OK, well that was kind of a crazy day. Equities gave up yesterday’s gains and then some as bond yields dropped. The 30 year bond yield hit a record low and the 10s2s spread slightly inverted, stoking fears of recession. In my opinion we should be reasonably concerned about the outlook as recession risks have risen but recognize that a.) the time between yield curve inversion and and recession could be long and b.) the Fed has been and will continue to be more dovish in the wake of the inversion than they have been in the past. On the other hand, the risk of continued chaotic policy out of the White House is high and could foster the type of coordinated pessimism that overwhelms the Fed.

Let’s begin by addressing this meme:

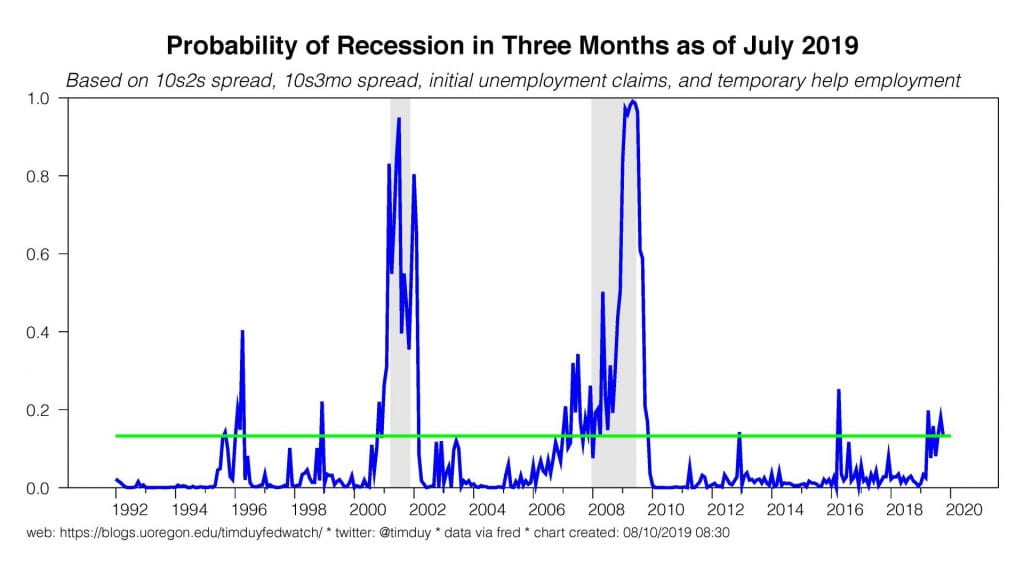

If economists at the Federal Reserve behaved this way, a 50bp cut at the September FOMC meeting would be a slam dunk. Remember, a yield curve-centric view of the world gives you a chart like this:

The Fed, however, will not be using such a simplistic model and will be wary that they can predict a recession a year or more in advance. Instead, they will look at the situation using more “actual economic data” and see something more like this:

Which means they will not be inclined to be as reactive to the yield curve as perhaps market participants desire. Remember, an inverted yield curve is a long leading indicator:

In the last cycle, the yield curve inverted in the beginning to 2006 while the recession did not begin until the end of 2007. Given the long lead times, we can pretty much guarantee that we are not yet at the peak of this cycle and hence incoming data will likely remain solid albeit not spectacular. The same good data flow could help prop up equities until the recession comes closer into view. The upshot is that an inverted yield curve does not mean a recession is right on top of us.

On the second point, this cycle is unusual in that the Fed has cut rates already; in the past, they have continued to hike rates after a 10s2s inversion. I don’t like to say “this time is different” given the yield curve’s past predictive ability, but the Fed’s response is different, and only time will tell if the early response is sufficient to avoid recession.

Whether or not the Fed’s response will or can prevent a recession depends on the aggressiveness of the rate cuts and how much chaos comes out of the White House. The Fed can increase their odds of breaking up the building pessimism and supporting the economy with a bigger rate cut, but I don’t think they are there yet. First, as noted above, they might not see the need for an aggressive cut in the data. Second, they are facing enormous political pressure to cut rates and they may fear that a 50bp cut would be seen as yielding to that pressure.

Even if the Fed responds aggressively in the days ahead, we should be open to the possibility that they the situation evolves into something that overwhelms them. I say this as a believer in the capacity of monetary policy to influence the economy. Still, a sufficiently-sized shock might overwhelm the Fed. Consider this latest tirade from President Trump:

Realistically, Trump’s incoherent trade policies are the proximate cause for the pessimism building in the business and financial communities. Trump, however, would never admit to this and instead projects his anger onto Federal Reserve Chair Jerome Powell. We should recognize that if we stay on this path much longer, rumors will again swirl that Trump is going to fire Powell. I don’t think Powell would back down; the Fed would fight an attempted firing. I can’t imagine though that financial market participants would patiently wait for the matter to be settled in the courts. I think market conditions would turn ugly.

So one can make a reasonable story where the ongoing trade wars and a showdown with between the White House and the Fed erodes confidence and turns the business community sufficiently pessimistic to trigger a recession before the Fed can react or before their reaction has time to work it’s way through the economy.

Bottom Line: A yield curve inversion does not mean that a recession is on top of us or that it couldn’t be averted. It does mean that the risks of recession are higher. The Fed will cut 25bp in September with a risk of 50bp. Obviously if credit markets seize up before then we will be looking at the possibility of an inter-meeting cut. A lot of chaos is flowing from the White House now and fostering a negative feedback loop where red days on Wall Street increase Trump’s anger at Powell. The results could become unpleasant.