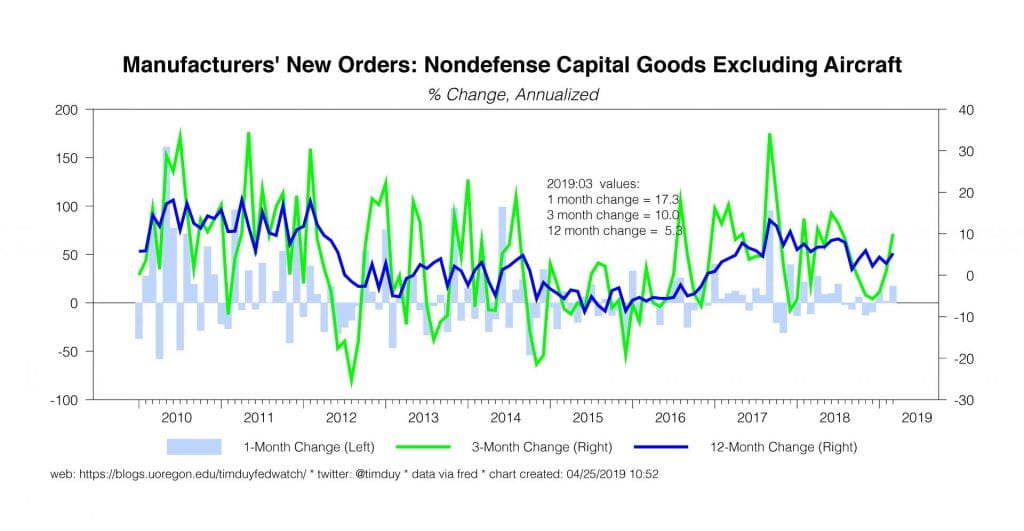

The Fed is in blackout ahead of next week’s FOMC meeting, so it’s a bit quiet in monetary policy-land. On the non-recession watch, core durable goods orders rose in March:

That’s another ding to the recession story. And, to be fair, a ding to the slowdown story as well. So far, this isn’t even shaping up to 2015-16 standards, raising the question of whether the soft landing story is really in play yet? That’s something I am watching closely; stable monetary policy assumes economic deceleration in the months ahead. Stronger-than-expected growth would cause us to question that outlook.

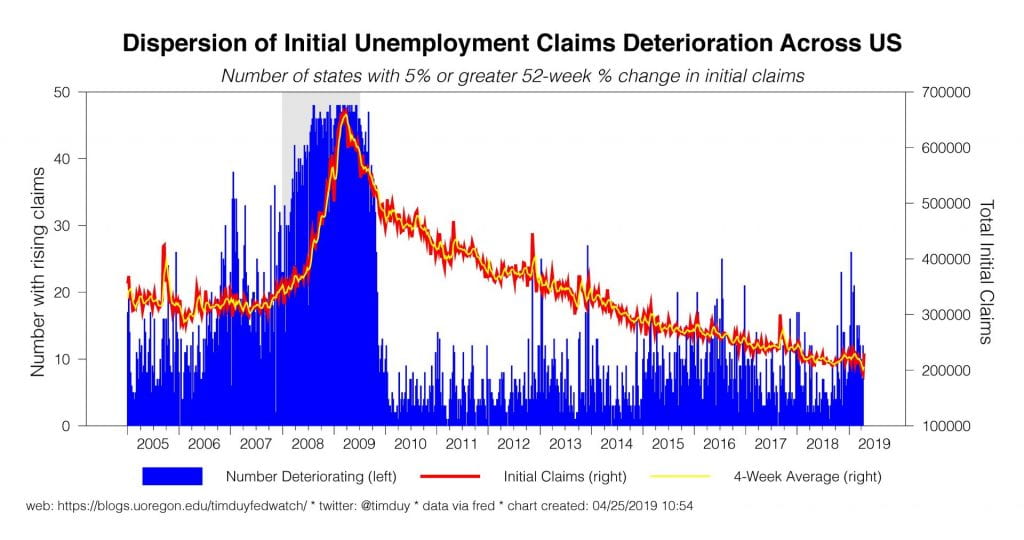

Initial unemployment claims popped this week:

That’s not something to worry about as there are two suspected culprits to account for the surge. Easter came late – the timing of holidays poses challenges for seasonal adjustment of weekly data. Also, a grocery strike likely impacted the data. Overall, nothing to see here, folks, move along.

Tomorrow is first quarter GDP. The Atlanta Fed is looking for 2.7%, which would be a pretty good number considering that the low estimate was just 0.2% in early March and the first quarter has been on the soft side in recent years. The Fed will be particularly interested in the internals of the report, in particular underlying domestic demand, and looking for that slowdown noted above. The inflation component is of course important, but is expected to remain sufficiently soft to support the Fed’s patient policy stance.

Bottom Line: That recession just isn’t happening. Even the degree of slowing could arguably be in doubt. Nothing though yet sufficiently definitive to push the Fed to change rates in either direction.

Pingback: Weighing the Week Ahead: How to Watch the Information Avalanche | Dash of Insight