Inflation jumped higher in July as core-CPI rose 0.6%, well in excess of Wall Street’s expectation of a 0.2% gain. This surprise gain can be attributed to a pricing rebound compared to the negative prints earlier this year and a response to temporary supply constrictions. It certainly does not by itself indicate the U.S. economy is poised for a 70’s-style Great Inflation. That said, it opens up the possibility that disinflationary forces are less severe than initially perceived at a time the Fed has embraced the fight against disinflation.

The pop in core-CPI was as impressive as the earlier collapse:

The gains were fairly broad-based. Among the major categories, only food and piped gas services posted negative month-over-month numbers. Core goods gained sharply:

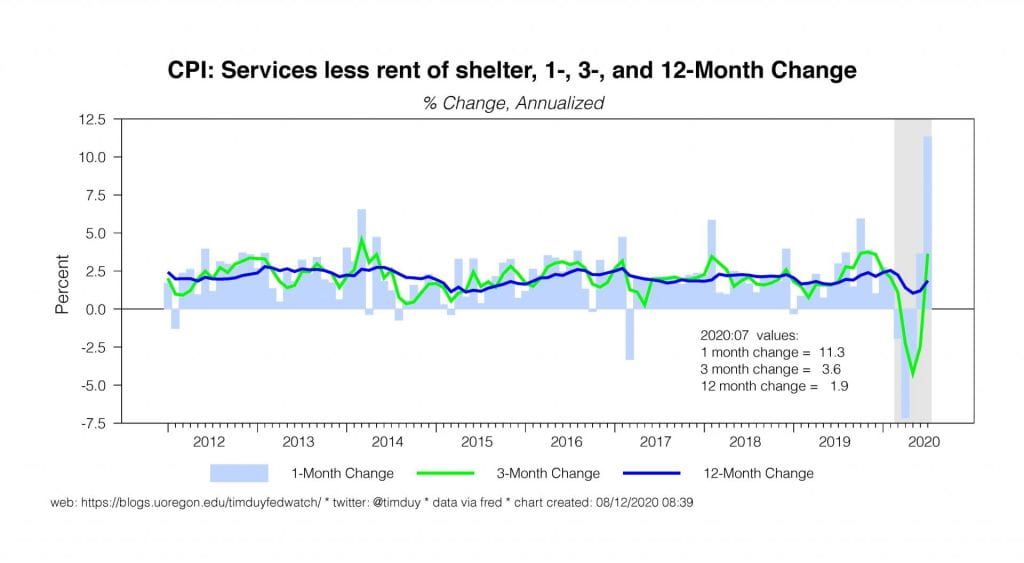

As did services less rent:

Even shelter has firmed in the last three months:

The conventional wisdom is that this is nothing more than a short-term bounce from earlier weakness and temporary supply constraints. Fellow Bloomberg Columnist Coner Sen says:

But what’s really happening is that pandemic-related supply and demand dynamics are distorting price signals in the short term. While we might get hot inflation prints for a few months, we should expect them to get back to normal as production does the same.

Coner does not expect the numbers to become the inflation of a failed state, and rightly so. To get interesting inflation like that, you need to see wage inflation of a similar magnitude. We just aren’t anywhere that point; that’s a whole different dynamic.

Instead of sustained high inflation, Coner says we return to “normal.” What exactly is “normal”? This question has me thinking that the underlying inflation forces are stickier than the Fed perceives them to be. Indeed, survey-based inflation expectations have actually firmed in recent months:

And recall that former Federal Reserve Governor Daniel Tarullo questioned the strength of our understanding about inflation:

The substantive point is that we do not, at present, have a theory of inflation dynamics that works sufficiently well to be of use for the business of real-time monetary policy-making.

When Tarullo wrote this, he was doing so at a point in time when we were trying to explain why inflation was not rising as fast as we anticipated. The logic works both ways. We could run into a period of time when inflation does not fall as much as anticipated. Or put it in a different way: In February we all came to the conclusion that the Phillips curve was dead and could not be a useful guide to inflation. Now, just a few months later, we are all using Phillips curve logic to confidently predict that disinflation is a major threat.

But if the Phillips Curve is flat:

Then as we shouldn’t conclude that low unemployment will drive substantially higher inflation, we also shouldn’t conclude that high unemployment will drive substantially lower inflation.

So the way of thinking about inflation is not to look at the extremes, but to think of it as sticky at 2% or a notch below. That’s enough to keep the Fed focused on the possibility of disinflation even if that possibility is less of a risk than we like to believe given the unemployment rate. The Fed has said absolutely, for sure, don’t even ask, that they aren’t thinking about thinking about thinking about raising interest rates anytime soon. Instead, all of the Fed’s energy is currently direct at looking for ways like yield curve control to boost the effectiveness of monetary policy and pushing for more fiscal stimulus to the point where they can’t raise interest rates because they have basically committed to not offsetting that stimulus.

If you have inflation sticky near 2% and a Fed that is dead set to holding rates at zero for as far as the eye can see, you are looking at a sustained period of real interest rates at nearly -2%. That should be friendly for real assets, especially if you get another blast of fiscal stimulus right before a Covid-19 vaccine hits the market.

Bottom Line: The inflation numbers aren’t telling us hyperinflation is on the way, but at the same time maybe the negative inflation earlier year this might not have been signaling deflation. Maybe the reality is much more boring and inflation is stuck in its recent range. Even that though has implications when the central bank remains positioned to fight disinflation.