If You Don’t Have Any Time This Morning

The Fed will do what it can to support the economy, but if fiscal policy stumbles, the Fed will have a hard time picking up the slack. And fiscal policy might be about to stumble badly.

Key Data

It’s All About Fiscal Policy Right Now

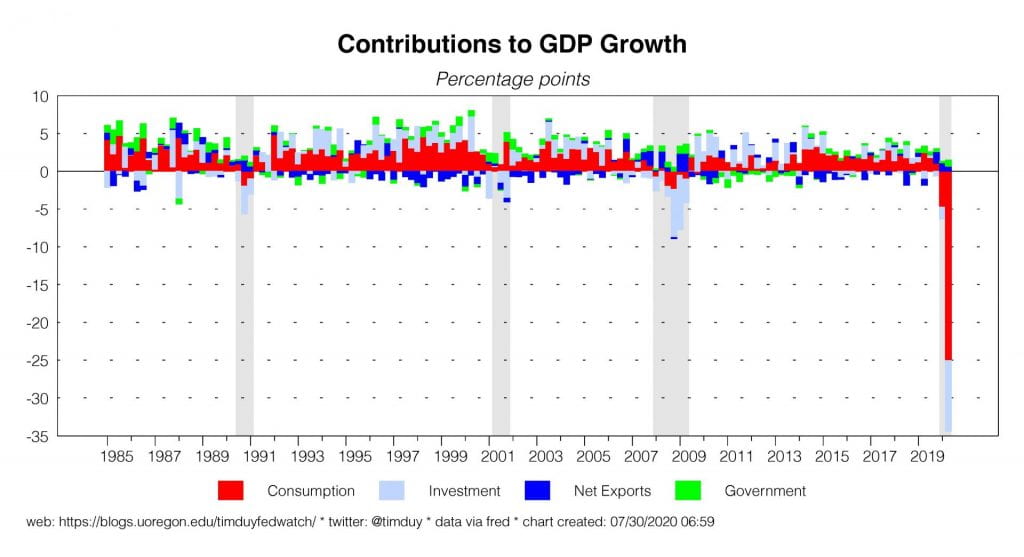

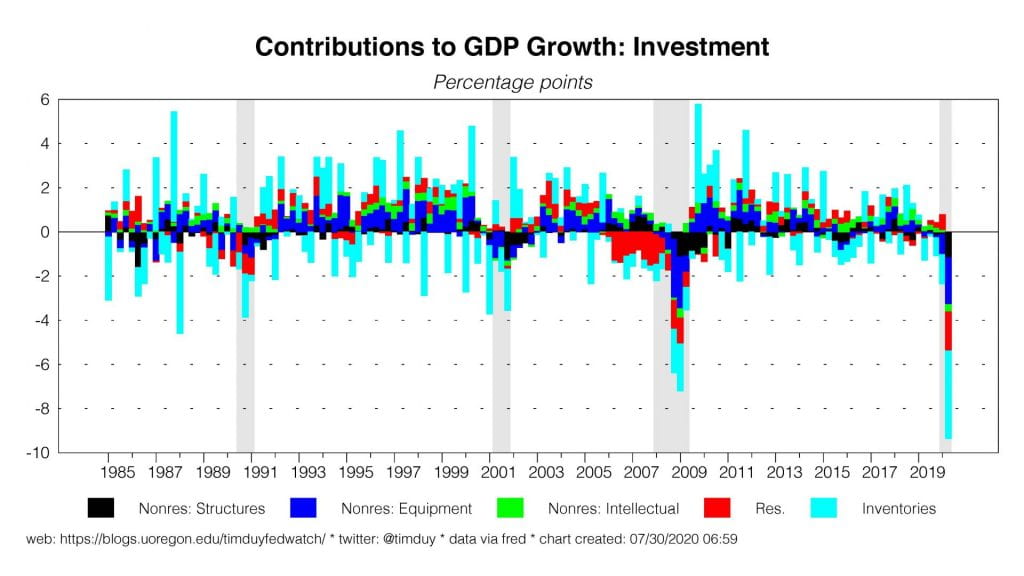

The second quarter GDP report was, as expected given the sudden stop of activity associated with efforts to contain the pandemic, quite dismal. GDP fell 9.5% during the quarter or 32.9% on an annualized basis, a bit better than market expectations of -34.1%. Consumer spending drove the decline which of course speaks to the nature of the specific shock of the shutdowns early in the quarter. The decline of nonresidential investment was consistent with that of the last recession; inventory reduction and residential investment extended the decline.

