If You Don’t Have Any Time This Morning

The Fed will cut rates 25bp this week with Powell retaining the option for further cuts depending on data/risks.

Key Data

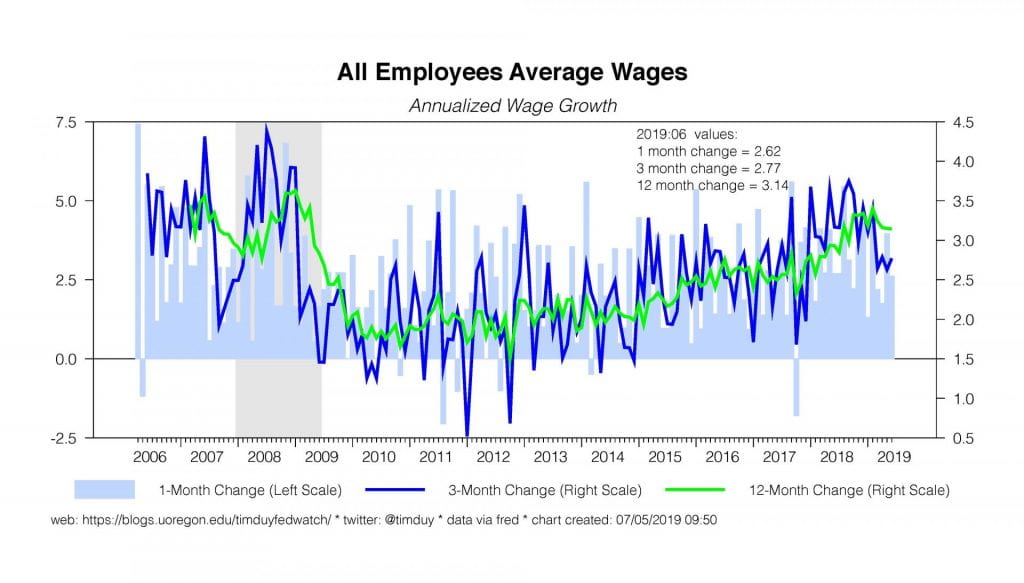

The economy grew at a better than expected 2.1% pace in the second quarter albeit with an unbalanced pattern of activity. From the Fed’s perspective, they will be happy that growth, supported by a rebound in consumer spending, has not yet slipped below trend. In fact, underlying demand held up quite well. Real final sales to private domestic purchasers rose at a 3.2% rate, pretty comparable to the 3.3% rate for all of last year.

On the other hand, the weakness in business spending – fixed nonresidential investment was down 0.6% – will justify their concerns that business confidence is struggling to overcome slow growth abroad an erratic US trade policy. Also on the negative side, residential housing investment has been negative for the last six quarters; housing hasn’t been driving activity for quite some time. New home sales have effectively flatlined but at least the very soft patch at the end of 2018 seems to be behind us.

While the 4.3% pace of consumption spending is not likely sustainable, the underlying strength likely is sustainable. I have said this before, but I think it is worth repeating: Do not bet against the American consumer in the absence of widespread job losses. With that in mind, note that initial unemployment claims continue to move sideways at very low levels. We have yet to see the upturn in claims consistent with even sharply slowing job growth let alone steep declines in the number of jobs.

![]()

Somewhat surprisingly, new orders for nondefense, nonaircraft capital goods continue to hold up. Of course, capital goods orders are not always a leading indicator. See, for example, the slow response of orders in the last recession. That said, they are holding up much better than in the 2015-16 period that followed the oil price crash. Moreover, they certainty belie the claims of any bearish analysts who have been selling recession fears since the end of last year.

Fedspeak

Blackout period last week. The prior week’s Fedspeak was pointing us toward a 25bp rate cut. Perhaps most telling was the rapid rejection of the early interpretationof comments made by New York Federal Reserve President John Williams. His speech argued for a rapid and forceful response to economic weakness when policy rates hovered near the zero-lower bound. Market participants instantly seized upon these remarks as indicating a 50bp cut was in the works. The response was so strong the New York Fed walked back financial markets by stating that Williams’ speech was an academic discussion not a signal about the July Fed meeting. Had Williams been signaling 50bp, he would not have needed to issue such a clarifying statement. Realistically, this incident was something of a rookie error on the part of the New York Fed and suggests that the Federal Reserve in general had not taken seriously the growing chorus of analysts anticipating a 50bp cut. It has been mostly St. Louis Federal Reserve President James Bullard alone willing to push back aggressively on the idea of a 50bp cut.

