Working on examples for a class, I stumbled upon one with implications for market participants. Specifically, what has the New York Federal Reserve’s Underlying Inflation Gauge (UIG) been telling us? The answer is somewhat surprising. It does provide new information about the path of core-inflation. Still, even at its height it wasn’t predictive of any worrisome inflation. There are two interpretations. One is that you ignore the UIG, the other is that you embrace the predictions of low inflation. I pick the latter interpretation.

The New York Fed UIG is an effort to capture the underlying trend in inflation. An attractive feature of the UIG is that its construction utilizes a wide array of financial and economic variables; The “full-data-set” version is based on 346 monthly, weekly, and daily series. This allows it to capture a number of factors such as, for example, tighter labor markets that may influence the path of core inflation. The objective is to add information to our traditional measures of core-inflation as those measures arguably exclude important information that might shape our inflation forecast.

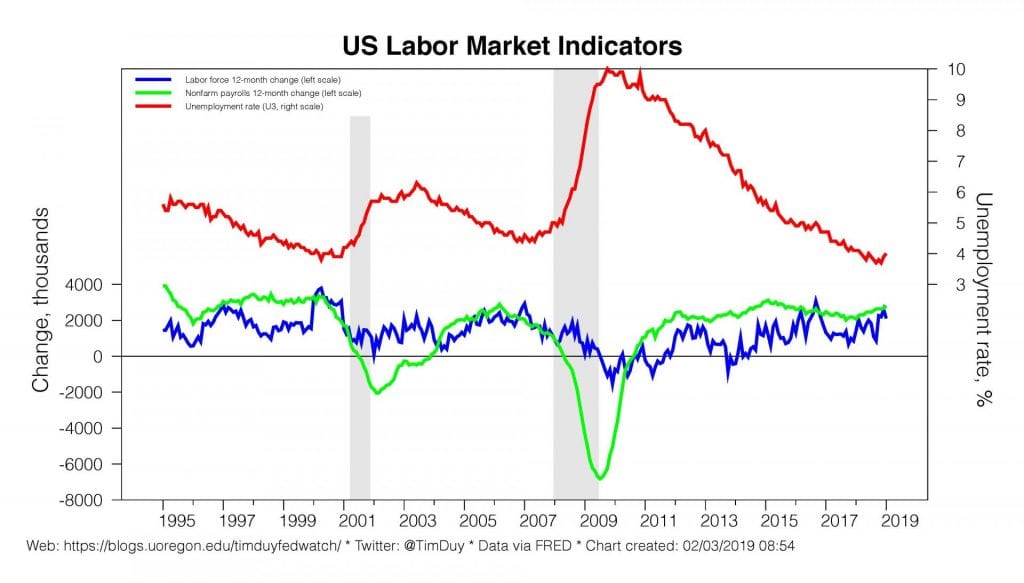

Last year the UIG created angst within some quarters of the investment community as it rose to highs last seen prior to the Great Recession. Examples can be found in the news here, here, here, and here. Neil Dutta of Renaissance Macro Research, however, argued prior to the highs in the UIG that “…if loose financial conditions and stronger growth do little to move price inflation, perhaps the premise of those who rely on UIG to claim inflation will turn up is flawed.”

With this in mind, I set out to understand a bit more about the dynamics between the UIG and inflation. While the UIG is presented along with year-over-year core CPI inflation, I focus on year-over-year core PCE inflation because the latter is the Fed’s preferred inflation measure (technically, the Fed targets headline inflation but use core as a predictor of the likely path of headline inflation). I also use the “full-data-set” version of the UIG as it received the most press last year and I am interested in the importance of the wider range of variables in predicting inflation.

Visually, the turning points of the UIG correspond to turning points of core-inflation. Moreover, high values of the UIG have corresponded to inflation rates in excess of the Fed’s 2% target. This is more easily seen in a scatterplot.

What I want to know is a.) does a change in the UIG predict a change in core-inflation and b.) what does the UIG say about the inflation forecast? To get at these issues I set up a simple two-variable vector autoregression with six lags. The Granger causality tests indicate that the UIG and inflation both have an impact on inflation but inflation does not have an impact on the UIG. That suggests a shock to the UIG will have an impact on inflation but not vice-versa, which is what the impulse response function show.

Roughly, a 0.07 percentage point shock to the UIG will be translated into an equal shock to core-inflation after three months (right hand charts). Moreover, the impact on core-inflation is fairly persistent (upper right chart). Shocks to core-inflation are not persistent and dissipate over the next twelve months (upper left chart) while having very little impact on the UIG (lower left chart). These basic results are not very sensitive to the choice of lag length, but lag lengths beyond 12 months tend to result in models where the cycles overrun each other and are not particularly instructive.

I find these results reassuring in that they suggest the UIG does capture factors that have a persistent impact on core-inflation. That said, has the magnitude of shocks been sufficient to heighten inflation concerns? To get at that question, I compute the 24-month inflation forecasts from the model for each month beginning with 2017:1 and ending 2018:11 (using recursive regressions that re-estimate the model each month). Those forecasts all point toward inflation settling into a range of 1.7-1.8%. In other words, adding the UIG to the inflation forecast has indicated for the past two year that inflation will fall short of the Fed’s target.

I think these results point toward the strength of the mean reverting properties of inflation in recent years as inflation expectations have become more entrenched and the Phillips curve less pronounced.

Bottom Line: The New York Fed UIG appears to provide new information about the direction of inflation but that information for the past two years has indicated inflation below the Fed’s target.