1.It would not allow the US to reach its full business output

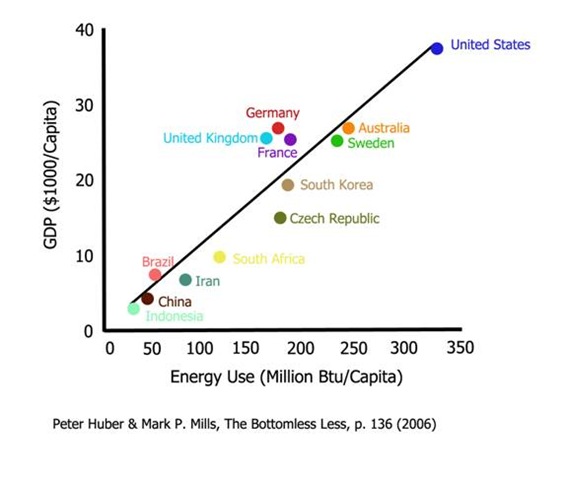

The United States is one of the world’s top manufacturer, according to the United Nations. The main resource that allows the U.S. to be such a manufacture powerhouse is the amount of energy we use. In fact, there is a direct positive correlation between GDP (economic output) and energy use. The more energy that is used, the higher the GDP is.

http://instituteforenergyresearch.org/studies/carbon-tax-primer/

Of course the majority of that energy use comes from fossil fuels, which are responsible for carbon emissions. According to The Institute for Energy Research, 85% of the energy we as use comes from fossil fuels (1). Therefore, taxing the source of 85% of our energy use would definitely affect businesses output and lower total economic output. If the US were to tax carbon use, it would put businesses and employees at risk whether they comply to the tax by simply lowering output, or by investing in renewable energy. However, renewable energy is not quite at its full potential and is still significantly more expensive than using fossil fuels.

2. Economic harm would follow

Putting a tax on carbon would raise the prices of virtually everything we as consumers need. Oil prices would rise, food prices would rise, transportation costs would rise, and anything else that is manufactured. By doing this, it raises the economic cost of living and would shift the state of the economy downwards. A common economic effect of raised prices leads to higher demand of money, leading to the government having to increase the money supply, possibly leading to inflation.

http://instituteforenergyresearch.org/analysis/australians-repeal-carbon-tax-case-carbon-tax/

Furthermore, if the United States Government were to tax carbon use, it would put our economy at harm by most likely reducing the growth of it. In a profit-driven world, taking away the main resource of corporations profit, will cause problems. One potential problem that could occur is businesses could reduce their production, lowering our nations GDP, thus increasing exports. The economy would suffer higher prices for domestic products and we would start relying even more on exports from other countries. Another potential problem with taxing carbon is it would increase businesses operational costs, and one solution to that is letting go of employees, once again slowing the economic growth.

It is entirely possible that smaller businesses find that it is costing them more to operate than the revenue they bring in, and outright close the business.

By having the price of domestic products increase, businesses might start exploring other options overseas as an effort to avoid this carbon tax. If they chose to do so, it would again reduce our nations GDP. In conclusion, taxing carbon emissions would cause businesses to lower their output, lay off employees, or close down. All of these can cause reduced profits and reduced GDP, which will slow the economic growth of America.

3. The poor would be affected the most

“The heaviest burden for climate change regulation costs falls on people – especially lower income groups…” (6). People in the bottom class of America often live their lives from paycheck to paycheck. Most of that money spent is on energy (electricity), food, and transportation. People living in poverty spend the highest portion of their earnings of these basic life necessities. Implementing a carbon tax will only raise these costs for those people who are already struggling. The wealthier will obviously be affected by this carbon tax significantly less than the poor, so is it fair for the poor to pay the higher price even though carbon emissions is a global problem. People who live in poverty have a much harder time changing their lifestyle in the short run due to financial constraints. This carbon tax will keep the poor just as poor or even poorer, not something most American’s will like.

This leads to a question of fairness and ethics for politicians if they are faced with a carbon tax proposal. The poor already struggle to get by each day and there is already a significant gap in income from the top to the bottom. Is congress willing to make that gap even bigger and let the poor suffer more even though this is a collective effort?

