September retail sales came in stronger than expected as the headline number pulled above pre-pandemic trend:

Core sales were down a notch but remain solidly above trend:

Food and drinking even gained although it still remains depressed:

Aggregate retail sales continued to gain in September despite now two months after the end of enhanced unemployment benefits at the end of July (otherwise known as the fiscal cliff that wasn’t; hey, I am as surprised as anyone else). I know this is going to be an unpopular opinion, but the fiscal stimulus may have been less important for retail sales than widely assumed. What we see inside the retail numbers – the shift in spending away from the services component – has happened in the economy overall. Spending on goods has remained strong largely because households were unable to spend on their typical basket of services and that extra money had to go somewhere. I will have more on that topic later this week.

The fiscal support was not unimportant, it was just important in different ways than expected. Consider this interesting story from the Wall Street Journal:

While the coronavirus was pummeling the U.S. economy, Americans’ credit scores—a metric used in nearly every consumer-lending decision—were rising. The average FICO credit score stood at 711 in July, up from 708 in April and 706 a year earlier, according to Fair Isaac Corp. , the score’s creator. Early estimates suggest the average score has held steady through mid-October at the July level, which is the highest since FICO began keeping track in 2005.

Surveys tells us the the vast majority of aid boosted household wealth via either direct savings or indirect savings (paying off debt). There is no question that this has bolstered the financial conditions of millions of Americans. Nor should there be any question that there exists a stockpile of spending power that will come into the economy when confidence improves.

Confidence is actually already improving, at least a little. The early October reading from the University of Michigan saw confidence edge up 80.4 to 81.2 as a gain in the expectations measure outweighed a loss in current conditions. Overall confidence remains well below its pre-pandemic levels but we should take comfort in the recent firming. We might haver expected by October confidence was collapsing due to the July fiscal cliff.

Disappointingly, industrial production edged down in September:

in part because auto production slowed a bit the strong post-lockdown rebound:

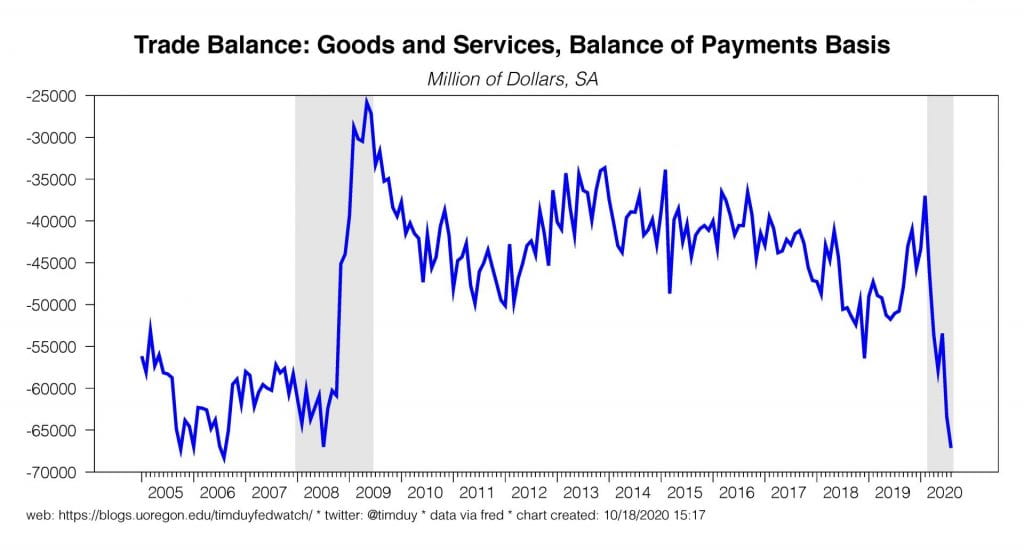

Still, even excluding autos manufacturing was flat on the month. I think a larger issue is that the recovery has been consumer-driven and on goods not services. Spending on consumer goods tends to be disproportionally off-shored to foreign producers. Hence we would expect the trade balance to widen, which is has (in stark contrast to the last recession):

The data highlights of this week will be housing starts and permits for September on Tuesday ad existing home sales on Thursday. Housing has been a supernova-sized bright spot in the economy; how much of the upward momentum can be sustained is an open question as builders will avoid overbuilding to maintain profit margins. Substantial retrenchment however is unlikely given the strong underlying demographic factors supporting housing demand. Also this week we get the Markit PMI numbers (Friday). There are a slew of Fed speakers this week. Most notable will be Federal Reserve Chair Jerome Powell on Monday (Cross-Border Payments and Digital Currencies), Vice Chair Richard Clarida also on Monday (U.S. Economic Outlook and Monetary Policy, which looks like a repeat from last week), and Governor Lael Brainard (Economic and Monetary Policy Outlook). From a macroeconomic perspective the Brainard speech seems the most likely to bring new information to the table. There are some presidents speaking (Williams, Mester, Harker) but the presidents speak a lot and often add little value but lots of color. That’s a little honesty to start your week.

Good luck and stay safe!