The Fed met last week and held policy steady; see my commentary from last week. Expect that situation to remain until there is a material change in the medium-term outlook. To be sure, the near-term outlook is challenging, but the Fed views itself as having limited ability to affect economic outcomes during the timeframe in which help is needed. The message sent by Federal Reserve Chair Powell was fairly clear on this point. He was also quite clear that the Fed believed they were providing the appropriate amount of accommodation to financial markets.

The Fed also implicitly acknowledged it is not going to sit on the long end of the yield curve simply because rates are moving higher. As long as the Fed believes higher rates are attributable to expectations of stronger growth rather than either a misunderstanding of the Fed’s reaction function or a financial market disruption, they likely are not going to get in the way of higher interest rates.

Federal Reserve Vice Chair Richard Clarida re-affirmed Powell’s message in an interview last week that included a fairly optimistic outlook:

“I don’t think we will have a double dip,” Clarida said Friday in an interview on CNBC. “We’ve said we could have a rough couple of months in the data but on the other side of this of course we’ve gotten very, very positive news on multiple vaccines.”

The mixed nature of the data flow has been consistent with Clarida’s observation that the economy is in for a challenge but a double dip is unlikely. Core retail sales, for example, came in below expectations, slipping 0.5% in November:

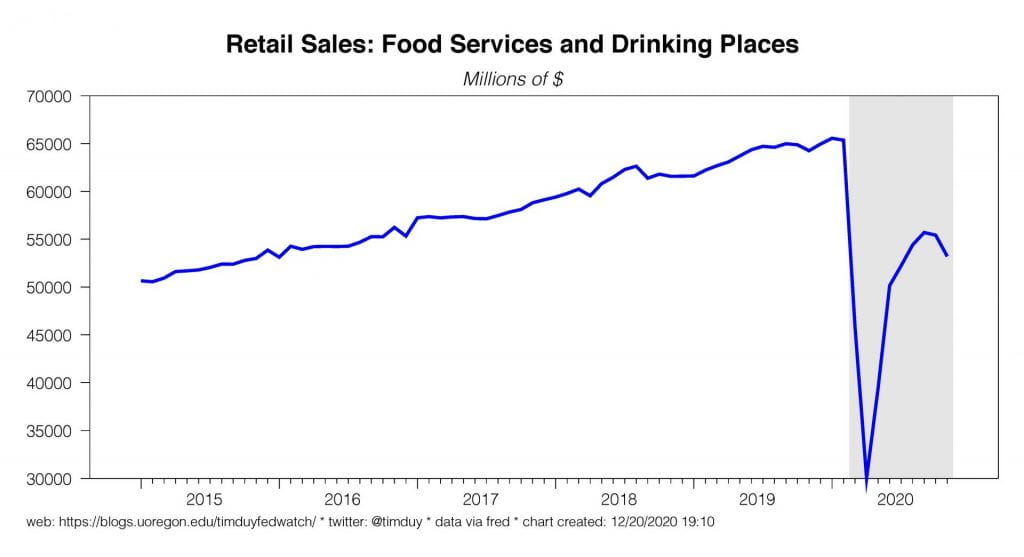

That said, I don’t yet know what we should expect for number that is so clearly above it’s pre-pandemic trend. Do we expect a level shift or a reversion to the pre-pandemic trend? Unsurprisingly, there was some weakness in sectors most affected by the latest lockdowns. Food services dipped but the decline paled in comparison to this past spring:

Likewise, initial unemployment claims edged higher but again nothing the earlier carnage:

Meanwhile, industrial production edged higher in November

Even as the Covid-19 surge worsened in December, the IHS Markit flash numbers were a tad weaker but still robust:

Adjusted for seasonal factors, the IHS Markit Flash U.S. Composite PMI Output Index posted 55.7 in December, down from November’s 68-month high of 58.6. The rate of expansion was sharp overall, despite easing to a three-month low. The loss of momentum was most notable in the service sector, where additional restrictions and softer demand impacted consumer-facing business once again.