Upcoming Data

Fairly busy week ahead. Tuesday we get the June report on personal income and outlays with expectations for 0.3% growth in real spending and 0.2% growth in core-PCE prices; subdued low inflation remains important for sustaining the Fed’s dovish feeling. Also Tuesday is the Case-Shiller home price indexes which are expected to reveal that the pace of home price appreciation remains markedly slower than recent years. Wednesday morning we get the ADP employment report while in the afternoon the FOMC will release their decision on rates followed by Federal Reserve Chairman Jerome Powell’s explanatory press conference. Thursday brings the ISM manufacturing report; expectations are the headline number sits at 51.9, just above the breakeven point. Thursday also brings construction spending for June and the usual initial claims report. Then comes Friday and the employment report for July. Wall Street is expecting around 150k job growth and a 3.6% unemployment rate. The Fed will be hard pressed to justify continued rate cuts if job growth hovers closer to 150k and above rather than closer to 100k. Also on Friday comes the trade balance for June and the final reading on July consumer sentiment from the University of Michigan.

Discussion

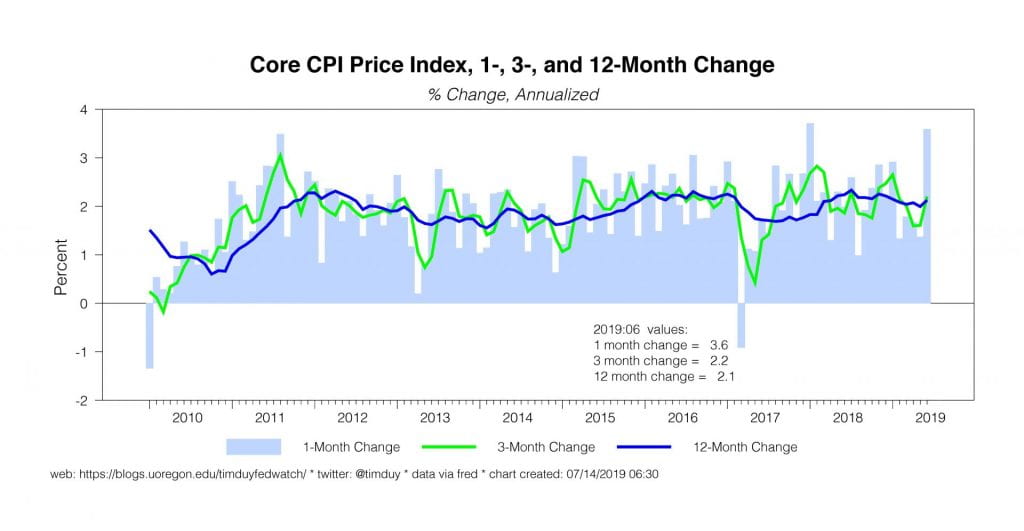

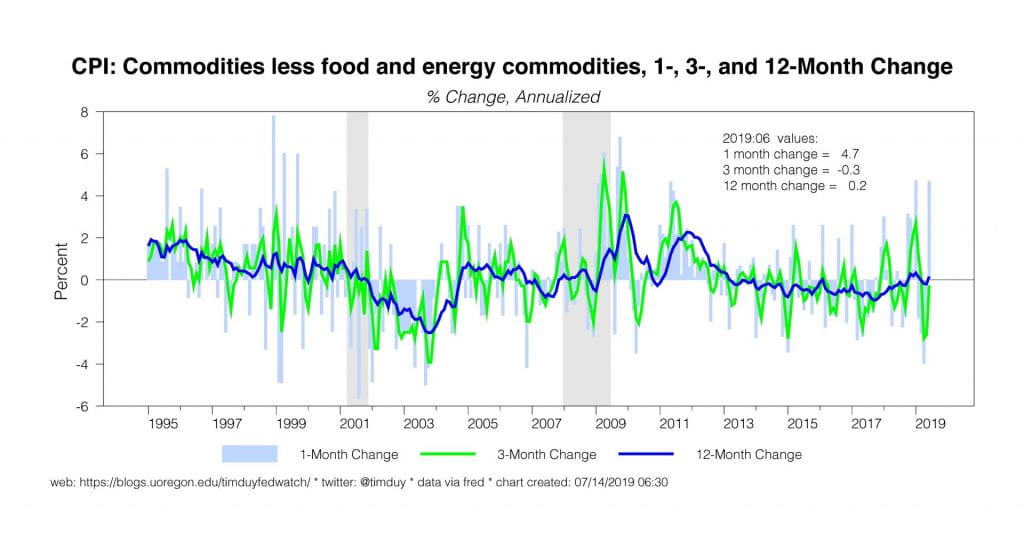

It’s fairly clear that the Fed will cut interest rates this week, and also fairly clear that they will choose 25bp over 50bp. More interesting will be the guidance we get from the statement and Powell regarding the direction of policy going forward.Where we sit now is that the flow of economic data remains insufficiently pessimistic to justify a rate cut relative to historical Fed policy moves. Yes, data has softened such that the economy appears to be growing closer to trend. No, data does not indicate impending recession. It is not evident to even everyone at the Fed that a rate cut is even necessary.

Moreover, relative to a few months ago, economic pessimism should have lessened. It should be evident at this point, for instance, that any fears of flagging consumer spending were overblown. And, similarly, the housing market is not heading into a 2006 downturn. Some downside risks have even been not just minimized (seems the trade wars are at a bit of a lull) but outright eliminated. The spending deal both nearly eliminates fiscal drag next year while ensuring that the debt ceiling will not be an issue for two years. Assuming the Fed had fiscal drag built into their forecasts, those forecasts will need to be upgraded accordingly.

