The minutes of the July 2o2o FOMC meeting were released today. They were somewhat disappointing as they walked back expectations that further policy action would soon arrive.

The Fed is moving closer to concluding its policy review:

Participants agreed that, in light of fundamental changes in the economy over the past decade—including generally lower levels of interest rates and persistent disinflationary pressures in the United States and abroad—and given what has been learned during the monetary policy framework review, refining the statement could be helpful in increasing the transparency and accountability of monetary policy. Such refinements could also facilitate well-informed decisionmaking by households and businesses, and, as a result, better position the Committee to meet its maximum-employment and price-stability objectives. Participants noted that the Statement on Longer-Run Goals and Monetary Policy Strategy serves as the foundation for the Committee’s policy actions and that it would be important to finalize all changes to the statement in the near future.

The “near future” is likely the September meeting. The most significant change to the Fed’s strategy is likely to be some flavor of an average inflation target whereby the Fed attempts to allow inflation to rise above 2% to compensate for periods of time below 2%. This differs from the current strategy in which the Fed only attempts to return to the 2% target. The practical implication of this policy shift is that the Fed will keep policy easy for longer than was the case in the last recovery.

Although the Fed had an understandably dour outlook, they are not inclined to change the forward guidance just yet:

With regard to the outlook for monetary policy beyond this meeting, a number of participants noted that providing greater clarity regarding the likely path of the target range for the federal funds rate would be appropriate at some point.

This is somewhat surprising given the outlook for inflation and unemployment; the Fed would obviously like to accelerate the recovery. That said, it appears that they still have yet to decide what shape such guidance would take:

Concerning the possible form that revised policy communications might take, these participants commented on outcome-based forward guidance—under which the Committee would undertake to maintain the current target range for the federal funds rate at least until one or more specified economic outcomes was achieved—and also touched on calendar-based forward guidance—under which the current target range would be maintained at least until a particular calendar date. In the context of outcome-based forward guidance, various participants mentioned using thresholds calibrated to inflation outcomes, unemployment rate outcomes, or combinations of the two, as well as combinations with calendar-based guidance.

It may have been too much to expect the Fed to both change its policy strategy and its forward guidance at the same meeting. This extension was interesting:

In addition, many participants commented that it might become appropriate to frame communications regarding the Committee’s ongoing asset purchases more in terms of their role in fostering accommodative financial conditions and supporting economic recovery.

As if it was a surprise that asset purchases had already evolved past their initial rational as supportive of market functioning. In the press conference that followed the July meeting, Federal Reserve Chair Jerome Powell said as much:

And we’ve always said, though, that we understand, accept, and are fine with the fact that—that those purchases are also fostering a more accommodative stance of monetary policy, which would tend to support macroeconomic outcomes. So it’s doing both, and—and, you know, we’ve understood that for some time. It’s not—the programs are not structured exactly like the—the QE programs were in the last—in the last financial—in the aftermath of the last financial crisis. Those were more focused on buying longer-run securities. The current purchases are all across the—the maturity spectrum. Nonetheless, they are supporting accommodative financial conditions. I think it’s—it’s clear that that’s the case.

Look for the Fed to make more explicit what Powell has already said. Also watch for the possibility that they shift the mix of assets toward to the longer end of the curve to prove that asset purchases are more like QE than only to support market functioning.

The Fed threw cold water on the notion of yield curve control for now:

A majority of participants commented on yield caps and targets—approaches that cap or target interest rates along the yield curve—as a monetary policy tool. Of those participants who discussed this option, most judged that yield caps and targets would likely provide only modest benefits in the current environment, as the Committee’s forward guidance regarding the path of the federal funds rate already appeared highly credible and longer-term interest rates were already low.

I have argued that yield curve control was on its way at some point after the Fed embraces enhanced forward guidance. Since they have yet to make the guidance move, they weren’t going to make the yield curve control move. That said, at this point the Fed believes that such guidance alone would be sufficient to lock down interest rates. Yield curve control would be redundant in such a world. The implication is the yield curve control would only come into play if the Fed believed that forward guidance was unable to hold interest rates in the desired range.

