If You Don’t Have Time This Morning

Barring a financial disruption, the Fed is on hold until the spring and is content to let fiscal support shoulder the burden caused by the winter wave of Covid-19 cases.

Vaccine Update

As of Sunday, Bloomberg estimates that the U.S. has given 4.33 million doses of vaccine. The pace of vaccinations should accelerate with experience much as occurred with testing capacity. Still, this is a disappointing start.

Recent Data

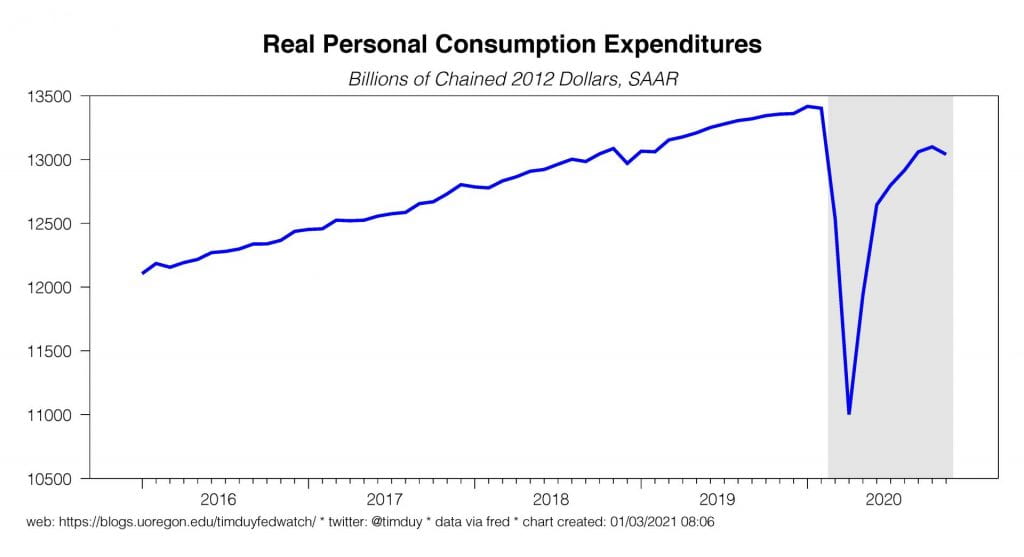

The data flow in the final weeks of 2020 was largely consistent with expectations consumer activity softened as Covid-19 cases rose. Consumer spending edged lower:

Recall that overall spending hides the underlying shift from services to goods spending:

A big question for the post-pandemic world is do spending patterns revert to pre-pandemic trends or is there an overall level shift up because goods spending retains its level shift as services recover? Wages and salaries climbed higher:

I view this as more important than the headline decline in personal income due to waning fiscal support. Wages and salaries are the basis of consumer spending power and their V-shaped recovery foreshadows the ability of the economy to rebound quickly after the virus is brought under control. The decline in spending still outpaces the decline in wages and salaries since last February:

The primary problem facing the U.S. economy is that the pandemic has damaged the ability to produce services viewed as safe, particularly in leisure and hospitality but also other personal services such as elective medical procedures, massages, etc. Containing the virus will allow these activities to recover.

New single family home sales dipped in November but remained well above pre-pandemic trend:

On housing, note that low interest rates are being capitalized into higher housing prices. Via Bloomberg:

Record-low mortgage rates were supposed to make it easier for homebuyers. Instead, they’ve helped push affordability to a 12-year low.

Watch this space; higher levels of housing wealth may translate into more cash-out refinancings.

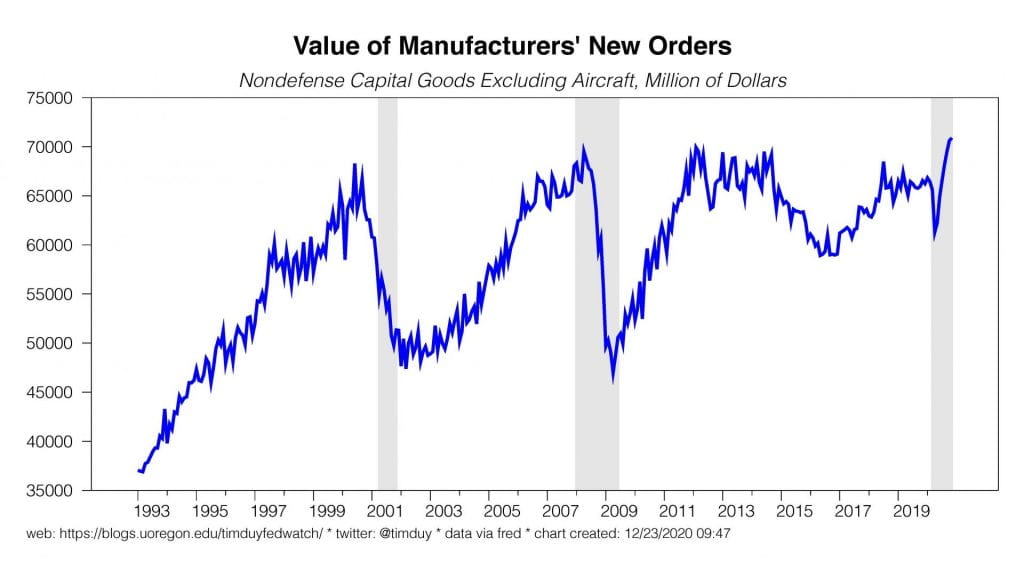

Core capital orders edged higher:

The V-shaped recovery in this data suggest firms are sufficiently optimistic about the future to compensate for the orders slowdown earlier this year. I expect some reversion in the coming months as pent-up orders demand becomes largely satisfied.

