The Fed has an inflation problem. How they deal, or don’t, with that problem remains an open question. In the context of weak or even mediocre growth, the Fed’s response would be straightforwardly dovish. In the context of solid or even strong growth, however, the Fed might ultimately be unwilling to maintain a dovish policy stance. Figuring out how the Fed responds to the latter situation is our current challenge. If the Fed is serious about needing to see actual inflation before hiking rates, then the answer is that they are on hold for the foreseeable future. If the Fed is serious about the inflation target, then the odds favor a rate cut over a rate hike. Realistically though, the Fed has talked dovish about low inflation yet taken a relatively hawkish stance with respect to inflation, tightening policy even though inflation consistently falls below the Fed’s target. It’s tough to say this time will be any different.

The GDP report has been throughly dissected at this point, so I will cover the highlights quickly. The nation’s economy grew at a faster than expected 3.2% pace in the first quarter:

And at first blush the growth might look fairly balanced:

But investment was driven by inventories:

After subtracting for that and net exports the underlying pace of activity, domestic final sales, grew at an anemic 1.4% pace. That said, this was also the quarter of the government shut down and some traditional residual seasonality that depresses the headline number. On that note, today we learned that consumer spending bounce back in March:

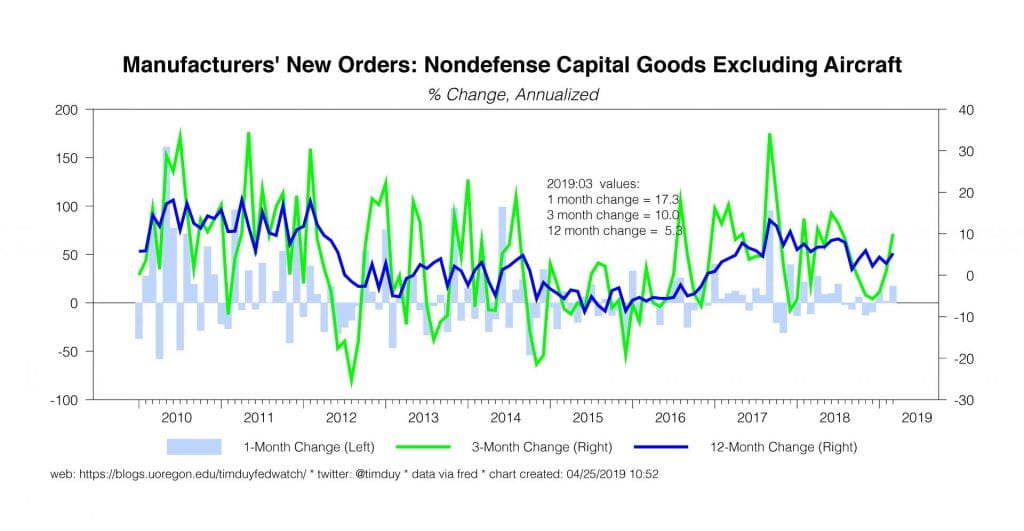

The consumer spending data stumbled in the first quarters of 2017 and 2018 as well, leaving the underlying pace of spending growth hovering around 3%. I don’t think that has changed; I think we are looking at a rebound in consumer spending on a quarterly basis going forward. Firming durable goods order suggest a good chance the same will happen to investment.

How will the Fed read this report? They will see through the headline number to the softer domestic demand component and use that to justify holding policy steady. Still, they won’t discount the possibility that the softness is less persistent than they expect. But justifying the pause is all they really need right now; they don’t have to commit to anything else until later in the year. We will see how things look in three months when the second quarter data is all available.

The real action is in the inflation story. Some weak, very weak numbers on the inflation front:

Core inflation, annualized, for the first quarter was just 0.7%. The Fed’s not going to reach its 2% inflation target this way, is it? Arguably, these numbers justify a rate cut. To be sure, the Fed’s not there yet and will instead view the numbers as most likely temporary given the growth forecast. They can’t hold that position forever though. If inflation doesn’t rebound toward target, it would be hard for the Fed to hold the line on rates even if growth remains reasonably solid. Hard but not impossible. As I said, this remains a policy gray area. They just haven’t committed sufficiently to the inflation target to lead us to believe they will take action to defend that target in the future.

Bottom Line: Incoming data supports the Fed’s patient policy stance. They will reiterate that policy at the conclusion of this week’s meeting. The weak inflation numbers pose a very real dillema for the Fed. An inflation targeting central bank should be seriously considering a rate cut. The Fed claims to be an inflation targeting central bank. But are they? We still don’t really know.