Joe Biden is the President-elect of the United States after have gained a solid lead in the electoral college over the weekend. President Donald Trump has not conceded the race and likely will always claim he actually won had there not been voter fraud. While some of Trump’s allies are dutifully following that line of thought, they unsurprisingly offer no evidence of widespread fraud. With the votes now counted, the odds of a successfully legal action of the scope necessary to change the election are very, very thin.

In Biden’s favor as he faces managing a pandemic-stricken economy, the October employment report indicates the job market retained substantial momentum heading into the fourth quarter. The private sector added 906k employees although the release of temporary Census workers and a loss of 65k state and local government jobs dragged the headline gain to 638k. To be sure, there remains a substantial hole of the million jobs relative to the pre-pandemic peak:

Still, the slowdown in job growth has been less severe than I expected. Importantly, October marks the third full month after the supposed fiscal cliff at the end of July and yet the economy continues to gain lost ground. Note that hours worked continued to grow at a solid pace in October:

Gains in jobs and hours worked means incomes are growing at a solid clip that that growth will support consumption.

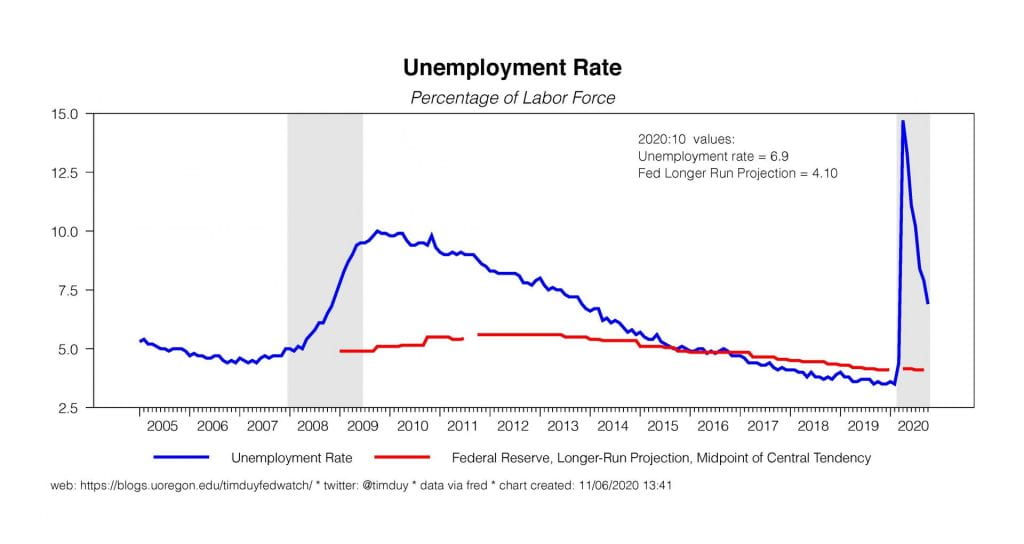

The unemployment rate sunk to 6.9%, still high but already well-below the Fed’s projected year end rate of 7.6% as of the September Summary of Economic Projections:

The Fed has consistently underestimated the strength of the rebound but unlike in past cycles this does not impact the expected timing of a rate hike. The focus is not on the unemployment rate but instead on the inflation rate. Until inflation is at 2% and looks like to remain modestly above 2%, the Fed expects to hold interest rates at zero. Ongoing solid economic gains may however prompt the Fed to rethink its asset purchase programs. At last week’s press conference, Federal Reserve Chair Jerome Powell said this:

… today, you know, we had a full discussion of the options around quantitative ease — not quantitative easing, the asset purchase program and, you know, we understand the ways in which we can adjust the parameters of it to deliver more accommodation if it turns out to be appropriate. Right now, we think that this very large effective program is delivering about the right amount of accommodation and support for the markets, and so it continues.

The Fed will deliver more accommodation via the asset purchase program if appropriate but if overall economic conditions are such that unemployment rate keeps dropping quickly they won’t find more accommodation necessary. We also still lack guidance on the conditions that would induce the Fed to pull back on the pace of asset purchases.

Although he may have more momentum in the economy than many expected at this point, Biden faces the problem of surging Covid-19 cases. The virus did not, as Donald Trump fabricated, magically disappear on November 4. Instead, the U.S. is experiencing new records in cases on a daily basis. This is not exactly optimal, to say the least. Biden is already laying out plans to address the virus and is expected to announce a coronavirus task force Monday. That said, his options are limited until the inauguration. The Trump administration appears to have largely abandoned the issue.

If the U.S. follows the pattern of this past summer, the surge will peak in a couple of months as behavior changes and local jurisdictions tighten restrictions on activity. I don’t expect the extent of general lockdowns as seen in Europe. In the U.S. that issue is in the hands of states and many governors are either content to let the virus run its course or concerned about the impact of shutdowns on economic activity. The latter extends to even states held by Democrats; with suppression now not really an option, there is on some margins a tradeoff between the economy and fighting the virus. I also doubt that widespread shutdowns are politically possible in a Covid-fatigued population. Moreover, I think the lure of the holiday season will prove impossible for many to resist; no matter the danger, too many people will still visit with family and friends. And some of their family and friends are going to die from that decision.

Yes, I understand I sound fatalistic, but this is the reality I am seeing on the ground. The best-case scenario for Biden at this point seems to be that the surge is nearing its peak around the inauguration and he gets to ride the downtrend while implementing his program and benefits from the eventual vaccine. The case remains that the economy cannot fully recover until the widespread use of a vaccine. Until then, certain sectors, particularly in leisure and hospitality, will remain encumbered by the dynamics of the virus. I expect those sectors suffer through a challenging winter.

Rumors are flying about Biden’s potential cabinet. This from Bloomberg for example, although the piece as an odd lede:

As President-elect Joe Biden forms his cabinet, he will make it a top priority to assemble an economic team that can confront the surging unemployment and business slowdown touched off by the coronavirus pandemic.

Unemployment is no longer surging and is on its way down. Putting that aside, some notable possibilities are current Federal Reserve Governor Lael Brainard for Treasury Secretary and the possibility of replacing Powell with Atlanta Federal Reserve President Raphael Bostic. I am not really thrilled with the latter possibility. Not about Bostic being Fed Chair but that Powell would conceivably be replaced. I would rather return to the bipartisan tradition of re-nominating the existing Fed chair that was broken when Trump did not renew Janet Yellen.

Bottom Line: Biden might have been dealt something of a lucky hand with respect to the economy. As a general rule, it is much better to have the recession at the front end of your administration than the back end. Even though he will likely face a recalcitrant Senate, do not mistake the current situation for the last recovery. A vast stockpile of savings is sitting in the background to fuel the economy next year, giving Biden a massive economic tailwind. Moreover, there was nothing wrong with the economy at the beginning of the year; there were no structural problems that needed to be fixed. Biden also has the opportunity to ride the downside of the current Covid-19 surge and the upside of the coming vaccine. And he has a Fed that has already committed to holding rates zero; President Obama had a Fed that was always looking to unwind. Looking past the current Covid-surge, there is a lot to like here.