“So far, I’d say this is small potatoes…”

New York Federal Reserve President William Dudley, February 8, 2018

“All that said, given the fundamental factors in place that should support the demand for housing, we believe the effect of the troubles in the subprime sector on the broader housing market will likely be limited, and we do not expect significant spillovers from the subprime market to the rest of the economy or to the financial system.”

Federal Reserve Chairman Ben Bernanke, May 17, 2007

Friday was yet another day of wild swings on Wall Street as market participants continue to digest the implications for stocks and bonds of this new stage of the business cycle. In short, there looks to be a painful repricing underway that involves a new equilibrium set of prices for bonds and stocks. For now, though the Fed doesn’t care about your pain. At least that’s the message from Fed officials. They want to keep the focus on the bigger picture. That bigger picture is the economic forecast – which continues to point to gradual rate hikes.

Continued here as a newsletter…

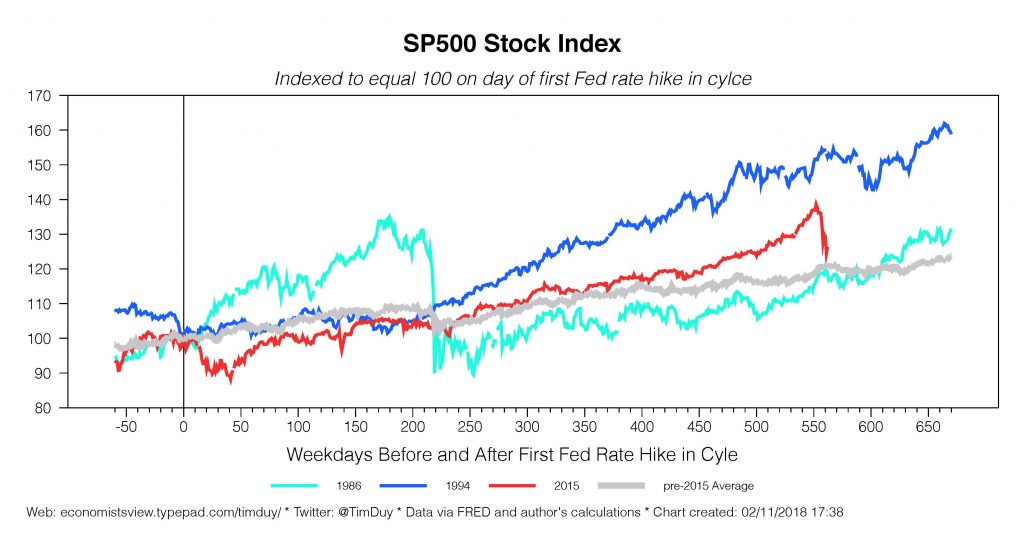

My position on Wall Street’s gyrations remains unchanged. Until late last year, the risk of higher interest rates was underappreciated. It wasn’t until the fall that the realization started to sink in that the Fed was nowhere near calling it quits. The economy was normalizing faster than anticipated. The wounds of the financial crisis were healing, leaving the stage set for the best economy since the late 1990s.

Stock prices, however, did not reflect this new reality. Even a partial normalization of interest rates would require a repricing of equities. The gains in stock prices in recent months were excessive. A correction was not unexpected. The spark for that correction appears to have been a solid employment report (although it is reasonable to say that we never really know why the psychology shifts).

I think that the shock to Wall Street is more likely than not to be contained to Wall Street. This looks more to me like 1987 than 2007. Indeed, I think this shock has a silver lining in that it might extend the length of this expansion.

Central bankers appear to feel similarly – the hit to stocks to date has yet to meaningfully impact their forecast. This is the message they want to push to sustain expectations that another rate hike is coming in March. See San Francisco Federal Reserve President John Williams, who I think lays this out nicely in this speech.

Logic would point us in the same direction even without policy maker guidance. Note that the Fed did not raise their rate hike expectations in light of the positive shock to equities over the past couple of months. An offsetting negative shock should then not cause a change in forecast either. We also know from the Fed minutes that some officials were concerned about the possibility of a drop of equity prices and the potential negative implications for the economy. These individuals will likely take comfort in some steam coming off of financial markets. Better a small hit than a 1987-like crash. Other officials saw high equity prices as reflective of very low neutral rates. They will see then see lower equity prices as a natural consequence of rising neutral rates – something that both looks to be happen and is consistent with their forecast.