Upcoming Data and Events

The first week of the month is typically busy and this one more so due to ongoing political conflict. It is important to read incoming data in the context of the current Covid-19 wave. We should see the damage being a fraction of what happened last spring . That said, upside surprises are more important than downside surprises; we should see some weakness in the data flow. The Federal Reserve will be looking beyond the near-term weakness.

The ISM manufacturing report will be released on Tuesday with market participants expecting it will edge down from 57.5 in November to a still-solid 56.5. Watch the comments on the employment situation. Weakness in the employment component may be attributable to Covid-19 staffing issues more than a lack of labor demand. On Wednesday we get the December ADP report (307k gain in private employment expected), IHS/Markit PMIs, and the minutes of the December FOMC meeting. The latter will be watched for insights into the path of the asset purchase program. On Thursday we get the ISM non-manufacturing report, also expected to be off from the previous December reading, and the usual initial claims report.

Friday of course is the first employment report of the year. Expectations are low; Wall Street anticipates a paltry 100k employment gain while unemployment edges up from 6.7% to 6.8%. An employment decline would not be out of the question. My sense is that the Fed is mentally prepared for weaker than expected numbers considering the circumstances. Fed speakers will say they are disappointed by weakness but look through the numbers and point to recently enacted fiscal support as the appropriate response to that weakness. Also Friday will be the main Fed speech of the week with Vice Chair Richard Clarida speaking on the topic U.S. Economy and Monetary Policy. Expect additional Fed chatter during this week’s ASSA meetings.

On Tuesday, January 5, elections in Georgia will determine which party controls the U.S. Senate. Democratic candidates have polling leads going into the election.

On Wednesday, January 6, Congress will meet to accept the results of the Electoral College. While a group of Republicans are expected to oppose certification, the end result will be that Congress formally recognizes Joseph Biden as the next U.S. president.

Discussion

The Fed is in a holding pattern, likely until the spring, as they watch how the pandemic plays out over the coming months. Fed speakers have reiterated that financial conditions are sufficiently accommodative to meet the Fed’s goals. Why don’t they do more to accelerate the recovery? Fundamentally, the Fed thinks that regardless of what they do now, they can’t just throw a switch that makes unemployment lower or inflation higher. The economy needs time to heal. They do believe they can hasten that healing at this time; they are simply working not to get in the way of that healing. The Fed would react to a sudden tightening of financial conditions with additional easing, but there has not been a tightening of conditions. The Fed has made clear that they are not sitting on the long end of the curve if rates rise in an orderly fashion consistent with expectations of economic improvement. The Fed does not believe modestly higher rates are inconsistent with its signaling.

Beyond this spring, the economy will determine the Fed’s policy path. The Fed will not be in any rush to bring forward any rate hikes. The Fed will look through any inflation associated with the normalization of economic activity as transitory. The more likely space of interest is the asset purchase program. If the economy looks to be gathering steam as I expect, Fed chatter about easing back on asset purchases will increase. Of course, if the pandemic holds firm the Fed will be in no rush to reduce accommodation in any way.

Congress justified the Fed’s decision to sit on the sidelines this winter by moving forward with a fiscal support package. Realistically, we should expect another bounce in the savings rate:

Fiscal support is pouring a lot of money into an economy that currently can’t make full use of that money due to the pandemic. And, if Democrats win the two Georgia Senate elections, there will be more money on the table. The push to raise the tax rebates from $600 to $2,000 could easily morph into simply another $2,000. This money, as well as the all of the accumulated savings since the pandemic began, has to go eventually go somewhere. I will keep pounding on the point that where it goes in the post-pandemic world will help drive economic and market trends. Keep that in mind when you read stories like this:

Bitcoin, the world’s largest cryptocurrency, topped $34,000 just weeks after passing another major milestone.

The IPO market is manic. Stocks haven’t been this expensive since the dot-com era. The Nasdaq 100 has doubled in two years, leaving its valuation bloated — all while volatility remains stubbornly high.

It’s a setup that’s left investors sitting on fat returns from 2020, a year that defied easy explanation. It’s also one that has a growing cohort of experts warning about a bubble.

We are currently engaged in a historic peacetime fiscal support of the economy in the form of channeling funds to households constrained in their ability to spend those funds:

This is an experiment; we don’t yet know the full consequences, good or bad.

Bottom Line

With fiscal support providing breathing room, the Fed is waiting to see how the data evolves as we get closer to spring before deciding on next steps. In the meantime, we need to be watching where the flood of fiscal resources flows.