The Fed begins its two-day FOMC meeting this morning. Conventional wisdom anticipates no change in rate policy. Conventional wisdom is correct in this instance. The Fed will stay on the sidelines for Chair Janet Yellen’s final meeting. The statement itself will likely be somewhat more upbeat relative to the December statement. With another quarter of solid economic growth and some firming of inflation in recent months, the risks to the outlook should shift from “roughly balanced” to just “balanced.” Overall, I expect the statement to leave little doubt that the Fed will return to rate hikes in March.

Continued here as a newsletter…

A March rate hike would be the first of the three anticipated in 2018 by the median FOMC policymaker according to the December Summary of Economic projections. Those three rate hikes remain a reasonable baseline. My expectation is that the hawkish tilt of both the voting rotation and the new leadership will dominate over the more dovish voices of last year. Solid data on the trajectory of the economy, including continued gains in the labor market, will almost certainly keep the Fed committed to rate hikes even if inflation again surprises on the weak side.

The strength of recent data on the back of a solid global cyclical upswing leads to the reasonable conclusion that the Fed could shift to a more aggressive pace of rate hikes. Easy financial conditions – arguably the easiest since the early 1990s – further supports this possibility. Indeed, it seems as if an FOMC with a more hawkish tilt would seize upon these factors to justify a fourth rate hike this year or even a surprise 50 basis point hike midyear.

But will the FOMC indeed turn hawkish? And under what conditions? And what are the market implications? With these questions in mind, I have been considering a variety of scenarios and the potential investment implications.