Still, the Fed will follow through on the rate cut for a number of reasons.It was about risks not about the data, and those risks have not entirely dissipated. Brexit remains an open, festering wound ready to go gangrene. And the lull in the trade wars is almost certainly temporary. Some of the improvement over the first half of the year is attributable to the Fed’s dovish shift: Financial markets remain buoyant and mortgage rates are lower. The Fed will need to follow through with a rate cut to maintain those benefits. With inflation low, the risk of policy error from a 25bp cut is fairly low. And the Fed’s forecasts indicate downward revisions of the natural interest rate, hence policy was tighter than they thought. More succinctly, the December rate hike was simply a small mistake than needs to be rectified.

Unless the data deteriorates or risks intensify, the case for future rate cuts quickly weakens.Powell and his colleagues will need to take this into account in their communications, beginning with the press conference. Powell needs to repeat the mantra that the Fed will aim policy toward sustaining the expansion to maintain a sufficiently dovish tone that keeps financial market participants thinking that rate cuts remain more likely than hikes. At the same time, however, he won’t want market participants to get too far ahead of the Fed and thus will emphasize the data dependent nature of policy. There is lots of room for error when trying to thread this needle, so the press conference might be volatile as Powell flips between the risks and the data.

I think the Fed will be attempting to signal that absent a substantial improvement in the data, the ongoing risks will justify another 25bp rate cut (it would still be a hard sell for the hawks) and that this is expected to be that baseline scenario. But anything more than another 25bp requires more evident deterioration in the outlook or an intensification of risks.Powell will not want to feed into any perceptions that the Fed is already locked into 75bp or more of easing.

Bottom Line: Look for 25bp from the Fed this week with a signal that they are prepared to do more but that they remain data dependent and are not committed to a specific policy path.

Initial unemployment claims continue to move sideways at low levels. The fact that they have stopped declining suggests a somewhat less vibrant labor market, consistent with the general deceleration of job growth in the first half of 2019. The lack of any substantial rise in claims, however, suggests that claims of imminent recession remain premature.

Initial unemployment claims continue to move sideways at low levels. The fact that they have stopped declining suggests a somewhat less vibrant labor market, consistent with the general deceleration of job growth in the first half of 2019. The lack of any substantial rise in claims, however, suggests that claims of imminent recession remain premature.