I don’t have a take on GameStop. Instead, I have a take on a GameStop take. This kind of commentary (via Axios) is floating around:

The current state of financial markets “is a feature, not a bug” of the environment created by low rates and extraordinary market intervention, says Vincent Reinhart, a 20-year staffer at the Fed who now serves as chief economist at Mellon…The Fed “has created space and created a comfort level for market participants to be aggressive in their actions and they’re being aggressive in their actions.”

The GameStop saga offers the latest opportunity to criticize the Fed for its low interest rate policy. I remind everyone that the Fed will largely ignore this criticism when setting monetary policy.

Recall what Federal Reserve Chair Jerome Powell said at this week’s press conference:

So I would just say that our — there are many things that go in as you know to setting asset prices. If you look at what’s really been driving asset prices in the last couple of months, it isn’t monetary policy. It’s expectations about vaccines and also fiscal policy. Those are the news items that have been driving asset purchases — sorry, asset values in recent months. So I know monetary policy does play a role there, but that’s how we look at it and I think, you know, I think the connection between low interest rates and asset values is probably something not as tight as people think because a lot of different factors are driving asset prices at any given time.

It is worth picking this apart. Powell attributes the bulk of the asset price move to an improving economic outlook attributable to the arrival of vaccines and supportive fiscal policy. He is clearly looking at markets overall rather than one small segment of the market or, in this case, a single stock. He does acknowledge the role of monetary policy which I would describe as two-fold. First asset purchases by the Fed drives market participants into other asset classes, supporting the prices of those assets, and second by creating an accommodative financial environment that supports the recovery more generally. When Powell says though that the relationship between monetary policy and interest rates is not as tight as perceived, he is saying that the Fed is not the proximate cause of each and every bubble of speculation that occurs in financial markets.

Powell could point toward a number of examples to remind market participants that a bubble can occur in a period of “normal” interest rates, such as the dot.com bubble of the late 1990s, that low interest rates don’t necessarily support a bubble, such as the extended zero interest rates in the wake of the GFC did not create a bubble, or that the Bank of Japan has held rates near zero for decades and not recreated the twin property and stock bubbles of the 1980s. As an aside, my inclination is the asset bubbles have more to do with investor psychology and the lure of easy money than monetary policy.

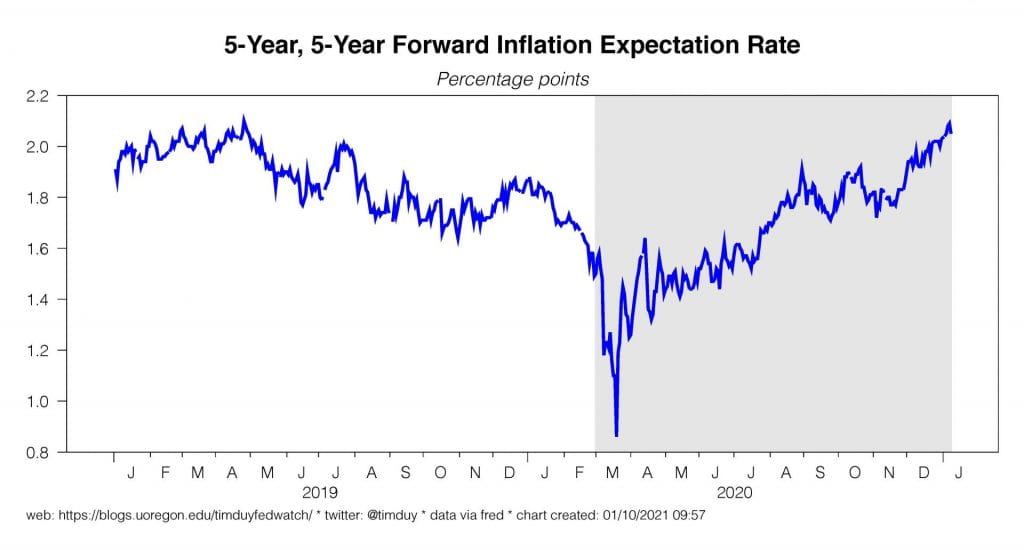

The Fed takes a very clear position on this issue: The primary objective of policy is to meet the Fed’s inflation and employment goals and they are not going to deviate from that policy without very good reason. The accusation of creating asset bubbles is not in the Fed’s opinion a very good reason. The Fed will tend to argue that the degree of tightening necessary to prevent or deflate a bubble would almost certainly be recessionary and consequently the appropriate policy response will be to strengthen the underpinnings of the financial sector to prevent any rapid collapse in an asset price from triggering a systemic crisis.

