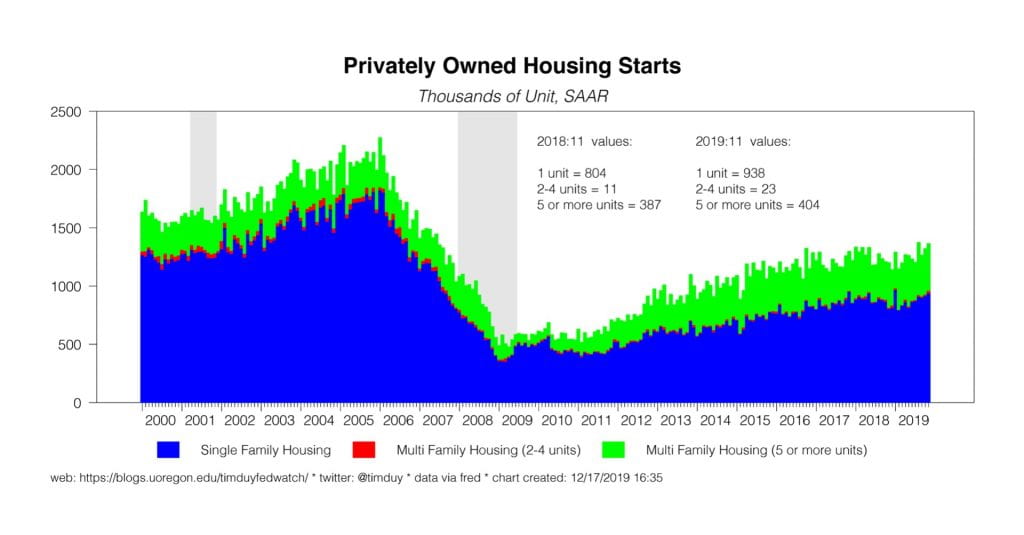

The data flow provides little reason for the Fed to change course anytime soon. Housing starts for November came in slightly above expectations:

Permits were also up to a cycle high. Single family permits remain on a clear uptrend with last year’s dip just an unpleasant memory. Will it end anytime soon? Probably not. Yesterday I pointed to favorable demographics for housing. Today George Pearkes argues that housing is “on sale”:

One last thing about housing: mortgage rates are bumping along at local lows, prices have started to bottom out but aren’t really ripping, but wage growth is still grinding along. By any metric, new homes are *cheap* right now, and will be w/o big beat-steepening. pic.twitter.com/dOHtm1IlHD

— George Pearkes (@pearkes) December 17, 2019

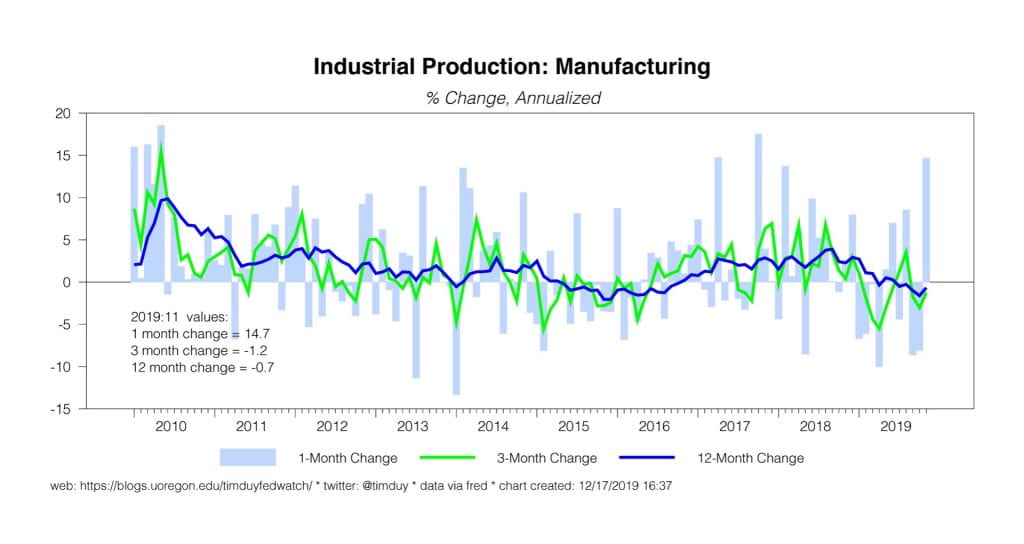

Elsewhere, the nation’s industrial sector rose a better than expected 1.1% in November, propelled higher by manufacturing:

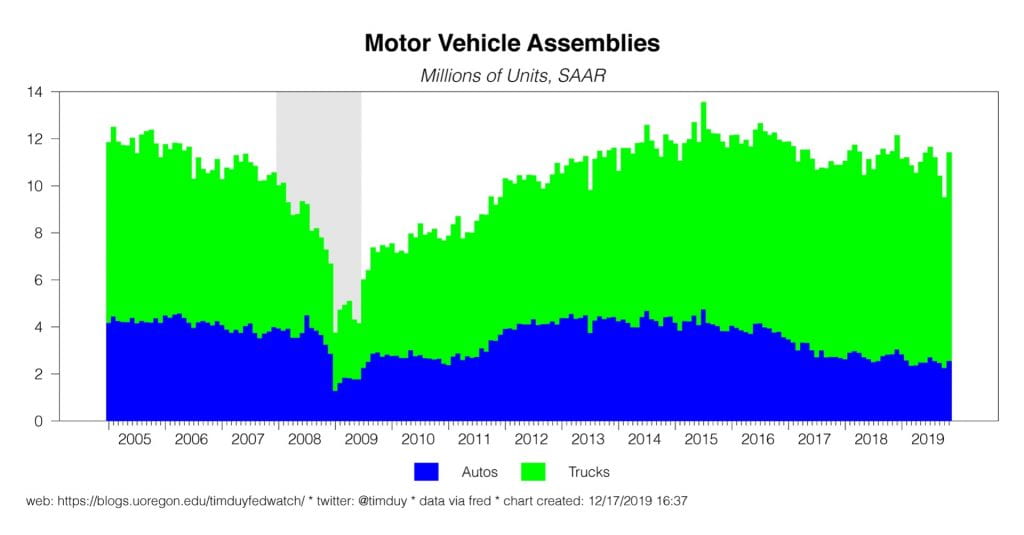

The return of striking GM workers clearly helped the numbers as truck production in particular bounced higher:

Still, it remains notable that despite all the angst of the past year, the weakness in manufacturing remains no worse than that of 2015-6. Note also that even excluding autos, manufacturing output was up 0.3% in November. Signs of stabilization? Reasonable given the Markit PMI numbers. Signs of recovery? Not yet. But again, stabilization is all we need to compare favorably with last year and say the worst is over.

Boston Federal Reserve President Eric Rosengren has an optimistic view of 2020:

My own view is that it is unlikely we will have an economic downturn in the coming year, given the generally positive financial conditions and the continued accommodative monetary and fiscal policies. Of course, this outlook assumes that we do not have a significant negative shock from abroad, or experience a negative shock from a sharp ratcheting up of trade disputes with major trading partners.

and he doesn’t see a reason for the Fed to change rates:

With the recent positive economic news, and with monetary and fiscal policy already accommodative, I see no need to make the current stance of monetary policy more accommodative in the near term. Given that monetary policy works with lags, and Federal Reserve policymakers have already eased monetary policy three times in 2019, my view is that it is appropriate to take a patient approach to considering any policy changes, unless there is a material change to the outlook.

I guess we should wonder about Rosengren’s definition of the “near term.” Next month? Next quarter? I am thinking the next few quarters. Rosengren probably anticipates one rate hike this year. Still, it seems inconsistent with a serial dissenter who argues:

Since April, the economy has performed pretty much as many professional forecasters expected – this, despite recent concerns with downside risks, notably those associated with slower global growth and uncertainty about trade policy.

Looks like he has fallen into line with the consensus view that a series of rate cuts were needed to keep the economy humming.

Tomorrow (Wednesday) is a light data day (mortgage applications, oil inventories) but things pick up again Thursday with unemployment claims, Philly Fed index, and existing home sales. None of these are likely to change the underlying narrative; still, the Philly Fed index should help us gauge the temperature of the manufacturing sector. Friday rounds out the week with the final read on third quarter GDP and, more importantly, November consumer spending and PCE inflation data. Also Friday is the final release of the November Michigan consumer sentiment numbers.

Bottom Line: Data stabilizing (manufacturing) to improving (housing) but not enough to prompt the Fed to change course.