These are the topics I am thinking about as the week begins:

Bloomberg Opinion

My article from Bloomberg last Friday:

There is $1 trillion stashed away in the U.S., and it just might save the economy. It’s enough to either boost consumer spending by at least $78 billion dollars a month over the next year or supercharge growth if confidence soon turns higher….

HS Markit PMI

Continuing on the theme that maybe the recovery will be more rapid than expected by the conventional wisdom, the IHS Markit PMI flash report for August came in stronger than expected:

U.S. private sector firms signalled a strong upturn in business activity in August, with both manufacturers and service providers registering expansions. Notably, it marked the first rise in service sector activity since the start of the year, while goods manufacturers recorded the fastest increase in production since January 2019.

Importantly for an economy still struggling with layoffs:

Increased sales and an uptick in backlogs of work reportedly sparked a strong rise in workforce numbers midway through the third quarter. The rate of employment growth was the steepest since February 2019.

One point I continually make in speeches: From a macroeconomic perspective, there was nothing wrong with the U.S. economy in February, no obvious imbalances. Lacking any excesses to work off, there is room for a more rapid recovery than experienced in the last cycle. We focus a lot on the downside risks; don’t forget about the other side of the distribution.

Hot Housing

Existing home sales exceeded the pre-pandemic level:

A solid V-shaped recovery continued for the housing sector. Tight inventories are pushing prices higher:

The hot housing market has three big implications. First, the economy tends to follow housing, which means the recovery will likely continue. Second, household wealth is expanding, which could support spending in a big way when confidence moves higher. Third, by itself a home purchase supports upwards of $3,700 of additional spending.

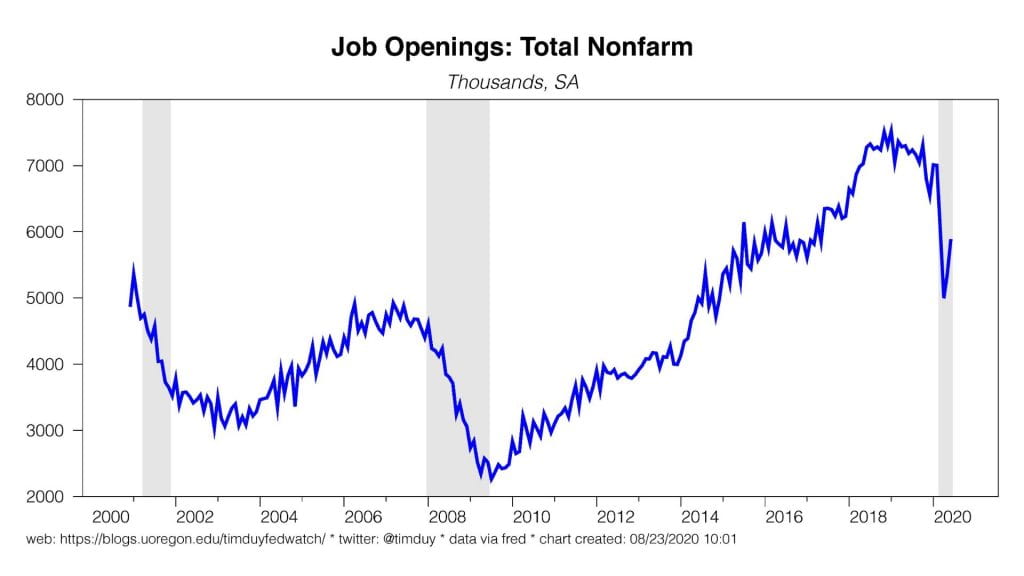

Job Openings Still Very High

We know that job openings have fallen since the pandemic began. What is less appreciated is that they are still very high relative to 2009:

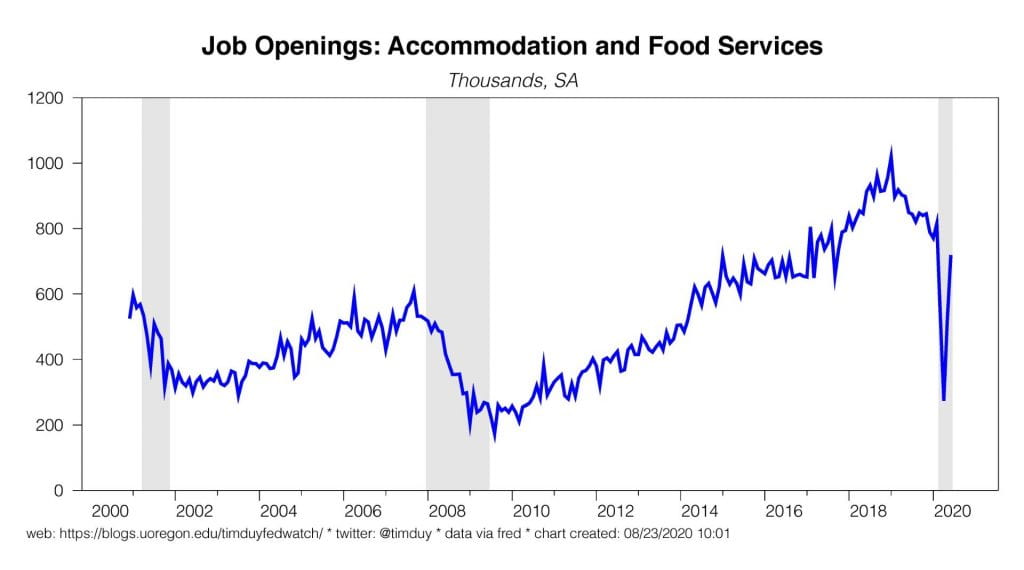

This struck me as particularly interesting:

The level of job openings in accommodation and food services is three times the 2009 level. How can that possibly be the case? The labor market is now operating well off it’s traditional Beveridge curve relationship:

A high degree of uncertainty can push the Beveridge curve out by making firms less willing to commit to filling open positions. That uncertainty is heightened now because so many of these lost jobs are still considered temporary rather than permanent. If that uncertainty were to dissipate more quickly than anticipated while job openings remained high, unemployment might snap back to pre-pandemic levels more quickly than anticipated. Think again about the IHS Markit and housing reports. I know, this isn’t the conventional wisdom, but that’s what makes it interesting.

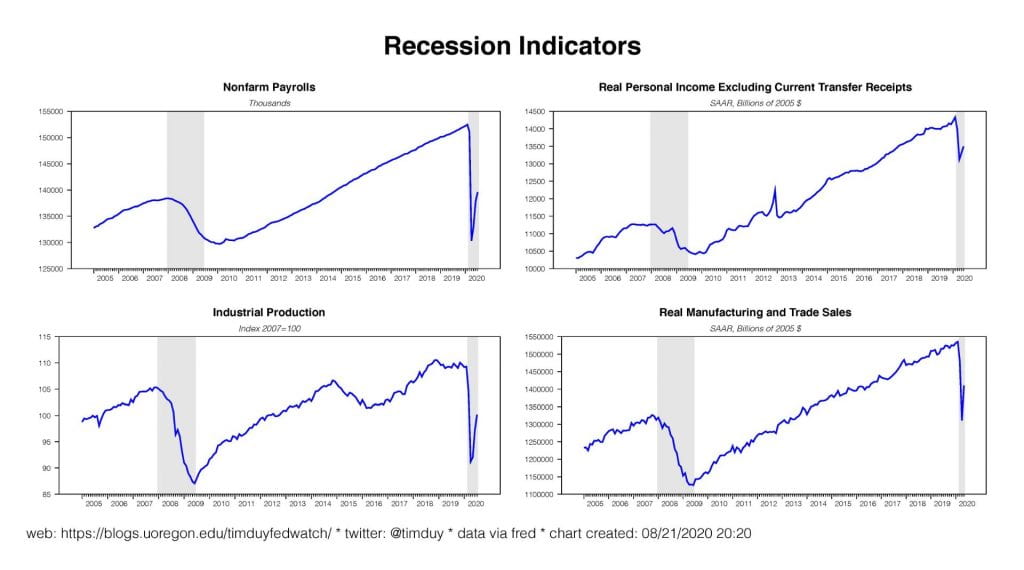

Is The Recession Over?

