The ISM report for August revealed that the manufacturing sector continues to struggle under the weight of trade wars and weak global growth. Headline and key internal numbers all slipped below 50 in September:

Importantly, this is the third trip below 5o since the end of the last recession; a manufacturing recession does not necessarily imply a US recession. Note also that in the last recession, the bottom fell out of manufacturing well after the recession officially began. My interpretation is that the causality flowed from the rest of the economy to manufacturing rather than vice-versa. In other words, if this is a primarily manufacturing shock, we still might not see it spill into the rest of the economy. That said, this is the ISM’s first trip below 50 since the last recession that coincided with an inversion of the yield curve. That’s a little bit more disconcerting.

The anecdotal comments in the report were considerably less worrisome. This in particular struck me as summarizing the general mood in the economy:

“Generally, business remains steady. However, we continue to plan for a hard Brexit and a long trade war between the U.S. and China.” (Miscellaneous Manufacturing)

My sense from talking with firms is they were already concerned about the sustainability of the expansion as it approached 10 years of age for no other reason than they didn’t think it could go on forever. The recent trade wars and the well-publicized relationship between yield curve inversions and recessions have intensified those concerns. We should be wary of such intensifying pessimism spreading throughout the economy.

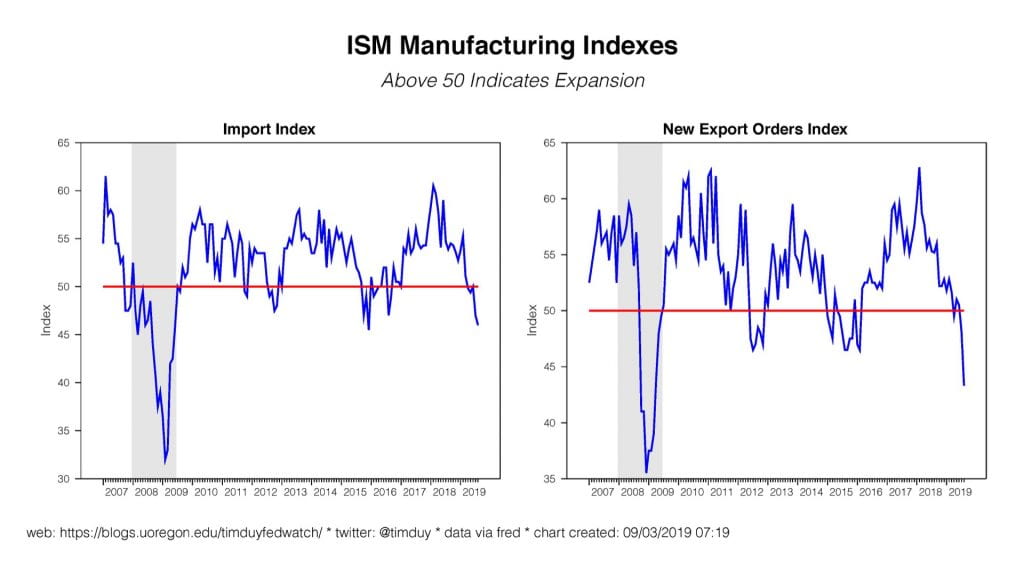

Speaking of trade wars, the international side of the ISM report is looking particularly weak:

The export orders index looks like it is in free-fall, likely reflecting the dual impacts of weak global growth and retaliatory trade policy. Again, this is a test of how much the manufacturing sector and it’s external linkages drive the business cycle. At what point do these factors directly trigger a broader U.S. downturn? At what point to worries alone about these factors trigger a downturn?

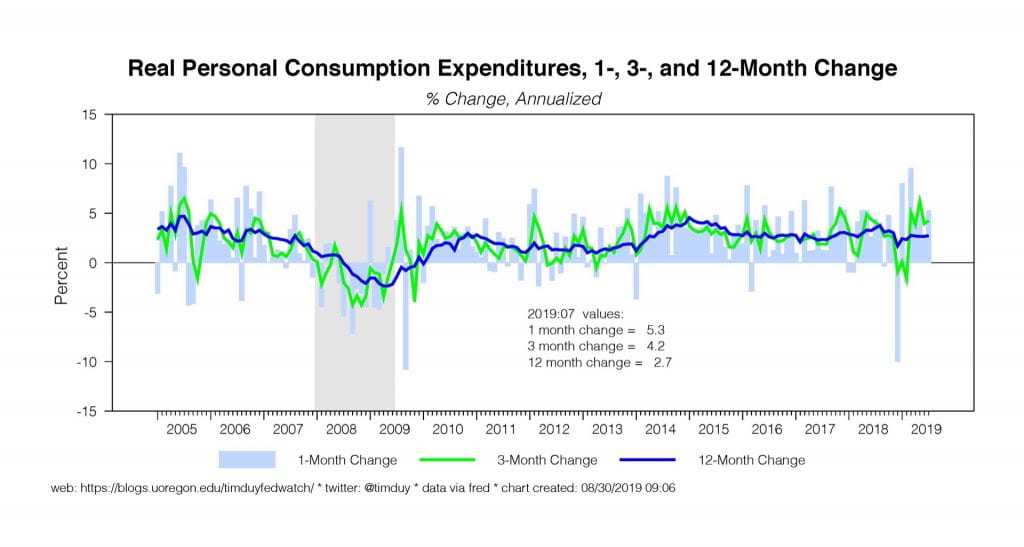

Financial market participants already viewed a Fed rate cut this month as a done deal prior to this data. This data though does elevate the probability of a 50bp cut. I think the Fed will tend to be loathe to cut rates 50bp given still solid overall numbers. See, for example, the strong consumer outlook as reported last week:

The Fed will place more weight on this week’s employment report than the ISM numbers. If employment stays reasonably strong, they will likely opt for the smaller rate cut.

Bottom Line: Weak global growth and Trumpian policy uncertainty continue to weigh on the economic outlook. The Fed will respond with lower interest rates. Absent weaker data beyond manufacturing, though, the Fed isn’t going to be happy about cutting rates and will resist a 50bp cut. Assuming a solid employment report, I anticipate continuing push-back from regional Fed presidents and another split vote at the upcoming FOMC meeting.