If You Don’t Have Any Time This Morning

Split opinions on the Fed about the need for a rate cut argues for 25bp at the end of this month.

Key Data

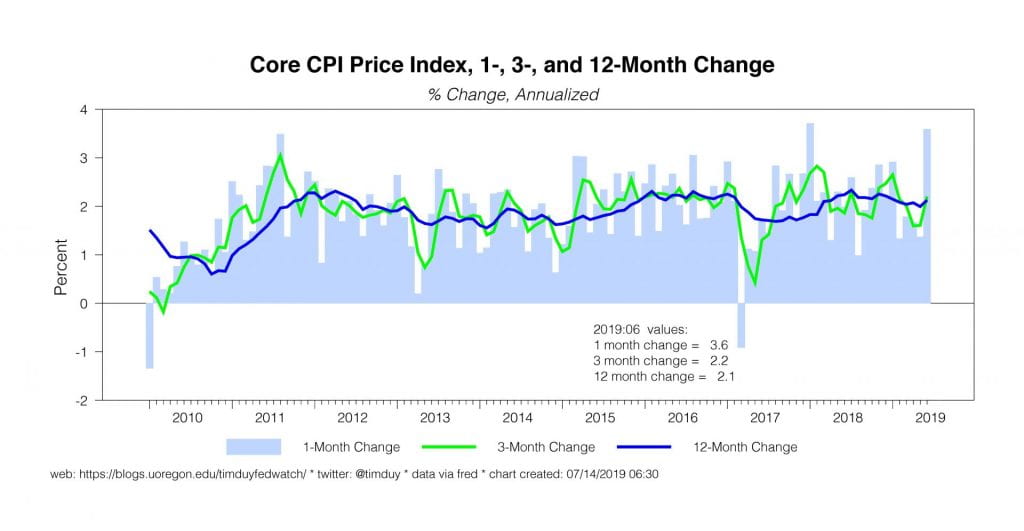

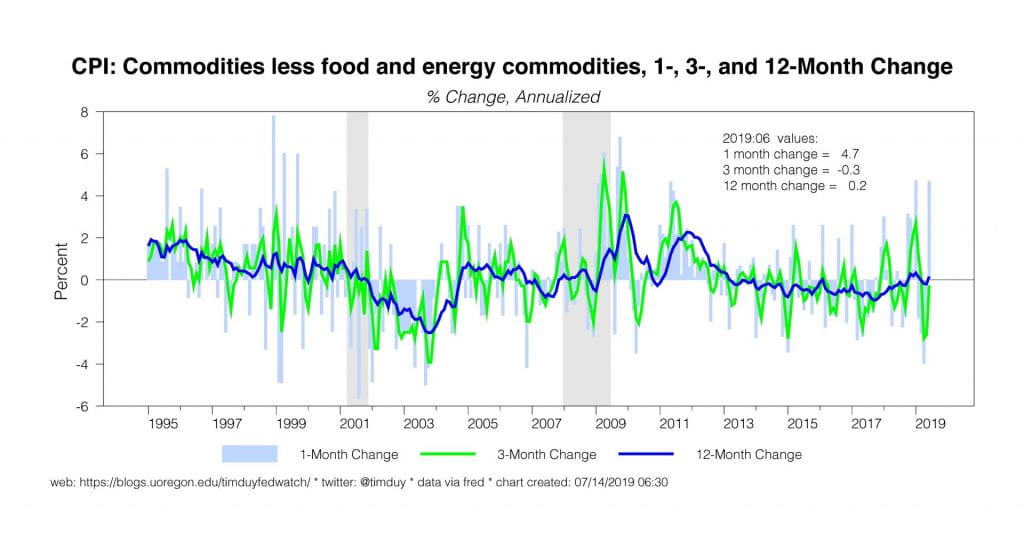

CPI data revealed firmer inflation in June. Pulled higher by apparel and used car and truck prices, core CPI rose 0.3%, its fastest monthly pace since January 2018. June PPI grew at a faster than expected pace, but the headline number was up just 0.1% while PPI excluding food, energy and trade services was flat after more rapid increases of 0.4% in both April and May. It would be tempting to conclude that the firm CPI inflation number in particular would soften the Fed’s resolve to cut rates, but it’s so far just one month and the Fed is more concerned about the possibility that weak growth going forward will weigh on future inflation. The Fed has shifted toward caring less about the threat of higher inflation and more about actual inflation; it will take more than one month for actual inflation to become interesting.

Initial unemployment claims continue to move sideways at low levels. The fact that they have stopped declining suggests a somewhat less vibrant labor market, consistent with the general deceleration of job growth in the first half of 2019. The lack of any substantial rise in claims, however, suggests that claims of imminent recession remain premature.

Initial unemployment claims continue to move sideways at low levels. The fact that they have stopped declining suggests a somewhat less vibrant labor market, consistent with the general deceleration of job growth in the first half of 2019. The lack of any substantial rise in claims, however, suggests that claims of imminent recession remain premature.

The Atlanta Federal Reserve’s GDPNow measure currently estimates the economy grew 1.5% in the second quarter. Although this headline number is disappointing, note that the current estimate of final sales to private domestic purchasers is a healthier 3%. The Fed will be more concern about the health of the underlying domestic economic and the business investment numbers than the headline number.

Fedspeak

The highlight of last week was Federal Reserve Chairman Powell’s testimony on the Semiannual Monetary Policy Report.My comments are here; the short version is that Powell made no effort to pull back expectations for a rate cut in July. Notably, he said that the uncertainties in global growth and trade policy had not ebbed since the June FOMC meeting.