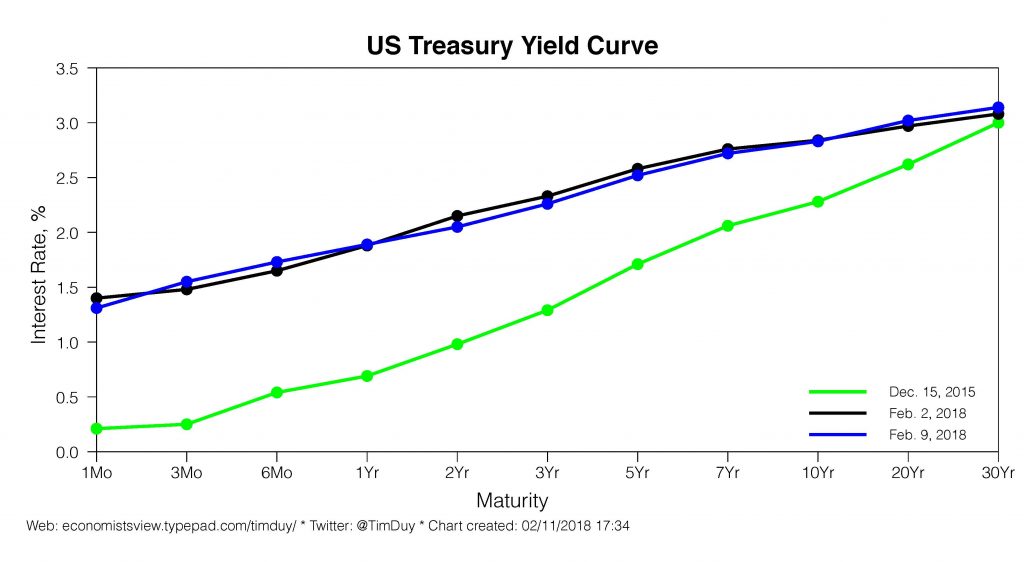

Indeed, I would add higher long-term rates give greater credence to the Fed’s rate forecast for this year and next. Chasing the long end of the curve is exactly what is needed if policy rates are going to return to something much more “normal.” Watch the very long bond – the anchor of the 30-year yield is slipping.

All of that said, I am not sure I would, like Dudley in the quote above, dismiss the market move as “small potatoes.” A ten percent swing in prices is going to hurt someone. Someone is on the bad side of a leveraged trade. How big and how bad, I don’t know. What I do know is that small events can balloon into larger problems. I don’t think that is the case in this instance, but neither did then-Federal Reserve Chairman Ben Bernanke in 2007. The lesson from then should have been that policy makers are wise to approach this things with a bit more humility, at least in public.

The further the financial crisis fades into the past, the more lessons will be forgotten.

I suspect the challenge for the Fed will be to keep market participants focused on their medium-term forecast. If, as many believe, wage growth and inflation make an appearance this year, the Fed will have the opposite problem from 2017. Then they struggled to keep the focus on gradual rate hikes despite disappointing data. In retrospect, I think the dovish policymakers did us few favors last year, tamping down rate hike expectations that then were quickly reversed in recent weeks.

In 2018, we should be cautious of the opposite, of rising rate hike expectations (to four and beyond). To be sure, this is the risk to the forecast. But policymakers will likely send a message that they will not overreact to higher inflation just as they did not overreact to lower inflation in 2017. I don’t think anyone could be faulted for believing that two percent is a ceiling, not a target. This would be the opportunity for the Fed to disabuse us of that notion and prove that the inflation target is symmetric. I suspect this message would be well received by market participants fearful that the Fed is going to accelerate rate hikes at the slightest provocation.

Bottom Line: Gyrations on Wall Street look to be best described as a negative shock that simply reverses a recent positive shock. If the latter did not have time to feed through to the broader economy, then the former will have limited negative impact. Unless that situation changes, keep an eye on the economic forecast for signals on the likely path of monetary policy. In particular, watch for policy makers to emphasize the symmetric nature of their policy target. This is potentially the first time in a long time they can prove the target is indeed symmetric. They can maintain focus on the forecast and calm market jitters without glibly dismissing the possibility that last week proves to be the tip of an iceberg.