4. Reducing our emissions will not change much, and setting the tax rate is nearly impossible; a cap is more reasonable.

http://www.ucsusa.org/global_warming/science_and_impacts/science/each-countrys-share-of-co2.html#.WS4ztRMrJn4

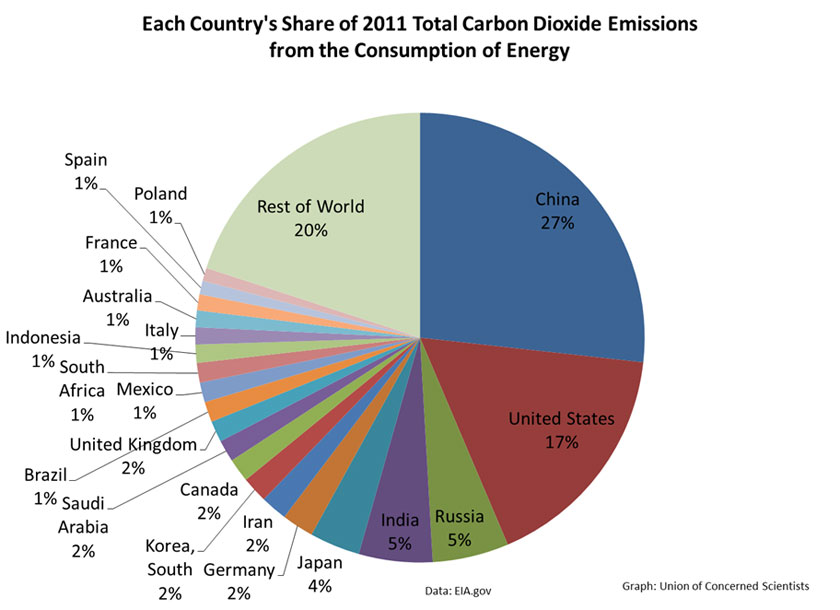

Shown in this pie graph, we can see that the United States is responsible for 17% of the entire world’s carbon emissions. At first glance, you can see we are the second largest contributor in the world. However, if you think about it more realistically, if the United States were to implant this carbon tax, how much of that percentage would go down? Lets start off with something a little more on the unrealistic side, a 50% reduction. That would reduce our total emissions to 8.5%, moving down to third highest. Once again, at first glance thats a significant reduction, but it doesn’t change any of the other countries. China will remain the highest contributor, and the other countries will continue to emit tons of carbon dioxide regardless of what the United States does. What we do in the United States, will likely not be picked up by other countries. Even if we reduce our emissions by 50%, which is already unlikely, we are only making a small difference in the amount of total carbon emissions of the world. The former Administrator of the EPA concluded, “I believe the central parts of the [EPA] chart are that U.S. action alone will not impact world CO2 levels….” (2)

In order for congress to make an “optimal” carbon tax, there needs to be accurate global climate scientific evidence (1). In other words, we don’t really know what exactly would happen if we reduced our carbon emissions, would it even make a difference? Are we already screwed for future life on this planet, or can we actually make a change? There’s only one way to find out, and without set evidence that reducing emissions would make a difference, it’s nearly impossible. Another reason why it would be hard to implant this tax is corporations would have a lot of protest against it. The United States is essentially ran by large corporations and they work hand-in-hand withe the government. This tax would put their profits at risk, which would more likely than not result in backlash.

“Many environmentalists prefer the cap-and-trade system because the cap ensures that the environmental purposes of the act are met. (2)” There is uncertainty on how effective a carbon tax would actually be on lowering emissions, some corporations may continue the same amount of the use, some may not. Therefore, the tax actually doesn’t target an emission reduction goal. A cap on carbon use is a more reasonable way to target carbon emissions. The cap will provide a clear limit on how much carbon can be used, whereas a carbon tax leaves it up to the consumer/corporation on how much they want to reduce their emissions.

References:

1.) Na. Institute for Energy Resource. Carbon Taxes: Reducing Economic Growth – Achieving No Environmental Improvement. http://instituteforenergyresearch.org/studies/carbon-tax-primer/

2.)Morgan, Derrick. August 21, 2012. A Carbon Tax Would Harm U.S. Competitiveness and Low-Income Americans Without Helping the Environment. http://www.heritage.org/environment/report/carbon-tax-would-harm-us-competitiveness-and-low-income-americans-without

3.)Beisner, Calvin. October 7,2015. A Carbon Tax Would be Bad for the Poor, and Everyone Else. https://www.usnews.com/opinion/blogs/letters-to-the-editor/2015/10/07/a-carbon-tax-would-be-bad-for-the-poor-and-everyone-else

4.) Na. November 18, 2014. Union of Concerned Scientists. Each Country’s share of C02 emissions. http://www.ucsusa.org/global_warming/science_and_impacts/science/each-countrys-share-of-co2.html#.WS4ztRMrJn4

5) Na. July 17, 2014. Institute for Energy Resource. Australians repeal carbon tax and case for carbon tax. http://instituteforenergyresearch.org/analysis/australians-repeal-carbon-tax-case-carbon-tax/

6). Parker B. Clifton. Februrary 28, 2014. Stanford News. Stanford research finds carbon regulation burden heaviest on poor. http://news.stanford.edu/news/2014/february/kolstad-carbon-tax-022814.html

1 Comment

Again, well thought out argument!