Federal Reserve Chair Jerome Powell and his colleagues often note the their dovish policy pivot this has been instrumental in supporting an economy subjected to numerous uncertainty shocks. The positive response of the housing market to lower interest rates supports that claim. New single family home sales came in ahead of expectations in August; the trend fairly clearly indicates that the sector has recovered from last year’s soft spot:

The housing sector is of course famously known as a leading indicator for the U.S. economy and hence the sector’s rebound would appear to indicate that recession fears are overblown. That said, remember that the 2001 recession had only a small housing component. Just as manufacturing doesn’t seem to have the same connection to the overall economy as it did in the past, the same may be true for housing.

Separately, Federal Reserve leaders continue to struggle with their next policy move. Minneapolis Federal Reserve President Neel Kashkari thinks the Fed needs to get more aggressive. In an interview with The Washington Post, he argued that the Fed has placed the U.S. economy in a “dangerous position” with the 2015-2018 rate hike campaign that left growth vulnerable to negative shocks. Kashkari can “easily see justifying” rates being 50bp lower then now. Kashkari’s dovishness does not disappoint.

In contrast, Chicago Federal Reserve President Charles Evans, a voting member, implied that he was not looking for another rate cut just yet. Via Reuters:

“I think we are in a good place in terms of the rate setting,” Evans said. “We have adjusted in a much more accommodative fashion.”

Evans identifying himself as holding a “steady course” dot makes it more likely that the core of the FOMC voting members remain’s biased toward an additional rate cut between now and the end of the year. The next meeting is something of a toss up still with markets now setting 50-50 odds of a rate cut. The lack of a clear direction reflects uncertainty about how the Fed will view incoming data and news. Either the data needs to worsen to justify a cut or the data needs to improve to stop the core group of FOMC voters from pushing forward with another cut. Steady data is an unknown but odds favor a cut in that circumstance.

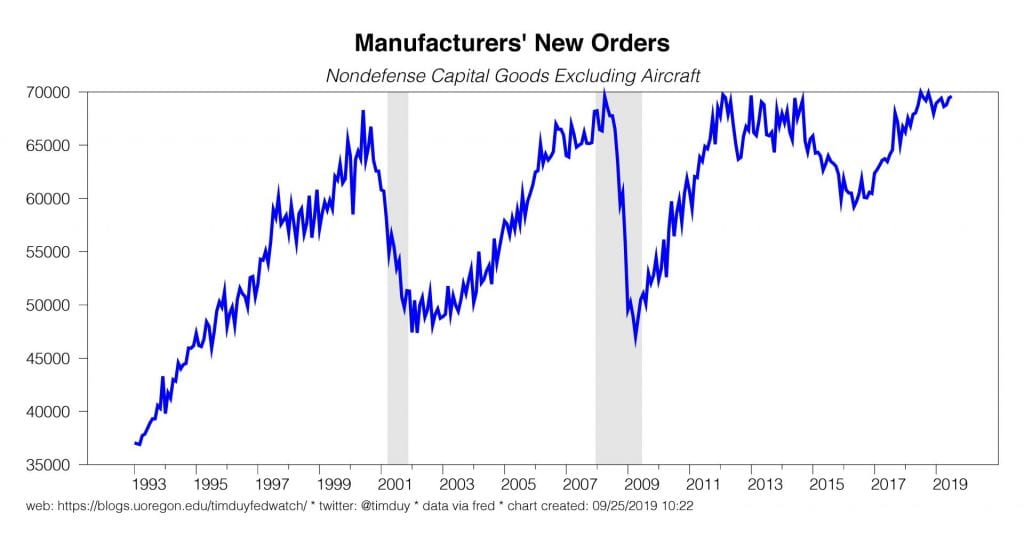

The housing data counts as a sign of improvement, but given the Fed’s focus on investment spending, I would anticipate them to be more responsive to further signs of weakness from the business sector than signs of strength from housing. Under this theory, this week’s most important release is Friday’s manufacturing orders report. Core new orders have held up well to date:

If that data reveals signs of substantial weakening, the conviction of the “we need another cut” camp will grow and the market odds should shift in that direction as well.

Bottom Line: With two rate cuts in the bag, the Fed is placing some extra emphasis in the data rather than the risks. The data could swing the October decision either way, though worth noting that a FOMC participant could both expect the Fed to cut rates again this year and pass on the October meeting. They can always follow up in December.