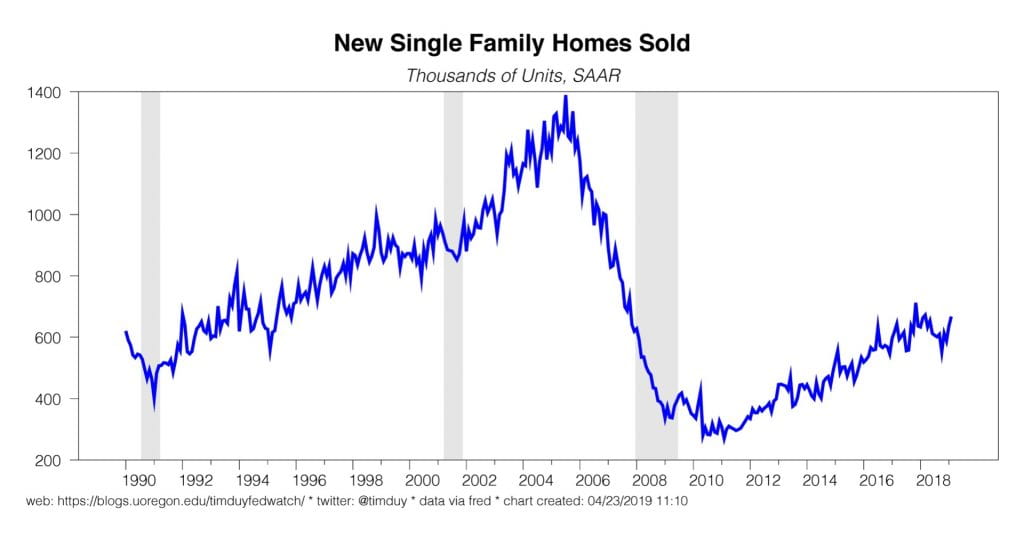

Some quick updates tonight. First and foremost, the new home sales data is the latest to cut against the recessionistas. Housing continues to rebound from the dip at the end of last year:

A good story going into the back half of 2018 was that rising housing prices, both new and used, would eventually kill off some demand. Higher interest rates, less generous tax deductions, and a bit of economic uncertainty added to the stress on the sector and sales fell. Builders, now realizing they have likely sated the higher end of the market, appear to have turned their attention to lower-priced product:

Lower prices help lure buyers back into the market. Note though that a housing rebound does not necessarily rule out a recession. See, for example, the 2001 recession, during which housing played no real part. Still, if the housing downturn was an important component of your recession call, you should rethink that call.

As far as nominees to the Board of Governors are concerned, one down, one to go. Hermain Cain withdrew his name from consideration, apparently realizing that it was actually a job you were expected to take seriously, so you weren’t allowed to run side businesses or give paid speeches. And apparently he didn’t realize the pay wasn’t all that great relative to the prestige. Of course, there is also the issue that he would his name would be dragged through the mud again on those sexual misconduct claims.

Speaking of being dragged through the mud, Trump’s other nominee, Stephen Moore, is seeing his past catch up to him. Sam Bell, who apparently spends most of his days cataloguing Moore’s past, caught Moore saying this today:

Moore today: “they’re pulling a Kavanaugh against me…I’m taking a 68% pay cut to do this job so, you know, it’s true public service…the people who keep me going are the people who love what Trump is doing… and the prosperity that Trump is bringing” https://t.co/ohRlSsd6TT

— Sam Bell (@sam_a_bell) April 23, 2019

Of course, with Moore there are tapes. Like of him being a goldbug. And actual writings that revealed, surprise, surprise, a strong misogynistic streak; see also Jim Tankersly at the New York Times. No one should feel sorry for Moore. Still, we can’t count him out just yet; Republicans in the Senate may have a hard time deep-sixing a chief proponent for their economic agenda. Can’t really say he is sufficiently qualified to guide your economic agenda but not be part of the Federal Reserve, right?

On a final note, stocks rallied to a record high Tuesday. Is this good news or a bad omen? Rich Miller at Bloomberg senses concern that history may repeat itself:

Some Federal Reserve policy makers seem resigned to running a heightened risk of asset bubbles and other financial excesses as they seek to keep the economic expansion going.

I tend to think such concerns reflect too much recency-bias in our analysis. The last two cycles ended with asset bubbles, so this one must as well, right? My response is that Japan suffered through joint property and equity bubbles and has found it hard to recreate that dynamic despite years of ultra-low interest rates. We should be open to the possibility that we experience occasional mini-bubbles like oil shale and cryptocurrencies that have some sector specific impacts but are not economy-wide shocks. Some bubbles just aren’t big enough to worry about from a macro perspective. The next cycle might just be a dirt-dull mild downturn like 1990.

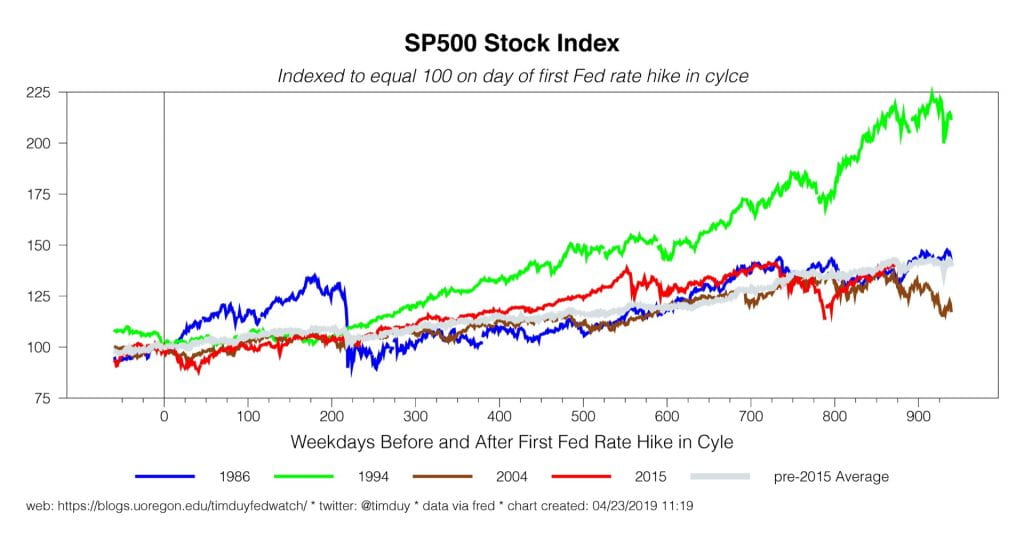

Also on bubbles, I find it interesting that the path of equities still follows the pattern that followed past rate hikes:

Doesn’t look like a late 90’s type of surge. Looks pretty average instead.

That’s it for now.