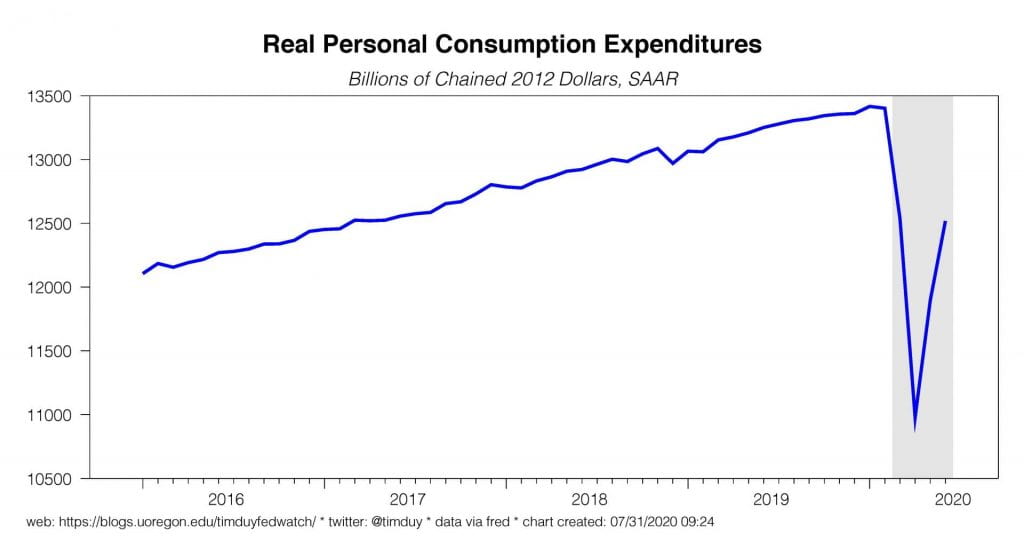

While consumer spending declined for the quarter overall, spending picked up sharply in May and June. This, along with inventory rebuilding and gains in housing (see this on lumber prices), helps set the stage for third quarter bounce in GDP growth. Still, gains will fall short of those needed for a complete recovery. Note the substantial gap, for example, of current levels of consumer spending relative to the pre-Covid trend. The inability to fully restart some sectors of the economy such as leisure and hospitality will put a lid on the near-term recovery and limit the extent any third quarter gains will be transmitted into the fourth quarter. The crucial issue is not so much that second quarter output collapsed; it’s really about where we end up at the end of the third quarter and how quickly the economy can grow from there. Until a widely available vaccine becomes available, we need to assume slow and choppy growth and a protracted period of high unemployment is the most likely path forward.

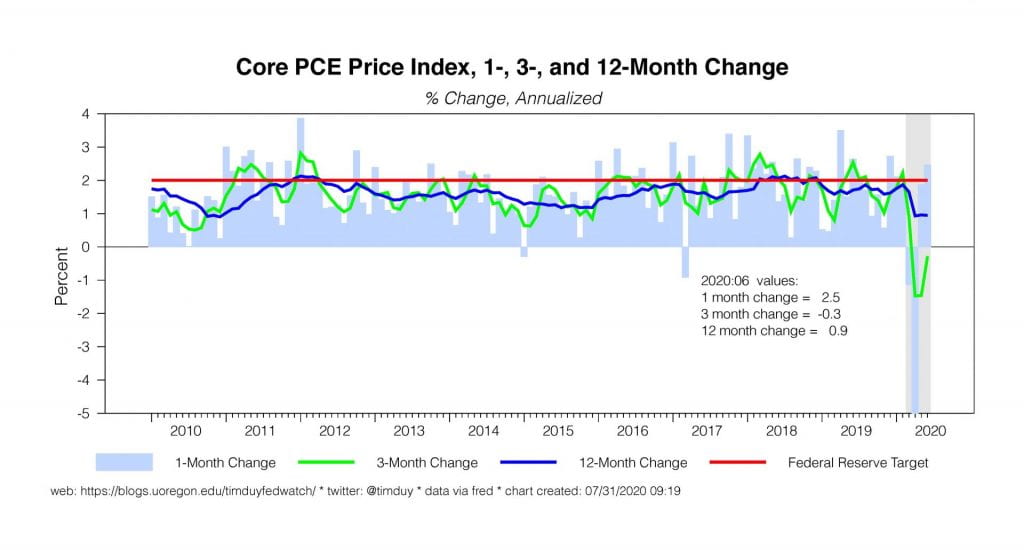

PCE inflation rebounded in May and June; annualized, core-PCE grew at a 2.5% rate in June while the year-over-year rate is 0.9%. The overwhelming expectation is that the last two months are something of an anomaly and that the ongoing recession will weigh on inflation for the foreseeable future. I think this has to be the baseline expectation; I also think we should watch for the possibility that income support helps ease the disinflationary pressures relative to those normal associated with protracted double-digit unemployment.

