My Bloomberg column this week listed six reasons to be optimistic about the Biden economy:

It’s fashionable to think that, just like his former boss, President Barack Obama, president-elect Joe Biden is inheriting a damaged economy that will struggle to recover, perhaps for years. The reality is quite the opposite, with Biden stepping into a dream scenario for economic growth on the other side of the battle with the Covid-19 pandemic.

I should add two more reasons. Number 7 is that the sector of the economy most impacted by the pandemic is fairly small:

A retreat in food services spending the winter from already depressed isn’t great but it also won’t have the same impacts as the hard shutdowns of this past spring. Number 8 is easier monetary policy. In the last expansion, the Fed was looking for reasons to tighten policy. This time, it is looking for reasons to maintain easy policy. Completely different policy emphasis.

Meanwhile, despite the pandemic resurgence, the economy continued to gain ground in November:

With the support of Alaska Senator Lisa Murkowski, the Senate is moving forward with a vote to appoint Judy Shelton to the Federal Reserve. The gold bug turned dove will almost certainly revert to her hawkish ways now that the Democrats have regained control of the White House. I don’t believe that Shelton is qualified to be on the Fed. That said, the potential damage she might cause is limited. She is no longer a contender for the Fed chair and she is being appointed to a term that ends in 2024, so she will be out the door soon enough.

As far as her potential impact on policy, I think her colleagues will treat her with respect publicly and largely ignore her privately. She will not be the first ineffective Fed governor nor will she be the last. Moreover, there is even some upside risk here. The only way to change her status would to do something constructive rather than destructive. I don’t expect that. I expect comic relief. But there is a path for her should she choose to take it.

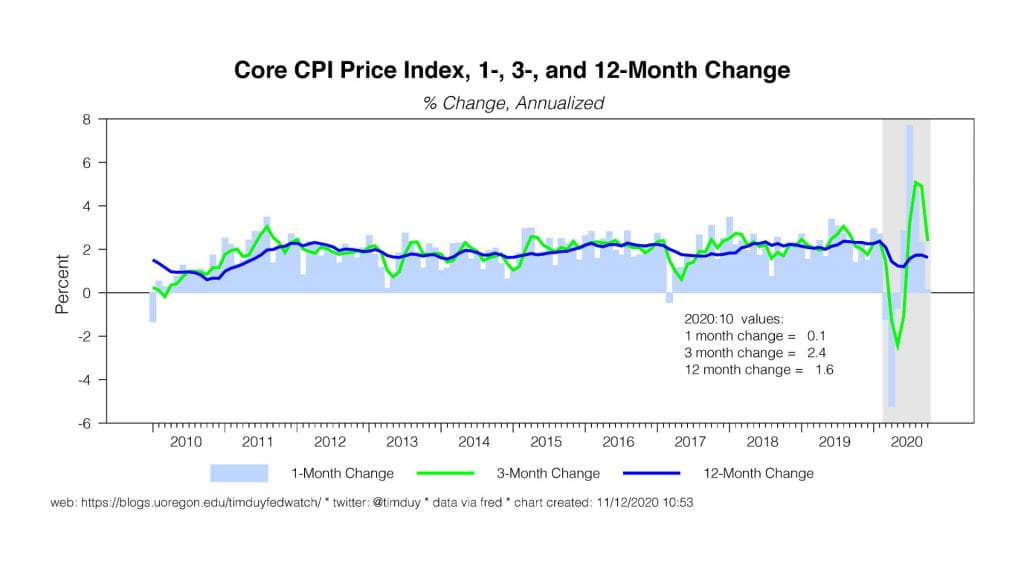

The CPI report revealed that both headline and core inflation were flat in October:

The still solid gains in employment are great news for the economy but they don’t mean much for monetary policy as long as inflation is locked down. Under the Fed’s new strategy, it can both cheerlead the recovery and remain credibility committed to accommodative policy. It’s a good place to be.

Covid-19 cases continue to surge in the U.S. The issue has been kicked to the states as there is not national leadership nor will there be until January. U.S. local governments continue to avoid broad lockdowns with Chicago being the latest example of lockdown light. By lockdown light I mean it is a stay-at-home advisory not order, a limit of six non-household members for private gatherings, and apparently no changes to business already under restrictions. The general approach with lockdown light is that the key problem is the social gatherings and thus a hard lockdown is an excessive blow to the economy. In addition, I think there are reasonable concerns that people will ignore strict stay-at-home orders during the holidays. My anecdotal evidence is that the strong desire to spend the holidays with family and friends spans the political spectrum. In my progressive community I regularly talk with friends and acquaintances that are planning family and friends events despite the pandemic. Sorry to be a fatalist but pandemic-fatigue is real and will kill a lot of people this winter. Please try to keep yourselves and your loved-ones safe!

Bottom Line: Rate policy on hold for the foreseeable future. There is a lot of upside in the future but we will have to endure a hard winter to get there.