If You Don’t Have Time This Morning

Fed still on hold, increasingly contemplating potential future outcomes but around a steady baseline – no rate hikes anytime soon and no tapering this year. It’s all data dependent though. The ongoing concerns of violence ahead of next week inauguration will continue to dominate the news cycle.

Vaccine Update

As of Sunday, Bloomberg estimates that the U.S. has given 7.73 million doses of vaccine.

Recent Data

The employment report was the highlight of the week, disappointing markets with a somewhat weaker than expected 140k job loss. I am going to take an unpopular position on this report: It was actually a strong report given the circumstances and reveals the underlying resilience of the economy.

We need to look beyond the headlines on this. Unsurprisingly, leisure and hospitality accounted for the bulk of the decline with the sector loosing 498k employees. We know, however, exactly what is happening in this industry and what is going to happen after vaccines are widely distributed: It’s going to bounce back quickly. The other challenged sector is government which shed 45k jobs in December and roughly 1.3 million since the pandemic began with the largest part of that weakness in education. While it is often assumed that funding issues primarily account for the reduction in education employment, you should also consider other factors. Notably, in a Zoom-classroom world, schools need only a fraction of the usual number of substitutes. In addition, teachers have taken voluntary leaves of absences during the pandemic. When schools reopen, both categories of teachers will bounce back, as well as the ancillary staff. In short, this problem will largely correct itself (watch though for schools to face a teacher shortage as some of the pandemic-impacted employees will certainly drift into other occupations).

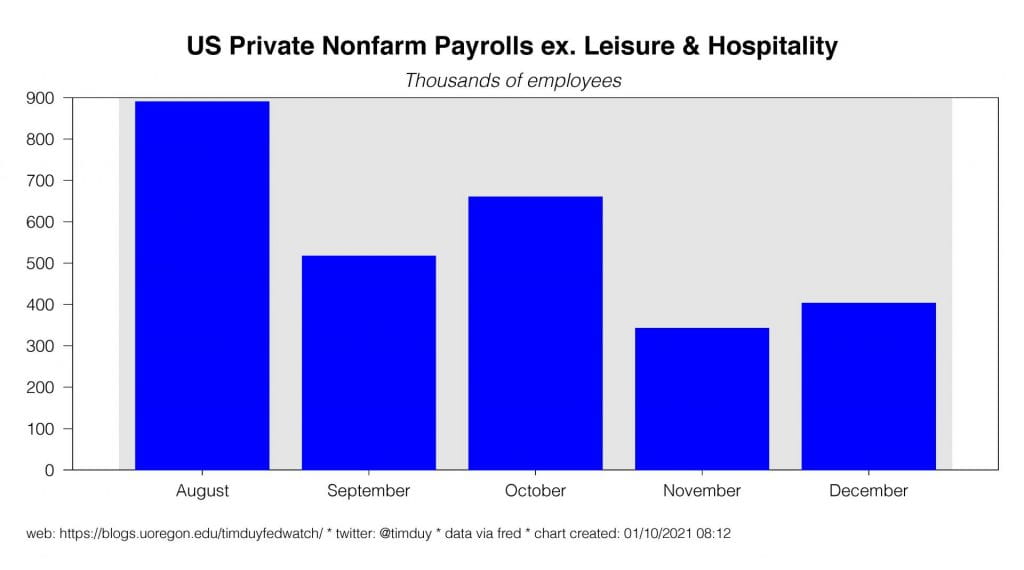

What does the picture look like outside of those sectors? The private sector excluding leisure and hospitality gained 403k jobs last month during the winter wave of the pandemic:

The three-month average growth rate was 468k. That growth rate alone – assuming no acceleration! – means 5.6 million jobs in 2021 not counting any bounce back in leisure and hospitality or education. The key point: Don’t use the three-month moving average of the headline number of 283k and extrapolate out to gauge expected job growth this year. That approach yields a way too pessimistic forecast.

Finally, note this story from the Wall Street Journal:

American manufacturers have gotten better at safeguarding their factory floors and containing infections of Covid-19 in their workforces. Despite the progress, they are still struggling to find enough people to staff their plants. The worker shortages are choking supply chains and delaying delivery of everything from car parts to candles just as demand is picking up…

… Companies are taking extraordinary measures to keep their lines running. At a Wisconsin dairy plant, managers have been asking employees to cancel vacation and the company recently asked a maintenance worker to help make cheese. An Ohio auto-parts maker advertised jobs on city buses and is considering adding a graveyard shift for working parents. A generator maker is so backed up on orders due to absenteeism that it has raised starting pay 25%.

There is a lot happening underneath the surface of the economy. This is not like the last expansion. Don’t let anyone tell you it is.

Fed Speak

I discussed last week’s Fed speak here and here. There is going to be a lot of chatter this week as well. The overall theme with continues to be one where policymakers emphasize the expected policy path as documented in the Summary of Economic Projections while increasingly acknowledging the growing potential for better-than-anticipated outcomes. As a reference point, consider this from Federal Reserve Vice Chair Richard Clarida via Bloomberg:

“My economic outlook is consistent with us keeping the current pace of purchases throughout the remainder of the year,” he said Friday during a virtual discussion hosted by the Council on Foreign Relations.

That’s your baseline. He also said:

Clarida allowed that his expectation for purchases could change if the economic outlook improved more than anticipated. But he also said that the economy is in a “deep hole” and that it would take time for the jobs market to heal and inflation to rise toward the Fed’s 2% goal.

