The challenge for market participants as December approaches is do you get lost in the near-term pessimism stemming from the Covid-19 surge or keep focus on the other side? I understand it is a difficult to think past the immediate suffering, but from a market perspective I believe it is important to maintaining a focus on the medium- and long-terms. Beyond the current surge awaits a solid if not surging economy.

In the near term, there will likely be some downward pressure on services spending, particularly in leisure and hospitality, as behavior changes and state and local restrictions on activity intensify in response to the rising number of Covid-19 cases, hospitalizations, and deaths. Still, there are four important points to remember when considering the outlook. The first is that the downward pressure will be less severe than the indiscriminate shutdowns of this past spring. The second is that, like it or not, now that we are well beyond the possibility of suppression, there is a tradeoff between the pandemic and the economy. That means that when the current pandemic surge levels off and starts reversing, behavior and restrictions will shift again and activity in impacted sectors will pick back up. The third point is that after we are on the downside of the current surge, a vaccine looks almost certain, so there most likely isn’t another large surge lurking in the future. This feel like the last month or two of the worst of the pandemic, hopefully. And, finally, the fourth point is that the U.S. economy is on a better economic footing than commonly believed.

I suggest avoiding the fiscal fetish trap and recognize that fiscal support is far less important for the macroeconomy than it was earlier this year. Yes, fiscal support was very helpful support. But the support was far more than needed to fill the pandemic hole:

The obsession with the fiscal stimulus has forecasters focused on that top line falling whereas they should really be focused on the bottom line, income excluding transfer payments, rising. More specifically, watch wages and salaries, which have made a V-shaped recovery:

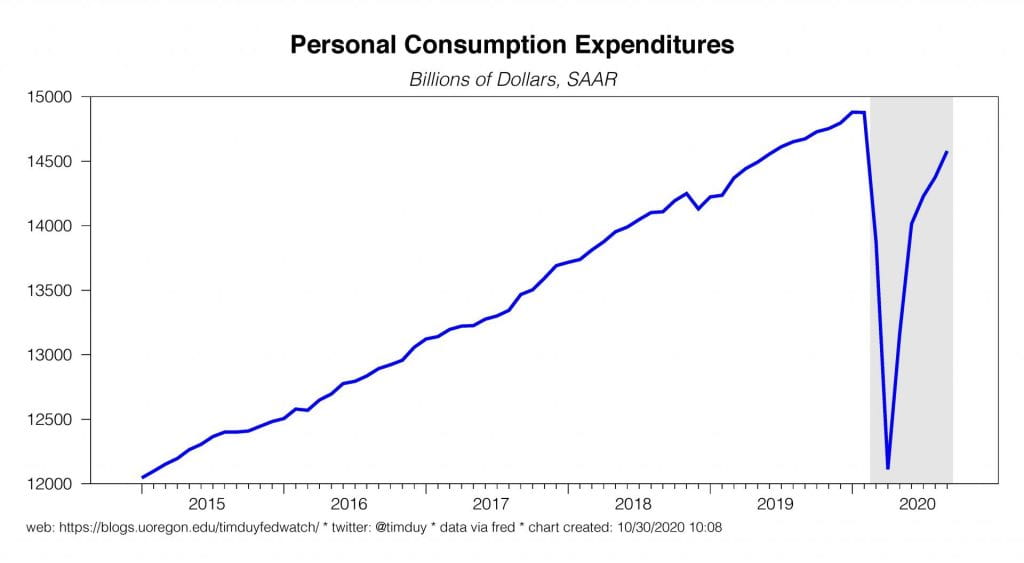

A recovery of wages and salaries means that fiscal stimulus is less important for sustaining aggregate spending. That’s what forecasters missed this summer when we predicted disaster from the end of enhanced unemployment benefits. Indeed, note also that the decline in wages and salaries is still in aggregate less than the decline in spending since the beginning of the pandemic:

So how does saving fit into this story? The fiscal support overshoot coupled with the decline in spending relative to wages and salaries pushed saving rates dramatically higher:

