It’s FOMC week. Last Monday I wrote about the upcoming meeting and incoming information has not changed my opinion. The Fed will most likely place some guidance around the asset purchase program but decline to make changes to the program at this time. I believe they will view the current Covid-19 surge as akin to a natural disaster where the most significant impacts occur in a time horizon in which they have little influence. Moreover, in comparison to this past spring 1.) the pandemic shock is much, much smaller, 2.) we know the speed with which the economy can recover on the other side, 3.) the other side now has a vaccine, allowing for even quicker recovery, and 4.) financial markets reveal no signs of distress and are instead are very well accommodated by the Fed.

The case for more easing at this time amounts too little more than the Fed has to “do something.” The risk to my forecast is obviously that they decide they have to “do something,” and that something will default to extending the average maturity of asset purchases. Comments in recent weeks by Fed speakers, however, suggest an inclination to delay changing the asset purchase program until next spring. But what kind of changes? We don’t know yet because we don’t know what the economy will look like. I would not assume though that they will decide net additions of accommodation are necessary.

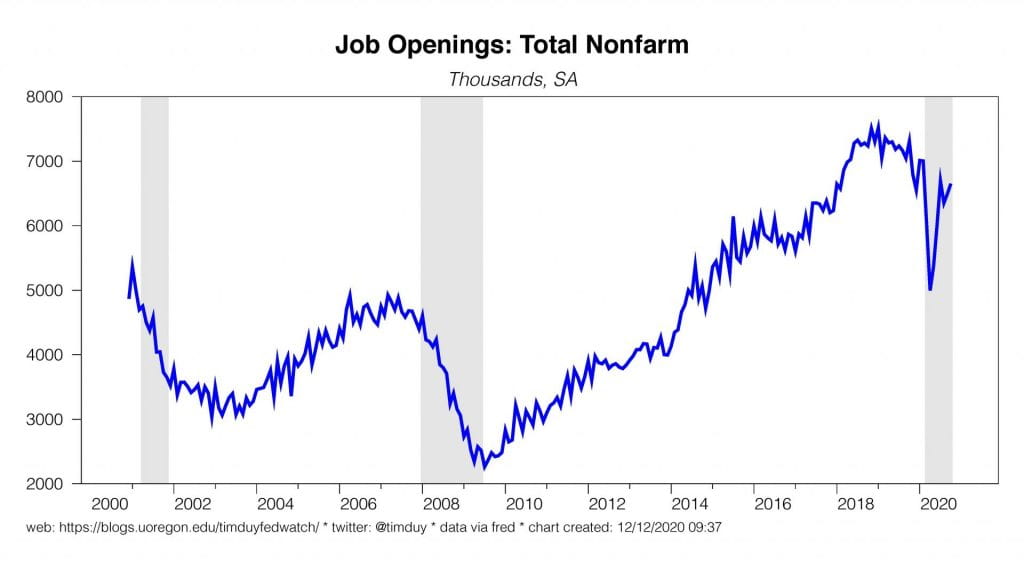

The JOLTS data continue to provide room for optimism. October job openings failed to drop as would be normally the case in recessions and instead hold at 2016-17 levels:

Openings are even solid in sectors that would be expected to be weak:

The strength in manufacturing job openings is notable; it fits with anecdotal evidence in the ISM report that pandemic labor supply problems weigh on hiring. Quits also remain higher than might be expected using the model of the last cycel:

Finally, the Beveridge Curve continues to revert toward its pre-pandemic space in stark contrast to the last recession:

The dynamics of the JOLTS report appear more similar to what you would expect if the primary issue facing the economy was supply side rather than demand side.

Consumer price inflation surprised on the upside in November: The gains look to be related to transitory price shifts in the service sector more than underlying inflation strength. Importantly, shelter inflation remains weak:

The gains look to be related to transitory price shifts in the service sector more than underlying inflation strength. Importantly, shelter inflation remains weak:

My suspicion is that it will not be until the spring until we really start to think about interesting inflation stories and even then “interesting” is like 25-50bp.