The minutes of the June FOMC meeting revealed particular concerns with declining business investment as firms responded to a more uncertain policy environment.These concerns were expected to be long-lasting and induce firms to undergo costly changes in supply chains. This from the Wall Street Journal speaks to such concerns:

Companies that make Crocs shoes, Yeti beer coolers, Roomba vacuums and GoPro cameras are producing goods in other countries to avoid U.S. tariffs of up to 25% on some $250 billion worth of imports from China. Apple Inc.also is considering shifting final assembly of some of its devices out of Chinato avoid U.S. tariffs.

This restructuring of supply chains is likely to continue as business executives have gotten the message that President Trump will not stop using tariffs as a negotiating strategy.Firms would be well advised to avoid concentrating production in any one country; today’s safe haven could easily become tomorrow’s battleground. The Fed is reasonably concerned that such restructuring only distracts firms from new investment and seeks to cushion some of that blow. Note too that these are costs borne by US firms that result in very little net change in the domestic landscape; there is little to suggest that firms are moving production back to the US.

Chicago Federal Reserve President Charles Evans believesthat economic growth is close to trend and is upbeat on the consumer but cautious on investment. He thinks a “couple” of rate cuts would raise inflation. St. Louis Federal Reserve President James Bullard still considers a 25bp rate point cut the appropriate move. If you can’t convince Bullard to move 50bp, it’s tough to see how you get a consensus for 50bp. New York Federal Reserve President John Williams gave a cautious assessment of the economy now that downside risks are higher compared to the beginning of the year. He added that market expectations were in part driving the Fed’s move toward a rate cut. Via Michael Derby at the Wall Street Journal:

Mr. Williams told reporters that part of the reason for lowering rates would be to help keep in place a shift in overall financial conditions that is itself tied to investors’ expectation of rate cuts…“The markets expect cuts so therefore you see lower mortgage rates, you see lower interest rates, and stronger financial conditions broadly, and I think that contributes to more consumer spending and business spending,” Mr. Williams said.

This kind of talk feeds into the perception that the Fed is only cutting rates because the “market” demands a cut. I think the better phrasing would be that rather than dictating policy to the Fed, the market anticipates the Fed will take the appropriate action to sustain the expansion and hence interest rates reflect the expectation of rate cuts.

In contrast, via Bloomberg, Richmond Federal Reserve President Thomas Barkin and Atlanta Federal Reserve President Raphael Bostic questioned the need for rate cuts given the apparently solid economy.

Upcoming Data

This week will be busier than last.Key reports include retail sales and industrial production on Tuesday. The Fed will be looking for signs that consumer spending continues to maintain the bounce that looks evident in the second quarter. Industrial production will give some insight into the degree of the manufacturing slowdown associated with weak global growth and trade policy issues. Wednesday we get housing starts and permits; here we are looking for the impact of lower interest rates on the housing market. I expect incoming data to reveal the housing market has firmed quite a bit after the scare at the end of last year. Thursday we get the usual initial unemployment claims data and on Friday comes the preliminary look at University of Michigan consumer sentiment for July. Powell will give a speech Tuesday titled Aspects of Monetary Policy in the Post-Crisis Era.

Discussion

It still looks like the Fed will opt for 25bp rather than 50bp at the July meeting. The message from Powell and others is that the primary motivation for a rate cut is a recalibration of policy considering greater downside risks while the underlying economy, in the words of Powell, remains in “a very good place.” A 50bp rate cut seems inconsistent with what seems to be the general assessment of the state of the economy.

To get to 50bp at the next meeting likely requires a substantial deterioration of the data that is difficult to see occurring in the next couple of weeks.Something along the lines of particularly weak readings across a variety of indicators – consumer spending, housing, manufacturing, and investment – might do the trick, but no one single indicator would change the tide. To get to 50bp, we need to see fairly substantial evidence that the impacts of an adverse trade policy shock are filtering through to the economy more rapidly than officials have seen up until now.

The same is likely true for the degree of cutting that occurs after this July cut.Again, the Fed is recalibrating policy, not reacting to a turn in the business cycle. At this point, only roughly half of Fed policymakers expect rate cuts this year, and then only 50bp. That argues for Evans’ “couple” of cuts given the current data flow. Obviously, weaker data will yield more rate cuts. At the risk of oversimplification, I would anticipate ultimately 75bp or more of cuts if the preponderance of data begins to suggest that the economy is slowing enough to push unemployment higher.

While the expansion remains intact, the inversion of the yield curve will reasonably induce many to look for a recession.My view is that the yield curve indicates that we should be on recession watch, meaning that conditions are more favorable to recession than at any other point in this expansion, but we are not yet at a point of recession warning. In my opinion, one key factor is that the Fed is cutting rates fairly early in the process; they are not dismissing the yield curve signal as they have done in the past.From the June minutes:

Participants also discussed the decline in yields on longer-term Treasury securities in recent months. Many participants noted that the spread between the 10-year and 3-month Treasury yields was now negative, and several noted that their assessment of the risk of a slowing in the economic expansion had increased based on either the shape of the yield curve or other financial and economic indicators.

If there is anything that would certainly help kill the yield curve as a recession predictor, it would be the Federal Reserve believing that it was a recession predictor.In the past, the Fed has continued hiking after the 10s2s spread inverted; this time they will be cutting without a 10s2s inversion. That policy change should be positive for economy; if the Fed pulls off the soft landing, I would anticipate equity markets to extend recent gains.

Bottom Line: I am still anticipating a 25bp rate cut this month. Policymakers advocating for a rate cut do not appear sufficiently motivated to argue for 50bp while a nontrivial contingent doesn’t believe a rate cut is necessary. It appears that getting consensus on anything more than 25bp would be a challenge considering the current state of the economy.