This was a fairly substantial FOMC meeting. The FOMC doubled down on its near-zero rate policy despite the economic gains of recent months. This was entirely consistent with recently announced changes to the Fed’s policy strategy. In a surprise move, it enhanced its forward guidance such that the guidance is now consistent with the updated strategy. The Fed continues to lean into the downside risks for the forecast, another reason not to doubt their commitment to zero-rates in the foreseeable future.

The primary implication is that the Fed is committing to an extended period of very low and negative real policy rates even as economic activity accelerates. What are the risks here? The first risk is that the Fed retains a lot of leeway to adjust financial conditions via the asset purchase program. There are no commitments to the pace of asset purchases. The second risk is that the Fed has completely left itself open to being blindsided by a better than expected recovery.

The easiest place to start is with the economic projections:

These are substantial improvements in the outlook. The recession is less severe than anticipated and unemployment declines while inflation rises much more quickly. The median rate expectation however remains near zero for another year and now only one FOMC participant expects a rate hike before 2023. These outcomes are entirely consistent with the new strategy as I explained here in Bloomberg and earlier this week in this blog. This is how the new strategy is operationalized.

Despite these improvements, all the Fed see are downside risks:

The path of the economy will depend significantly on the course of the virus. The ongoing public health crisis will continue to weigh on economic activity, employment, and inflation in the near term, and poses considerable risks to the economic outlook over the medium term.

At best, this analysis is starting to sound unoriginal. The Fed remains very, very clearly focused on the last battle. It assumes a long and slow recovery like in the wake of the Great Recession and a complete lack of inflationary pressures. I don’t think we can make these assumptions any more. This isn’t 2007-2009. We don’t know what it is, but we do know that it isn’t 2007-2009. There was nothing wrong with the economy in January. There are no sizable misallocations of investment to overcome. The Fed didn’t let the financial sector crumble. There has been a massive improvement in household finances attributable to fiscal stimulus. And the economy is quickly growing around the virus.

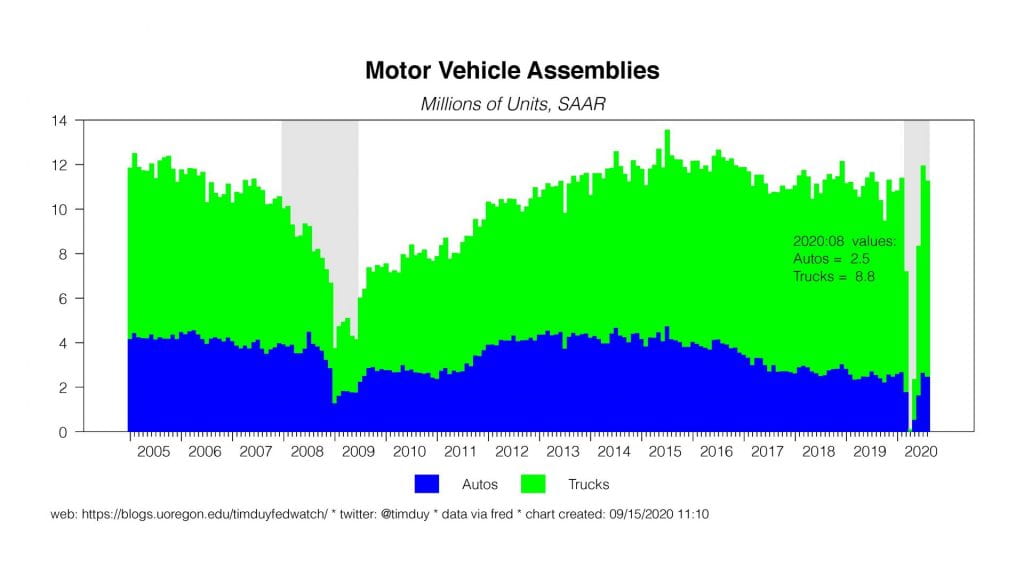

One chart that really screams the difference in the two recessions is the recovery in auto production:

Not to mention housing activity. Builder confidence is at record highs:

I was fairly pessimistic early this year but the facts on the ground are shifting and I think you have to shift with those facts. The Fed is though focused on downside risks and locked into the zero-rate policy path in at least the near term. I think you can describe the near-term path as credibly irresponsible, which is exactly where you want to Fed to be if you want them to let the economy rip.

My preference is to let the economy rip, so I am not going to criticize the Fed. From a macro perspective, it’s a stance that should be positive for risk assets and negative for longer term bonds (the risk on a negative outlook for bonds though is that rising rates push the Fed into more asset purchases on the long end).

The Fed further reinforced the projections with the statement:

The Committee seeks to achieve maximum employment and inflation at the rate of 2 percent over the longer run. With inflation running persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent. The Committee expects to maintain an accommodative stance of monetary policy until these outcomes are achieved. The Committee decided to keep the target range for the federal funds rate at 0 to 1/4 percent and expects it will be appropriate to maintain this target range until labor market conditions have reached levels consistent with the Committee’s assessments of maximum employment and inflation has risen to 2 percent and is on track to moderately exceed 2 percent for some time.

The first part of the reiterates the results of the strategy review. The reference to an inflation average is completely disingenuous because they can’t define a time frame around average, but we all know that at this point. It’s just a game we are playing with the Fed, kind of like flirting. The last part, the commitment to holding rates at near-zero until the economy is both at maximum employment AND inflation is at 2 percent is the unexpected enhanced forward guidance. It is really nothing more than making explicit what the Fed had already made implicitly. This though confirms Fed is locked into its current policy stance until inflation hits 2 percent.

This is all bullish. Run with it, don’t fight the Fed. But watch for things to go sideways. So how can they go sideways? The most obvious place is that while the Fed has committed to a rate policy path, they have not done the same for asset purchases. The Fed can very easily wind down asset purchases and claim to be maintaining accommodative financial conditions. It’s not exactly unprecedented. Moreover, it is now all too easy to see a rapid pivot on asset purchases given that the Fed has so completely embraced the “this is 2010-2018 all over again” scenario. If unemployment and inflation continue to surprise on the upside, the Fed could be caught off guard and want to quickly pull back on quantitative easing. And what if there is a vaccine and in nine months we all book our Hawaiian vacation (yeah, I’m projecting)? That scenario has got to be on your radar as much as the downside scenarios.

Bottom Line: The Fed is committed to zero-rates for the foreseeable future. They are not committed in the same way to the pace of asset purchases. The Fed though is not inclined to shift its current stance very easily. The bar is high for a rate hike. I suspect it is not nearly so high for the Fed to pull back on asset purchases. In the near term, that isn’t going to happen because the Fed is wedded to the bearish risks for the economy. If the forecast changes, the Fed will change with it. But they may be slow to change, and then change abruptly.