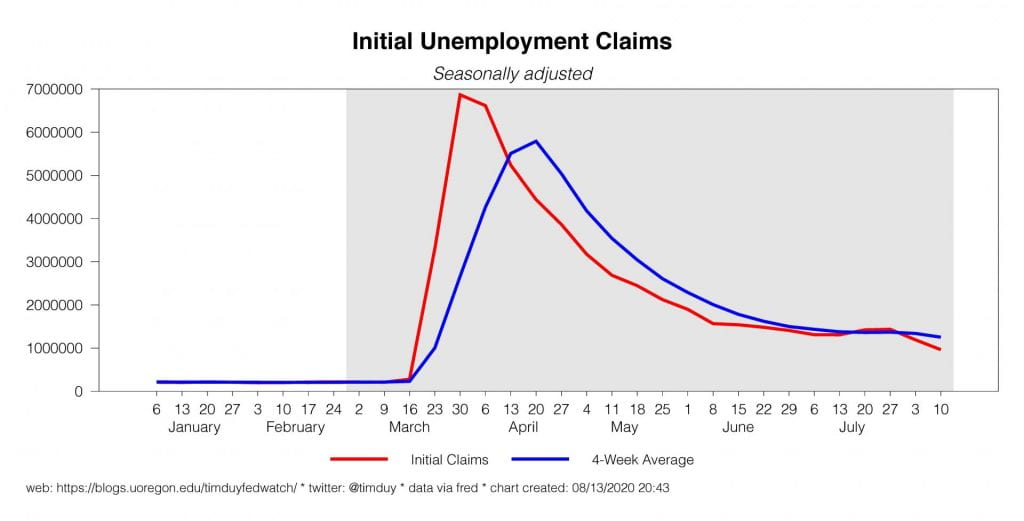

Initial unemployment claims fell below 1 million to 936,000:

There were an additional 488,622 Pandemic Unemployment Assistance claims. Continuing claims maintained its long, slow decline:

Still one of those glass half empty, half full situations. Claims continue to move in the right direction even if still above the worst of the Great Recession. But they remains at high levels, and with the enhanced benefits now expired, the fiscal cushion is limited. Moreover, we aren’t yet sure how quickly claims will decline considering the ongoing epidemic is keeping a lid on growth in many regions, the payroll protection plans has ended, and state and local governments face revenue constraints.

The standoff in Washington D.C. continues as neither side is ready to give ground. The Wall Street Journal speculates that the fight over the coronavirus support may spill over into late September:

The gulf in legislative proposals and the complicated political dynamics have prompted some lawmakers and aides to begin eyeing an alternative course on coronavirus relief: pairing the measures with legislation to keep the government funded after Sept. 30.

Congress must pass legislation by that deadline to prevent a government shutdown, and lawmakers will likely opt to approve a temporary measure that would fund the government until after the election. Coronavirus-relief measures could be attached to the stopgap bill, providing another deadline to try to force lawmakers to put together a compromise.

That seems to raise the possibility of a government shutdown in the fall…which would be a bit ugly going into the election. I am a bit surprised that the fact that we are currently going over a fiscal cliff has yet to rattle Wall Street. I imagine that we shouldn’t discount entirely the possibility that even with the fiscal cliff the economy will remain on the mend.

Wednesday, Boston Federal Reserve President Eric Rosengren gave some rather pointed comments about the economy:

While the fiscal and monetary stimulus has been significant, it cannot fully offset the economic drain caused by the public health crisis. Limited or inconsistent efforts by states to control the virus based on public health guidance are not only placing citizens at unnecessary risk of severe illness and possible death – but are also likely to prolong the economic downturn.

Very direct and ratcheting up the rhetoric from the Fed that Covid-19 still threatens the economy and there is only so much it can do to compensate for the resulting economic damage.

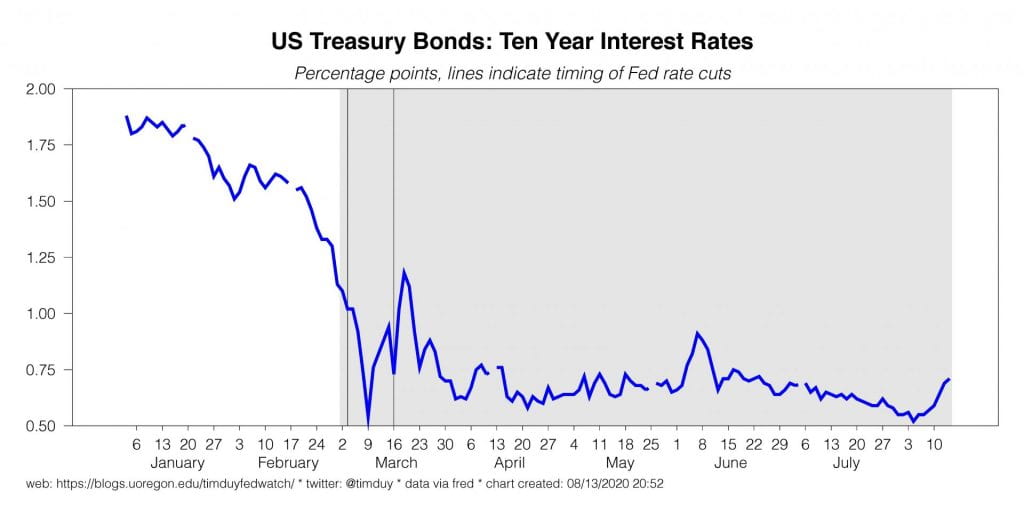

Bonds are selling off a bit as the market absorbs new supply:

I know, not the sell-off of the century. Roberto Perli attributes part of the move to an inattentive Fed:

Treasuries selling off again after lower bid/cover at the 30yr auction.

9 of the 21 bps increase in the 10yr rate since the Aug 4 low is due to a higher expected future fed funds rate.

9 bps is small but doesn’t help. Wouldn’t have happened with better forward guidance or YCC. pic.twitter.com/Hnd4YZbniI

— Roberto Perli (@R_Perli) August 13, 2020

This echoes my thoughts on Bloomberg earlier this week. The Fed will only let this go so far before they tighten up the guidance. This move though by itself won’t garner much Fed attention.

Bottom Line: Slow but ongoing progress in the economy that is threatened by the continuing pandemic and faltering fiscal support. Nothing here to move the Fed in any direction but easier.