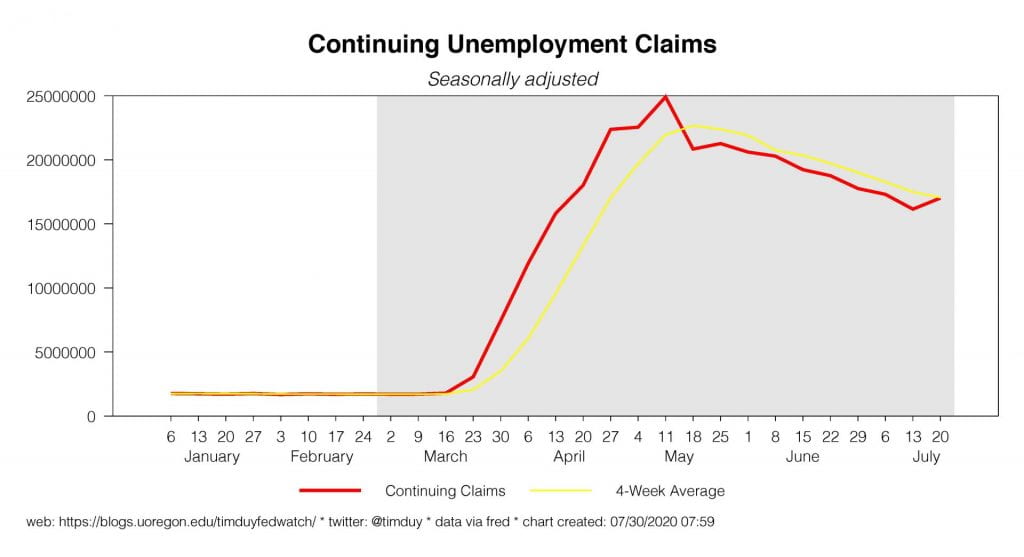

Initial unemployment claims have flatten out around 1.4-1.5 million while continuing claims edged higher ; the lack of improvement in these data suggest the economic recovery stalled out in July and argues for the importance of extending enhanced unemployment benefits.

Fedspeak

The FOMC concluded a two-day meeting last Wednesday; my full reaction is here. From the statement and the press conference, my main takeaways are:

- The Fed knows that there is not a tradeoff between the economy and the virus.

- The Fed very much wants continued fiscal support for the economy given the inability to contain the virus.

- The Fed understands that they have limited near-term power to offset a fiscal retreat.

- The Fed expects to keep interest rates low for years and don’t want you asking about when that’s going to change.

Minneapolis Federal Reserve President Neel Kashkari gave an interview to CBS news Sunday. Some interesting stuff here. For example:

KASHKARI: Well, the thing that surprised me the most economically, we knew the GDP would be very low with 20 million Americans still out of work, you know, the economy is reeling. There’s one bright spot that I saw, though. The US personal savings rate has taken off. Before the crisis, it was around 8%. Now it’s around 20%. Now, let me tell you what’s going on. Those of us who are fortunate enough to still have our jobs, we’re saving a lot more money because we’re not going to restaurants or movie theaters or vacations. That actually means we have a lot more resources as a country to support those who’ve been laid off. And so while historically we would worry about racking up too much debt, we’re generating this savings ourselves. That means Congress has the resources to support those who are most hurting.

Kashkari attributes the rise in the savings rate to spending collapse among those who did not lose their jobs. That savings, he argues can be funneled into safety net spending. I am clearly not the person who is going to argue against fiscal stimulus here, but I find this particular logic somewhat strained. I don’t think the savings rate necessarily justifies the fiscal spending in this manner; the fiscal spending drove up incomes and was a factor in driving up the savings rate. I see this as a reminder that we should be careful in assigning causality to accounting identities.

