If You Don’t Have Any Time This Morning

The Fed will likely cut rates this month, but the data doesn’t support a 50bp move.

Data

The employment surprised on the upside as firms added 224k employees in June. Needless to say, 224k remains a healthy pace of job growth that belies both claims of impending recession and the expectation of deep interest rate cuts. While it is tempting to say that the June report offsets May’s, this latest report does not undo narrative that the labor market slowed in 2019.Notably, May’s report delivered large downward revisions to previous months; there were no such countervailing upward revisions in June’s. Absent such revisions, the June report looks like a good outcome around an underlying pace of growth that has slowed markedly since the final months of 2018.

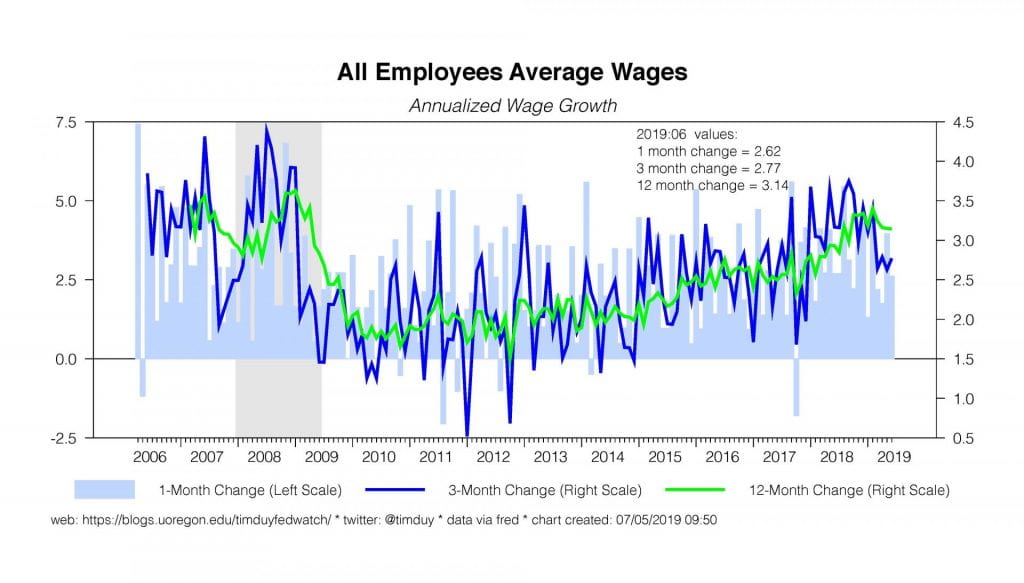

Weaker wage growth in recent months also suggests a change in the weather.There too we see a shift downward in wage growth from above to below 3%. The lower wage growth should catch the Fed’s eye. While it is not necessarily the case that faster wage growth feeds directly into inflation, it seems very unlikely that faster inflation could be sustained absent rapid wage growth. The wage numbers thus fit nicely into the narrative that inflation concerns should really remain on the back burner.

The ISM reports came in largely as might be expected given the apparent slowdown in overall economic activity.The manufacturing sector has clearly slowed with the new order measure now flirting with the breakeven mark. That said, these numbers are not unlike what has been seen many times throughout this expansion; this is the third time (2011-12, 2015-16, and now) the manufacturing sector has eased back over the past ten years. In contrast, while the service sector measure has also fallen, the composite index remains well above the breakeven mark and has throughout the expansion. The service sector is a much larger part of the economy. It is very difficult to believe that the economy would enter recession on manufacturing alone.The service sector would need to join it in recession, and so far that is clearly not the case.

Fedspeak

Fed speak has been fairly light in recent weeks but what we have points toward a 25bp cut rather than the beginning of a series of cuts. Notably, in a Bloomberg interviewSt. Louis Federal Reserve President James Bullard pushed back on the notion of 50bp saying that such a move would be overdone. He specifically referred to any impending action as “insurance”:

“Inflation is running low, inflation expectations are running low, and you would like to get those back up to 2%,” he said. “I don’t think you have to take huge action to get this. This is more in the realm of insurance.’’

Federal Reserve Chairman Jerome Powell largely reiterated the themes of the most recent post-FOMC press conference in a recent speech. That said, it appears that he too was attempting to push back on growing market expectations for a period of substantial rate cuts:

Many FOMC participants judge that the case for somewhat more accommodative policy has strengthened. But we are also mindful that monetary policy should not overreact to any individual data point or short-term swing in sentiment.