If the recovery continues to improve, even at a slower pace, the recession may have ended during the summer, at least according to traditional timing indicators:

Don’t hate the messenger.

Trading Places?

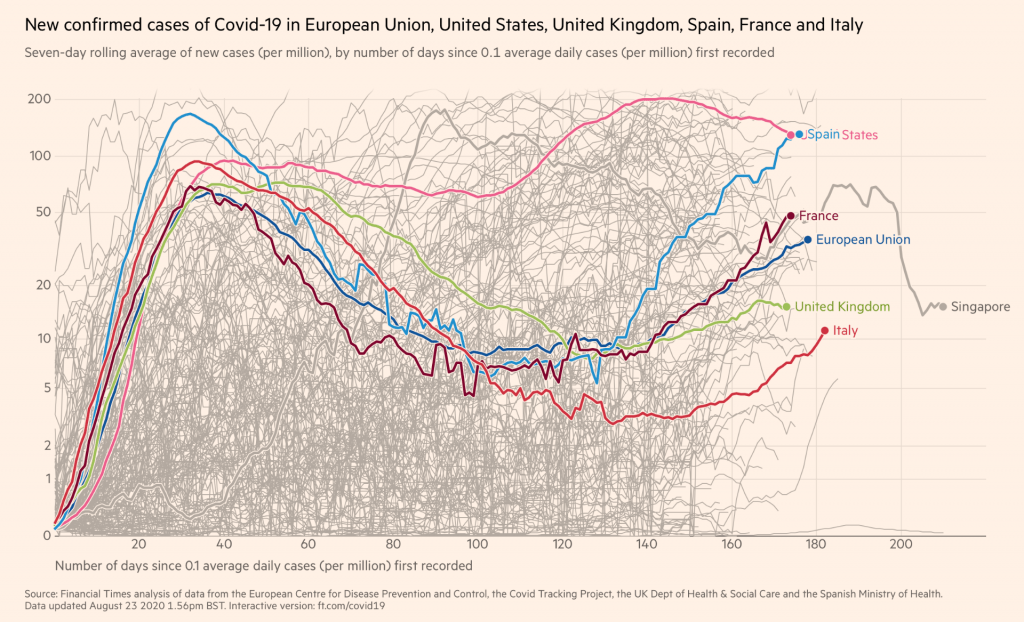

As Covid-19 cases start to trend down in the U.S., they are trending back up in Europe:

Spain is now at the U.S. rate. Will the rest of Europe also close the gap? Two big narratives could fall apart. The first is that Europe is doing a better job of containing the pandemic than the U.S. The Covid-19 virus is insidious for everyone; you can’t let your guard down it appears. That said, I still doubt that there will be another round of generalized lockdowns like we saw earlier this year, especially after the U.S. appears to be gaining some control without shutting it all down again. I think we are more likely to continue to see rolling, localized fluctuations in restrictions than national lockdowns. It’s just not clear we can get away with that twice. The West is not China:

The second follows from the first, that because Europe has a better handle on the pandemic the European economy will recover more quickly. Obviously, if the U.S. and Europe trade places, it might in turn derail some interest in the weak dollar story. I noticed this too via Bloomberg:

For money managers nervous about U.S. equities at all-time highs during an economic crisis and election year, Europe could be the antidote.

Investors from BlackRock Inc. to Manulife Investment Management say the region’s coordinated and fast response to the pandemic is also a good reason to be confident, despite the fact that European stocks have stalled since early June.

That trade might end in tears if Europe takes over the U.S. in Covid-19 cases.

Jackson Hole

The annual Jackson Hole event goes virtual this year. Federal Reserve Chair Jerome Powell will be speaking Thursday morning. He is expected to give a preview of the outcome of the Fed’s policy review strategy. There are fairly low expectations going into this speech. It seems possible if not likely that all the ink spilled on this process will yield only some flavor of an average inflation targeting strategy. While important, this seems to be more of a tweak to the existing framework than a grand redesign (I am not sure we could have expected anything else). The practical implication is that the Fed will hold rates lower for longer, but there will not be a new mechanism to accelerate the pace of recovery.

Bottom Line: There are a lot of moving pieces right now that I read as telling me the certainty we had a couple of months ago about a slow recovery is very much less certain now.