Is the labor market poised for a sharper recovery than expected by the conventional wisdom? Among Fed officials, for example, only St. Louis President James Bullard anticipates a rapid rebound with a prediction that the economy may fully recovery by the end of the next year. His colleagues likely look upon his claims with disbelief and instead focus on the ongoing pandemic and the stalled fiscal support package as reasons to be cautious about the future.

How seriously should we take Bullard’s claims? Is the economy poised for strong gains? The Bullard view may seem crazy on the surface, but this is not a typical recession. A rapid rebound is definitely a non-trivial upside risk to the outlook. Given the proximity to the lower bound and the resulting one-sided policy risks, the Fed is well advised to focus on outcomes on the left-hand side of the distribution. Market participants, however, should not so lightly dismiss the right-hand side of the distribution.

What stands out in this recovery is the V-shaped recovery in key cyclical sectors of the economy such as housing:

And even core durable goods orders:

More broadly, typical recession dating indicators support the contention that the recession ended during the second quarter:

The Atlanta Fed estimate of third quarter GDP growth is 32%. While not sufficient to recover all the ground lost from the earlier declines, it is clearly an economic expansion.

But is it a self-sustaining expansion? The argument against Bullard goes something like this: Enhanced unemployment benefits explains the strength of the rebound and concluded at the end of July. Those benefits are critical because there are no jobs for those who lost their jobs to the pandemic. Consequently, demand will falter and aggravate weakness stemming from the second and third order impacts of the initial job decline. There is no self-sustaining recovery.

All of that is fair and basically follows the script of the last recession. But the story relies on the assumption that the demand for labor is impaired. According to conventional wisdom, there are no jobs available.

That is where I am running into a problem. The JOLTS data is telling me that there are jobs available. Headline job openings bounced back strongly and now sit at 2018 levels:

You might reasonably suggest that this can’t be true of the some of the sectors most impacted by the Covid-19 pandemic. But you would be wrong:

The story here is that while job openings have indeed declined, they have not declined dramatically in comparison to the last recession. Job openings in accommodation and food services, for example, reached a low of 173k in August 2009. The number of openings is currently nearly 4 times higher at 663k. Overall, the level of claims is at 2018 levels, the time that the job market started to go into overdrive.

What about going forward? Even if job openings drift sideways as they did in 2002-2003, they are drifting sideways at a level consistent with the 2018 job market, which wouldn’t be too shabby. But job openings could also rise as they did with the conclusion of the 2007-2009 recession. Except now they would be rising from a high base.

Workers too sense a strong job market in the making. The level of quits jumped in June and July, almost back to 2018 levels and at levels consistent with the peak of the 2001-2007 expansion:

Taken at face value, the JOLTS data suggests a substantial amount of resilience in labor demand. There may be a great deal of room for the economy to bounce back more quickly than expected and make Bullard’s comments sound reasonable.

The high level of openings is also playing havoc with the Berveridge Curve:

Using headline unemployment, the Beveridge curve appears to have initially shifted sharply to the right and is returning rapidly returning to the pre-pandemic point, very much in contrast with the last recession. Back then the labor market followed the curve down and to the right before shifting modestly out to the right. It wasn’t until 2017 that the economy returned to the pre-Great Recession curve.

The shift of the Beveridge curve would be consistent with a high level of uncertainty in the economy that makes employers wary to fill openings. If that uncertainty clears quickly though, they may scramble to bring on new workers. The unemployment rate could drop quickly.

This brings us to a controversial topic. Will there be a structural mismatch between employers and workers? Such claims during the past expansion were certainly overstated and consequently the conventional wisdom is that no such thing could occur now. You aren’t even allowed to think about it. The behavior of job openings now, however, provides a much greater reason to believe something interesting is happening relative to the last recession. The behavior of permanent unemployment relative to openings also argues in that direction. In this case, the economy is shifting further away from the pre-pandemic curve as time passes:

The rising rate of permanent job loses suggests an increasing amount of structural damage from the pandemic. This has always been the concern; the structural damage limits the ability of the economy to grow because of resources wasted in the process of matching workers and firms. Unlike the last recession, however, this process occurs at a time with vastly more job openings. And at a time when child care challenges are pushing some parents out of the labor force. The case for a structural mismatch in the labor market appears stronger now than during the last recovery.

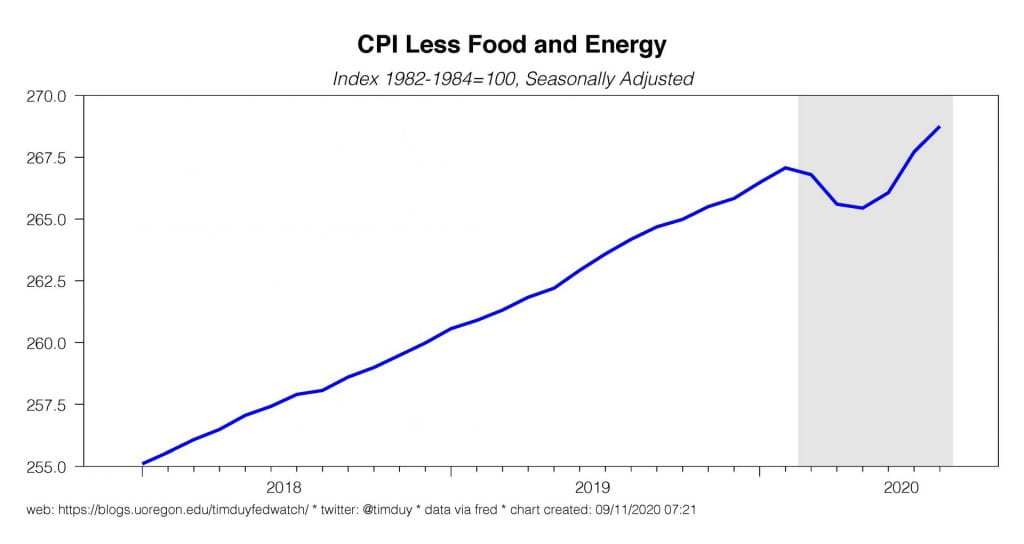

What to watch for? Wage growth. The conventional wisdom is that high levels of unemployment will continue to depress wage growth. If the recovery is sustainable at a high level of job openings, that may not be the case. Unemployment could fall very quickly and the damage from the recession might have triggered some structural dislocations. If job openings stay strong, I would anticipate wage growth will firm more quickly than anticipated. That would also support firmer inflation numbers. That doesn’t mean hyperinflation. The deeper dynamics that drives rapid and persistent wage growth in high inflation era do not appear evident. Still, we don’t need hyperinflation to get interesting inflation numbers. We just need something above 2% to raise some fun policy questions for the Fed.

Bottom Line: Watch job openings and the Beveridge curve. An enormous amount of ink was spilled on this topic during the last expansion, but curiously little now.