The December FOMC meeting ended largely as anticipated with a quarter point rate hike, making the Fed good on their expectation of three rate hikes for 2017. What about 2018? The Summary of Economic Projections revealed that the median policymaker still anticipates another three rate hikes in 2018. But will they deliver? The answer to that question depends, of course, on the actual evolution of the economy relative to policymaker’s expectations. But at this point, I wouldn’t bet against them on the dovish side.

Continued here in newsletter form…

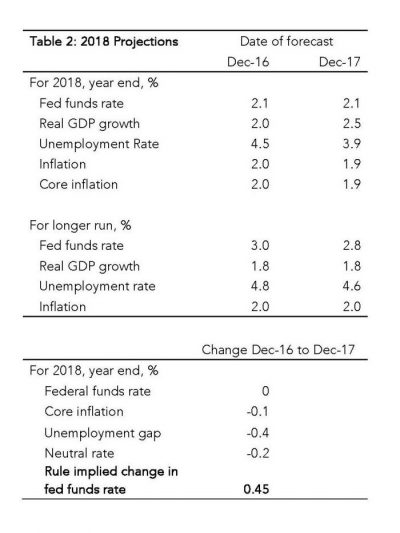

There were two key changes in the median forecasts for 2018. The year-end unemployment projected was revised down to 3.9 percent from 4.1 percent while growth was revised upward from 2.1 percent to 2.5 percent. Remaining 2018 forecasts stood unchanged, as did the longer-run estimates.

Consider first the implications of the change in the unemployment forecast. Begin by viewing the changes in the 2018 forecast in the framework described by San Francisco Federal Reserve economists Fernanda Nechio and Glenn Rudebusch. Using the equation

Funds rate revision = neutral rate revision + (1.5 × inflation revision) – (2 × unemployment gap revision).

they show that a widely used policy rule can explain the change in the Fed’s 2016 rate forecast. Table 2 follows the Nechio-Rudebusch methodology of comparing the current forecast for year-end 2018 with the forecast from last December. Using the rule followed by the Fed in 2016, the projection for the federal funds rate projection for 2018 would have risen 45 basis points over the course of 2017, driven by an increase in the magnitude of the unemployment gap that outweighed downward revisions in the inflation and neutral rate forecast. Instead, the 2018 revisions remained unchanged at equivalent of three 25 basis point rate hikes. An important implication falls out of this analysis: Relative to the 2018 economic forecast changes, the projected path of policy is dovish. This can be explained by the surprising inflation weakness over the past year. Policymakers now believe a return to full employment requires an extended period of activity in excess of that consistent with full employment.

An important implication falls out of this analysis: Relative to the 2018 economic forecast changes, the projected path of policy is dovish. This can be explained by the surprising inflation weakness over the past year. Policymakers now believe a return to full employment requires an extended period of activity in excess of that consistent with full employment.

Now, one might reasonably conclude that if the Fed holds a dovish rate forecast, then the risk is that they are more likely than not to fall short of their expected three rate hikes in 2018. Indeed, given the persistence of weak inflation, this seems on the surface like a safe bet. I would be cautious, however, of such an interpretation. Note that using the same analysis (see table 3), the Fed would have reacted to the sharp downward revisions in the 2017 inflation and neutral rate forecasts by skipping the December rate hike. In other words, the Fed ran a hawkish policy in 2017 relative to changes in the economic forecast.

The lesson: The Fed could very well ignore another inflation shortfall in 2018 and instead hold true to the projection of three rate hikes. This will be true as long as they can write-off any inflation weakness as temporary and thus see an inflation rebound in 2019.

Also in favor of the Fed’s rate forecast is the likely direction of error in their unemployment forecast. The unemployment forecast is fairly nonsensical. Back in September the Fed predicted a 2.1 percent growth rate in 2018 would drive a 0.2 percentage point decline in the unemployment rate. Now they expect a 2.5 percent growth rate delivers a decline of the same magnitude. Something does not add up.

Perhaps they will claim that faster growth would be possible with a temporary boost to labor force participation or a reduction of underemployment. This runs opposite, however, of their post-FOMC statement, which claims that the labor market will simply remain strong, rather than strengthen further. Without a substantial improvement across the labor market, it seems unlikely that the economy will run at a pace 0.7 percentage points above potential growth yet unemployment will only decline 0.2 percentage points. After all, unemployment in 2017 so far fell 0.6 percentage points on back of the currently projected 2.5 percent GDP growth rate.

In the context of the Fed’s stated view on labor markets, the unemployment forecast makes sense only if you they expect a productivity boost. But no such boost is evident in the longer-run GDP forecast, which was unchanged. And I suspect that a higher estimate of productivity growth would be met with a higher neutral rate estimate and thus wash out in a rate forecast. So what this tells me is that the Fed’s forecast implicitly anticipates a temporary productivity boost. Watch for that. But if I had to bet on the Fed’s unemployment forecast, I would bet that it is still too high. If it comes in lower than expected like in 2017, it will again weigh against any inflation shortfall.

Finally, look at the distribution of dots in the Fed’s infamous “dotplot.” Six of the dots are below the median projection, compared to four above. “Aha,” you say, “clear evidence of a dovish Fed in 2018.” Be careful there. Three of those six dovish dots are defnitely Bullard, Evans, and Kashkari, and I suspect a fourth is Kaplan. All four are nonvoters in 2018.

What about the remaining two dots? One is likely Brainard. Will she still be on the FOMC by the end of the year? I am not confident of that; not sure she how closely associated she wants to be with this administration. And is the final dovish dot Yellen’s? Obviously, she is departing.

At least four and very possibly all of those six dovish dots will not be voting by the end of 2018. So, while the distribution of dots looks dovish, it really is hawkish.

Bottom Line: Don’t read too much dovishness into the outcome of this FOMC meeting and expect the Fed will easily drop from three to two or less rate hikes in 2018. The Fed’s rate projection is already arguably dovish, the unemployment forecast is subject to hawkish errors, the Fed ran a hawkish 2017 policy, and the voting members of the FOMC turn decidedly more hawkish in 2018. I continue to believe the Fed will have a hard time deviating from their projected path until economic activity in general, and job growth in particular, downshift to a lower speed. The GDP growth forecast, however, keeps moving in the opposite direction.