Powell also noted during Q&A that “an ounce of prevention is worth a pound of cure.” One other point from Powell’s speech is that emphasis on the benefits of low unemployment:

Like many others at the conference, I was particularly struck by two panels that included people who work every day in low- and middle-income communities. What we heard, loud and clear, was that today’s tight labor markets mean that the benefits of this long recovery are now reaching these communities to a degree that has not been felt for many years. We heard of companies, communities, and schools working together to bring employers the productive workers they need—and of employers working creatively to structure jobs so that employees can do their jobs while coping with the demands of family and life beyond the workplace. We heard that many people who, in the past, struggled to stay in the workforce are now getting an opportunity to add new and better chapters to their life stories. All of this underscores how important it is to sustain this expansion.

The focus away from inflation and toward employment is important. In a low inflation environment, the Fed’s fight has shifted to the benefits of sustaining the expansion and with it persistently low unemployment. That argues for a more careful and on net dovish policy approach.

Not everyone at the Fed is sold on a rate cut. Cleveland Federal Reserve President Loretta Mester argues against cutting rates:

Cutting rates at this juncture could reinforce negative sentiment about a deterioration in the outlook even if this is not the baseline view, and could encourage financial imbalances given the current level of interest rates, which would be counterproductive.

She prefers instead to hold rates steady and allow for inflation to gradually edge higher given her baseline outlook of steady continued economic growth.

Upcoming Data

Fairly light data this week. The main event is the CPI report, released Thursday. Wall Street is expecting a flat headline number but a 0.2% rise in core inflation, a combination that will support the Fed dovish tendencies.On Thursday we also get the usual initial claims report. Other notable reports are wholesale inventories on Wednesday and we get another reading on price pressures with the PPI report on Friday.

The main Fed event this week is Powell’s appearance in Congress to deliver the Semiannual Monetary Policy report (House on Wednesday, Senate on Thursday). Also, we should keep an eye on Federal Reserve Governor Randal Quarles’ speech on Thursday titled Financial Regulation and Monetary Policy. With stocks again making record highs amidst a persistently low inflation environment, the interplay of monetary policy and financial stability remains something not far from the minds of central bankers.

Discussion

It looks like market participants got too far ahead of the Fed in the last few weeks. There has yet to be a sufficient weakening of the data to justify a 50bp cut this month let alone a long series of rate cuts. Moreover, it really isn’t that difficult to make the case for stable policy that Mester made this past week. Absent the dovish shift in Fedspeak in recent weeks, and the lack of pushback against the generally dovish interpretation, the data flow would likely have not alone have driven expectations as far as they had gone.

Why are rate cuts even part of the discussion? I think that we have to look back to the final months of 2018 to answer that question. From the Fed’s perspective, the economy was quite strong and showed few signs of slowing. Notably, the pace of job growth was still on an upward trend, fueling concerns that the economy would soon overheat. Had the Fed anticipated the overall softening of activity and in particular the decline in job growth since then, I suspect they would not have followed through with the December rate hike.

In this light, a rate cut this month is simply a correction of the fairly small error made in December.The need to correct that error became important given growing downside risks from trade tensions and slower global growth. There is no need to risk a sharp slowing in the economy given that inflation remains low. Moreover, if the Fed wants to sustain the expansion, they cannot delay a rate hike until the data reveals that a recession is underway.That just guarantees they would soon again find themselves at zero interest rates. All of this argues for an insurance cut rather than a panic cut. That means 25bp, not 50bp.

Furthermore, the story does not add up to one in which the Fed foresees multiple rate cuts. The most recent SEP forecasts reveal that seven participants expect 50bp of rate cutting in total this year, one expects 25bp, eight expect no change, and just one expects another rate hike. Given that, as Powell has said, that all virtually all participants believed the case of additional accommodation has risen, the odds favor the group moving toward the 50bp direction. But we won’t get there without more data.

Where we will get without more data is an insurance cut. But after that, the more hawkish participants are going to start digging in their heels against further cuts. At the risk of oversimplifying, I expect that if the economic environment looks to be generating job growth around 150-175k, the Fed will likely cut rates once that then shift back to patient mode. If we are seeing a situation emerge where job growth is likely to slide to 100k, the Fed will deliver another 25bp. Less than 100k will bring another.

To be sure, these scenarios hinge on a continued quiescent inflation outlook.A dovish Fed is one that faces few inflationary pressures. The Fed will tolerate modest overshooting of the target, but will get nervous if inflation looks to be heading sustainable above 2.5%. There seems like little risk of this now, but certainly something to keep an eye on. Also, we don’t know how the Fed will react to record high equity prices. The Fed wants to sustain the recovery, but doesn’t want a repeat of the late-90s either. And we don’t know what other trade/global risks will emerge in the second half of the year.

Bottom Line: The data is not supporting a 50bp cut, nor does there seem to be much stomach for a such a move at the Fed. The story emerging is one of an insurance cut to reverse December’s hike. A 25 basis point cut this month looks likely; given the dovish direction of the Fed as revealed in the SEP, the odds favor still another 25bp, but that looks more fragile than I believe a few weeks ago.