transitory weakness inflation.The April PCE report gave support to the Fed’s hypothesis, but the May CPI report took away some support. See my note on the May CPI numbers here. Perhaps most worrisome for the Fed were declining survey-based and market-based measures of inflation expectations. The University of Michigan measure of long-run inflation expectations fell to a record low in June while the 5-year, 5-year forward expected rate of inflation remains mired below 2%.

On a positive note, industrial production bounced higher.The weakness spreading through the nation’s factories continues to fall short of the degree experienced in 2015-16. Of course, even that weakness occurred outside a recession; realistically, the declining share of manufacturing in the economy relative to the service sector means we need to carefully parse this data to differentiate between sector-specific and economy-wide shocks.

Contrary to expectations, consumer spending remains alive and well.Retail sales rose in May and previous months were revised higher. The underlying pace of sales remains consistent with something close to early 2017, solid but not exciting. No wonder then that consumer confidence continues to hold near cycle highs. Absent sizable job losses, it is simply unreasonable to expect that consumer spending will tumble off a cliff. If people have jobs, they have money, and if they have money, they spend money.

Fedspeak

Blackout period ahead of this week’s FOMC meeting, so no Fedspeak to report. It’s notable that at least there appears to have been no effort to push back on market expectations via deep background.

Upcoming Data

Light data schedule this week. Tuesday we get new residential construction data for May. On Friday we get more housing data with existing home sales, also for May. If you are expecting bad housing news, I would note that homebuilder stocks have been on a tear lately and are at 52-week highs. On a local note, it looks like housing markets around me bounced back in May. I am thinking that we are likely past any lingering housing concerns from late last year.

Initial unemployment claims as usual on Thursday. And, of course, the big event for the week is Wednesday’s conclusion of the FOMC meeting, the release of the Summary of Economic projections, and Federal Reserve Chairman Jerome Powell’s press conference.

Discussion

I think it is very unlikely the Fed will cut interest rates this week.I don’t think the internal consensus yet exists to support such a move. The data flow is not deteriorating quickly enough to justify an immediate rate cut. Arguably, this past week’s readings on consumer spending and manufacturing suggest the economy is nowhere near teetering into a recession and will give ammunition to the wait-and-see crowd on the FOMC.

That said, I still expect the Fed to open the door for a July rate cut on the basis on the deceleration in job growth and weak inflation readings.The Fed is clearly focused on “sustaining” the expansion, not controlling inflation. Sustaining the expansion at this point means protecting against excessive deceleration in the pace of activity. Moreover, weak inflation makes it even more important to protect against the downside risks. The Fed should be very wary about going into a recession with inflation already on a soft trend. Eventually, the Fed is going to need to put up or shut up about inflation concerns.Seriously, aren’t we all getting a bit tired with Fed officials bemoaning the possibility that inflation expectations are slipping yet ignoring any evidence that those expectations are indeed slipping?

In the FOMC statement, I expect the Fed will signal that a more dovish stance by replacing “the Committee will be patient” with “the Committee will act as appropriate” to sustain the expansion.I would expect Powell in his press conference to note that “appropriate” policy could be a rate hike, but we all kind of know which way the wind is blowing. It would be a signal that the odds of a rate cut clearly outweigh the odds of a rate hike.

What about the dots? Powell, in his recent Chicago speech, told us ignore the dots in favor of understanding the dynamics behind the dots:

A focus on the median forecast amounts to emphasizing what the typical FOMC participant would do if things go as expected. But we have been living in times characterized by large, frequent, unexpected changes in the underlying structure of the economy. In this environment, the most important policy message may be about how the central bank will respond to the unexpected rather than what it will do if there are no surprises. Unfortunately, at times the dot plot has distracted attention from the more important topic of how the FOMC will react to unexpected economic developments. In times of high uncertainty, the median dot might best be thought of as the least unlikely outcome.

With respect to the dots, I have quite a bit of sympathy for the Fed’s communication challenges. The dot plot arose from a good faith effort on the part of the Fed to more fully communicate the analysis behind monetary policy decisions. What is being communicated, however, is not a consensus view whereas the actual policy decision is a consensus view. The Chair is stuck trying to bridge that gap in the press conference, sometimes less successfully than other times.

Still, what has been given is difficult to take back. Powell can downplay the dots, but they will nonetheless be published. And if they are published, we have to talk about them. That’s the way this works. I expect the 2020 rate median projected rate hike will revised away. I think the 2019 median will hold steady. My expectation is that there will be at least one dot that anticipates a rate cut later this year. Regarding the remainder of the forecasts, I expect that the inflation forecast for this year and the longer-run employment forecasts will both be revised lower. Due to the solid first quarter GDP number, the growth estimate is likely to be revised higher.

Bottom Line: The Fed is likely to turn more dovish this week and open up the possibility of a rate cut. I think they still need more data to justify a rate cut. Another jobs report alone the lines of the May report would go a long way toward supporting that cut in July.