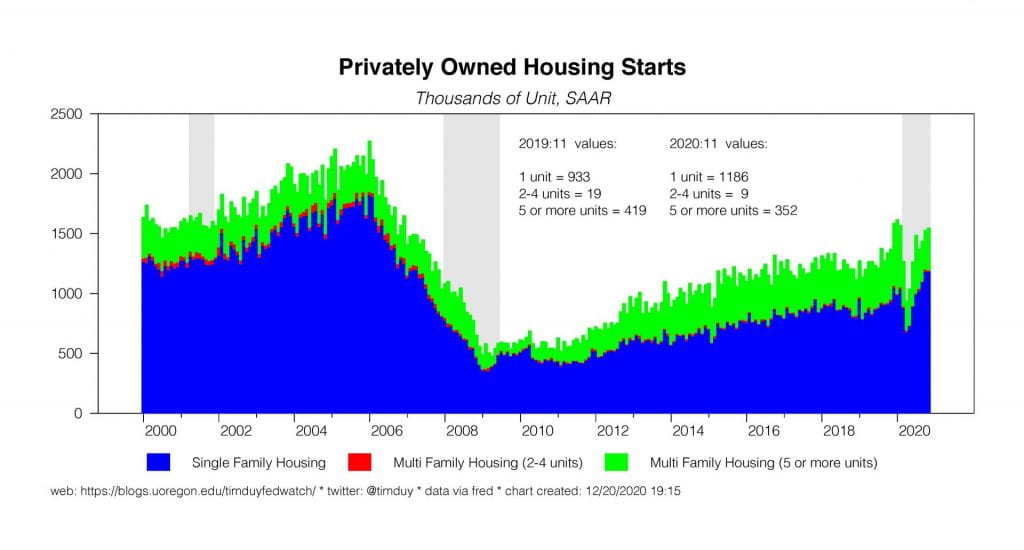

That’s really not much softness all things considered. The housing market remains solid. Although starts were roughly flat in November:

future starts, otherwise known as permits, rose 6.2%. This shouldn’t be surprising given the backlog of homes sold but not yet started:

The Atlanta Fed GDPNow forecast ended the week with an expectation of 11.1% growth for Q4.

Although we have a holiday-shortened week there will still be plenty of data to chew on. Tuesday brings the revised Q3 GDP numbers, an event that typically has little market relevance. More important will be existing home sales for November; sales are expected to be a touch weaker than in October. I wouldn’t read much into any weakness; the underlying market is clearly quite strong.

Personal income and outlays data for November arrives on Wednesday. We are anticipating incomes and spending to both be softer, the former as fiscal support ebbs and the later as the virus resurgence takes its toll but from a market perspective these are both short-term issues. Expect the savings rate to remain above its pre-pandemic level; the stock of saving to bolster the economy next year continues to grow. Inflation will likely remain at levels that ensure the Fed doesn’t have to think about raising interest rates anytime soon.

Also Wednesday comes November new home sales, expected to be a notch lower at 990k than the 999k pace of October. This would still be a super-charged rate. Finally, on that same day we also get December Michigan consumer sentiment numbers. Thursday (note: economic calendars have this scheduled for both Wednesday and Thursday) brings the usual initial claims report, likely to continue to edge higher. In addition, we get durable goods numbers. Core orders are expected to be 0.6% higher, extending the solid rebound this year, but note this can be a volatile series.

Some important items to watch this week. First, I thought a double-dip recession was unlikely to begin with and think it extremely unlikely now that Congress has reportedly reach a compromise on a fiscal support plan worth $900 billion that includes $600 direct payments for most people, renewed enhanced unemployment benefits of $300 per week, a fresh $284 billion for PPP, and money for airlines and transit. The liability shield and state and local aid were dropped from the negotiations. This is the bridge the Fed was hoping Congress would deliver to support the households and firms during the pandemic winter.

Second, in more disconcerting news, there appears to be a more infectious new variant of Covid-19 driving cases sharply higher in the U.K. Scientists believe that vaccines will still be effective with the new variant but it does raise the stakes for an efficient rollout of those vaccines. Time is clearly of the essence. At least 8 nations have announced U.K. travel bans; I would not be surprised by additional announcements. In other vaccine news, Johnson and Johnson announced that its vaccine candidate is moving forward with late-stage trials and expects to have data by late January. The vaccines keep coming.

Good luck and stay safe this week!