The Federal Reserve faces a most uncomfortable confluence of events as central bankers begin their two-day meeting to ponder the path of rate policy. In a nutshell, equities continued to struggle in the midst of fairly solid data as President Trump complains yet again about rate hikes while stoking the uncertainty that appears at least partly if not mostly to blame for the volatile equity markets. Yes, I know, it’s a lot to follow. Hopefully I can break it down into more manageable pieces.

Begin with the easy part. Recent data remain largely consistent with the Fed’s outlook. As a reminder, the Fed’s forecast anticipates the growth will ease in 2019 relative to this year but remain at a pace that would continue to intensify inflationary pressures. In short then the Fed expects growth to slow on the back of past rate hikes and waning fiscal stimulus. I don’t think the Fed will view incoming data as inconsistent with that outlook. Industrial production continues to gain:

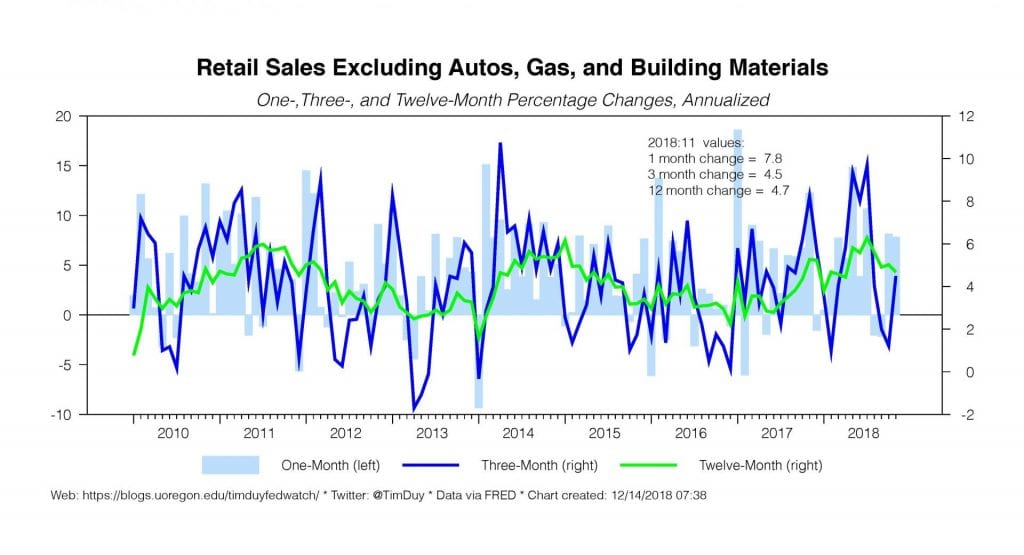

Households continue to spend at a healthy rate:

Even initial jobless claims, the boogeyman of the bears, tumbled sharply by 27k to just 206k, pulling the four-week moving average lower:

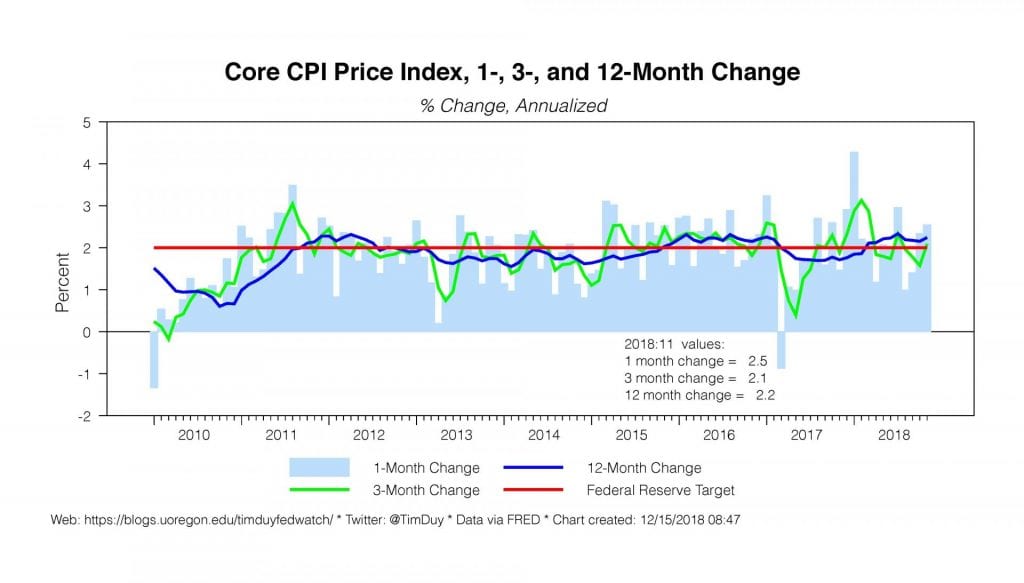

And core-inflation firmed:

In response to the data, the Atlanta Fed now estimates fourth quarter growth is tracking at a 3% pace. All told, outside of the downdraft in equities and related financial tightening, I don’t think there is much here to induce large shifts in the Fed’s forecasts for 2019. Those forecasts were as of September hawkish in the sense that they predicted further rate hikes.