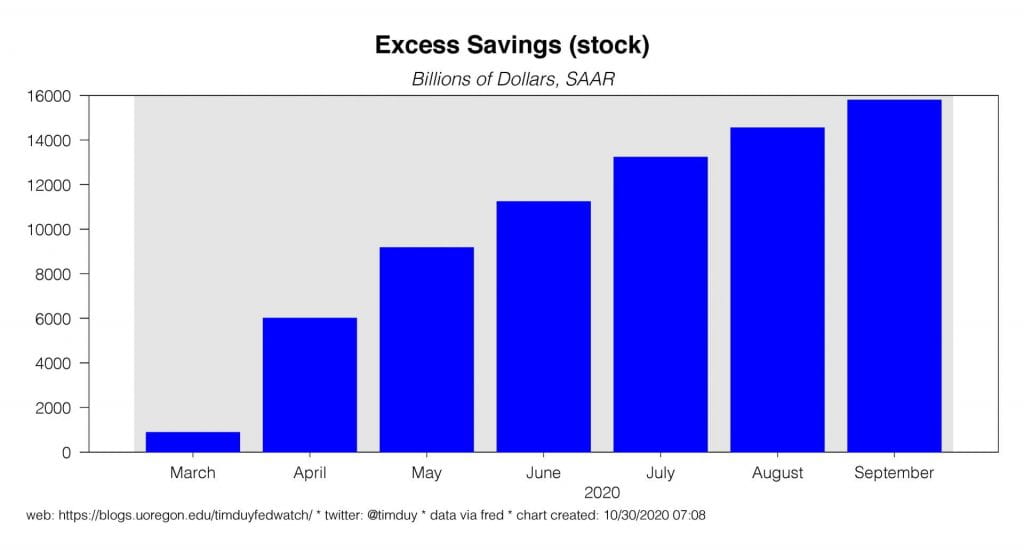

Importantly, as of October the saving rate is still almost twice pre-pandemic levels. Households are not drawing down on the saving cushion. They are still increasing the cushion. By my estimates, relative to the pre-pandemic saving trend, households have accumulated $1.4 trillion of excess (forced) savings this year:

Note that commentary such as this from NBC news is just dead wrong:

Income and spending moving in opposite directions indicates that Americans are drawing down on the money many socked away early in the pandemic. It also shows the extent to which the recovery has been supported by the government, because much of the reduction in income was associated with a drop in pandemic assistance.

The idea that households are already drawing down on savings in aggregate is a common misperception. To be sure, it is happening on an individual level. Consider this, for example, from the November FOMC minutes:

However, several participants expressed concern that, in the absence of additional fiscal support, lower- and moderate-income households might need to reduce their spending sharply when their savings were exhausted. A couple of these participants noted reports from their banking contacts that households appeared to be rapidly exhausting funds they received from fiscal relief programs.

This is undoubtedly true on a micro level. The micro stories are real, but they don’t necessarily add up to the macro story. The fact that the saving rates remain positive (and above pre-pandemic levels) means that savings are growing not shrinking. In aggregate, the stockpile of savings accumulated since the pandemic began hasn’t been touched and is still growing. A decrease in the saving rate does not mean that households are drawing down savings. Drawing down savings in aggregate means a negative saving rate. The possibility of a negative savings rate is actually an under-discussed possibility for next year. Look for my Bloomberg column this week on that topic.

Separately, even though we can expect services spending to soften with the pandemic surge, watch for other sectors to help compensate. Notably, the housing market is red hot. New home sales are at levels last seen during the housing bubble:

That graph is mind-boggling but consistent with the demographics; Millennials are aging into their home-buying years and then the high-earning years will follow. That is a multi-year trend you should be ready to ride. And importantly for the macroeconomy, the number of homes sold but not yet started has doubled:

This is literally months of higher construction activity in front of us, not to mention the durable goods spending needed to fill those houses when they are occupied. Traditionally, housing is a good leading indicator and it is hard not to be positive about the economic outlook with numbers like these.

Also note the V-shaped recovery in capital spending continues:

Watch for this to show up in this week’s ISM numbers.

This is a jam-packed week. In addition to the ISM manufacturing numbers Tuesday, Federal Reserve Chair Jerome Powell will testify in the Senate on CARES act. We should expect him to reiterate that the Fed has pledged to use all of its tools to support the economy and advise that Congress authorize additional aid. On Wednesday Powell repeats his performance at the House while the ADP report on private job growth (400k expected) helps focus our attention on the labor market. Thursday brings the initial claims report; claims have been ticking higher and should continue to do so given the pressure of the resurgent pandemic. Also on Thursday is the ISM non-manufacturing numbers. The November employment report comes Friday. Expectations are for a 500k employment gain, but it’s a tricky report. Supporting a solid report is that the most recent pandemic restrictions most came about after the reference week. Supporting report on the softer side are seasonality issues. Retailers are adding fewer seasonal employees than in past year while some, such as Amazon, likely pulled forward seasonal hiring in the form of permanent hiring earlier in the year. Consequently, the seasonal factors might depress the report. Job growth outside of the trade and transportation sectors might paint a more accurate indicator of the health of the job market.

Good luck and stay safe this week!