Happy holidays to all! This is the last Fed Watch of the year. Watch for big changes in this content coming in 2021.

The year is ending on a familiar theme of tension between the near- and medium-term outlooks. The high level of Covid-19 cases and the related negative impacts on activity dominate the near-term while the expected relief due to an increasing number of available vaccines dominates the medium-term. The Fed is focused on the expected improvements this spring and summer while leaving winter challenges to the fiscal authorities.

After a long delay with last-minute theatrics by President Donald Trump, Congress has authorized a new round of fiscal support for the economy that includes checks to families, enhanced unemployment benefits, more PPP money, and an eviction moratorium extension. The Fed will see this fiscal support as justifying its decision to hold the mix and pace of asset purchases steady at its December meeting.

Congress is currently debating an increase of the tax rebates from $600 to $2,000 per person. Trump and Congressional Democrats strongly support the proposal while it is getting a mixed reaction in the Senate. Senate Majority Leader Mitch McConnell looks to be trying to poison the move by attaching additional requests by Trump including an election review and the end of Section 230 protections for internet providers that are anathema to Democrats. Even if not passed, there is a growing sense that Democrats will win both the special Senate elections in Georgia; if that occurs, Democrats will control the agenda in 221 and $2,000 checks will be even more likely.

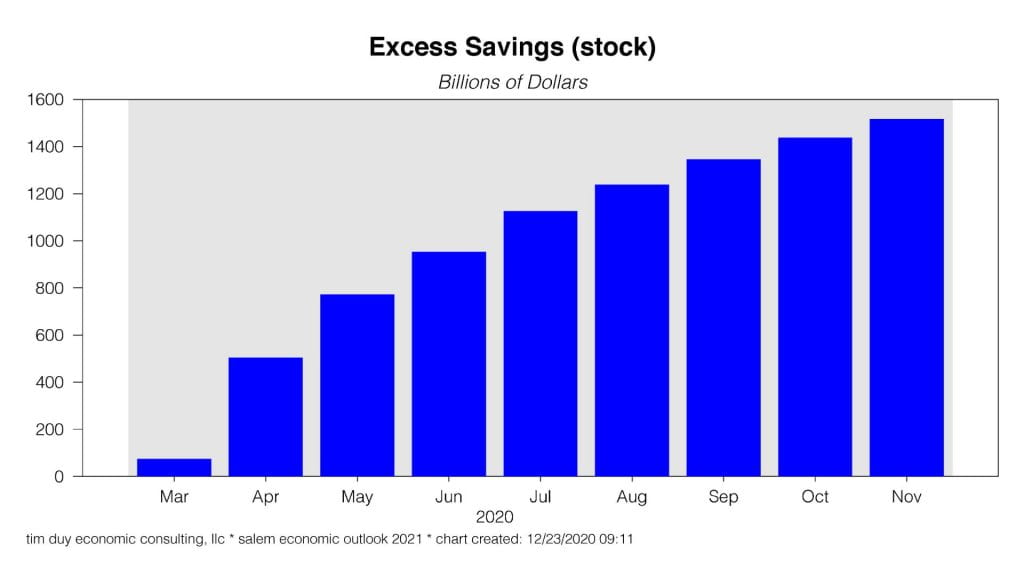

What happens to the past and fresh rounds of government stimulus is possibly the most important question for market participants in 2021. Incomes continued to outpace spending in November leaving the personal saving rate at a still-high 12.9% and further increasing the stock of excess savings accumulated since the beginning of the pandemic:

Watch for the saving rate to explode higher again as the government pushes out this fresh round of support. Large portions of the fiscal support will find its way into savings because fundamentally the U.S. economy suffers from a supply shock. It is not in aggregate that households don’t have the means or willingness to spend; it is that many of the traditional channels of spending are not available due to the pandemic. Eventually vaccine distribution will be sufficient to unlock the pandemic-impacted sectors of the economy, but for now you can’t buy what’s not available. We think of monetary policy as pushing on a string during a recession, but in this case we can also think about fiscal policy as pushing on a string.

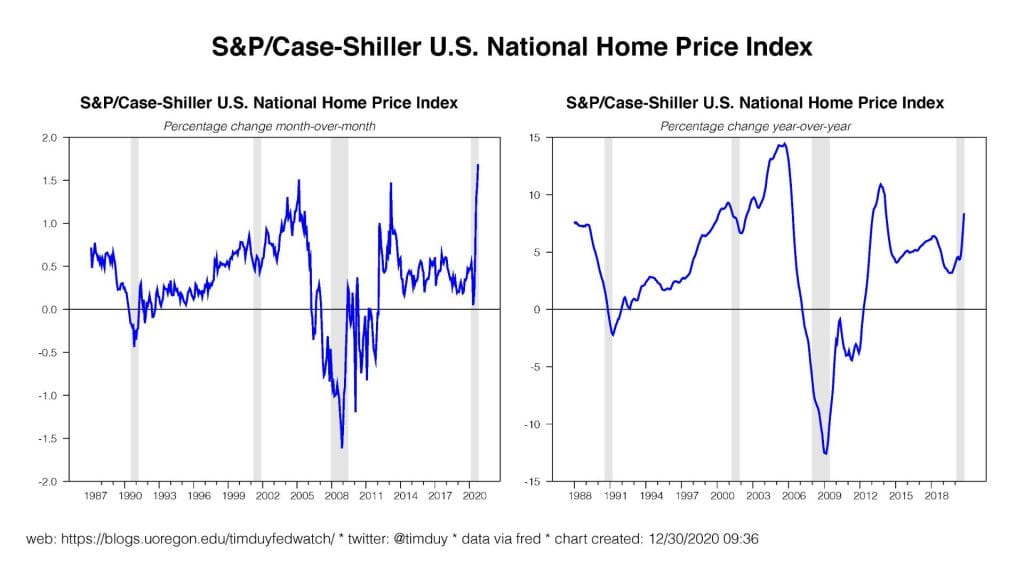

So where does the fiscal support eventually end up? Certainly, some will go toward satisfying pent-up demand in leisure and hospitality; this will likely meet a temporary supply restriction that forces prices higher. Good spending might also get a boost, although that already is well above pre-pandemic trends; additional goods spending will likely be off-shored and have little impact on inflation. Some though will end up as a permanent increase in the level of saving and that will (I think) will continue to support asset prices. This arguably is already happening with stocks at record highs and a pace of home price appreciation not experienced since the housing bubble:

It seems easy to tell a story where the Fed retains its current expected path of rates as they look through any inflation as transitory (attributable to a rebound in services spending) while asset markets continue to climb higher. This is the space I am thinking about as 2021 approaches.

Bottom Line: 2021 will hopefully be an improvement on 2020. Whether it will be or not depends on the success of vaccination campaigns. Optimistically, by mid-year the economy will be well on its way to normal. But what does normal look like given the magnitude of fiscal support pumped into the economy? We will soon find out.