If You Don’t Have Time This Morning

The Fed will hold policy steady this week while Powell downplays tapering talk. FOMC preview below.

Vaccine Update

As of Sunday, Bloomberg estimates that the U.S. has given 21.1 million doses of vaccine have been delivered while the rate of vaccination now exceeds 1 million per day.

Recent Data and Events

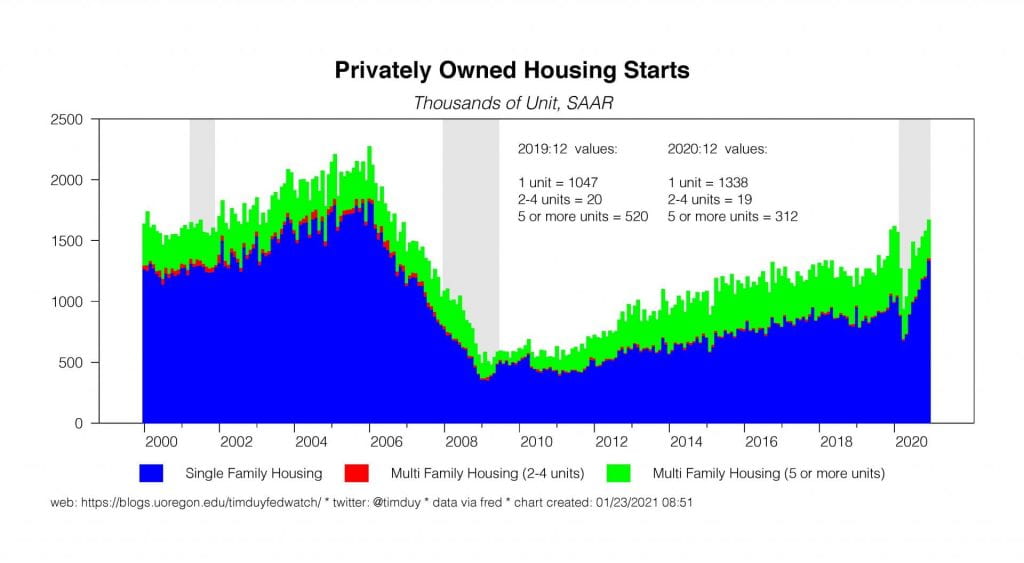

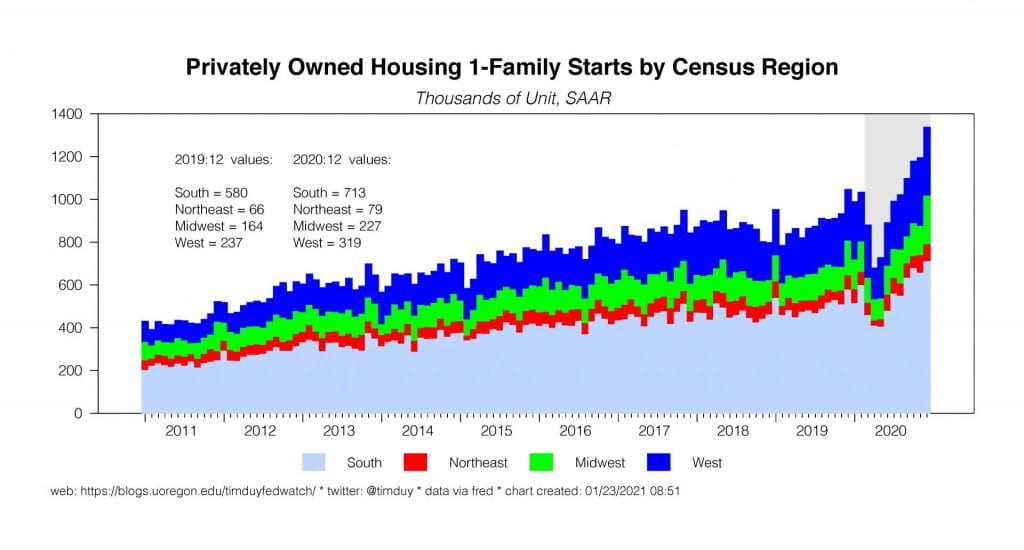

Fairly slow week for data overall but still a handful of notable releases. The housing market continued to power forward in December:

Single family starts pushed further above the pre-pandemic trend:

For the year, starts were just over a million units compared to 893k in 2019, meaning that strong starts later in the year more than compensated for the slowdown last spring. It would not be surprising to see the pace of starts moderate somewhat from December’s 1.34 million units now that last spring’s hole is filled but the sector overall remains supported by demographic trends. In other words, don’t confuse any moderation with sectoral weakness.

The IHS Markit Flash PMI for January indicates the US economy jumped out of the gate in 2021:

Adjusted for seasonal factors, the IHS Markit Flash U.S. Composite PMI Output Index posted 58.0 in January, up from 55.3 in December. The private sector seemed to regain growth momentum at the start of 2021, as the pace of increase quickened to the second-fastest since March 2015.

At the same time, private sector businesses signalled another monthly increase in new business. That said, the overall rate of growth eased from that seen in December, as service providers indicated a slower expansion in new orders following a rise in virus cases and greater restrictions on business operations. Nonetheless, the upturn among manufacturers accelerated and was the steepest since September 2014.

On inflationary pressures, the report had this to add:

A number of firms were able to partially pass-on greater cost burdens, however, as the pace of charge inflation quickened to a steep rate. The impact was less marked in the service sector as firms sought to boost sales, but manufacturers registered the sharpest rise in selling prices since July 2008.

