The soft CPI numbers for April throw some cold water on the Fed’s expectation that recent weak inflation data will prove to be transitory. Core CPI clocked in at an anemic 1.4% annualized monthly rate and 2% yearly rate in May:

Recall that CPI inflation generally runs hot compared to PCE inflation, hence these numbers remains consistent with below-target inflation. Shelter inflation has pulled back from recent strength:

The stronger numbers earlier in the year had come as a surprise to me given softer housing markets and the rapid pace of apartment construction in recent years. If the data is reverting to my expectations, one source of strength in recent numbers may be persistently weaker going forward. Goods inflation is softer:

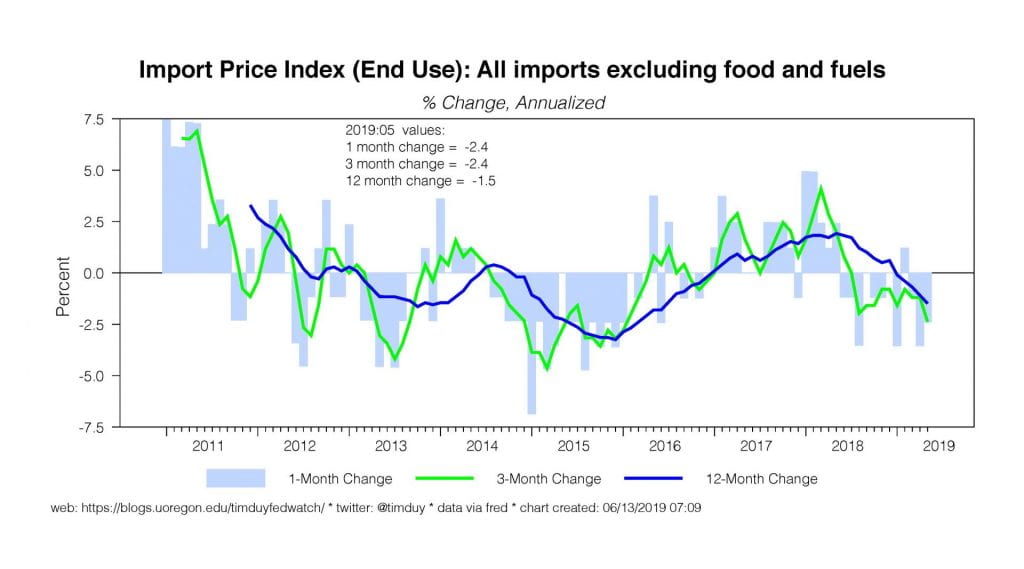

Relatedly, import prices are falling again:

This points toward weaker global demand which is in turn places some downward pressure on US inflation. Service sector inflation is also on the softer side:

It’s instructive to look at the acceleration in of services inflation in the periods 1999-2001, 2003-2006, and in 2007-2008, each of which contributed to a potentially more persistent inflationary environment that caught the Fed’s attention. There is no evidence in recent broad trends to suggest that such concerns are relevant at this time.

Separately, initial unemployment claims continue to move sideways:

The relative stagnation of the claims data remains consistent with a labor market that has shifted gears to a slower pace but does not show signs of recession.

Bottom Line: My read is that at a minimum inflation remains a nonissue with the risks weighted toward the possibility that recent weakness is more persistent than transitory. In addition, the slowing pace of job growth should take more pressure off inflation in the months ahead. The combination gives the Fed room to cut rates. Assuming this data flow continues to hold, I anticipate the Fed to signal a rate cut at next week’s FOMC meeting and follow through with that cut in July.