Economists increasingly worry that the next recession is closing in on the U.S. economy. Bloomberg, for example, reports that economists now see a 35% chance of recession in the next twelve months. Such roughly one in three odds of a recession suggests that while the baseline forecast of many economists is one of continued albeit slower growth, they see enough risks to the outlook that they need to hedge their bets against the possibility of more adverse outcomes.

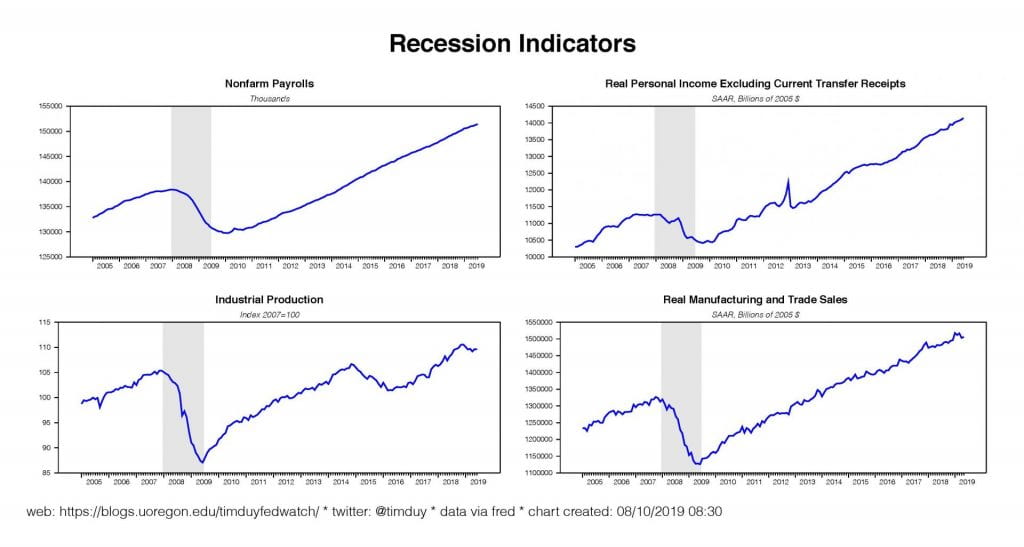

I would say that these odds are notably high given that Wall Street economists – permabears excluded – generally hesitate to call a recession for three reasons (at least in my experience). One is that by definition if you aren’t in a recession you are still in an expansion and hence the data flow is generally reasonably solid. In other words, we generally lack the data to worry about a recession because of charts like these:

Here only industrial production is showing weakness but still less than experienced in the non-recessionary 2015-16 downturn. With manufacturing a smaller and smaller part of the economy, we would reasonably expect to see more of these sector specific shocks that have minimal impacts on overall activity.

A second reason economists hesitate to call a recession is because timing is everything on this call. Call a recession too early and you give up months if not years of potential gains. Given that recessions are relatively few and far between, the natural bias is to avoid the error of calling a recession too early. A third reason follows a similar line of reasoning. Recessions are nowadays fairly infrequent. There are not a lot of recessionary months in the data. With non-recessionary data the norm, forecasting models tend to spit out non-recessionary outcomes.

