Big data day coming up with the monthly employment report. Most likely the report will not yield anything to prevent the Fed from raising rates.

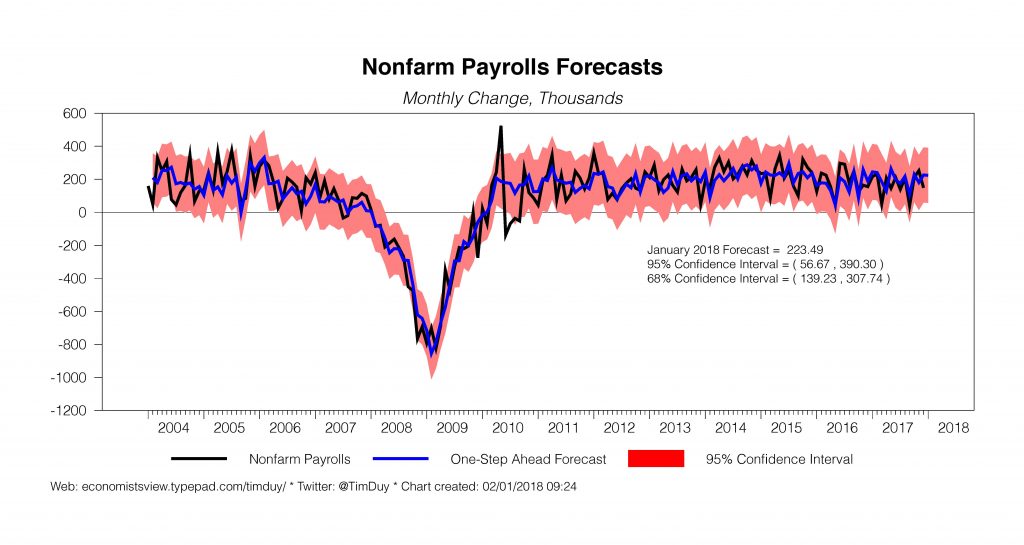

What to expect from the report? Consensus expectations for payroll growth remains at 175k in a range of 150k to 205k. The ADP report suggests the consensus is too pessimistic. Of course, the same could be said of the last report as well. That said, my expectation is that the report is more likely to surprise on the upside rather than the downside. Note though that even a report that falls short of expectations like last month (payroll gain of 148k) remains sufficient to keep the Fed on track for further tightening.

