Although Fed officials continue to resist the notion that rates will shift either up or down in this year, I think the odds still favor a cut over a hike. To be sure, Fed officials remain optimistic, especially considering the economy did not fall off a cliff in the first half of 2019 as some feared after the financial turmoil of late last year. Incoming data, however, suggest that activity is slowing as expected. Ultimately, with inflation still quiescent, I don’t think it would take much additional slowing to prompt the Fed to ease policy a notch to help sustain the expansion. On the other side of the coin, low inflation means the Fed won’t jump at a rate hike even if data rolls in stronger than expected.

Industrial production softened in April, tumbling 0.5% on the month while the dispersion of weakness rose:

This data has the feeling of past mid-cycle slowdowns. A decline in vehicle production contributed to the weakness:

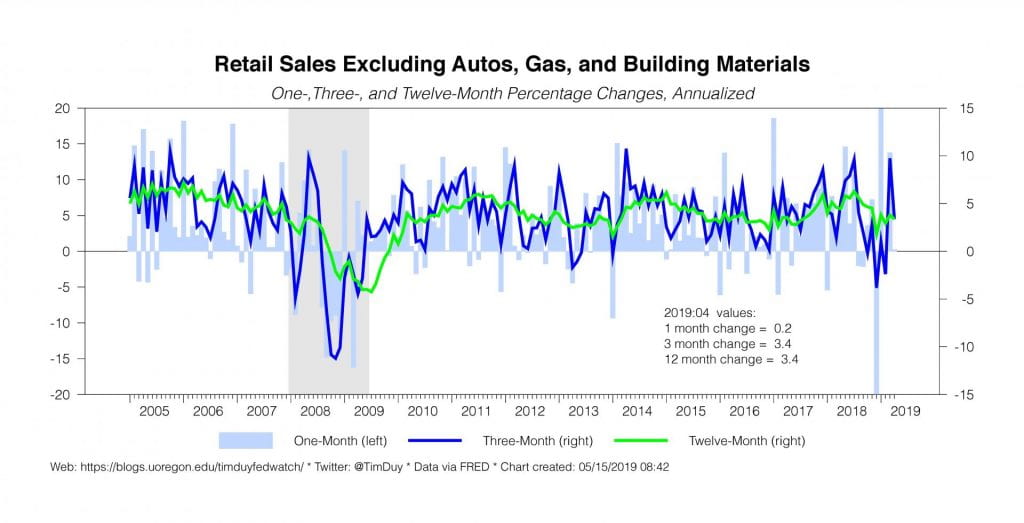

Realistically, auto sales already peaked for this cycle and hence there is little reason to expected a sustained pick-up in this data anytime soon. Weak auto sales also weighed on overall retail sales while the underlying trend remained softer relative to 2018:

Consumer activity looks to be settling into something closer to the 2016 pace – not recessionary to be sure but still supportive of the story that growth will ease toward trend this year.

Core inflation remained soft in April:

Which is interesting considering that shelter costs accelerated:

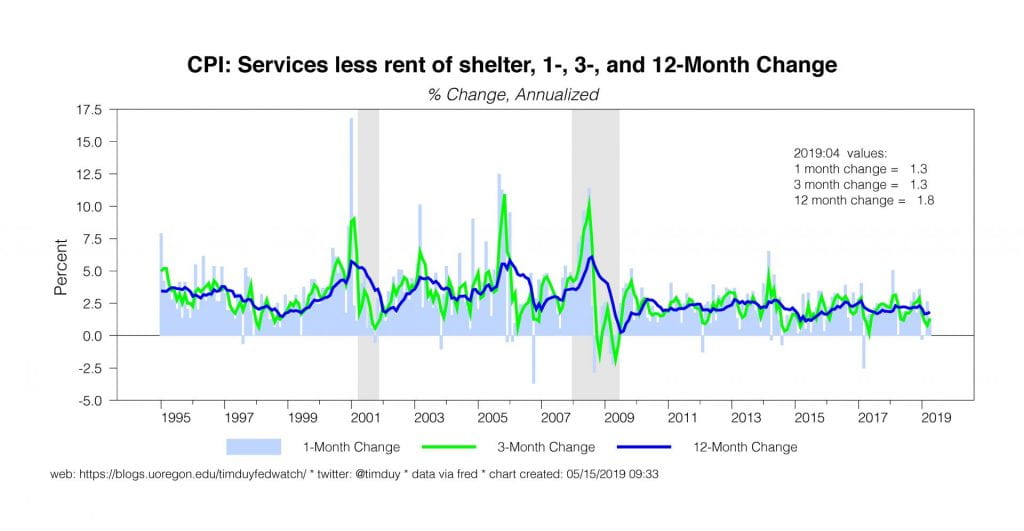

Obviously then there was offsetting weakness elsewhere in the numbers. Services excluding shelter inflation decelerated:

And outright deflation returned for a second month in core-goods:

Used cars (not unrelated obviously to the overall weakness in the auto sector) and apparel helped drive the declines. The Fed believes the recent weakness of inflation is temporary and as such is resistant to cutting rates without a compelling story on the growth side of the equation. Continued weakness in the inflation numbers into the back half of the year, however, would lower the bar to a rate cut.

Used cars (not unrelated obviously to the overall weakness in the auto sector) and apparel helped drive the declines. The Fed believes the recent weakness of inflation is temporary and as such is resistant to cutting rates without a compelling story on the growth side of the equation. Continued weakness in the inflation numbers into the back half of the year, however, would lower the bar to a rate cut.

Meanwhile, renewed trade war concerns supported a fresh inversion of the yield curve:

Market participants are looking for a rate cut that the Fed isn’t ready to give. The Fed’s resistance shouldn’t be a surprise. The yield curve is a long leading indicator; it will invert well before enough data turns to catch the Fed’s attention. Still, the fact that the Fed has already backed away from rate hikes, as well as the low inflation environment, leaves the Fed better positioned to shift gears ahead of a recession compared to most cycles.

Bottom Line: The Fed will retain its “patient” policy stance until the tone of the data shifts meaningfully relative to their forecast. That hasn’t happened yet. My bet is that when the shift happens, it is more likely to support a rate cut than a hike.