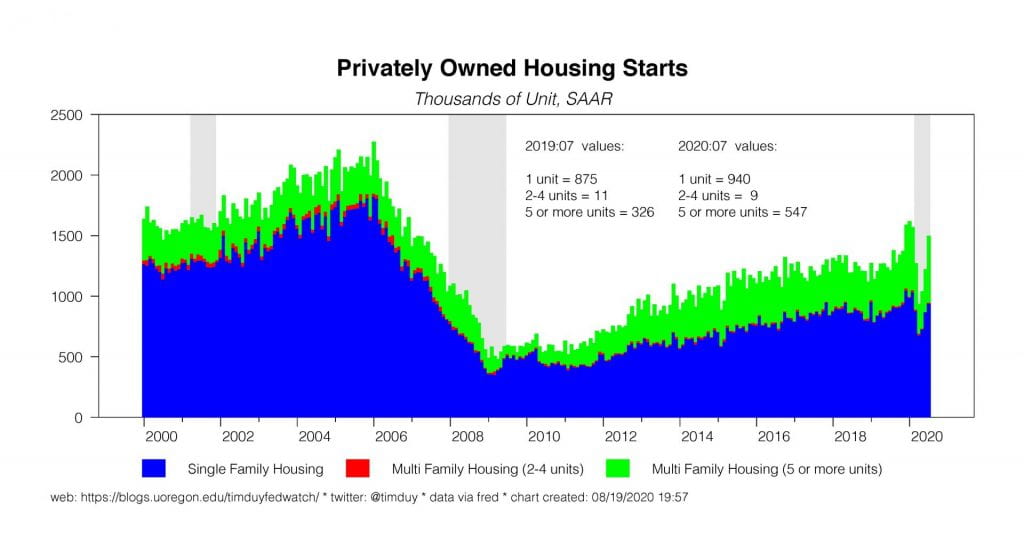

Separately, the housing market continues to run hot with starts rebounding:

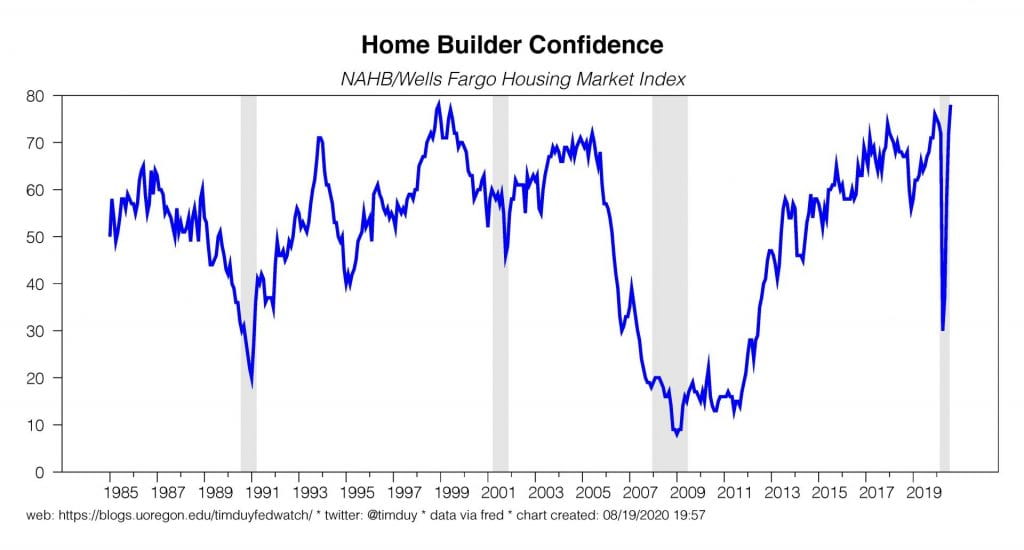

while builder confidence is now at its highest level since 1998:

Traditionally, housing is a good leading indicator for the economy as a whole; I don’t think we can ignore the possibility that the economy grows around the virus more quickly than anticipated. The conventional wisdom has fully embraced the idea that this recovery will mirror the last. That already isn’t happening.

Bottom Line: The Fed remains focused on downside risks but as of yet is unwilling to act further to support the recovery. Maybe they won’t need to.