The flow of funds data for the third quarter arrived this past week and revealed a new high for household wealth. In another contrast to the last recession, the strong housing market has supported housing equity wealth:

The drop in this metric is really about the denominator; personal income surged on the back of the fiscal stimulus. Interestingly, households might be starting to tap that wealth. Via Calculated Risk we see the first real uptick in mortgage equity withdrawals in a long, long time:

I can’t see the validity in the argument that the Fed needs to sit on the long end of the curve to support housing when housing is already red hot and homeowners may be at the front end of taking advantage of that market to boost their spending power in much the same way as they did during the housing bubble. Any expectation that the Fed needs to hold rates down for the sake of housing seem to me more like trying to fight the last battle than a realistic examination of this cycle.

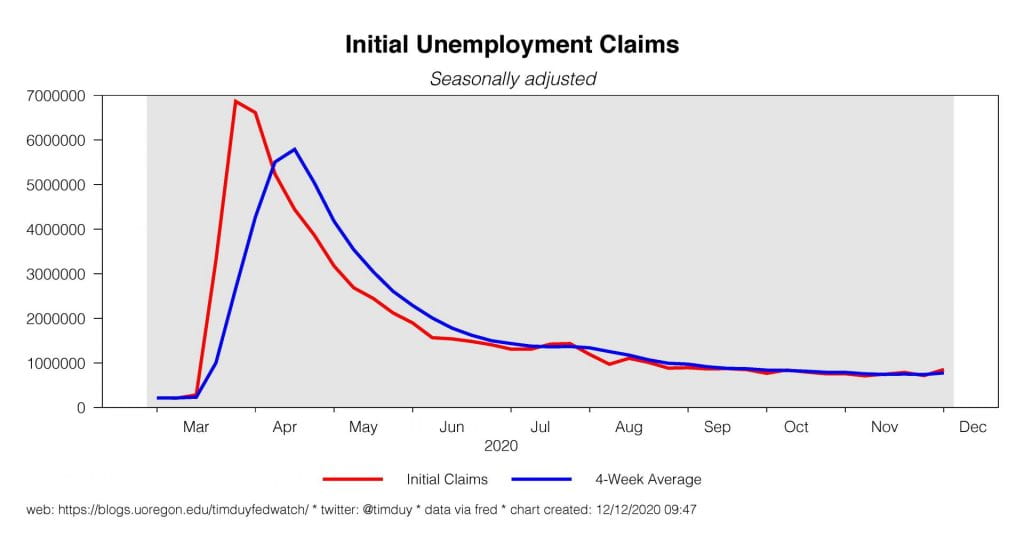

Initial unemployment claims rose as expected but if you were looking for a repeat of this past spring, you were disappointed:

Claims will remain elevated until we move past the current pandemic surge.

We are looking at a moderately heavy data this week aside from the FOMC meeting. Industrial production comes Tuesday with markets looking for a modest 0.3% gain in November. In addition to the FOMC outcome, on Wednesday we get November retail sales. Wall Street anticipates a soft number with headline down 0.3% and core sales up 0.2%. The assumption is the spending party is over as the pandemic surge weighs on food and drinking services in particular. The case for an upside surprise to retail sales is that spending on services continues to be redirected toward goods spending and that shift will support a stronger than expected holiday shopping season. Markit/IHS numbers will also hit the screens on Wednesday. Thursday brings the latest update on the housing market with the anticipated flat housing starts numbers for November as well as the usual initial claims report. On Friday Federal Reserve Governor Lael Brainard will give a speech titled “Climate Change and Financial Regulation.”

Vaccine distribution in the U.S. begins this week. I would suspect some hiccups along the way, but mass immunizations are the light at the end of the tunnel.

Bottom Line: The pandemic surge will weigh on the U.S. economy this winter but we understand the economic implications with greater certainty than this past spring. It is easier now to look through to the other side, especially with a vaccine now available and more to follow. The Fed will likely also look through to the other side especially since their tools cannot operate in the relevant time frame and financial markets remain buoyant.

Good luck and stay safe this week!