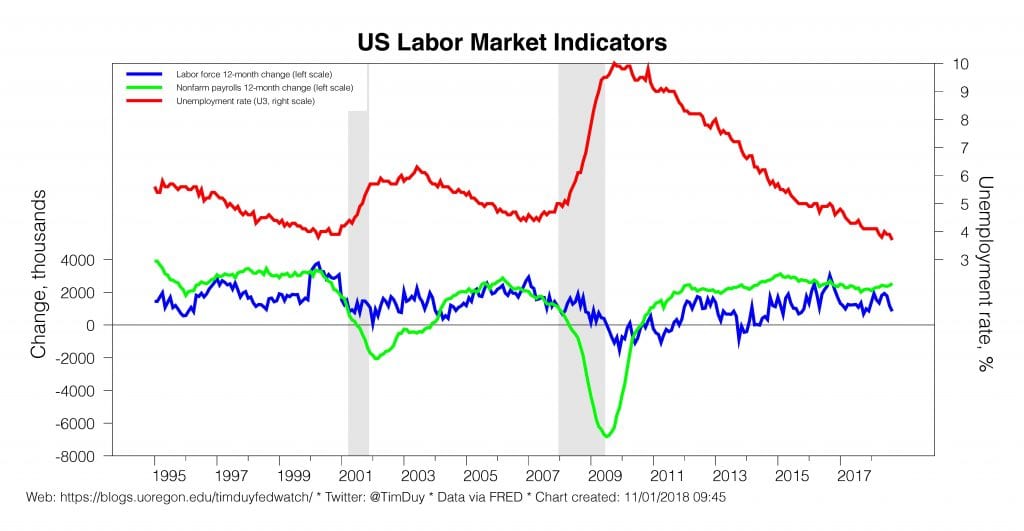

Friday morning the BLS releases the October employment report. It will most likely leave expectations for a December Fed rate hike intact. We should focus on the unemployment rate and wages. Steady or even an uptick in the unemployment rate would help convince central bankers that they can squeeze more out of the labor market. That said, continued acceleration in wage growth would suggest that any lingering slack may be minimal.

The September payrolls gain was on the soft side; I anticipate upward revisions. The October report will likely be stronger. The consensus expectation is for a NFP gain of 190k in the range of 150k-231k. The ADP report released yesterday estimated a gain of 227k private sector employees, suggesting upside risk relative to the consensus. My model agrees that the risk is to the upside.

The unemployment rate ticked down to 3.7% in September. Wall Street expects it to hold steady; given the variance in labor force participation, anything in the 3.6%-3.8% range should not be a surprise. Whatever the number, we should compare it against the Fed’s current year end forecasts for 3.7% (median and central tendency) issued in September. Recall that this estimate nudged up from 3.6% in June, indicating more confidence that they could get more help from labor force expansion. So far, this bet has been wrong, but could be quickly right given the nature of the data. A downward tick in the unemployment rate would like increase overheating concerns.

Wages are expected to be up 3% (range 2.8%-3.2%) relative to year ago levels. Continued acceleration of wage growth would nudge Powell & Co. toward thinking that maybe they are approaching limits to what they can squeeze out of the labor market.

Bottom Line: It would take quite a dive in the data to stop the Fed from hiking in December. We won’t find that kind of dive int he next employment report. The Fed will tend toward hiking rates until they are confident that economic activity is likely to slow enough that concerns of overheating fade. We aren’t there yet.