I would not read any monetary policy implications into these inflation anecdotes just yet. One-time price adjustments in a subset of goods does not qualify as inflation. It will not be interesting inflation until it becomes a self-sustaining process across a wide spectrum of consumer goods and coincides with faster wage growth.

Initial unemployment claims edged down from 926k to 900k last week.

Janet Yellen received the unanimous vote of the Senate Finance Committee to advance her nomination as Treasury Secretary to the full Senate. She is expected to be confirmed by the Senate on Monday. As expected, Yellen pushed for administration priorities including the proposed fresh fiscal support package:

“To avoid doing what we need to do now to address the pandemic and the economic damage it’s causing would likely leave us in a worse place fiscally and with respect to our debt situation,” Yellen said.

Yellen does not seek a weaker dollar in order to gain a competitive advantage yet remained unwilling to commit to the strong dollar policy of the past. This administration looks to actively push back against efforts by other nations to manage their currencies to gain a competitive advantage in trade. This is something to keep an eye on to see how this rhetoric translates into policy. Lastly, note that the increasingly hawkish attitude toward China will carry over from the Trump administration:

“China is undercutting American companies by dumping products, erecting trade barriers and giving illegal subsidies to corporations,” Yellen said, calling the nation an “important strategic competitor.”

Fed Speak

Last week was a blackout week for the Fed ahead of this week’s FOMC meeting.

Upcoming Data and Events

The data flow picks up again this week. The highlights of the week will be the FOMC meeting (no policy changes expected) this Wednesday and the GDP report on Thursday. Wall Street expects that GDP clocked in at a 4% rate in the fourth quarter. In contrast, the Atlanta Fed GDPNow model estimates growth at 7.5% for the quarter suggesting the possibility of an upside surprise.

Other reports include durable goods on Wednesday, a traditionally volatile number that has been uniformly positive in recent months, and the personal income/consumption/prices report of Friday, much of which can be imputed from the prior day’s GDP report. We get the final January Michigan sentiment number on Friday but note that this data may have less usefulness as it increasingly reflects political divisions.

President Biden’s $1.9 trillion fiscal plan is running into headwinds in Congress with Republicans withholding support for a large stimulus so soon after December’s package. I can’t tell you how this will play out just yet; my inclination is to think the eventual support will fall short of Biden’s initial plan. I tend to focus on the administration’s effort to control the pandemic as the primary factor in the strength of the U.S. cyclical upswing this year.

| Day | Release | Wall Street | Previous |

| Wednesday | Core Durable Goods Order, Dec., m-o-m | 0.5% | 0.4% |

| Wednesday | FOMC Statement and Press Conference | ||

| Thursday | Initial Unemployment Claims | 878k | 900k |

| Thursday | GDP, Q4, q-o-q | 4.0% | 33.4% |

| Thursday | New Home Sale, Dec., m-o-m | 860k | 841k |

| Friday | Personal Spending, Dec., m-o-m | -0.4% | -0.4% |

| Friday | Personal Income, Dec., m-o-m | 0.1% | -1.1% |

| Friday | Core PCE Price Index, Dec., y-o-y | 1.3% | 1.4% |

| Friday | Michigan Consumer Sentiment, Jan. | 79.2 | 79.2 |

FOMC Preview

The FOMC meets this week and is widely expected to hold policy constant. The statement will be fairly similar to that of December with the exception of possibly acknowledging the pandemic-induced slowdown in consumer spending this winter. The real action will be the press conference. Journalists will push Federal Reserve Chair Jerome Powell to clarify recent remarks by regional bank presidents regarding the possibility of early tapering of asset purchases. Expect Powell to hold the line set by his Board colleagues Richard Clarida and Lael Brainard: It is too early to be talking about tapering. Any talk of tapering on the part of regional presidents is just speculation of what might happen under certain particularly optimistic scenarios. The Fed though has committed to not acting on the basis of optimistic forecasts and instead will be reactive to the data. Until the data becomes more uniformly supportive of a substantially better than anticipated outcome, the Fed will dismiss talk of tapering as unwarranted.

Powell will express concern about weaker job growth this winter but will emphasize the impacts are temporary and best addressed with fiscal policy. Even though he will downplay tapering talk, I think Powell will express optimism about the latter half of the year. The accelerating pace of vaccinations and the December fiscal package greatly reduce the downside risks to the outlook. The Fed will certainly take note of improving private sector growth forecasts; it is reasonable to expect that the internal forecasts are more optimistic as well.

With any luck, a journalist will press Powell to clarify Clarida’s recent statement that the Fed will hold rates at zero until inflation been at or above 2% for a full year. This has not been formalized in the statement although Clarida has said that such a one-year memory has been chosen by the FOMC. My sense is that given persistently low inflation, the Fed leans toward the one-year rule on the expectation that inflation only modestly exceeds 2%. I don’t think they want to publicly commit to the one-year rule though because they want flexibility to address the possibility that inflationary pressures emerge more quickly than they expect.

Journalists may also question Powell on the rising longer-term interest rates. I anticipate that Powell will say higher long rates are not by themselves an impediment for the economy, are consistent with an improving economic outlook, and not indicative of a lack of credibility of the Fed’s commitment to low policy rates. Powell will emphasize the path of short-term rates reflects the Fed’s credibility. Powell would also say that the Fed will of course react to any adverse financial market moves that threaten the outlook but conditions now are very accommodative and don’t justify a policy shift.

Bottom Line: There is plenty of optimism for the latter part of 2021, but the Fed isn’t counting the chickens before they hatch.

Good luck and stay safe this week!