We have a fairly good idea of the Fed’s reaction function as it pertains to the employment and inflation. If we review the incoming data and keep our eyes on that ball, the case remains to continue edging up policy rates into the neutral range and then turn increasingly data dependent. By that measure then the case for a rate hike on Wednesday appears fairly straightforward.

The Fed though has an implicit financial stability metric. Because they have never made it explicit though, we don’t know how it might apply in the current situation. The Fed doesn’t like to move on market moves alone. That said, with equity markets tumbling to 14-months lows, it seems easy to make the case that the Fed should opt to simply skip this month and come back to the table in January. Stopping short of the lower estimates of neutral when the economy continues to perform as expected would be a bitter pill for some FOMC members to sallow. But equity prices are data too, and the Fed is data dependent. Hence this becomes the risk to the rate hike call.

President Trump’s latest tweet highlights another aspect of this policy decision. Trump again implored the Fed to stop raising rates, tweeting “It is incredible that with a very strong dollar and virtually no inflation, the outside world blowing up around us, Paris is burning and China way down, the Fed is even considering yet another interest rate hike.”

There are actually two problems here for the Fed. First is that skipping on the rate hike in light of the data and their forecasts could appear to be caving to the President’s demands. As noted earlier though, they could delay on the basis of the equity sell off, but that has its own problem of the appearance of a Powell put on the stock market rather than a Powell put on the economy.

The second problem is that one factor driving the uncertainty on Wall Street is Trump himself. If the “outside world is blowing up” and “China way down,” these events are the direct results of Trump’s policy of weaponized uncertainty. Anywhere you turn, there is a potential crisis attributable to Trump’s chaotic policy approach. Trade wars and the related potential to disrupt global supply chains. The threat to shut down the government over a border wall that is not getting funded. And next year promises to see an increase in the chaos Trump will likely want to deflect attention as a Democratic House of Representatives promises to bring even more investigations into Trump and his family.

In a sense, Trump’s weaponized uncertainty drives down equity prices which in turn induces the Fed to do what Trump wants and stop raising rates. How much does the Fed have to do to cushion the stock market against Trumpian uncertainty? How much to cushion the economy against the same?

It is an ugly situation for the Fed to navigate. So what do they do? I think the most likely approach is:

- Hike rates 25 basis points to push rates at the edge of the lower range of neutral estimates. Allows the Fed to follow the data and push back on the notion that markets and Trump are driving policy.

- Drop “further gradual increases” for language that imparts much more uncertainty about the future path of rate hikes. Makes clear that future rate hikes are not certain. Arguably also opens the door for a rate cut should the data turn sour.

- Emphasize in the statement they are vigilantly monitoring financial, economic, and political developments around the world. Recognizes the fears of Wall Street.

- Release forecasts that are on net more dovish than the September version. This may include a reduction in the estimate of longer run unemployment. This acknowledges that persistently low inflation implies the economy can run at a lower unemployment rate. Also recognizes the impact of weaker equity prices on the outlook.

- Unlike September, when Powell emphasized the forecasts in his press conference, he will indirectly say to ignore the forecasts as he recognizes that they will remain unnecessarily hawkish.

As far as questions for Powell that I would like to hear:

- He will of course not answer questions about Trump’s pressure on the Fed, so I don’t think reporters should waste their questions on that issue.

- “What is the information content of the equity market decline? How does or doesn’t it impact the growth forecast?”

- “The yield curve is now flatter than it has been in this cycle. How do you and your colleagues interpret the current shape of the yield curve?”

- “Do you believe job growth remains in excess of that consistent with long-run price stability?”

- “Are you viewing the potential impacts of trade war escalation as primarily supply side or demand side shocks?”

- “Vice Chair Richard Clarida has revived forward looking inflation measures from the TIPS market as relevant policy guides. In contrast, your predecessor Janet Yellen downplayed the inflation expectations content of these indicators. Where do you stand on the issue?”

- “What will trigger the Committee to reassess the pace at which the Fed is winding down the balance sheet?”

- “How do you credibly claim to want to eliminate forward guidance when you retain the SEP as supposedly a key element of your communications strategy? Aren’t you just increasing uncertainty by eliminating an emphasis on the near-term path of policy, which should be more knowable, in favor of the less knowable long term forecast?”

- “What is the greatest external risk currently concerning the Fed? Hard Brexit? Trade wars?”

- “What is the greatest internal risk currently concerning the Fed? Housing? Corporate debt? Waning fiscal stimulus?”

Bottom Line: The baseline case is for a dovish hike that basically sends the message that the data is consistent with another rate hike but IF the economy turns slower more quickly than anticipated, this will be the last hike for some time if not the last hike of the cycle. The risk is that the Fed skips this meeting and leaves January open IF the data continues to support a hike. It is worth thinking about what the Fed would need to do to offset the impacts Trumpian uncertainty should that bleed over from Wall Street to Main Street.