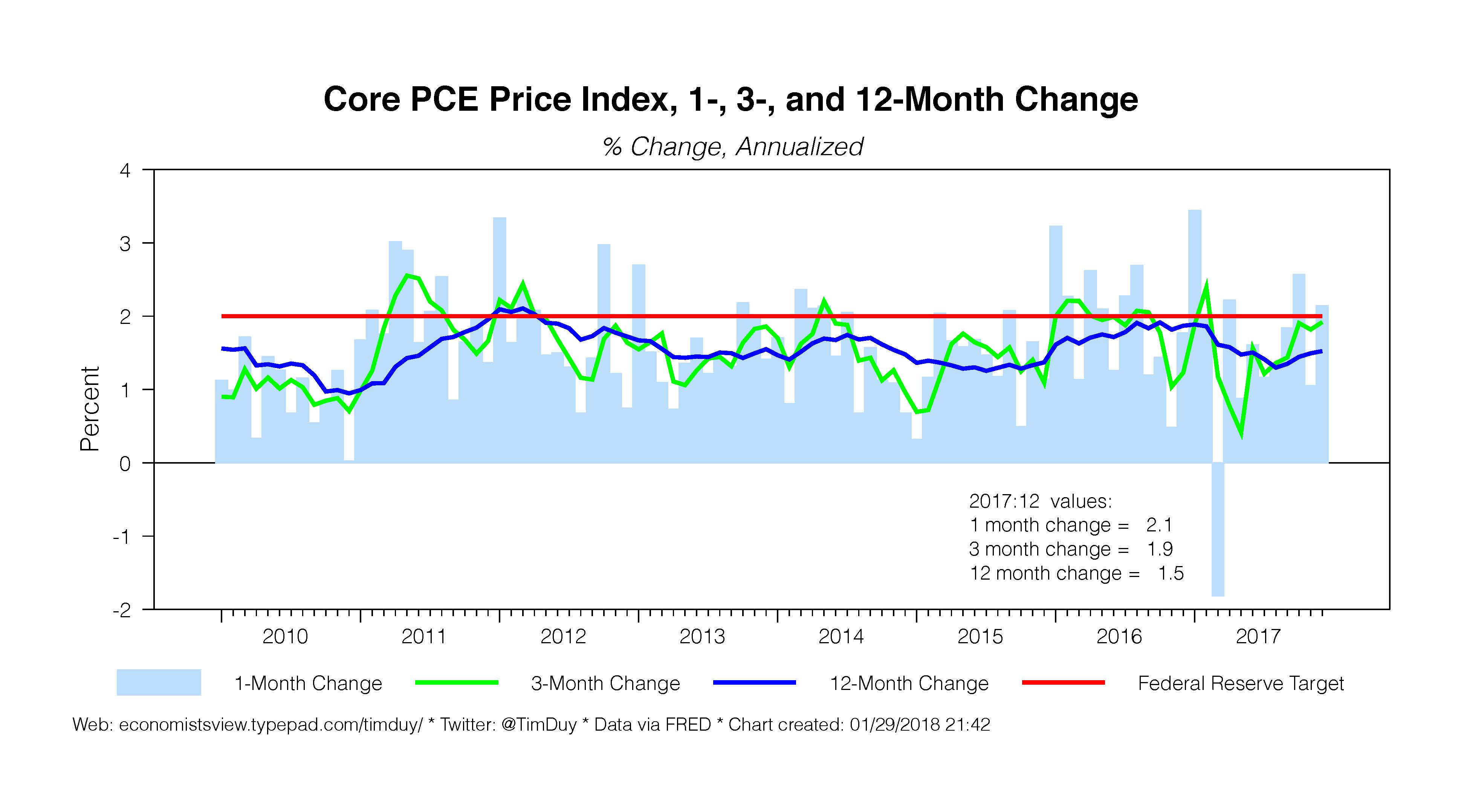

One concern is how the Fed would respond to a surprise jump in the inflation numbers. In theory, they should respond in the same way in which they responded to the surprise inflation shortfall in 2017. Rather than slowing the pace of rate hikes, they instead stayed the course on the planned three rate hikes and the initiation of balance sheet reduction.

If the Fed is treating its inflation target symmetrically, they should then respond to a positive inflation shock by again staying the course. In other words, they should remain focused on the medium-term forecast and not overreact to above target inflation. Moreover, the closer policy moves to the neutral rate, the greater the possibility that an overreaction to higher inflation turns policy too tight and triggers a recession. Consequently, extra caution is warranted and argues against an acceleration in the pace of rate hikes. Under this scenario, I would anticipate the yield curve to shift upward or steepen further in the near-term, essentially a continuation of recent trends.

Be wary, however, of the idea that this implies longer term yields will blow out. I don’t think that the fundamental factors (saving glut, investment shortage, demographics) holding down long-term rates have eased yet. Consequently, my expectation is that similar to recent run-ups in long rates, buyers will find opportunity as the yield on the 10 year exceeds three percent. Moreover, the long rate currently benefits from a global cyclical upturn. It will lose support when that upturn plays out later in the year. If this occurs, the cycle will shift back to yield curve flattening (assuming the Fed stays on track for another three hikes in 2019).

I think that if you are looking for even higher rates, you likely need more than just an inflation surprise, you need a sustained change to the inflation dynamic that the Fed does not seem inclined to get in front of. That would push up term premiums and create the kind of environment more supportive of higher rates. That said, I wouldn’t expect that out of the Yellen Fed, and certainly not out of a more hawkish leaning Powell Fed.

Arguably, this assumes too much patience on the part of the Fed. Historically, the Fed tends to overreact late in the cycle and forgets about those pesky long and variable lags in monetary policy. A more hawkish Fed would arguably be more prone to making this mistake. Under these circumstances, I would be very wary of shorting the long end of the curve. This scenario suggests instead a resumption of the yield curve flattening experienced for most of this cycle.

An arguably even more bullish scenario for longer-term yields would be a Fed that turns hawkish not due to inflation, but in response to frothy financial markets. My suspicion is that the Fed would break the economy in the process of trying to tame the behavioral forces carrying risk assets higher. In that case, the Fed would be holding policy tight while the economy and financial conditions rolled over. That would be bad.

Finally, another possibility you should have on your radar is a potential rate cut. A catalyst might come along that reverses the current psychology on Wall Street and sets in motion a price correction. My expectation is that the Fed would respond to a substantial correction by either delaying expected rate hikes or, if needed, even a rate cut. Yes, the Fed will face withering criticism that the it only continues the Greenspan put. But I don’t think that ultimately either Wall Street or Main Street would like a world in which the Fed doesn’t respond when needed.

Bottom Line: At this point, I don’t think we can be confident that a Powell Fed would be demonstrably more hawkish than a Yellen Fed. Indeed, I think you can argue that the Yellen Fed had a hawkish tilt by holding the line on policy despite low inflation. Consequently, a continuation of that policy in the face of inflation surprises would yield a dovish tilt to the Powell Fed. And that it seems to me remains the best bet in the absence of further policy guidance. As that guidance arrives, I will update my expectations accordingly.