It’s election week in the U.S. and the whole world is watching. Democratic presidential candidate Joe Biden is anticipated to win. The polls suggest a decisive victory outside the margins that vote tampering is likely to be successful but obviously 2016 opens up the possibility that Trump wins. Assuming Biden wins, he will inherit an economy navigating a pandemic while still struggling to recover from last spring’s shutdowns.

If the Democrats carry the Senate, we should expect another round of substantial fiscal support out of Washington. If the Republicans hold the Senate, they will look to weaken a Biden presidency with all tools available including more paltry fiscal support. In either case, the early days of a Biden administration will be spent trying to mitigate the damage the current President Donald Trump will cause in his remaining months in power.

As anticipated, output rebounded sharply in the third quarter as GDP grew at a 33.1% pace. As also anticipated, this number is misleading as it hides the extent of the damage from the pandemic. Output is 2.9% below last year’s levels. Assuming the potential growth is around 2%, the true shortfall is closer to 5%. Not great, but not exactly a depression either.

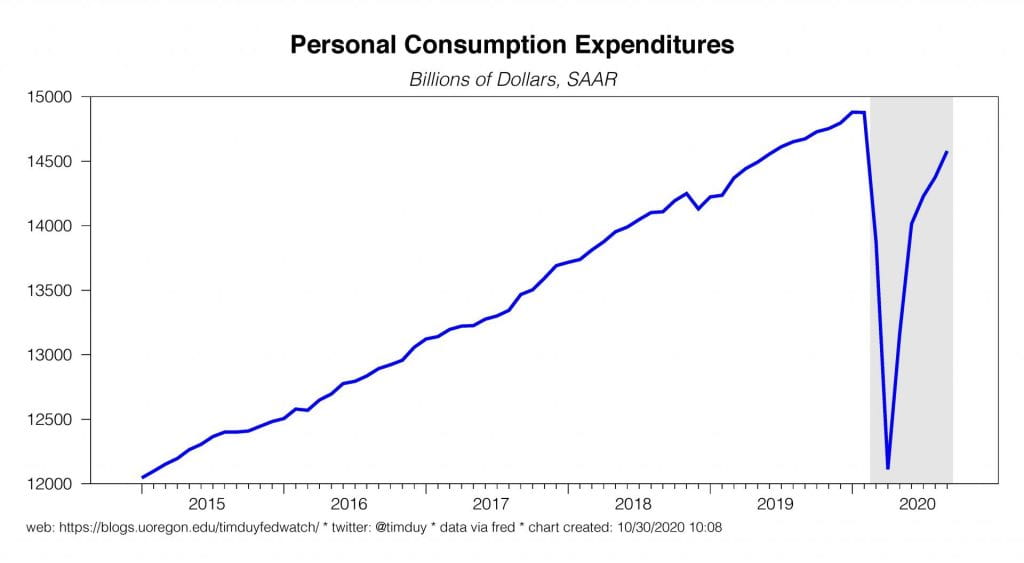

Of course, growth will slow markedly in the fourth quarter. This isn’t rocket science. You can dress it up anyway you want, but the fact that the economy collapses if you close it down and surges after you open it back up isn’t particularly revealing. The pace of growth will obviously decline to something more toward normal after the initial stop-start dynamics have played out. Interestingly, the quarter ended with more momentum than anticipated. Consumer spending grew 1.2% in September, up from 0.7% in August:

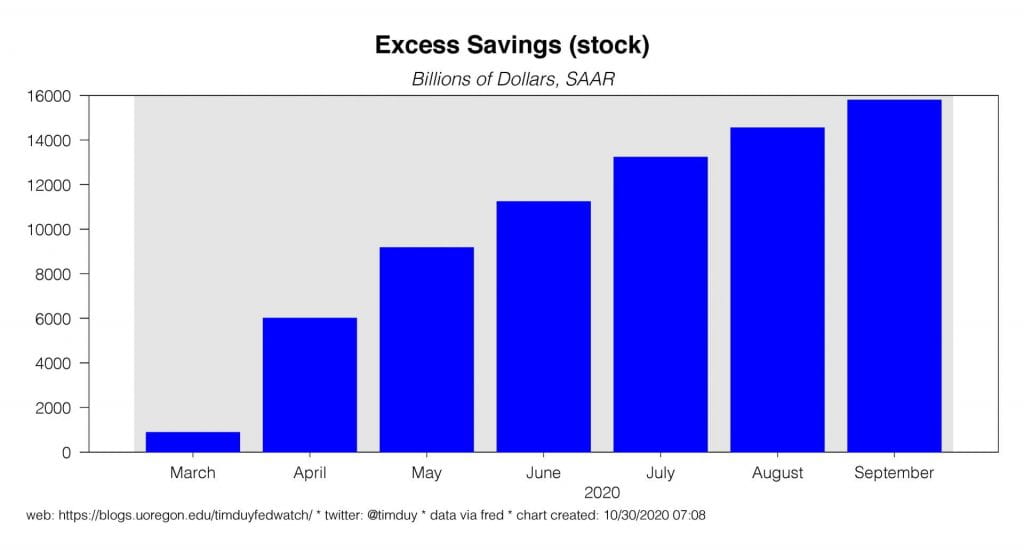

Remarkably, the saving rate declined just a notch, falling to 14.3% from 14.8%. Even two months after enhanced unemployment benefits ended, the saving rate remains very high. That stockpile of pent-up demand just keeps growing:

In aggregate, the decline in spending still tracks the decline in income less transfer payments:

If spending is tracking income growth excluding transfer payments, that spending growth can be maintained as long as jobs growth continues. The explains why the economy can still grow without more fiscal support. Fiscal support is then not absolutely necessary for growth but there remains a powerful justification for support in hastening the recovery and alleviating the unequal impacts of the recession.

The pandemic remains the chief impediment to healing the economy. The services sector cannot fully recover until people are confident they can return to crowded venues. Until services can heal, demand will continue to be pushed into goods spending:

This will be unraveled at some point in the future. There will be an explosion in leisure and hospitality spending next year, assuming of course a vaccine and sufficient uptake of a vaccine.

Inflation remains muted:

If inflation settles into a 2% trend, the Fed isn’t raising interest rates for a long, long time.

Another sign that the quarter finished on a strong note was another gain in new orders for core capital goods:

An unexpectedly solid V-shaped rebound. As far as October is concerned, the Weekly Leading Index suggest the economy still has upward momentum:

The impact of the latest Covid surge remains a risk in the outlook. Europe has responded with a fresh round of national lockdowns despite the economic damage they will cause. The narrative that Europe will outperform the U.S. in virus control and have a stronger economic rebound looks to have fallen apart. I still don’t anticipate a nationwide lockdown for the U.S. Regional variations in the level of restrictions are more likely. I don’t think another nationwide lockdown has political support in the U.S. nor do I think a Covid-fatigued population will easily resist the pull of the holiday season regardless of government decrees. I do think heavily impacted regions will experience fresh weakness in services spending, something that was almost inevitable as winter arrives and the opportunities for outdoor dining in particular dwindle in much of the nation. I expect a long, hard winter.

The Federal Reserve meets this week. I don’t expect any substantial change in the statement other than to update the FOMC’s view of the economy; the recent surge in Covid cases will weigh on the minds of meeting participants. There isn’t a pressing need to adjust policy just days after a contentious election nor has there been a consensus reached about the next steps for policy. In the press conference, Powell will likely continue to identify the path of fiscal policy and Covid as the important factors in the forecast.

I sense it will be a struggle to pay attention to the data this week. It is though the first week of the month and that brings ISM and Markit surveys, ADP employment, the usual jobless claims report on Thursday, and, to cap off the week we get the employment report for October. The key issue is obvious. We are looking to the data for signs of how much momentum remains in the economy going into the final quarter of the year.

Good luck and stay safe!