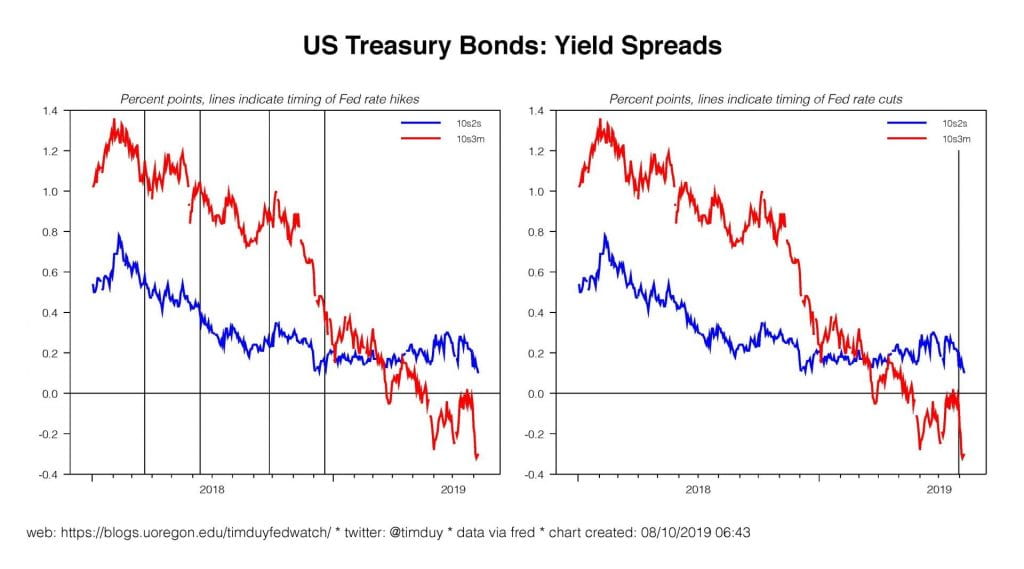

There is one class of model, however, that clearly currently spits out a very high probability of recession. That class of models is based on the yield curve and they tend to produce something like this:

I almost hesitate to post this chart as I fear I will see it all over bearish Twitter feeds when I wake up in the morning. That said, it isn’t exactly a secret. An inverted yield curve is a well-known harbinger of recession, one that I have often said you ignore at your own peril.

The current shape of the curve, however, is a bit unusual and throws a wrench into my analysis. I have long held a preference of the 10s2s spread as a recession indicator. Specifically, recessions tend to follow occurrences where the Fed continues to tighten policy even after the 10s2s spread inverts:

In only one of these four episodes did the economy manage to avoid recession at the end of a tightening cycle (we could add the 1998 rate cuts as another example, but I excluded in the interest of brevity). In 1995, the Fed stopped raising rates before the 10s2s spread inverted and soon turned to rate cuts. In the other episodes, rate cuts came too late:

I think one can argue that the Fed almost pulled off a soft landing in 1989 but policy proved to be still too tight when the economy, already struggling under the impact of the S&L crisis, was hit the oil price shock and Iraq War.

The current episode is unusual in that the 10s2s spread never inverted before the Fed began cutting interest rates. In that way it is similar to the 1995 story. But it is unlike 1995 in that the expectations of Fed easing have driven the short end of the yield curve into a fairly substantial inversion:

I find this to be quite annoying as I am not prepared for this situation. What’s the correct interpretation here? Should we take at face value the high recession probabilities generated by yield curve-based models?

My interpretation is that market participants have correctly anticipated the Fed’s reaction function with the expectation of substantial easing in the months ahead hence creating the inversion on the short end. This easing will be sufficient to derail impending recessionary threats. If the Fed’s easing was expected to be insufficient, I would expect that the 10s2s spread would be inverted.

Consequently, at this point I still do not expect a recession in the near year. Under my baseline scenario, the Fed’s upcoming rates cuts will slightly steepen yield curve and the picture will look like 1995. If the Fed remains a little too tight – doesn’t cut fast enough or deep enough – the yield curve will be flat to flirting with inverted like in 1989. The latter case would risk leaving the economy too vulnerable to negative shocks and it would be all too easy to see a geopolitical conflict pushing the economy toward recession before the Fed could react.

If recessionary shocks multiply now before the Fed reacts again, the 10s2s spread will invert before the end curve steepens as the Fed pushed interest rates down to zero. The most likely scenario to get there is that we essentially talk ourselves into recession as Trumpian uncertainty triggers coordinated pessimism that freezes business investment while the Fed is still pondering the data. I don’t see it there yet, but it is a reasonable story to tell.

Bottom Line: I agree with the assessment that risks to the economy have grown in the past 6 months. Boiled down to the essentials, the economy is slowing to trend and the multiplying downside risks leave it vulnerable to slowing below trend. The yield curve is telling me that these shocks will not overwhelm the Fed. Powell & Co. can still sustain the expansion and are expected to do so. “Expected” is key of course; the slower the Fed moves, the more likely they are to miss the opportunity to avoid recession. A policy error is a very real potential outcome here. To enhance the odds of avoiding recession, I would advise the Fed to get a 50bp cut done at the next meeting. While I fully expect the Fed to ease at the September meeting, at the moment the Fed seems likely to stick with the less aggressive 25bp cut.