Although we have only a few data points in hand, the odds are swinging solidly toward another Fed rate cut at the end of this month. If tomorrow’s employment report reveals an ongoing loss of momentum in the U.S. labor market, a rate cut will be locked in.

Given fairly resilient U.S. data and a divided Fed at the September FOMC meeting, I believed the Fed was positioned to hold rates steady in October with the risks tilted toward a rate cut. That view assumed continued data resilience. The data, however, is not cooperating.

Notably, the stress in manufacturing apparently intensified in September. The latest report from the Institute of Supply Management revealed that the global downturn weighed heavily on the sector; the new export orders measure fell further and now sits deeply in a range associated with past recessions.

To be sure, the manufacturing sector is now a fairly small part of the economy, nor is it clear that an external shock can trigger a U.S. recession. Consider, for example, that a U.S. recession did not follow the shock from the Asian Financial Crisis that also hit U.S. manufacturing. This example suggests that fears of U.S. recession might be overblown. The Fed may think similarly and conclude that recession risk it low, but the data and risks are evolving in such a way as to make this an increasingly risky bet.

Haven’t they already adjusted policy to compensate for the risks of slower global growth? Remember that the threats are not entirely external and that the risks are arguably now intensifying again. Trade policy disputes – entirely attributable to President Trump – weigh on manufacturing. And now the drama surrounding the impeachment process also creates additional uncertainty that threatens to further stall business investment.

The actual and ongoing damage to U.S. manufacturing from the global slowdown evident in the ISM report by itself argues for easier policy. Ongoing trade uncertainty combined with additional risk to the economy as the nation turns its focus on the impeachment battles further bolsters that argument.

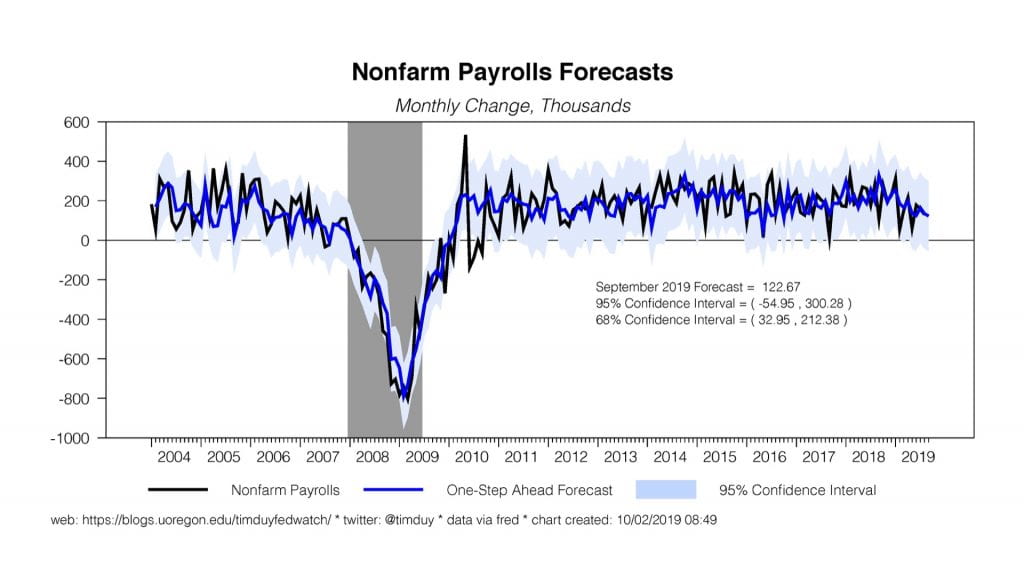

While today’s ISM service sector report may provide additional reason for another rate cut, a weak employment report would certainty cement the case for easier policy.The labor market has been losing momentum for months and this week’s estimate of private job growth from ADP shows no reversal of that trend. My estimate of September job growth is a moderate pace of 123k, bolstered in part by Census hiring: Although job growth at that level remains sufficient to hold the unemployment rate roughly steady, the Fed can’t yet be confident that job growth won’t continue to slow enough in the months ahead and put upward pressure on unemployment. This is pretty much the last thing they want to see with inflation still low.

Although job growth at that level remains sufficient to hold the unemployment rate roughly steady, the Fed can’t yet be confident that job growth won’t continue to slow enough in the months ahead and put upward pressure on unemployment. This is pretty much the last thing they want to see with inflation still low.

Bottom Line: To prevent another rate cut, the Fed needs a reason to believe that they have eased enough to offset the forces weighing down the US economy. It is difficult to see that they can reach such a conclusion without an improvement in the data flow. It is almost impossible how they can reach this conclusion now that it appears the negative forces on the economy are intensifying. By only the first week of October, the stage will likely be set for a third rate cut at the end of the month.