Kashkari also adds this:

And if you look over the long term, our inflation has been very low. Inflation continues to be low. Inflation expectations continue to drift lower.

I am kind of wondering where he is seeing inflation expectations drift lower; the survey measures have firmed up since the recession began. And we know that market-based TIPS measures have also firmed in recent weeks. I am not really worried about inflation, but I am still watching for signs like this that policy makers are so entrenched with the idea that inflation can’t be a problem that they kind of miss any inflationary signals.

Separately, Nick Timiraos at the Wall Street Journal writes that the Fed will soon make a substantial policy shift:

The Federal Reserve is preparing to effectively abandon its strategy of pre-emptively lifting interest rates to head off higher inflation, a practice it has followed for more than three decades.

Instead, Fed officials would take a more relaxed view by allowing for periods in which inflation would run slightly above the central bank’s 2% target, to make up for past episodes in which inflation ran below the target.

Remember, you heard it here first. From my Bloomberg column two weeks ago:

For the Federal Reserve, this time really is different. Having learned a hard lesson in the last recovery — don’t tighten monetary policy too early — the central bank is leaning in the opposite direction. In practice, that means the Fed will not just emphasize actual inflation over forecasted inflation, but will also attempt to push the inflate rate above its 2% target. It’s a whole new ballgame.

Upcoming Data

Employment week!

ISM manufacturing numbers for July arrive Monday; market participants expect it to edge higher to 53.6 from 52.6. In contrast, the ISM services number (Wednesday) is expected to retreat 57.1 in May to 55.0; there is a solid possibility that the decline might be more pronounced due to the rising number of Covid-19 cases.

Wednesday we also see the ADP report with an expected gain of 1,500k relative to 2.369k rise in June. This will potentially provide a preview of Friday’s employment report. Currently, Wall Street expects a continuation of recent trends with a 1.65 million gain in jobs and a decline of the unemployment rate from 11.1% to 10.5%. In contrast, high frequency Census data suggests a job loss, which would also be consistent with the ongoing high pace of initial jobless claims and slowing activity in the regions most heavily impacted by Covid-19.

Discussion

The focus of the week is fiscal policy. A key reason that the economic damage of the Covid-19 pandemic is less severe than the sharp drop in GDP would suggest is that Congress threw a bunch of money at the problem including a critical enhanced unemployment benefit of an additional $600 a week. With Senate Republicans flailing to respond to a House relief package passed months ago, the benefit expired last week. This is not good and, quite frankly I am surprised given that the GOP electoral prospects will not be helped by the ongoing delays.

The Wall Street Journal reports that Democrats have yet to budge on their demand that the $600 payment continues:

House Democrats led by Speaker Nancy Pelosi want any economic-relief package to include a long-term extension of the enhanced unemployment benefit, arguing the extra funds have been a critical support to those who lost their jobs amid the pandemic. The White House and Senate Republicans, however, want to trim that additional payment, saying in some cases people are being paid more to stay at home than if they returned to work.

House Leader Nancy Pelosi suggested tying the benefit to the unemployment rate such that it would decrease as the economy healed. Great idea; an automatic stabilizer would end the need to have this fight repeatedly. Democrats are also pushing for substantial state and local aid and a public health strategy to contain the virus.

Democrats are digging in their heals while Senate Leader Mitch McConnell has a challenge to move anything without their support. Via the New York Times:

But at least 20 Senate Republicans are unlikely to support any additional spending, party leaders have acknowledged, in part because of concerns over the level of spending and its effect on the national debt. Under a $1 trillion plan Republicans unveiled on Monday — a narrower proposal than the Democrats’ plan — a number of provisions, including the $600 weekly federal unemployment benefit, would be severely curtailed.

This seems like a very bad place for McConnell. The longer this continues, the worst will be the economic damage. The worse the economic damage, the more the White House will push for a deal, and the greater the pressure for McConnell to make deal that without the full support of Senate Republicans.

I don’t entirely know how this gets resolved in the near term. My instinct continues to be that the end result will be something with broad contours that look closer to the Democratic proposal than the $1 trillion that many Republican Senators have their hearts set on.

Bottom Line: Continued income replacement is crucial to sustaining the recovery. With the economy still producing a steady stream of job losses as indicated by initial jobless claims and still restrained by the ongoing pandemic, a failure to soon enact a new fiscal response would threaten the recovery. I still think, however, the longer this drags on, the larger the ultimate package will be.