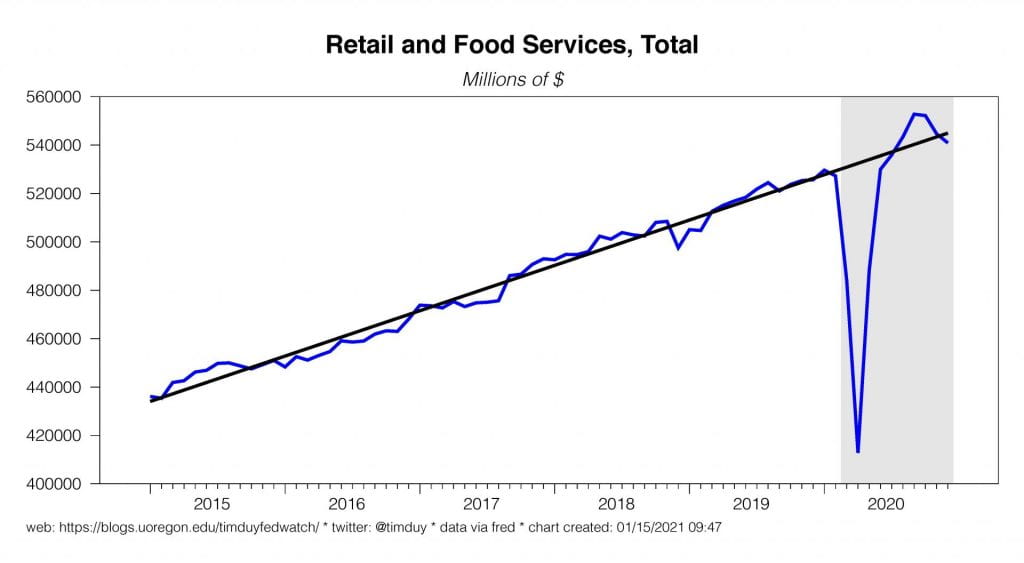

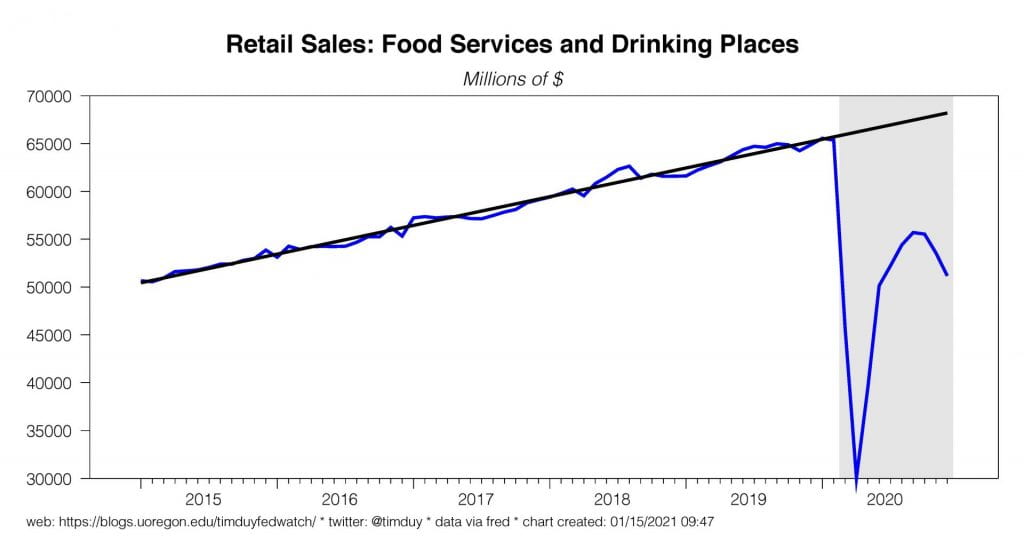

Another issue to be considered is the role of fiscal policy and forced saving. It is often assumed that if that monetary policy creates any bubbly behavior seen in financial markets. In this cycle, however, the inability of households to purchases their usual basket of goods and services coupled with rivers of federal money has swelled household balance sheets with cash. That cash will show up somewhere and not necessarily consumer price inflation. Not all of that saving will support pent-up consumer spending, and maybe not much of it at all, which suggest that it may have minimal implications for consumer price inflation. Instead though if it remains as a level shift up in savings, it supports asset price inflation.

My instinct is that the pool of savings supports a series of asset bubbles from Bitcoin to GameStop to whatever’s next. As long as these asset bubbles rise and fall without meaningful impacts on real economy activity, I expect Fed critics will be disappointed by the Fed’s lack of interest. To be sure, small but recurring asset bubbles may eventually lead to a larger, more disruptive bubble, but I don’t think that is yet the case. The Fed will cross that bridge when it gets to it.

Still, anticipate some random Fed speak revealing concern about the Fed’s impact of asset prices. Just as some policy makers will speculate on the possibility of the early end of tapering, others will eventually suggest monetary policy needs to be more attentive to irrational exuberance. These concerns have been an on-again, off-again feature of the FOMC minutes for as long as I can remember but always limited to a minority view.

Bottom Line: The Fed will strongly resist the criticism that they are to blame for overly exuberant financial markets, particularly when that exuberance is limited to a single stock. Policy is firmly focused on jobs and inflation. For me, worrying that Fed policy runs counter to “fundamentals” never has paid off. My approach remains to try to understand the driving forces of Fed policy and accept that policy as a “fundamental.”