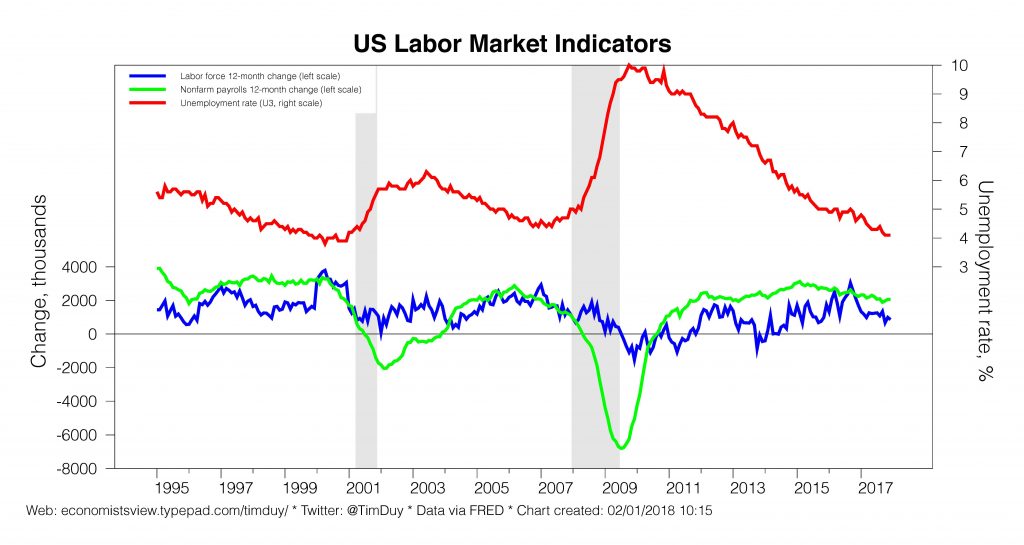

Wall Street also expects the unemployment rate will hold constant at 4.1 percent. Here again I think the risk is weighted toward a better number. Job growth continues to run ahead of labor force growth; eventually this will translate into a lower unemployment rate. Remember that the unemployment rate is already just a small step away from the Fed’s year end estimate of 3.9 percent. A 0.2 percentage point move in a single month is not in any way outside the realm of possibilities. All else equal, such a move would place upward pressure on the Fed’s rate forecast.

Of course, all else is almost never equal. Continued tepid wage gains would likely induce further reductions in the Fed’s longer-run unemployment estimates. And tepid wage gains are expected to continue with Wall Street anticipating just 2.6 percent higher hourly earning relative to last year.

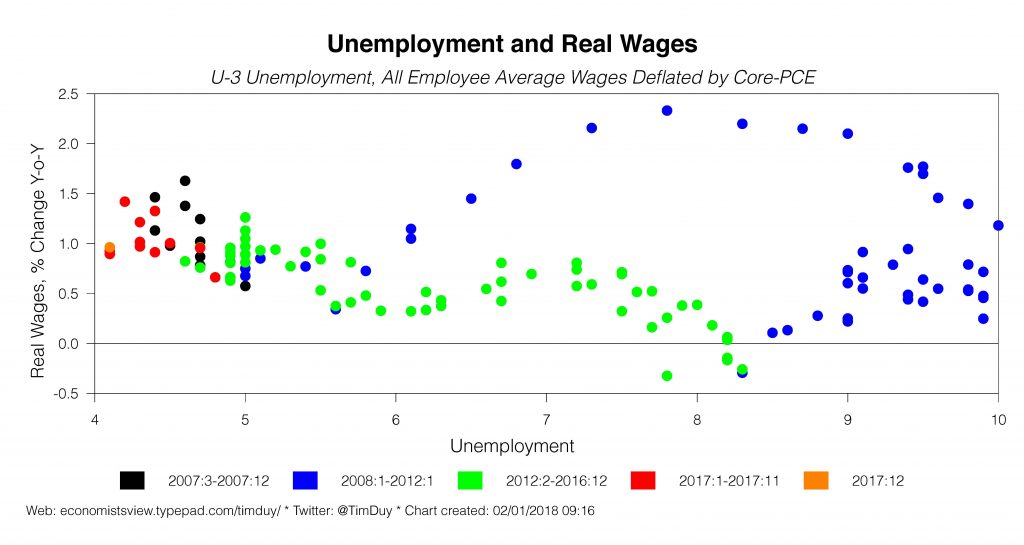

Part of the low earnings growth can be attributed to low inflation. Part can also be attributed to low productivity growth. Compared to a year ago, real output per worker in the final quarter of 2017 was up just 1.1 percent. Note that real hourly earnings growth for all employees was up just about the same amount at 0.96 percent. In short, real wage growth remains stuck at just where you might expect it to be given productivity growth and inflation.

Even with low productivity growth, in theory real wage growth could accelerate if labor markets remained sufficiently tight to drive up nominal wages but competitive pressures were sufficient to restrain inflation. The difference would come from profit margins, which would likely weigh on equity prices. Still, it is not yet clear that the Fed is willing to run that experiment.

Finally, note that the still low productivity numbers suggest the economy remains in a low r-star world. That suggests some caution is assuming the upward pressure on long yields can be maintained.

Bottom Line: Employment report will keep the Fed on track. Most likely it will entrench expectations of three rate hikes this year. Relative to consensus expectations, I see the risks as weighted toward raising the probabilities of more rather than less.