“It could be quite some time before we would think about tapering the pace of our purchases,” he said.

Some participants are already thinking about it, but I will leave that alone. More importantly, it is all about how quickly the economy can rebound. If the jobs story I posited early holds, then the Fed talk about tapering will only increase.

Upcoming Data and Events

The week starts slow with the first major data release I am watching is the CPI report not coming until Wednesday. Core-CPI is expected to come in on the weak side with a 0.1% monthly gain, a number consistent with the Fed seeing no reason to change its rate forecast. Also Wednesday the Fed will release its latest Beige Book. Thursday brings the usual initial claims report. Friday we get retail sales and industrial production with the focus on the former as we look for clues about how much consumer activity slowed last month. Also on Friday is the Michigan consumer sentiment report; this report needs to be read cautiously as the results are increasingly politicized.

Federal Reserve Governor Lael Brainard, Vice Chair Richard Clarida, and Chair Jerome Powell all speak this week with the Brainard speech (Wednesday) most likely to give some new perspective. The will be plenty of Fed presidents as well.

Realistically, the focus of the week will be the ongoing political turmoil in the U.S. Covid-19 has taken a backseat for the moment.

| Day | Release | Wall street | Previous |

| Wednesday | Core-CPI, Dec. | 0.1% m-o-m | 0.2% m-o-m |

| Wednesday | Beige Book | ||

| Thursday | Initial Unemployment Claims | 780k | 787k |

| Friday | Retail Sales, Dec. | -0.2% m-o-m | -1.1% m-o-m |

| Friday | Industrial Production, Dec. | 0.4% m-o-m | 0.4% m-o-m |

| Friday | UMich Consumer Sentiment, Dec. | 80.0 | 80.7 |

Discussion

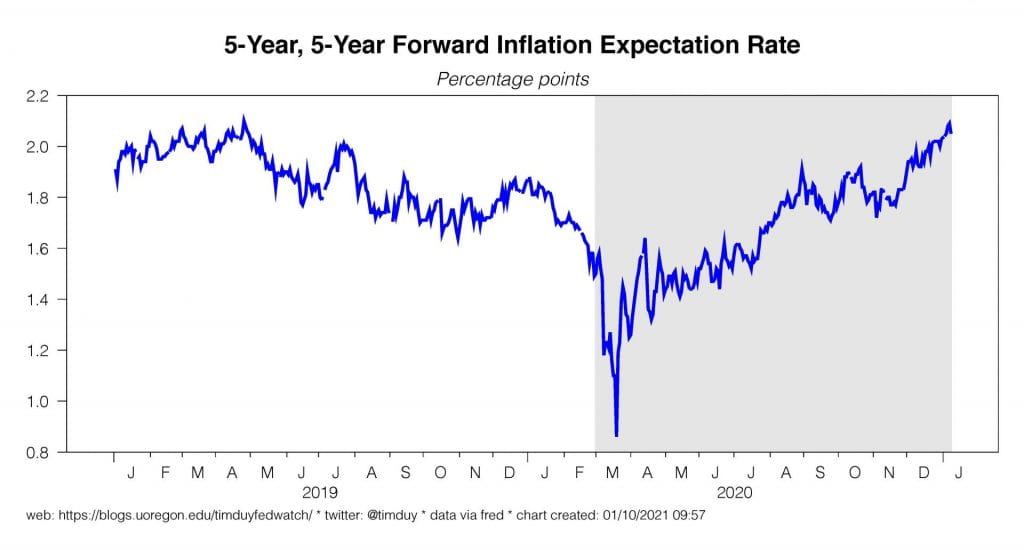

Long bond yields and market-based inflation expectations are rising. Ten-year treasuries rose to 1.10% while the five-year, five-year-forward rate climbed to pre-pandemic levels and then some.

My sense is that the growing upside risk to the economy is driving these moves. With Democrats taking control of Congress and the White House, the path to more fiscal stimulus becomes clearer. From Bloomberg:

President-elect Joe Biden on Friday called for trillions of dollars in immediate further fiscal support, including increased direct payments, after a surge in coronavirus cases caused U.S. payrolls to drop for the first time since April.

“The price tag will be high,” Biden said of his planned package in Wilmington, Delaware. He promised to lay out his proposals next Thursday, before taking office on Jan. 20. “It will be in the trillions of dollars.”

The Fed will be hesitant to get in front of this rate move as long as they suspect it about growth prospects rather than a misunderstanding of the Fed’s reaction function. The fairly limited moves in the short-end of the yield curve suggest the bond market is being driven by the former not the latter. Note too that the space here is a little tricky to navigate. Even if traders start to contemplate a 2022 rate hike, it does not necessarily follow that they are challenging the Fed’s reaction function. It could simply be that market participants are betting that the Fed’s forecast is a notch or two too pessimistic. Fed officials will signal if they think market participants are moving in a direction substantially different from the Fed. With this in mind, note that Clarida this week again expressed a lack of concern about the rising yields.

Lastly, be wary of claims that rising long rates will dampen the recovery. As always, to answer the question of the impact of rates we must first understand what’s moving rates. We should not be terribly concerned if rates are moving higher due to a more promising growth outlook; if that growth does not materialize, then rates will retreat. In other words, this isn’t a taper tantrum situation yet.

Bottom Line

Fed betting on steady policy but with constant reminders that actual outcomes are data driven.

Good luck and stay safe this week!