Today’s news highlights the dilemma facing the Fed at this week’s meeting. This, for instance, from Bloomberg:

The first Covid-19 vaccine shots were administered by U.S. hospitals Monday, the initial step in a historic drive to immunize millions of people as deaths passed the grim milestone of 300,000.

And this, also from Bloomberg:

New York is headed toward a second full shutdown if Covid-19 cases and hospitalizations continue at their current pace, Governor Andrew Cuomo said.

But we also have this from the New York Federal Reserve:

The November Survey of Consumer Expectations shows that consumers’ year-ahead spending growth expectations rose to 3.7 percent—the highest level in more than four years—despite flat income and earnings growth expectations.

Interesting, the spending outlook improved across all income groups but the gains among households making less than $50k were particularly notable:

The message is clear: The surge of Covid-19 cases this winter has had terrible health consequences and softened the economy in the near-term while the vaccine raises medium-term hopes and households are prepared to spend next year. The Fed will likely navigate this space by holding the size and composition of asset purchases constant while providing guidance on the path of the program. They can’t do much about the near-term but can stand ready to change the asset purchase program as needed if the economy struggles to rebound as spring approaches.

If the Fed surprises, they will do so by extending the maturity of purchases in some manner that matches the updated guidance. I wonder though that this sets the Fed up to disappoint market participants. What change is the Fed going to make that would have substantial impacts on the economy? It seems like the Fed would have to do something large to have such impacts but nothing indicates they are prepared for a substantial change in the asset purchase program. If the Fed shifts buying out along the yield curve, how far are they willing to go to hold down long rates? If the Fed doesn’t do enough to hold down long rates, it will engender expectations for more action. Is the Fed prepared to go big?

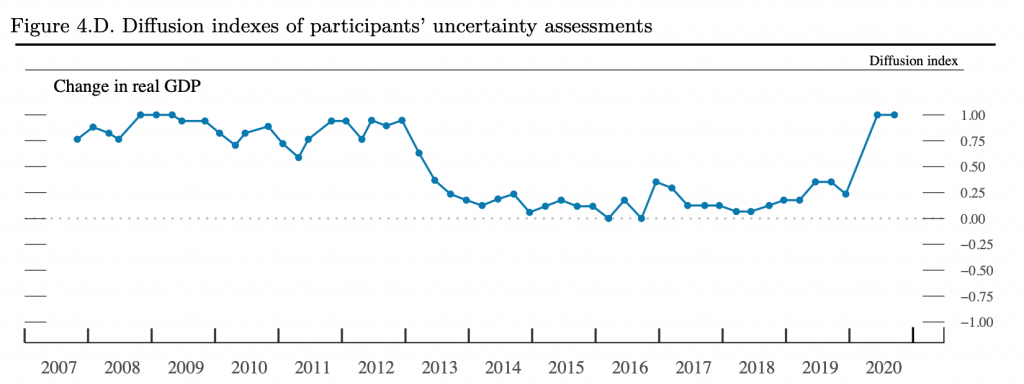

Separately, the Fed is updating the SEP’s information on the balance of risk into more user-friendly charts. Consider the diffusion of uncertainty and risk for participant’s GDP and core inflation outlooks:

With these visuals, the Fed’s decision not ease policy further already arguably demands some additional explanation. As of September, participants were very unconfident about the outlooks for growth and inflation while they saw the risks to the outlooks as weighted toward the downside. In other words, participants feared that their forecasts were too optimistic even though those forecasts anticipated a slow return to full employment and price stability. Why fail to take additional action when not only is the outlook soft but you think the outlook is both likely wrong and too optimistic? Market participants might reasonably be confused on your policy intentions with this kind of signaling.

I would like to see journalists push on Powell for a clear explanation of this disconnect (assuming of course that the Fed doesn’t move to ease policy further). The answer probably has multiple parts: Yes, the risks are on the downside but the high degree of uncertainty still includes the possibility of large upside surprises. Yes, meeting the Fed’s objectives takes a seemingly long time but it is within an acceptable policy horizon. The economy is simply in a deep hole that requires some minimum amount of time to correct. Yes, they could take further action but they may be concerned about the efficacy of additional policy when financial conditions are already very accommodative. Indeed, the Fed elevated the importance of financial stability in the recent update to its policy strategy; the Fed might be concerned about easing further into already loose financial conditions.

Fiscal stimulus negotiations continue, keep your fingers crossed. While the recovery may be self-sustaining absent additional support, such support would both increase confidence in a positive outcome and minimize the burden to households most impacted by the crisis.

Bottom Line: Regardless of the outcome of the Fed meeting we should get some additional clarity on the role the Fed believes it can play in the recovery process. It would be nice to pin down the Fed on the issue of if they can accelerate the recovery, why have they so far declined to do so?